-

BTC’s price has increased slightly in the last 24 hours.

Over $17 billion BTC has been accumulated in the last few months.

As a seasoned researcher with years of experience in cryptocurrency markets, I have witnessed numerous market cycles and trends. The recent accumulation phase of Bitcoin by long-term holders (LTH) is reminiscent of the patterns that preceded past bull runs. LTHs are back in the game, indicating renewed confidence in BTC‘s long-term potential.

Recently, Bitcoin [BTC] has been experiencing a phase where long-term investors (LTI) have consistently been buying more coins. This trend might influence Bitcoin’s price as it tries to regain its position within the $60,000 price bracket.

LTHs back Bitcoin

According to an analysis by AMBCrypto, the chart of long-term Bitcoin holders on Glassnode shows some significant patterns about who owns the cryptocurrency over a prolonged period.

By early 2024, individuals holding Bitcoin for a long time (long-term holders or LTH) were found to be controlling more than 14 million Bitcoins. Yet, this number saw a significant decrease in the first quarter of that year, dropping down to about 13.35 million Bitcoins by March 2024.

As a seasoned cryptocurrency investor with years of experience under my belt, I have witnessed numerous market fluctuations and trends. The recent decline in Bitcoin’s price has caught my attention due to its potential implications for long-term holders. From my perspective, it seems that these investors might be distributing or selling their Bitcoin, possibly in response to current market conditions or seizing profitable opportunities. This is a common occurrence in the cryptocurrency world, and I have seen similar patterns before. However, it’s essential to keep in mind that each investment decision should be based on individual research and risk tolerance.

By March 2024, the pattern changed significantly, with long-term investors gradually increasing their Bitcoin investments. Approximately 300,000 Bitcoins were accumulated in long-term holdings by August 2024, indicating a period of increased savings or ‘hoarding’.

As a seasoned investor with over two decades of experience under my belt, I have witnessed various market trends and fluctuations. The recent behavior of investors holding onto Bitcoin instead of selling it suggests to me that they have renewed faith in its long-term value. This trend is reminiscent of the dot-com boom era, where many investors held onto their stocks rather than sell, despite facing significant volatility. This confidence and resilience are often indicators of a strong belief in an asset’s future potential, which could be the case with Bitcoin. However, it’s essential to remember that investing always involves risk, and I would advise cautious optimism when considering any investment, including Bitcoin.

As a researcher studying long-term investment trends, I’ve observed a consistent upward trajectory in Bitcoin holdings over time. This suggests that experienced investors remain optimistic about Bitcoin’s future potential, disregarding temporary fluctuations in the short-term market.

Possible implications for future moves

This upward trend in long-term Bitcoin holdings could significantly affect Bitcoin’s price.

Over time, experienced investors amassing Bitcoin may bolster faith in its potential worth, leading to a more consistent and steady pricing structure.

A positive outlook, commonly held by knowledgeable investors, could signal an upcoming price increase, as they are looking ahead to possible future growth.

Furthermore, the continuous buildup by investors holding onto their assets over a prolonged period implies a shrinking supply within the market. This could potentially lead to less market instability and foster a more consistent trading atmosphere.

Reducing the number of Bitcoin units accessible for quick trading could lead to smaller price fluctuations, potentially fostering a steadier long-term growth pattern.

As an analyst, I’m observing a pattern that suggests a potential market bottom could have been reached. It appears that long-term investors are strategically adjusting their positions, seemingly preparing for a recovery phase to follow.

Over time, these buildup periods have often resulted in increased prices due to a change in the balance between supply and demand, with the latter pushing for higher costs.

