-

BTC has managed to stay close to its psychological resistance level.

Indicators showed the potential for a price breakout.

As a seasoned analyst with years of experience navigating the crypto market’s volatile waters, I have learned to respect Bitcoin [BTC] for its unpredictable nature and resilience. September has historically been a challenging month for BTC, but this year it seems determined to defy tradition.

Traditionally, Bitcoin [BTC] has seen its fair share of volatility during the month of September, typically experiencing downward trends.

Regardless, King Coin’s price has remained fairly steady, hovering near its present psychological resistance point. If the current trend persists, we might witness a more optimistic shift in October.

Bitcoin faces consecutive declines

For the last three days, Bitcoin has seen a series of drops, currently valued near $58,650 as we speak.

The decrease started on September 14th, occurring after Bitcoin surpassed a significant level during the preceding trading day’s activities. In that specific session, Bitcoin experienced an increase of around 4%, peaking at roughly $60,543.

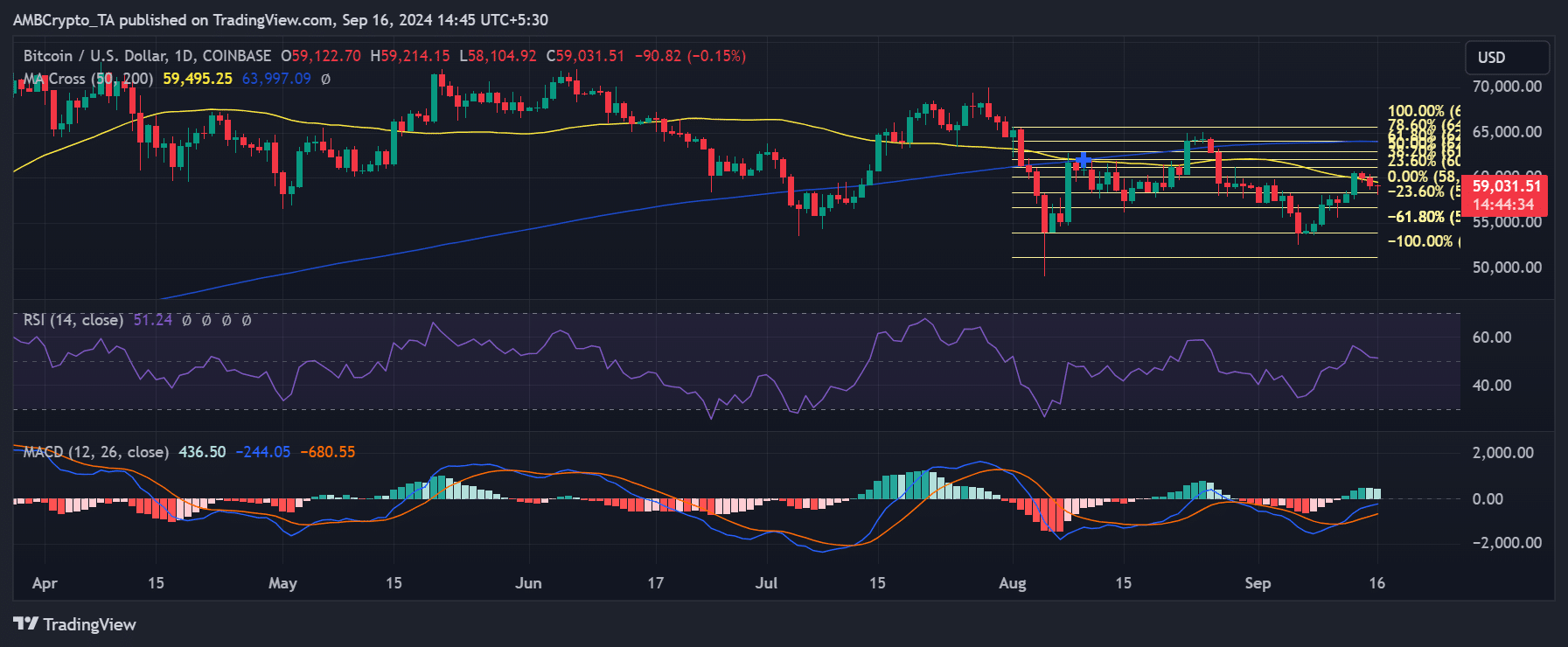

momentarily, the upward trajectory caused Bitcoin (BTC) to enter a favorable period for buyers, as its Relative Strength Index (RSI) rose close to 50. Yet, during the current reporting, the RSI was hovering around the neutral point, suggesting that the bullish trend might be starting to lose momentum.

Bitcoin: October rally ahead?

As we entered October, Bitcoin’s price was maintaining a position close to significant technical points. The yellow line denoted the 50-day moving average, standing at approximately $59,495.25, while the blue line indicated the 200-day moving average, which was around $63,997.09.

Bitcoin’s value was hovering close to the 23.6% Fibonacci retracement point, approximately $58,104.92, suggesting a possible barrier for further increase. If Bitcoin were to fall, the $55,000 mark could serve as the next notable support level, determined by Fibonacci extensions.

If Bitcoin manages to surpass its 50-day moving average, which is approximately $59,500, and continues its upward trend, it could potentially hit the 200-day moving average at around $63,997. This latter figure represents a significant barrier for further price increase.

In October, signs like a favorable Moving Average Convergence Divergence (MACD) pattern and a stable Relative Strength Index (RSI) might point towards a potential price increase. This could be more likely if the market’s bullish forces manage to reassert their dominance.

Reaching around $63,000 might ignite FOMO (the fear of missing out), possibly propelling Bitcoin back towards its record peak.

Supply on exchanges shows a slight uptrend

According to a recent examination by Santiment, there’s been a modest rise in the amount of Bitcoin being traded on exchanges. However, the trading activity level has stayed fairly consistent, with volumes falling within similar ranges.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the time of writing, the total BTC supply on exchanges was approximately 1.8 million.

Due to the current market drops, an increase in supply might indicate a greater likelihood of substantial price increases in October. This suggests that Bitcoin could potentially experience a bullish surge.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-09-17 06:15