- 52.67% of top traders held short positions, while 47.33% held long positions

- A section of whales appeared to be accumulating ETH too

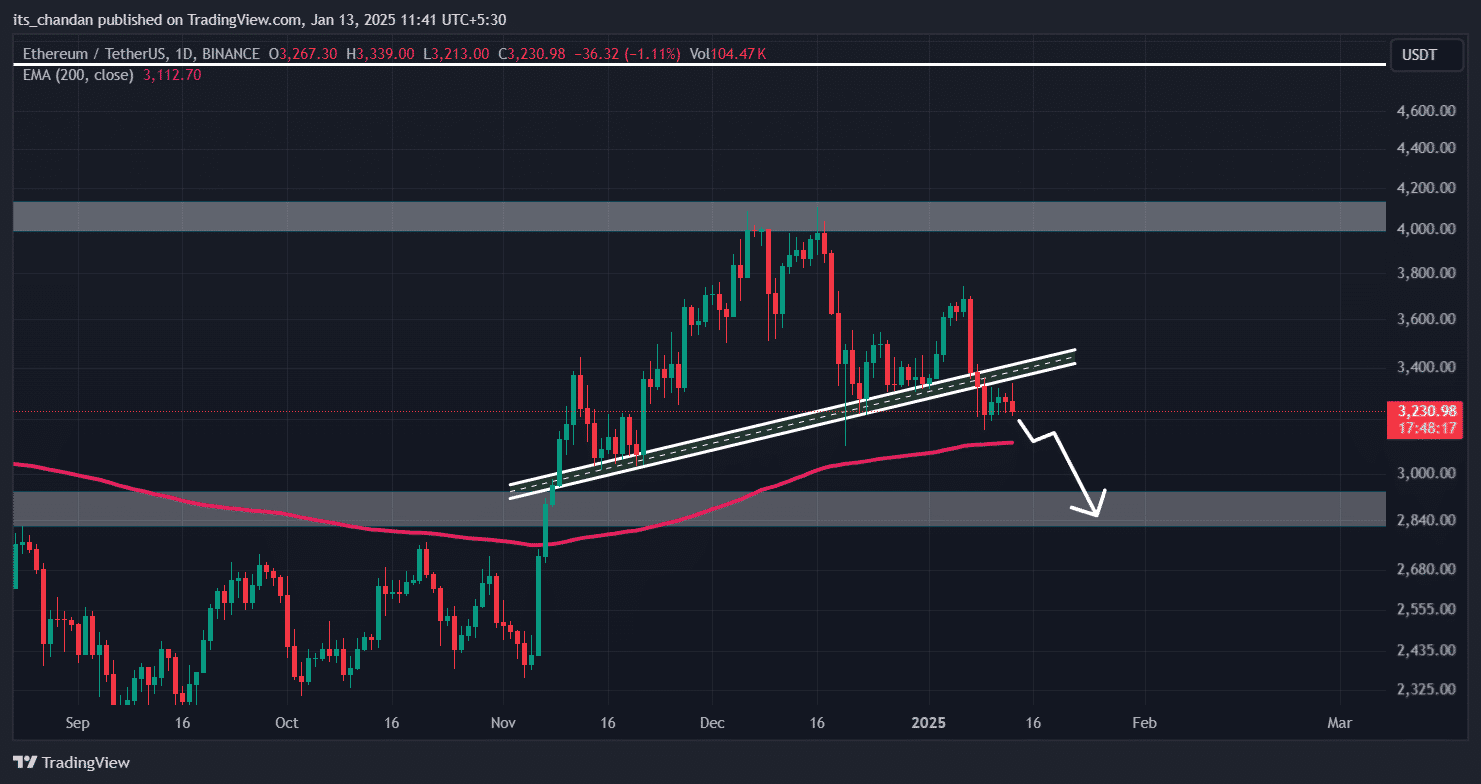

At the moment of reporting, it appears that Ethereum (ETH), the second most valuable cryptocurrency in terms of market capitalization, might be indicating a possible drop in price due to a bearish trend visible on its chart analysis.