How BTC has trended

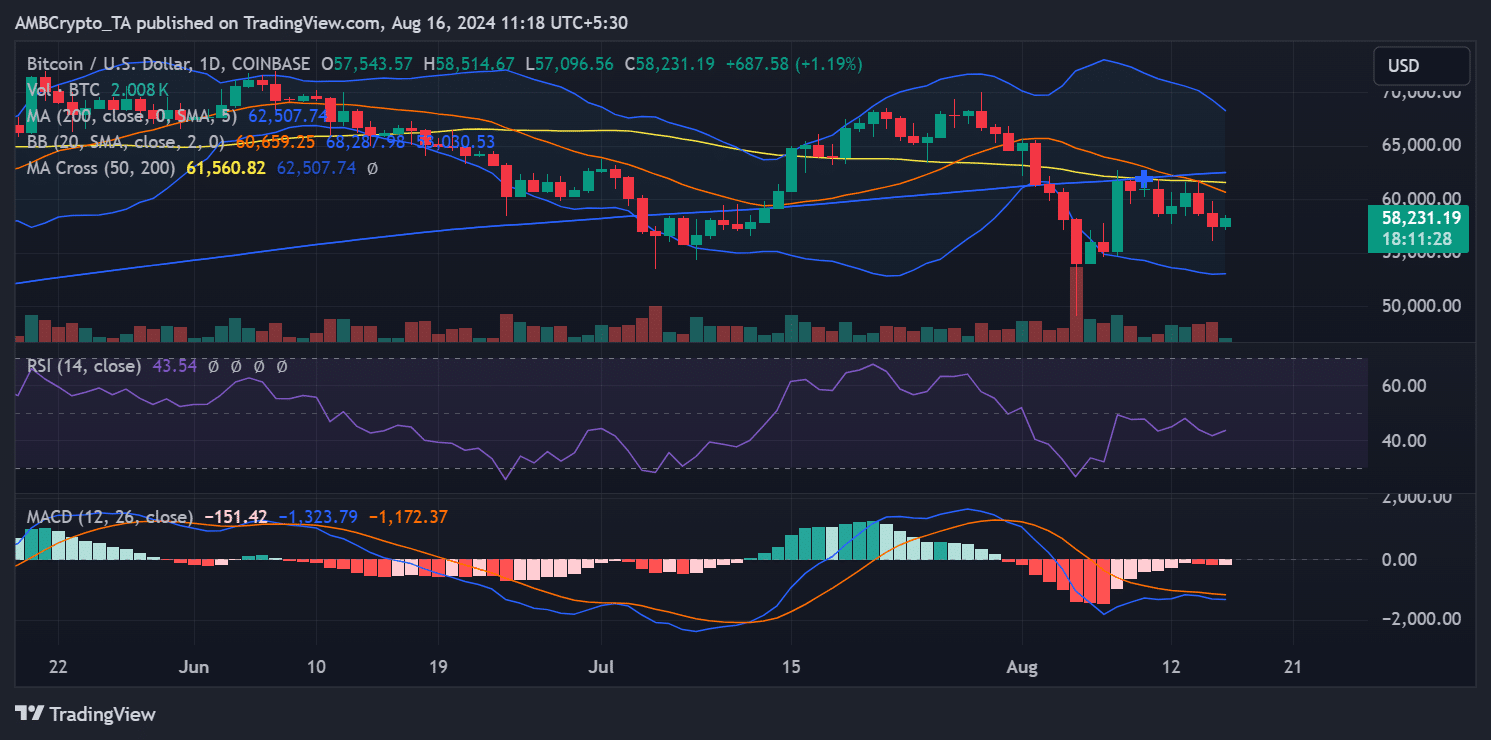

At the moment, the value of Bitcoin stands at approximately $58,231.19, reflecting a slight rise of more than 1.19% during the most recent trading period. Interestingly, the Bollinger Bands suggest a decrease in market volatility as they have narrowed.

As we speak, the price appears to be heading towards the median line, implying a potential for stable movement or pause. The ceiling stood at approximately $68,287.98, whereas the floor hovered around $50,030.53.

Additionally, the Relative Strength Index (RSI) stood at approximately 43.54, positioning it within the neutral range yet moving towards the oversold region.

Based on my extensive experience in the financial markets and my observation of Bitcoin’s price action over the past few years, I believe that Bitcoin might be undervalued at its current price level. However, despite the compelling fundamental analysis and technical indicators suggesting a potential upward trend, there has yet to be significant buying momentum from retail investors. As someone who has seen bubbles and bear markets come and go, I am cautiously optimistic about the future of Bitcoin but also recognize that it remains a highly volatile asset with inherent risks. It is important for potential investors to thoroughly research and understand the technology behind Bitcoin before making investment decisions.

Furthermore, the Relative Strength Index (RSI) suggests that the selling activity could be close to depleting, implying a possible price change if Bitcoin manages to surpass the midpoint of the Bollinger Band or experiences a significant increase in trade volume.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2024-08-16 13:34