-

After falling below the $0.11 baseline, Dogecoin approached an important support range

DOGE’s open interest decline exceeded the daily loss, implying weakening bearish momentum

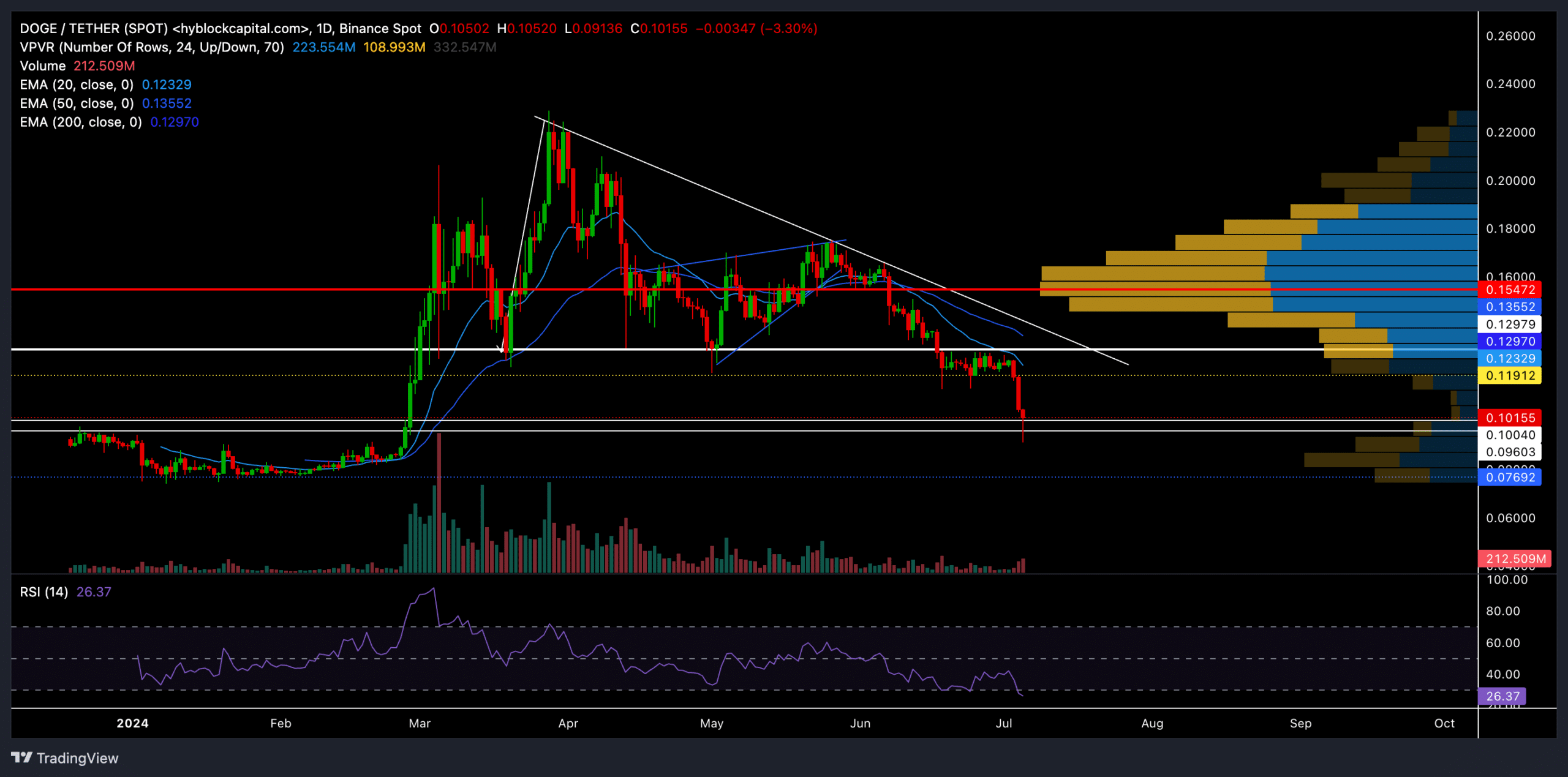

As an experienced analyst, I’ve seen my fair share of bull and bear markets in the crypto space. Dogecoin’s [DOGE] recent downturn has been particularly noteworthy due to its swiftness and intensity. After falling below the crucial $0.12 support level, DOGE approached an important support range at around $0.096-0.11.

As a Dogecoin investor, I’ve witnessed firsthand how the coin’s failure to break through the $0.22 resistance level in May triggered a shift in market sentiment. The bears took advantage of this situation, and as a result, we saw a series of bearish candlesticks on the chart. Dogecoin dipped below both its 20-day and 50-day moving averages during this downtrend.

In our previous piece, we warned that DOGE might give in to downward trends and dip below the significant resistance of $0.12. A possible turnaround from the nearby support zone at $0.096-$0.10 could halt the decline, allowing buyers to regain control.

At the time of writing, DOGE was trading at around $0.101.

Will Dogecoin bears continue to put pressure?

Since the price action changed direction at the $0.22 resistance level, the downward trend, or bearish pressure, has strongly influenced the memecoin’s market. Over the past three months, this bearish pressure caused the value of the memecoin to decrease by more than 54%.

As a researcher studying the behavior of memecoins during economic downturns, I’ve observed an intriguing development in the coin’s price action on the daily chart. The memecoin formed a descending triangle structure, which is a classic bearish pattern, taking over three months for the price to test and repeatedly fail at the $0.129 support level. Eventually, the bears managed to push the price below this level with a series of red candles, signaling a breakout from this bearish pattern.

At the point of the breakout, bulls made an immediate return to test the level. However, the 20 Exponential Moving Average (EMA) proved a formidable obstacle, hindering the rally as the altcoin persisted in its decline and drew closer to the significant support zone of $0.01-$0.096.

Moving forward, this price range is significant in preventing immediate bloodloss in the market. Intriguingly, an examination of the volume profile within this range indicated that the current price was teetering on the edge of a sizable liquidity pocket. Consequently, bears might encounter resistance from bulls when attempting to push prices lower.

If the price moves away from its current support level, it may give bulls an opportunity to revisit the $0.11 to $0.12 range. On the other hand, should the price surge above the 20 Exponential Moving Average (EMA), it might enter a period of reduced volatility.

If the memecoin drops below its current support level, there is a risk of a prolonged downtrend that could bring the price down to around $0.08.

At present, the Relative Strength Index (RSI), a common indicator used to determine overbought and oversold conditions in the stock market, remains in oversold territory. If there is a subsequent rebound from the current level, it could be seen as a bullish sign, indicating a potential reversal of the downtrend.

Open Interest declined

Based on Coingecko’s latest data, I observed a significant decrease of approximately 12% in Dogecoin’s open interest within the past 24 hours. Despite this reduction, the coin’s price only declined by around 4%. This discrepancy suggests that traders might have shown hesitation or uncertainty during this period, leading to less commitment to holding positions.

In such a situation, it’s possible that the market is preparing for a change in direction, be it a reversal or a period of stability before continuing its trend.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-06 11:03