- Arbitrum’s DeFi TVL has increased steadily and recently reached a one-month high of $2.45 billion.

- Despite a rise in TVL and open interest, bearish signals around ARB continue to dampen the market sentiment.

As a seasoned crypto investor with a knack for identifying promising projects and navigating market trends, I find myself intrigued by Arbitrum [ARB]. Despite the bearish sentiment surrounding ARB, the recent surge in DeFi TVL to a one-month high of $2.45 billion, coupled with the spike in open interest, paints an optimistic picture for this layer 2 network.

Arbitrum [ARB] has been stuck in a bearish trend, as its price has dropped by 11% in the last month. However, the downtrend is showing signs of weakness as in just four days, ARB has bounced from $0.49 to $0.56.

At the moment of reporting, ARB had dropped some of its recent advancements, trading at $0.551. However, on-chain indicators hint that ARB might recover and potentially regain its highest points for the month.

Rising DeFi TVL could fuel ARB rally

In a recent development, Arbitrum has been overtaken by Base in terms of the value locked within it (Total Value Locked or TVL), making Base the leading layer 2 network by this measure, with Arbitrum now ranking as the second-largest.

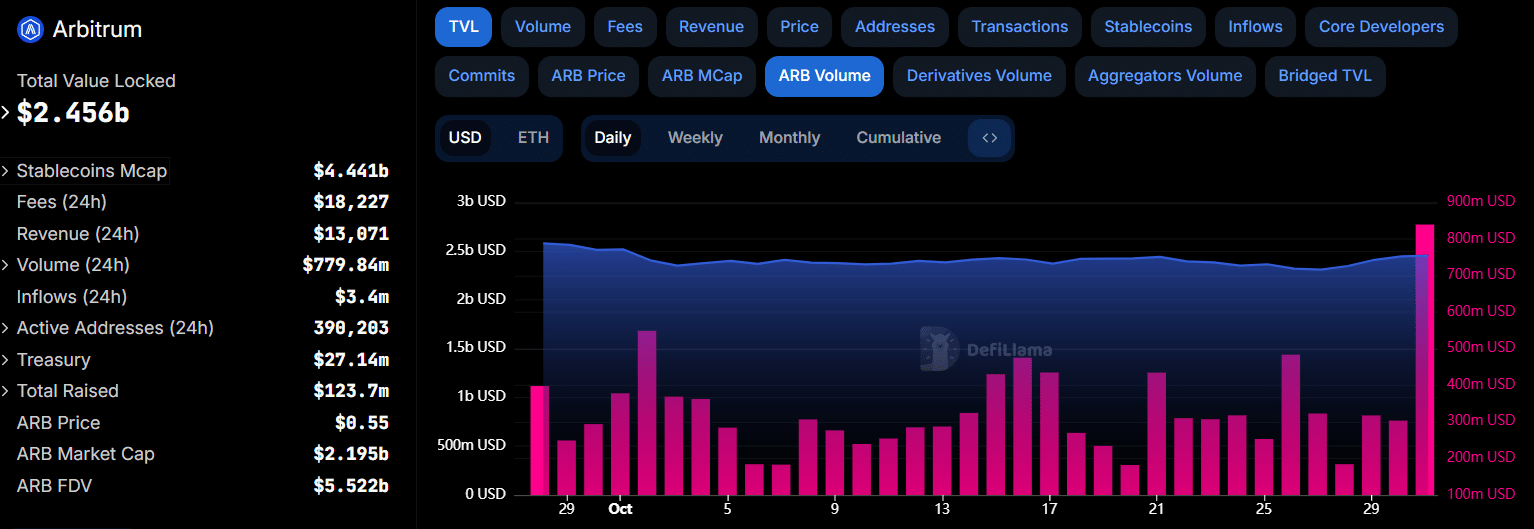

According to DeFiLlama’s data, it appears that the use of decentralized finance (DeFi) within the network is on the rise once more. At this moment, Arbitrum’s total value locked (TVL) in DeFi stands at approximately $2.456 billion, which is its highest point in over a month.

Additionally, trading volumes for ARB on both centralized and decentralized platforms have reached their peak levels since August, coinciding with an increase in Total Value Locked (TVL).

Increased TVL (Total Value Locked) and a surge in transaction volumes suggest a heightened curiosity about Decentralized Finance (DeFi) solutions built on the layer 2 platform. Consequently, this trend might aid in the rebound of ARB’s price.

