- Solana has experienced a sustained decline in the last seven days.

- Despite the application of a Solana ETF, negative market sentiment persisted.

As a seasoned crypto investor, I’ve witnessed firsthand the unpredictability of the digital asset market. The recent developments surrounding Solana (SOL) have left me both hopeful and cautious.

As a crypto investor, I’ve seen my fair share of market downtrends, and one that stood out was Solana (SOL). But then, something exciting happened – 3iQ, a Canadian digital asset management company, announced their intention to apply for a Solana ETF. In their report, they shared details about X, which added to the growing hype surrounding this promising cryptocurrency.

As a researcher at 3iQ Corp, I’m thrilled to share that we have taken a significant step forward in our journey by submitting a preliminary prospectus for the Solana Fund (QSOL) in Canada for an initial public offering.

Traders and SOL enthusiasts stand to benefit significantly from the QSOL application. This platform presents an excellent chance to derive financial gains through the staking of Solana (SOL) tokens.

Similarly, it expands opportunities for investment, thereby broadening the potential avenues for individuals looking to generate income and contribute to the SOL ecosystem.

The approval of QSOL will bring diversity and open doors for other altcoins.

In simpler terms, the acceptance and prosperity of QSOL would serve as a model for other nations, including the United States, to adopt comparable agreements and regularly evaluate the approval of ETFs for smaller cryptocurrencies.

Market implications of QSOL’s application

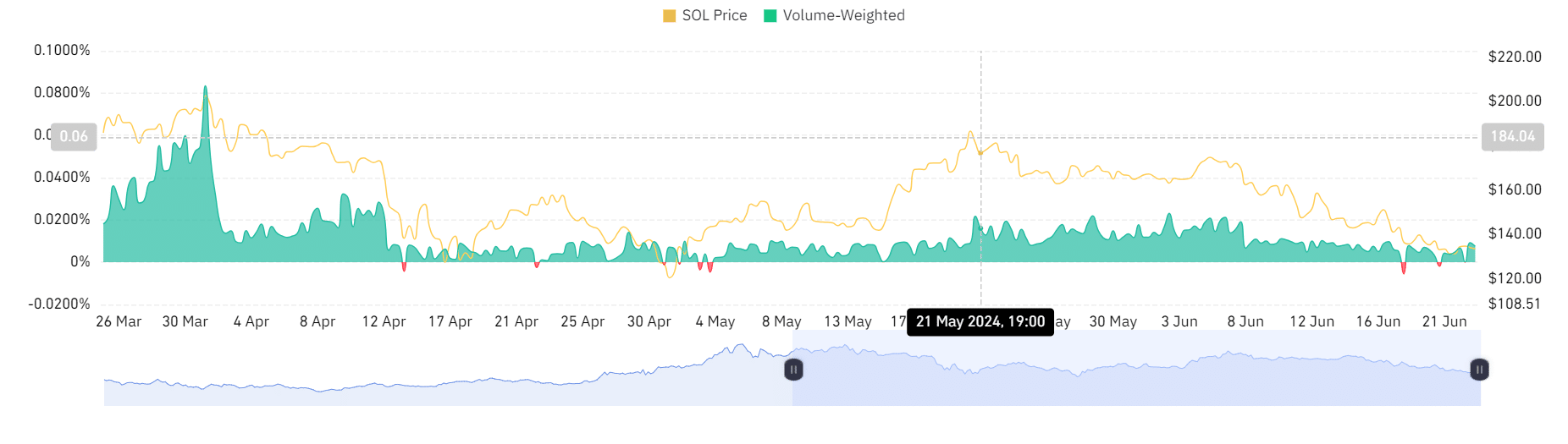

Over the past week, there’s been a noticeable decline in SOL‘s value. The announcement of the QSOL app hasn’t managed to bring about a turnaround in market sentiment and halt this downtrend.

