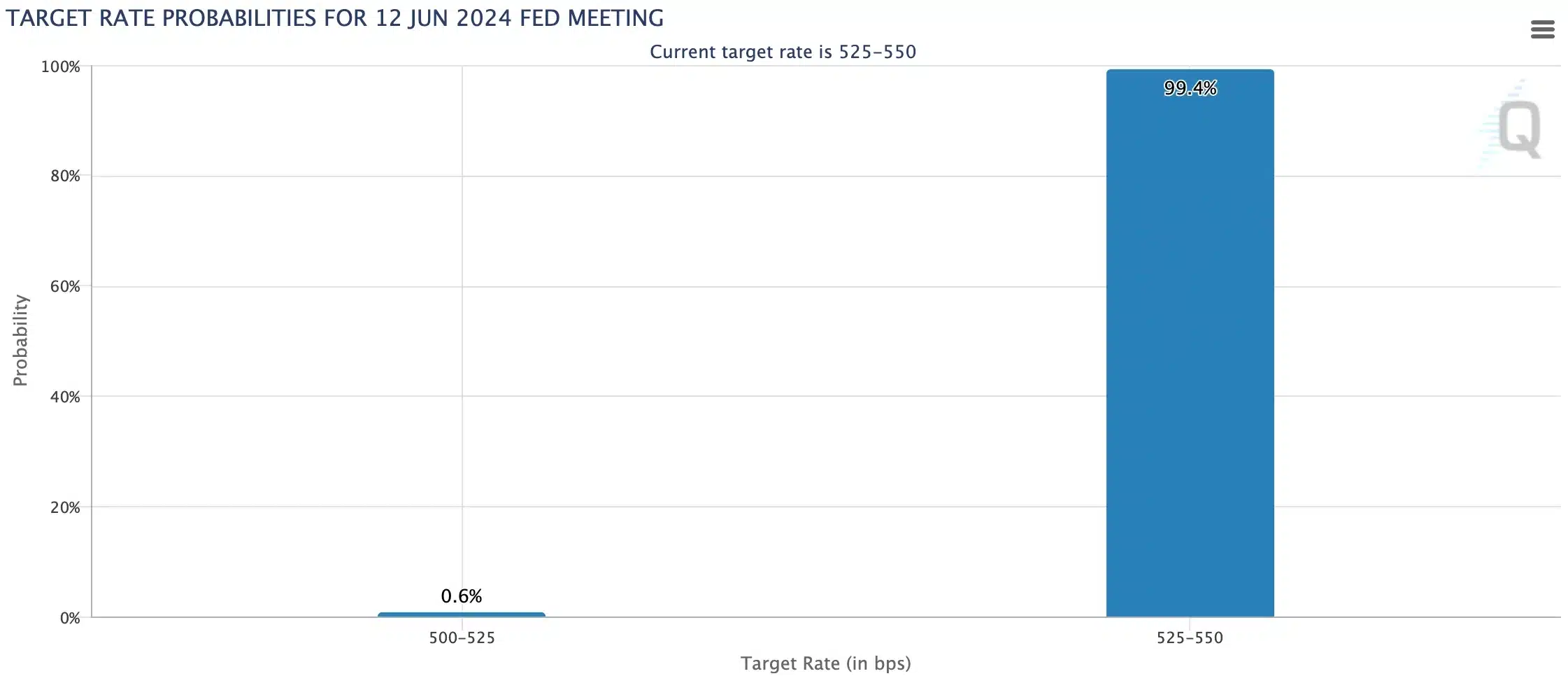

- The CME FedWatch Tool has indicated a low probability of a cut.

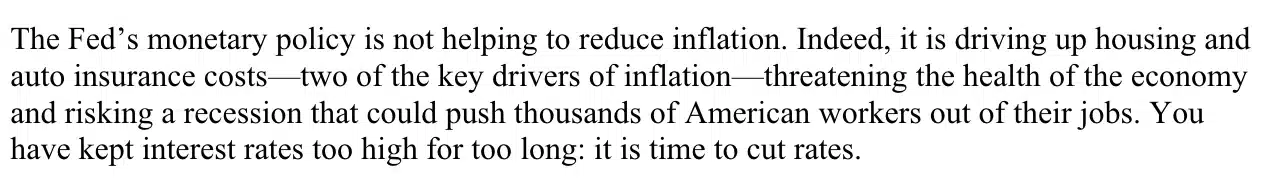

- Senator Warren’s letter hinted at Bitcoin’s bullish situation.