Arbitrum’s open interest surges

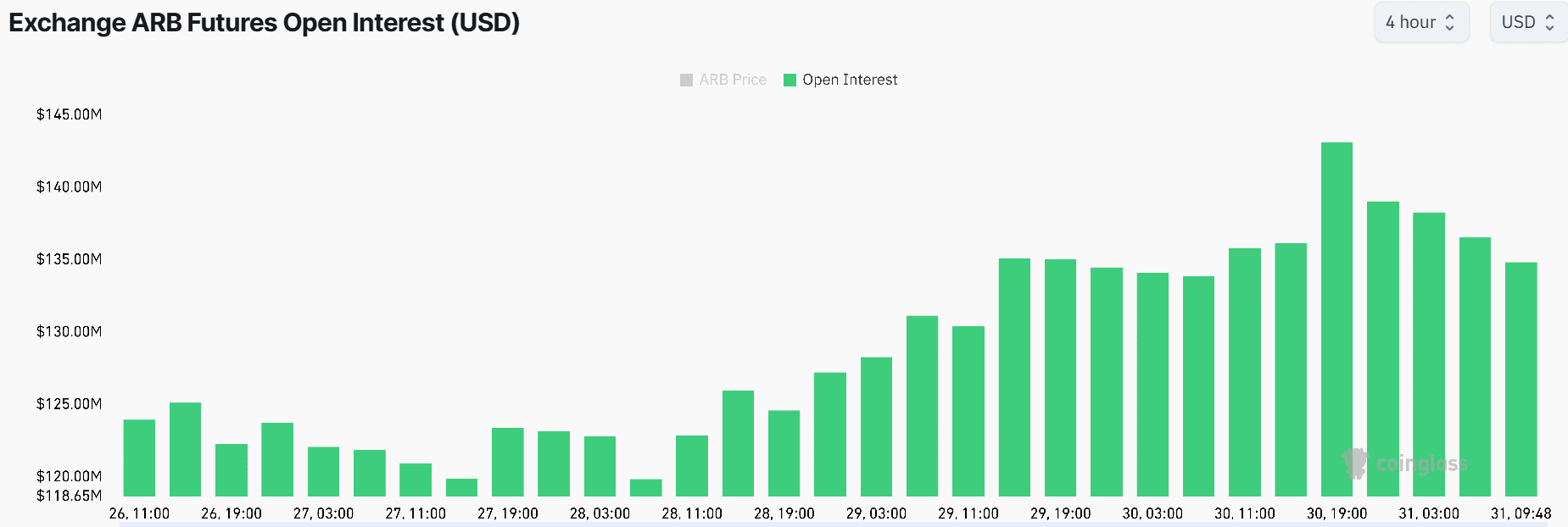

Additionally, there’s been a significant increase in anticipatory actions related to Arbitrum. This is evident in the rise of open interest, which currently stands at approximately $135 million as we speak.

In a span of only three days, ARB’s Open Interest (OI) surged beyond 10%, implying that derivatives traders are actively creating fresh positions related to the token.

An increase in Open Interest (OI) alongside a rise in price typically reflects optimistic market feelings, or bullishness. Additionally, Arbitrum’s funding rates have predominantly been favorable since September, which strengthens the argument for a bullish outlook.

Is ARB poised for a breakout?

