- Willy Woo predicted that Bitcoin could reach a minimum of $700,000 based on conservative wealth allocation.

- He dismissed the $24 million mark as unrealistic, requiring total global wealth investment into Bitcoin.

As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find Willy Woo’s predictions intriguing and insightful. Having witnessed firsthand the meteoric rise and fall of several cryptocurrencies, I can attest to the fact that Bitcoin remains unique due to its resilience and market dominance.

Bitcoin [BTC] has been on a bearish ride ever since its peak above $73,000 back in March.

Currently, the value of the asset stands at $64,020, which represents a 13.2% decrease from its record high in March, and about a 4.4% change over the last seven days.

Despite the current bear market, I’ve been keeping an eye on the predictions from Willy Woo, a well-respected figure in the cryptocurrency world, about Bitcoin’s possible future value.

Expectations and market dynamics

As a financial analyst, I propose that the lower end of Bitcoin’s potential value could be approximately $700,000 per coin, whereas its upper limit might reach an astounding $24 million under certain optimistic scenarios.

As a crypto investor, I must acknowledge that attaining the optimistic projection implies a highly unlikely situation. This hypothetical scenario envisions every penny of the world’s combined wealth, approximating $500 trillion, being diverted into Bitcoin. Such a shift would be far-fetched, considering the vast amount of existing investments in various sectors and assets globally.

In this situation, he pointed out, it’s extremely rare. He expressed strong doubt, suggesting that a Bitcoin valuation of $24 million each is virtually impossible.

As a crypto investor, I’ve been pondering about the potential role of institutions in the Bitcoin market. Following my research, I believe it’s crucial to set realistic expectations for their involvement.

He mentioned that Fidelity suggests allocating 1-3% of portfolios towards Bitcoin, a significantly lower investment than BlackRock’s 85% in certain instances.

In a more practical perspective, Woo suggested an allocation of around 3%, believing it would be reasonable. If this viewpoint were widely accepted, Bitcoin’s value could potentially reach $700,000 per coin.

Discussing more about his forecasts, Woo explained the S-shaped curve of adoption, pointing out that as of the current press time, the worldwide adoption of Bitcoin stood at approximately 4.7%.

It’s expected that if adoption rises to a range of 16% to 50%, the value of Bitcoin might surge to the levels he specified, primarily due to growing mainstream approval and investment.

Bitcoin current market stance

However, the current market tells a different story.