Several crypto experts have voiced optimism regarding this progression. For example, Ash Crypto commented on X, asserting that,

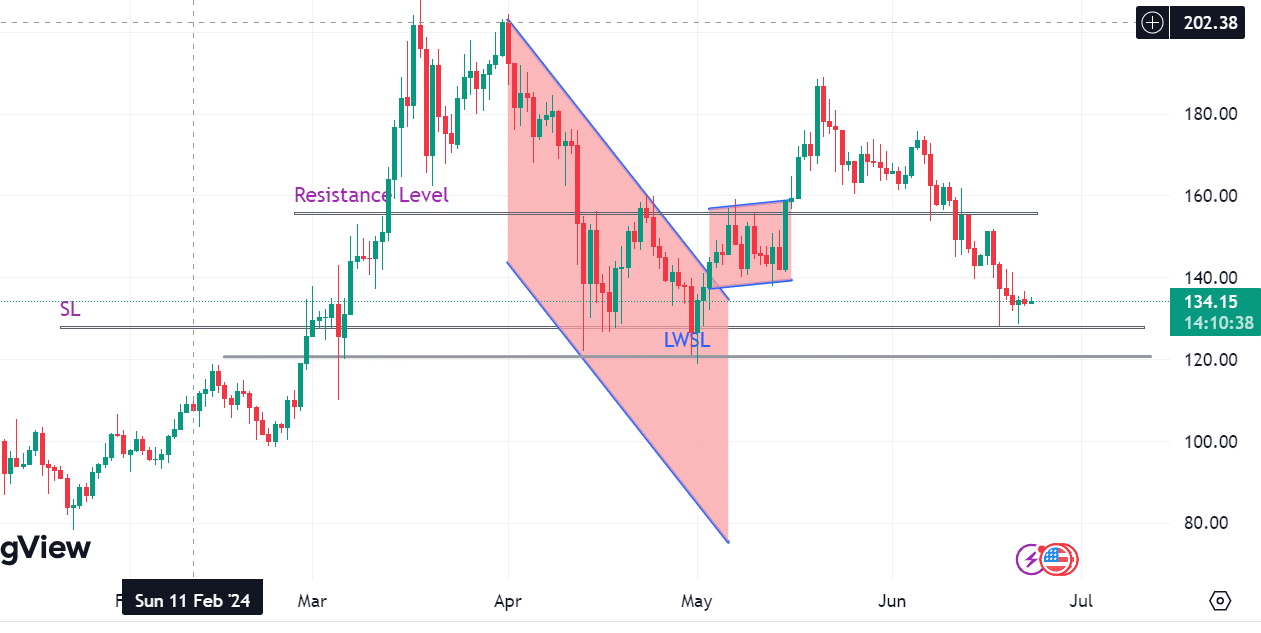

” Sol is now retesting its support level. Everything is screaming bullish for Solana.”

In spite of the buzz and optimistic reports, AMBCrypto’s assessment indicated that the market attitude stayed negative. Currently, Solana was being traded at $134.63, representing a 0.66% rise over the previous 24 hours.

Over the past week, there has been a drop of 6.53%, and the trading volume has significantly decreased by 62% to reach approximately $738 million. As reported by CoinMarketCap, Solana’s market capitalization has experienced a growth of 0.59% within the last 24 hours, amounting to around $62.2 billion.