As a seasoned crypto investor with a few years under my belt, I’ve learned to keep an eye on key economic indicators and their potential impact on the cryptocurrency market. With the upcoming FOMC meeting scheduled for the 12th of June, I’m paying close attention to developments that could influence market dynamics.

As the Federal Open Market Committee (FOMC) is set to meet on the 12th of June, there’s been much buzz in the crypto community regarding potential impacts on market trends.

Based on current signs, I believe it’s unlikely that interest rates will be adjusted in the upcoming meeting. According to the CME FedWatch Tool, there’s only a slim chance of a 0.6% reduction in the form of a quarter-point cut.

I’ve come across some recent developments where Senator Elizabeth Warren penned a missive to Federal Reserve Chair Jerome Powell on the 10th of June. In this correspondence, she advocated for consideration of reducing interest rates. Her argument was that such a move would be beneficial.

Impact on the crypto market

Based on information from CoinMarketCap, the international cryptocurrency market experienced a decrease of 0.45% within the past day as of this moment, influenced by sentiments of apprehension, uncertainty, and doubt (FUD).

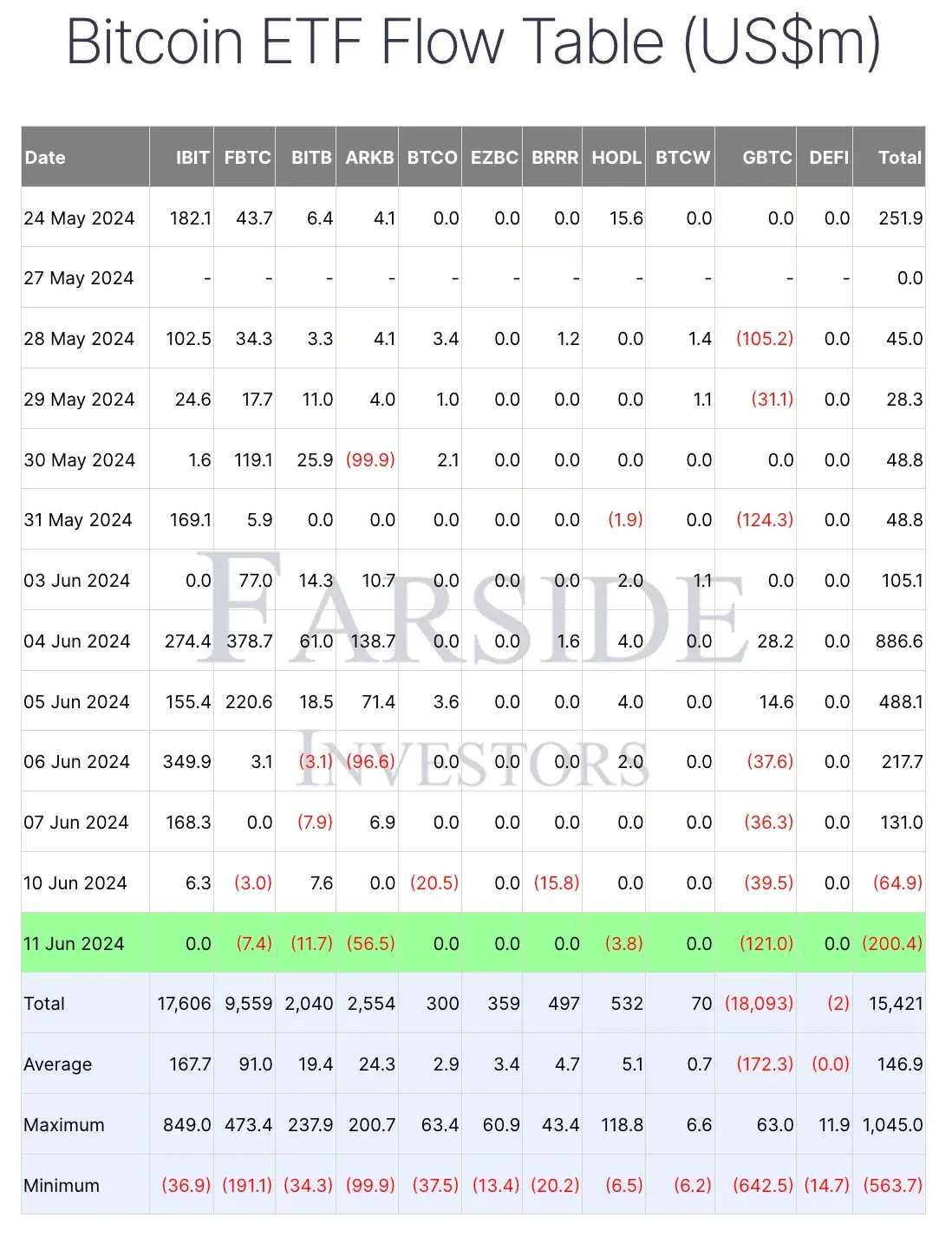

On June 11th, I noticed substantial withdrawals from Bitcoin [BTC] spot exchange-traded funds (ETFs), totaling $200.4 million. Among these, Grayscale Bitcoin Trust ETF (GBTC) accounted for the largest portion of the outflows, according to Farside Investors’ data.

It’s worth mentioning that when central banks reduce interest rates, there is typically a surge in demand for higher-risk assets such as Bitcoin and cryptocurrencies. Therefore, Senator Warren’s stance may inadvertently boost the value of these digital currencies.

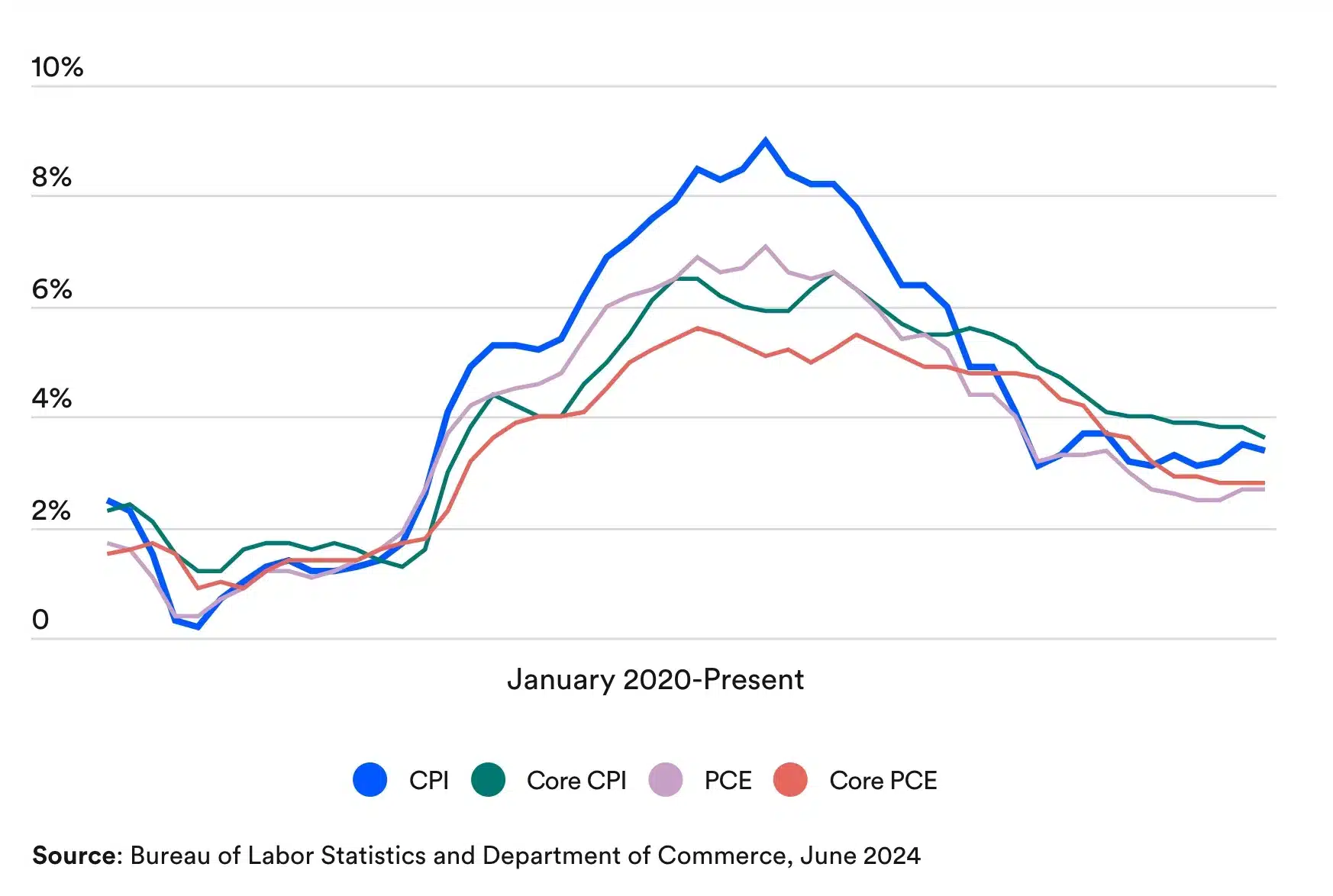

Inflation remains sticky

Needless to say, the inflation rate in the US has been a matter of concern for quite some time.