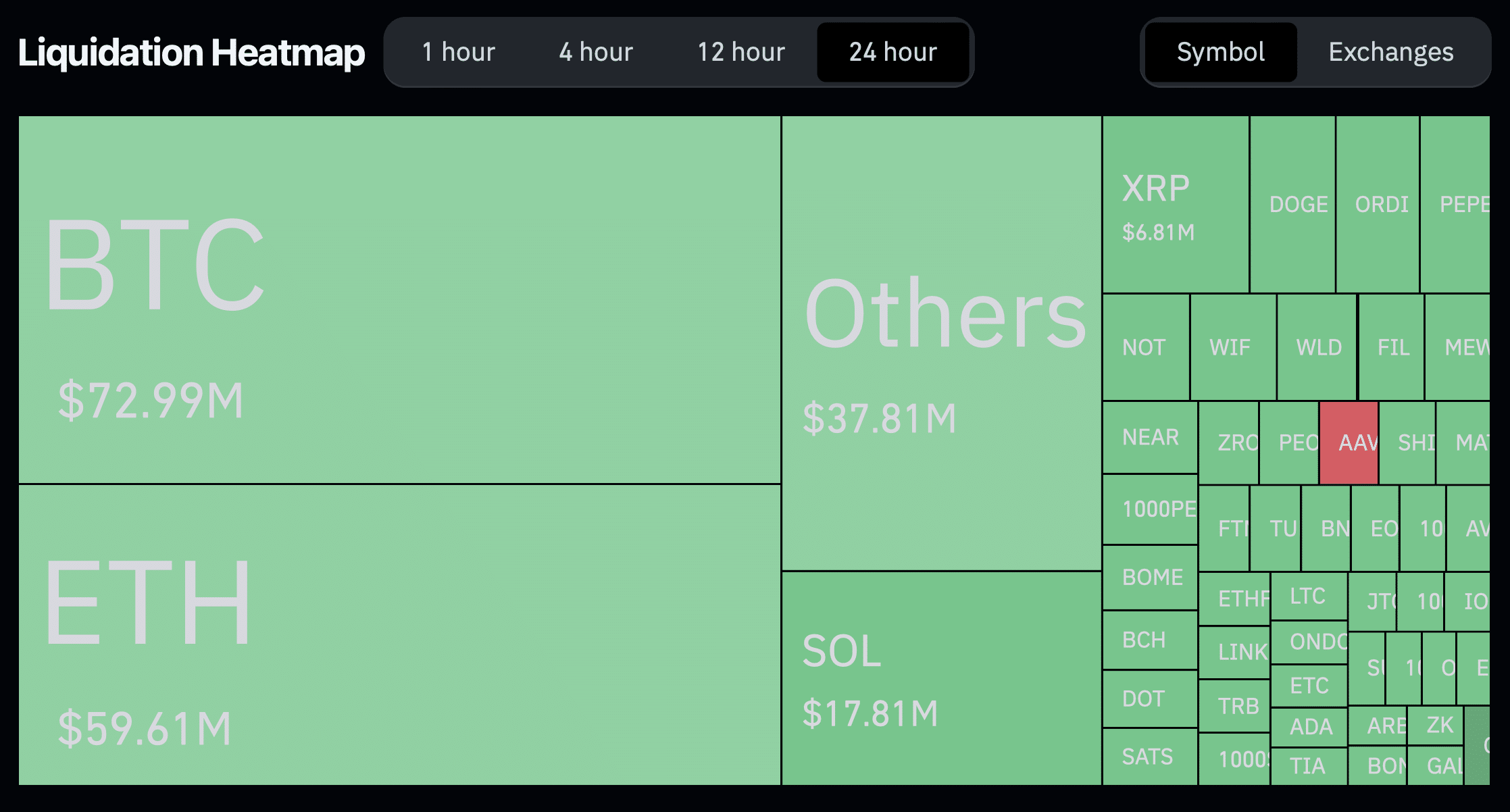

In the past day, about $72.99 million worth of Bitcoin trades have led to trader closures (liquidations), making up around 28.9% of the total $255.67 million in liquidations, according to data from Coinglass.

Mostly, these were long-term investments, indicating a potentially volatile time for investors expecting quick profits.

Crypto expert RektCapital recently commented on the ongoing market downturn, positing that this correction could potentially be less prolonged compared to past instances. He elaborated on his viewpoint by stating…

As a seasoned investor with over two decades of experience under my belt, I’ve learned that patience is the key to success. From my personal observations, I can confidently say that market patterns often follow a predictable rhythm. The initial retrace inside a pattern took me a full five weeks to bottom out, and another one followed suit, lasting four weeks. However, the current retracement seems to be moving at a much faster pace, potentially taking only 2-3 weeks to reach its lowest point. This rapid progression could be indicative of a shift in market dynamics, or simply a temporary aberration. Regardless, I’ll remain vigilant and adapt my strategy accordingly.

