- CAKE’s recent rally brought it to a crucial resistance level near the 200-day EMA

- Failure to hold above the $1.8 support level may expose CAKE to further downside

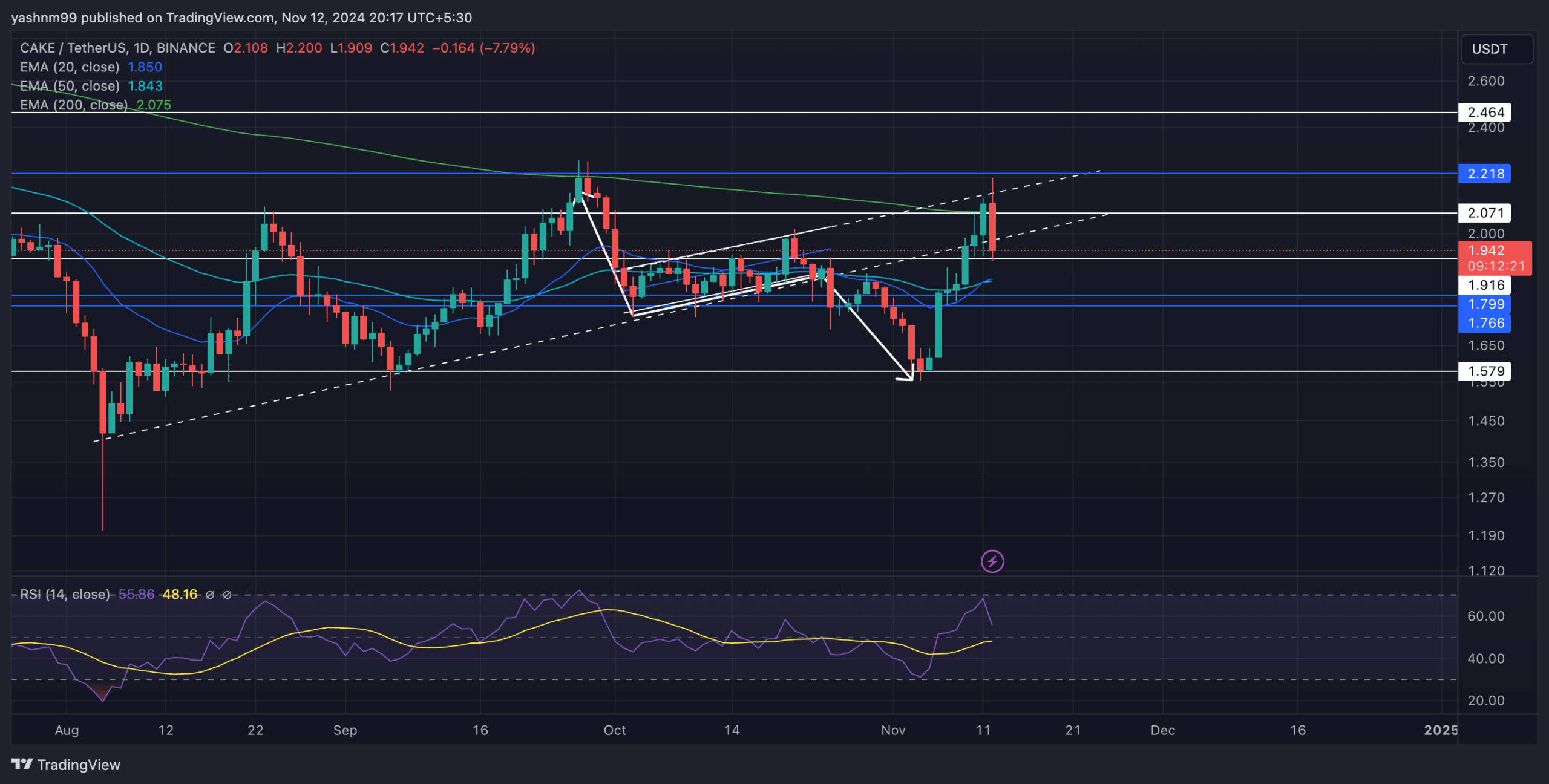

As a seasoned crypto investor with over five years of experience in this wild and volatile market, I’ve seen my fair share of rallies and crashes, moonshots, and dumpsters. The recent rally of PancakeSwap’s [CAKE] has caught my attention, but it seems we’ve hit a crucial resistance near the 200-day EMA.

As an analyst, I’ve noticed that PancakeSwap’s [CAKE] latest rebound has encountered considerable resistance around the $2-mark, which aligns with its 200-day Exponential Moving Average (EMA). Although CAKE has bounced back from its extended lows, it currently stands at a crucial point where a prolonged surge could potentially instill optimism in the bullish camp.

Can CAKE break above the 200-day EMA?

Lately, CAKE has struggled to surpass the 200-day Exponential Moving Average (EMA) at $2.075, which has been a formidable barrier since April. This EMA has functioned as a resilient resistance level for approximately 7 months now, as every effort to move beyond it has been swiftly met with selling pressure.

At the moment of this writing, CAKE’s price hovered approximately around $1.941, slightly above both its 20-day Exponential Moving Average (EMA) at $1.85 and its 50-day EMA at $1.843. These two EMAs appeared to be quite close together, potentially forming a significant support zone. Despite some bullish energy, it dwindled just shy of the $2.1 resistance level.

Traders should keep an eye on the $1.8 support point, which is where the 20-day and 50-day moving averages intersect. If there’s a strong close beneath this level, it might trigger a decline towards the $1.579 support level, another crucial point. A bearish intersection between the 20-day and 50-day moving averages could potentially lead CAKE back to the $1.8 support area. If the price falls below this level, it may expose the coin to the $1.5 support zone.

Initially, the price encountered a strong barrier at $2.071. If CAKE manages to surpass this point, it could potentially target further resistance levels at around $2.2 and potentially even reach $2.4.

Following a drop out of the overbought region, the Relative Strength Index (RSI) stood approximately at 55 at the current moment. This trend supports a decrease in purchasing strength over the recent days. If we see a possible rebound at the 50-level, it suggests a slowdown in overall sentiment as the price may be stabilizing around the Exponential Moving Averages (EMAs).

CAKE Derivatives Data revealed THIS

Over the past day, the long/short ratio was approximately 0.93, leaning slightly towards short positions. On Binance, though, CAKE’s long/short ratio stood at 2.12, suggesting a stronger preference for long positions. Moreover, there was a significant surge in CAKE’s trading volume, increasing by 56.48% to reach $52.22 million – an indication of heightened trader interest. Furthermore, Open Interest experienced a modest increase of 0.51%, reaching $16.5 million, implying that traders are hopeful and choosing to maintain their positions.

Keeping a close eye on the fluctuations in Bitcoin‘s price is essential for traders, especially since the overall market mood significantly influences the direction of CAKE’s trend.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-13 13:43