- ADA’s resurgence is turning heads in the institutional world, with Grayscale leading the charge

- This move is likely tied to ADA’s impressive price surge in late 2024, with ADA soaring by over 300%

As an analyst, I’ve observed that at the close of 2024, Cardano [ADA] was priced at $0.80 and currently trades at $1.14. This surge has undoubtedly caught the eye of investors, particularly with the ADA/BTC pair showing a positive trend. With altcoins vying for an influx of capital and Bitcoin approaching a potentially risky zone, could Cardano potentially take the lead in the upcoming altcoin cycle?

Cardano’s long-term future seems bright

It’s clear as day – The last seven days have been exceptionally lucrative for Cardano. Those who remained steadfast during the challenging Q4 are now enjoying substantial returns, with their earnings looking quite impressive.

It’s even more intriguing that the revival of ADA is drawing attention from institutional investors. Interestingly, Grayscale’s biggest multi-asset fund, the Digital Large Cap Fund (GDLC), has recently reincorporated ADA into its investment portfolio without much fanfare.

Following an impressive 300% increase during the latter part of 2024 that propelled ADA to $1.33, this growth spurt might turn out to be significant.

Indeed, currently, Grayscale controls assets valued at over $11 million in ADA. If the GDLC application for an exchange-traded fund (ETF) is successful, as was filed in October 2024, this value could potentially increase further.

If Bitcoin (BTC) and Ethereum (ETH) have already experienced substantial growth due to ETF inclusion, it would be groundbreaking if Cardano were also included in such an investment vehicle.

But, what’s next for ADA in the near-term?

In plain English: The graphs clearly show that Cardano is starting the year strong, outperforming others in the market. With a 30% increase, it’s leaving its competitors behind, and the rise against Bitcoin in the ADA/BTC pair suggests more investors are viewing it as an attractive option for diversifying their portfolios.

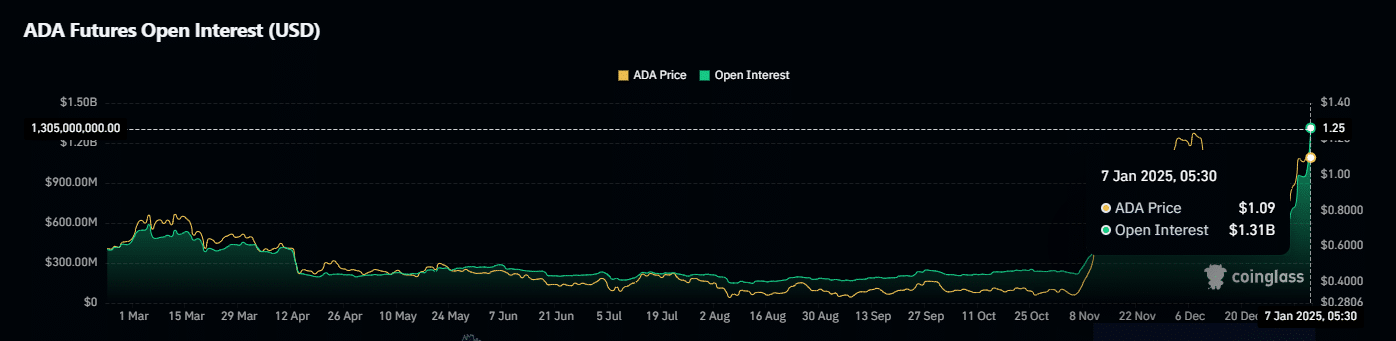

In addition to this rally, Open Interest (OI) experienced a significant surge by 11%, reaching an impressive peak of $1.31 billion. To clarify, at the moment, ADA’s Open Interest is actually higher than when it previously reached its yearly high of $1.24 billion during the “Trump pump.

Here’s the twist – to sustain this positive trend, it’s crucial that they persist in their efforts towards amassing more.

To continue this rise, it’s essential that they carry on building up their stockpiles.

Or for a more conversational tone:

In order to keep things moving forward, they need to stay focused on adding more to what they have.

In a situation where the gap between quick and prolonged liquidations is minimal, any slight change might cause Cardano to plummet, potentially forcing out long positions and creating a tight squeeze.

Read Cardano (ADA) Price Prediction 2025-26

Despite a 30% increase in trading activity and an uptick in outflows from the spot market, ADA may effortlessly surge toward $1.50 in the short term.

Should this pattern persist, it’s plausible that Cardano might spearhead the upcoming altcoin surge, given that Bitcoin’s dominance is showing signs of a ‘death cross’, suggesting a potential transition that may pave the way for altcoins to outshine other cryptocurrencies.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-08 08:41