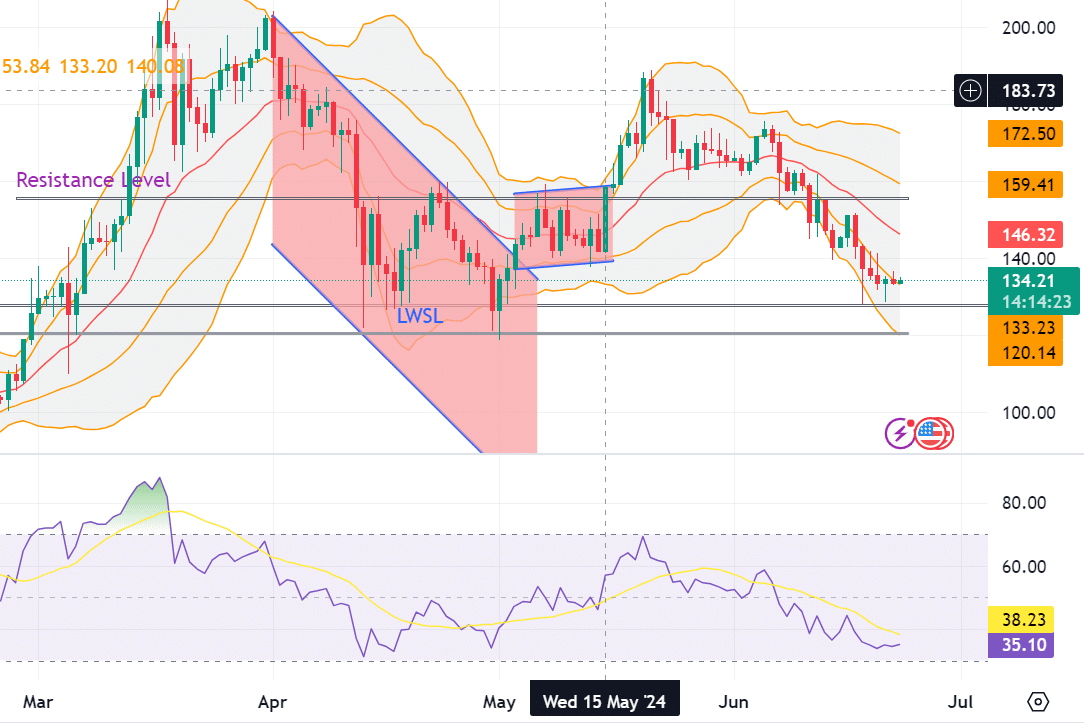

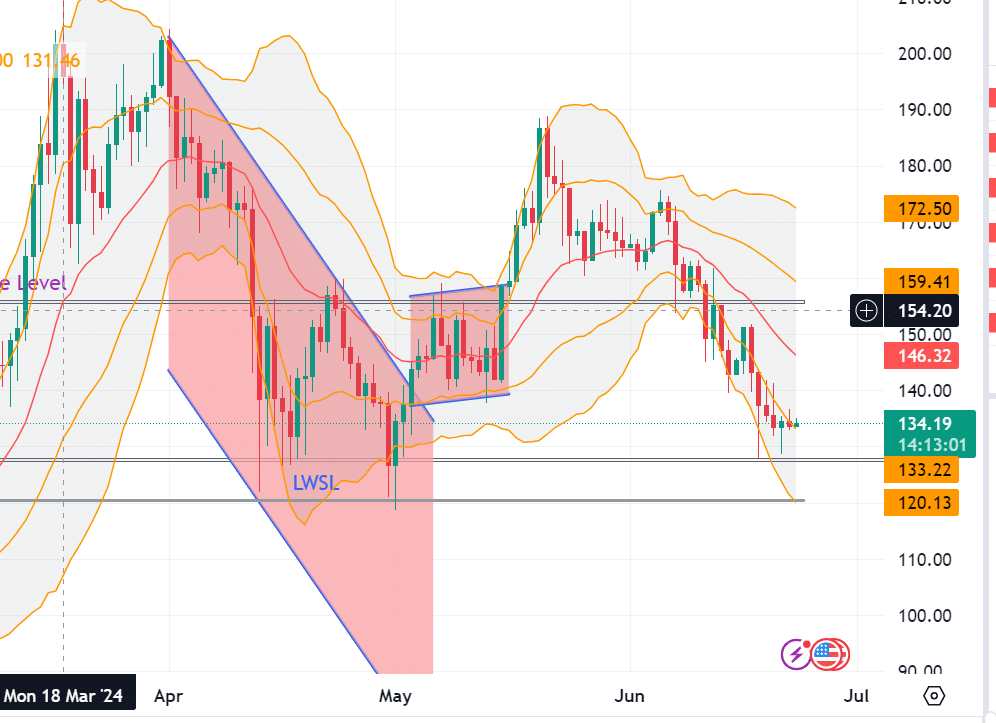

The RSI indicator for SOL has been consistently dropping. Currently, its value is 35 points lower than the moving average of 38. Ever since it dipped below the moving average on the 6th of June, it has been unable to halt this downtrend, suggesting a significant selling force in the market.

At the current moment, the persistent downward trend in SOL sales indicated that it was approaching significantly oversold levels.

As a crypto investor closely monitoring Solana (SOL), based on my analysis using Bollinger Bands, the next significant support for this digital asset is approximately around the 120 mark. If SOL fails to maintain its current support level and falls below this figure, it could potentially lead to further price declines.