As a researcher examining data from authoritative sources like the Bureau of Labor Statistics and the Department of Commerce, I’ve found that the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index, has demonstrated more robust growth than the Consumer Price Index (CPI) recently.

However, both indicators indicate persistent inflation.

Optimism persists

Despite concerns, Michaël van de Poppe took to X (formerly Twitter) and noted,

“Price action can be deceiving after a rate decision remains unchanged. Initially, the market may react negatively, but the significant price movement often occurs later on.”

Further elaborating on his point of view, he said,

After past Federal Open Market Committee (FOMC) meetings, Bitcoin experienced a rise of over ten percent, while Ethereum saw a surge of more than twenty percent. Before these events, both cryptocurrencies decreased by a similar magnitude. As a result, it’s plausible to anticipate a rebound in their prices following the upcoming FOMC meeting.

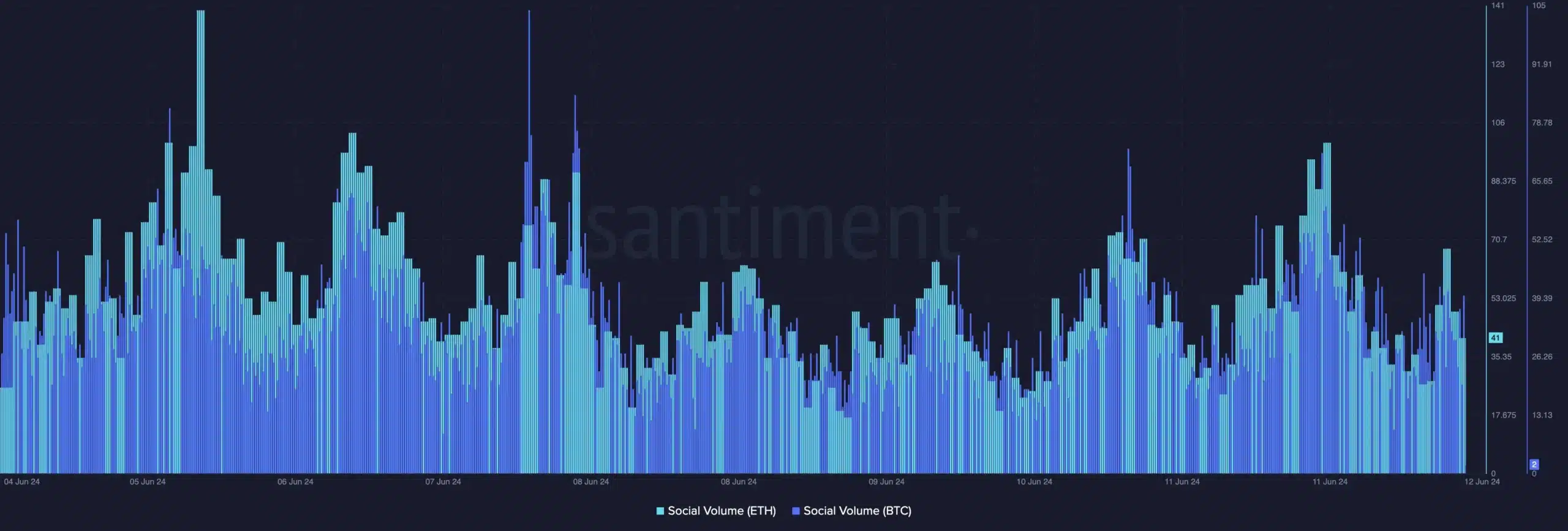

The findings from AMBCrypto’s examination of Santiment data reinforced the trend, as it showed a noticeable surge in social chatter surrounding Bitcoin and Ethereum [ETH].

With anticipation building around the Federal Reserve’s announcement regarding interest rates, it’s intriguing to consider whether historical patterns will recur or if the financial markets will experience significant repercussions from this FOMC gathering.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-12 20:08