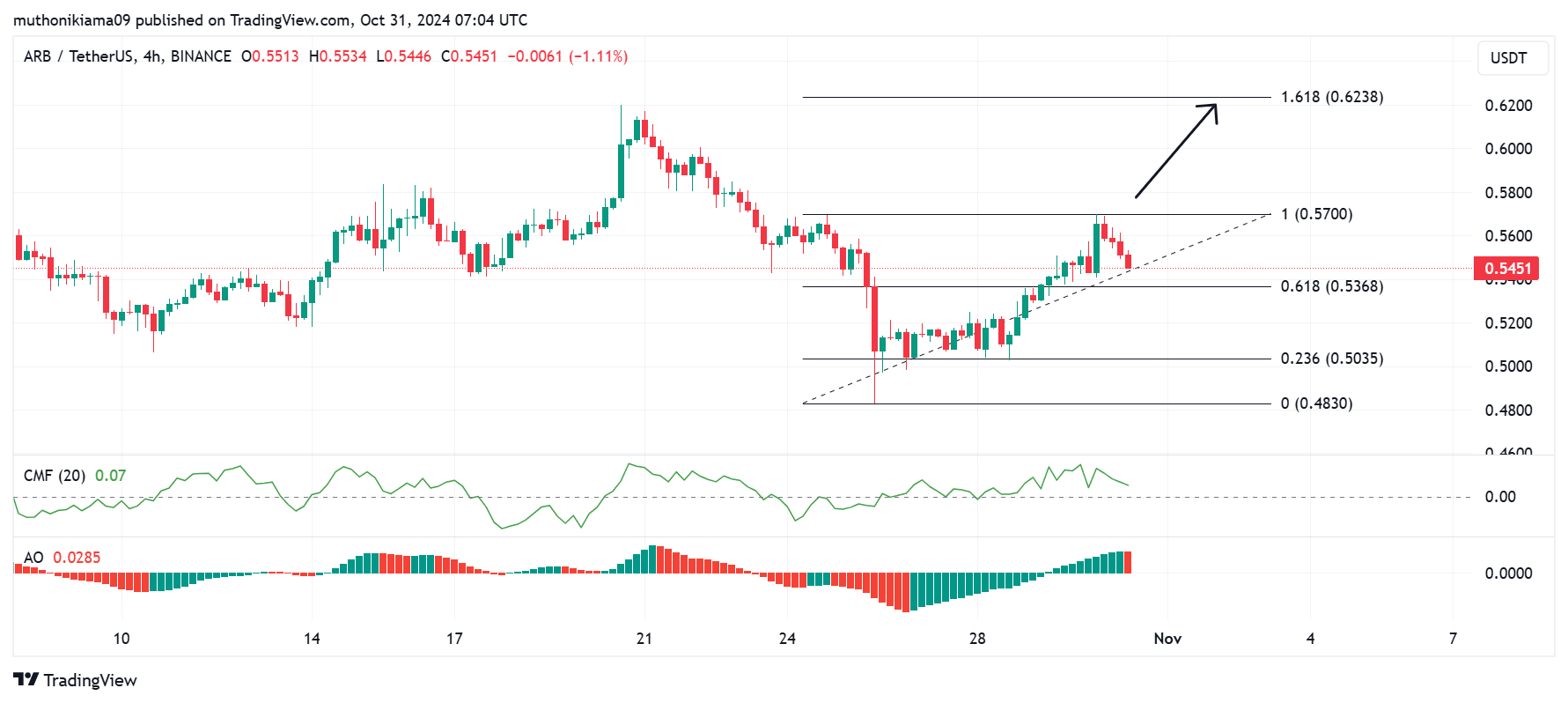

According to Arbitrum’s four-hour analysis, the current trend is leaning more towards a bull run as the momentum has turned favorable for buyers. The Chaikin Money Flow (CMF) indicator indicates a stronger demand from buyers compared to sellers, with a value of 0.07 suggesting increased purchasing power.

The Awesome Oscillator indicates a shift in power towards buyers in ARB’s market, as the oscillator bars have turned positive.

Nevertheless, the shift in these indicators warrants careful consideration. The Commodity Movement Index (CMF) points downward, indicating a decline in buying activity. Furthermore, the appearance of a red Accumulation/Distinction Oscillator bar suggests that sellers are currently in control.

If new buyers enter at current prices and Arbitrum breaks resistance at $0.57, the next target will be the 1.618 Fibonacci level ($0.62).

Realistic or not, here’s ARB’s market cap in BTC’s terms

If ARB follows a downward trend and falls beneath its 0.618 Fibonacci support (approximately $0.53), it’s possible that the price will drop significantly, seeking liquidity around $0.48.

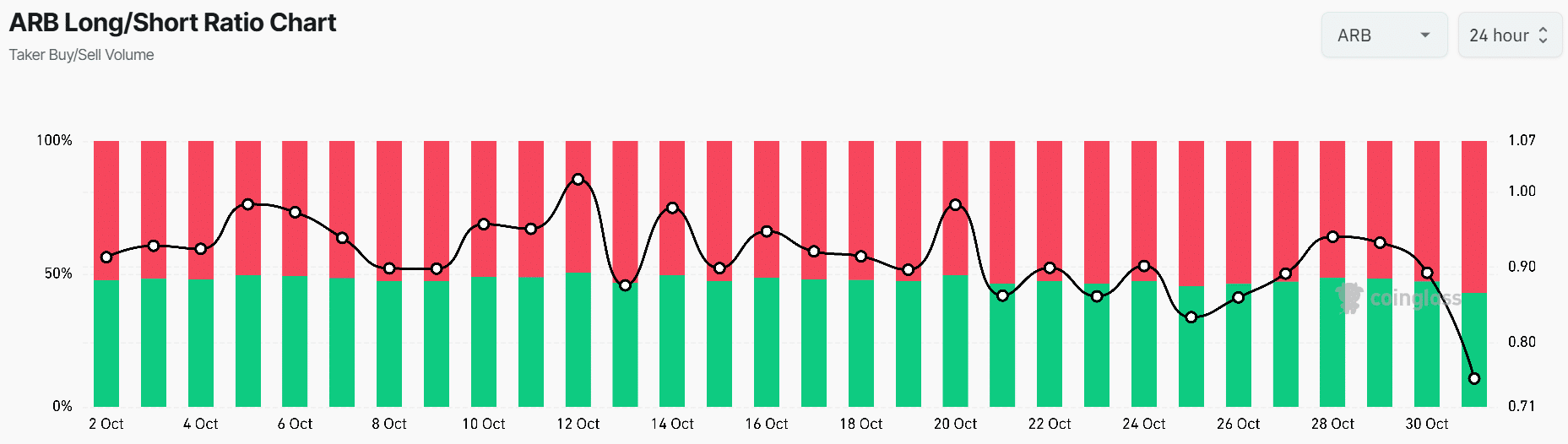

Based on the Arbitrum long/short ratio, it seems that a significant number of traders are betting on another price decrease. The current ratio stands at 0.75, indicating that about 57% of traders have opted to open short positions. This indicates that the traders might not be as hopeful that the bullish trends associated with ARB will persist.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-10-31 19:04