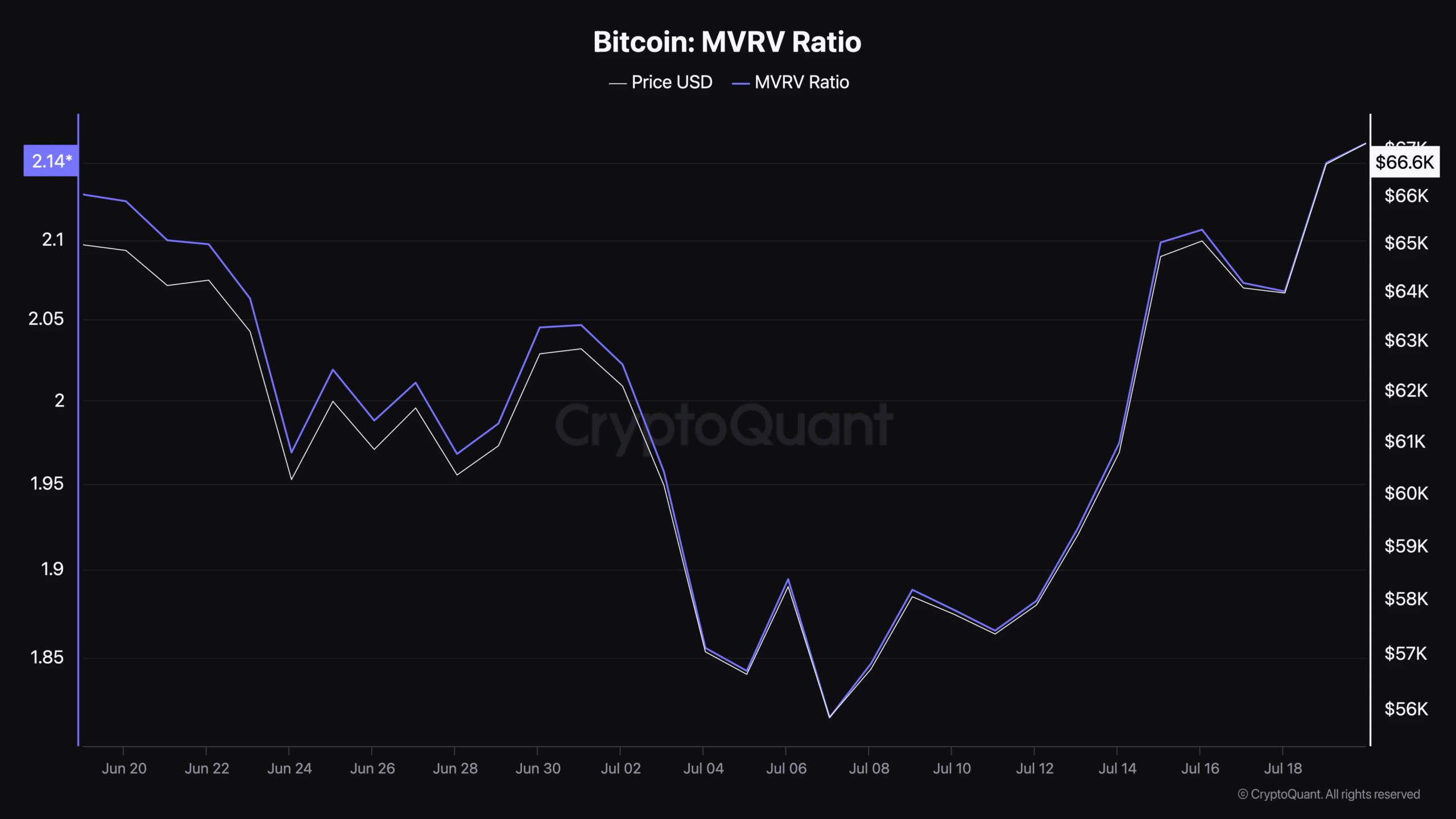

Expanding on the topic, it was observed at the current moment that the Bitcoin’s Market Value to Realized Value (MVRV) ratio, a tool for gauging potential profits and losses by measuring market value relative to realized value, stood at 2.1 as per CryptoQuant data.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A MVRV (Moving Average of Venture Realized Value) ratio above 1 implies that Bitcoin’s current market value is higher than its realized value, implying that many investors may be in a position to sell their coins at a profit. This potential mass selling could impact the market balance and stability.

In addition, as per a recent report from AMBcrypto, there seems to be an increasing demand to sell Bitcoin.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-08-02 18:16