Prevailing market sentiment

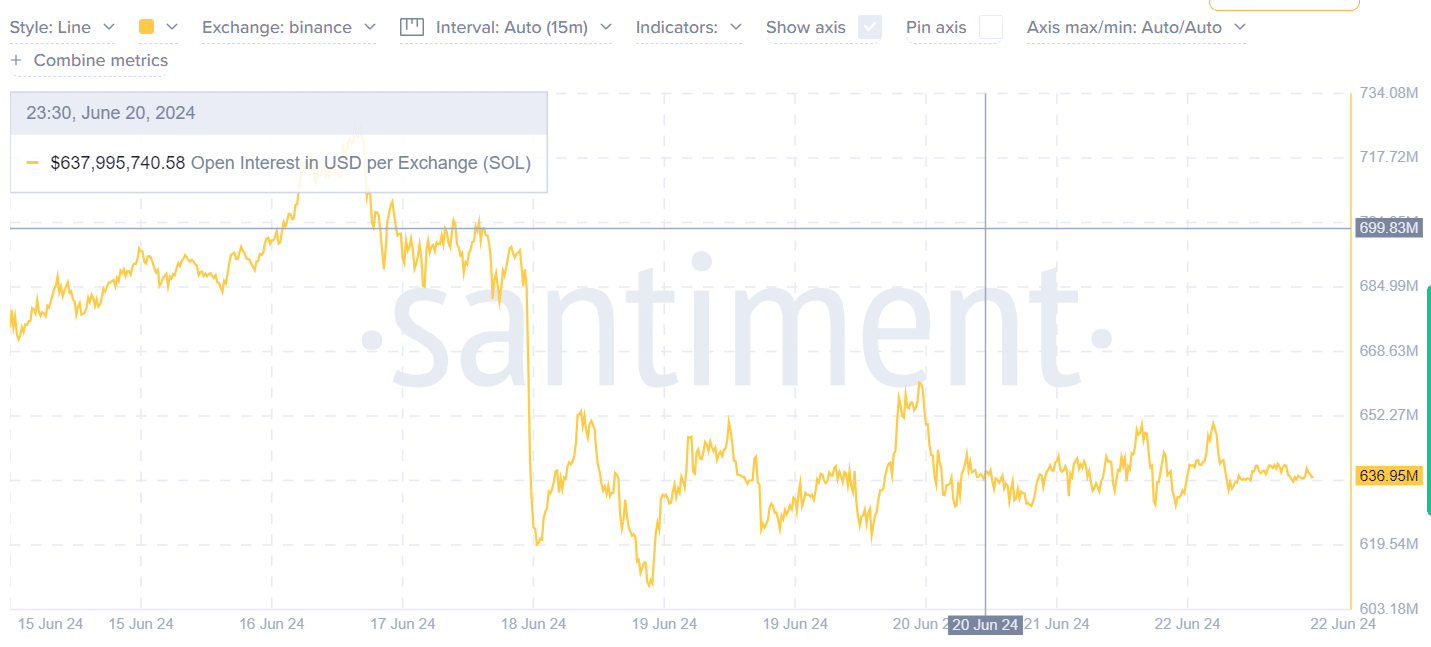

According to AMBCrypto’s analysis using Santiment, there has been a steady decrease in Open Interest from $728 million to $636 million. This persistent drop indicates waning enthusiasm and diminished investor interest towards altcoins.

When investors exhibit a lower interest in the market, it signifies that more of them are selling off their losing positions rather than buying new ones. This behavior reflects a pessimistic outlook on the market.

Similarly, the Volume-Weighted Funding Rates at Coinglass have consistently dropped. A decrease in Funding Rates indicates increased negativity among investors, as they show less interest in taking on leveraged long positions.

Will SOL recover or decline further?

As a researcher examining the market trends, I’ve discovered that according to AMBCrypto’s analysis, Solana (SOL) seems to be heading towards its lower support level, approximately around $127.

Should the altcoin manage to maintain its current support at around $120, it would then attempt to surmount its resistance near $155. Conversely, failing to uphold this support could lead to a slide in price, reaching approximately $121 or even $120.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-23 16:08