- Litecoin saw a strong bullish resurgence amid the recent market rally.

- The current momentum and positive derivatives data suggest buyers can still push higher, but a close above the immediate resistance range is crucial.

As a seasoned researcher with years of market analysis under my belt, I find myself intrigued by Litecoin’s [LTC] recent bullish resurgence. The current momentum and positive derivatives data suggest that buyers could potentially push higher, but a close above the immediate resistance range is crucial to validate this optimism.

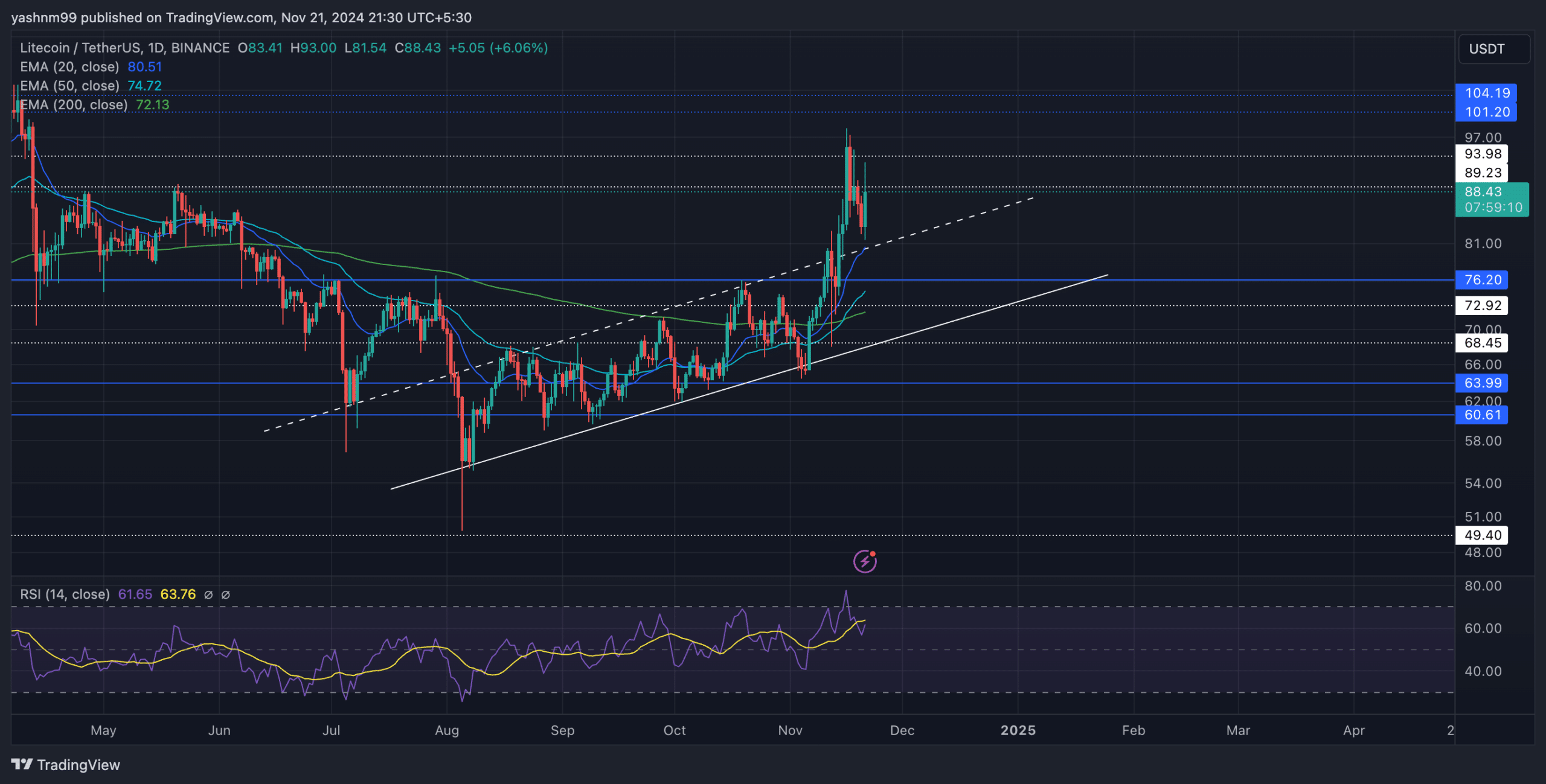

The latest surge in Litecoin’s value [LTC] has taken it beyond its resistance trendline, potentially placing it within an area of the chart that could signal a significant price breakout.

At the moment, LTC was approximately $88 per unit, representing an increase of more than 2% over the past day. A key point to consider is whether the current buying trend will continue, potentially pushing prices towards stronger resistance levels, or if we might experience a short-term correction instead.

LTC jumped above its EMAs to depict strong buying momentum

For the past three months, Litecoin followed an ascending channel trend. More recently, it surged beyond this pattern due to strong buying activity. During this surge, it finished above significant moving averages such as the 20-day, 50-day, and 200-day Exponential Moving Averages (EMAs).

This week, the altcoin has made repeated attempts to surpass a substantial resistance zone, roughly between $89 and $93.

If the bulls successfully push LTC past $93, it might surge toward the resistance area of $100 to $104. However, if they fail to break this resistance, a potential drop could occur back towards the support region around $76, which may extend down to the $72 zone. This level lines up with the short-term moving averages and immediate trendline support (shown as white, dashed).

In simpler terms, when the Relative Strength Index (RSI) shifted from being too high (overbought) to a more normal level, it signaled a rise in buying pressure. If the RSI doesn’t manage to cross its moving average, this can lead to a slow trend on the charts.

LTC Derivates data revealed THIS

Analyzing derivative statistics indicates a relatively optimistic trend for Litecoin (LTC). Notably, trading volume has significantly spiked by approximately 76.14%, reaching $1.14 billion. This surge suggests that an increasing number of traders are participating in the market as the price rises.

As an analyst, I notice that open interest is subtly climbing up. This could indicate that traders are strategically positioning themselves for a notable shift, be it a breakthrough in the opposite direction or further continuation of the ongoing trend.

Read Litecoin’s [LTC] Price Prediction 2024–2025

In a relatively even split, the long/short ratio stands approximately at 0.9414, however, there seems to be a slightly stronger bias towards optimistic views, or ‘bullish’ sentiment, on trading platforms like Binance and OKX. Notably, skilled traders appear to be placing their bets on rising prices.

It’s also important to consider the overall market, particularly Bitcoin’s movements, as they greatly affect other altcoins like Litecoin. If Bitcoin continues to do well, it could help Litecoin push past the $93 resistance.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-11-22 09:11