Ethereum’s (ETH) bearish outlook

It’s worth pointing out that the negative pattern he’s showing isn’t limited to Ethereum (ETH); it can be seen in other significant cryptocurrencies like Bitcoin (BTC), Ripple (XRP), and Solana (SOL) as well.

Starting from December 2024, Ethereum (ETH) has been experiencing a continuous decline. It has dropped below and subsequently revisited the level at which it initially fell – a move that reinforces the pessimistic outlook for ETH’s price movement.

ETH price prediction

According to its latest market behavior and past trends, if current attitudes persist, it’s likely that Ethereum (ETH) could fall by around 10% to reach approximately $2,850 in the future. Yet, technical signs hint at the potential for a price increase as well.

As an analyst, I observed on the daily timeframe that Ethereum’s Relative Strength Index (RSI) was approaching the oversold zone, suggesting a possible recovery. Meanwhile, the 200 Exponential Moving Average (EMA) signaled a positive trend for the asset, indicating an uptrend it was experiencing.

Traders maintain a bearish bias

Although these indicators suggest a positive market outlook, traders are still reluctant to invest in long positions, according to the on-chain analytics firm CoinGlass. Currently, Ether’s long/short ratio is 0.94, suggesting that traders have a predominantly bearish mindset.

When assessed, 52.67% of top traders held short positions, while 47.33% held long positions.

Despite the ongoing bear market, it’s worth noting that traders have been increasing their positions substantially. This trend is especially evident with Ethereum (ETH), as its Open Interest grew by 4.5% within the last 24 hours. These figures suggest that short-term traders are bearing a bearish sentiment, which might signal a possible price decrease in the near future.

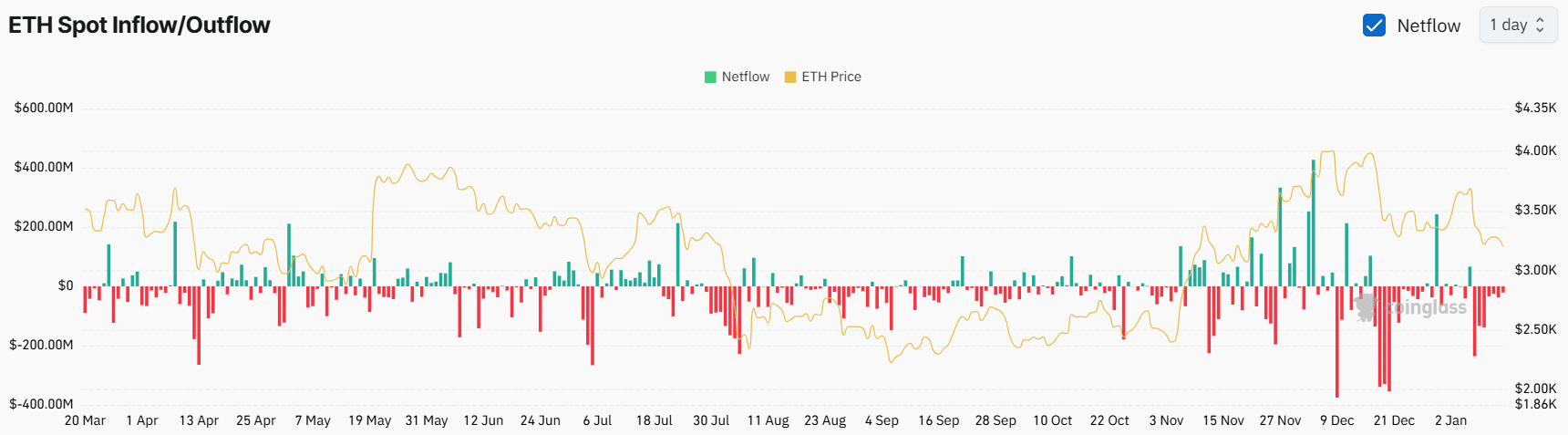

Whales’ recent activity

Alongside traders, it seems that long-term investors and large holders are also amassing Ethereum, according to the inflow/outflow measure provided by CoinGlass.

It appears that recent data indicates that exchanges have experienced withdrawals totaling more than $21 million in Ethereum (ETH) during the past day, suggesting possible accumulation which might lead to increased demand and a chance for purchasing at an opportune moment.

Read More

2025-01-14 06:15