-

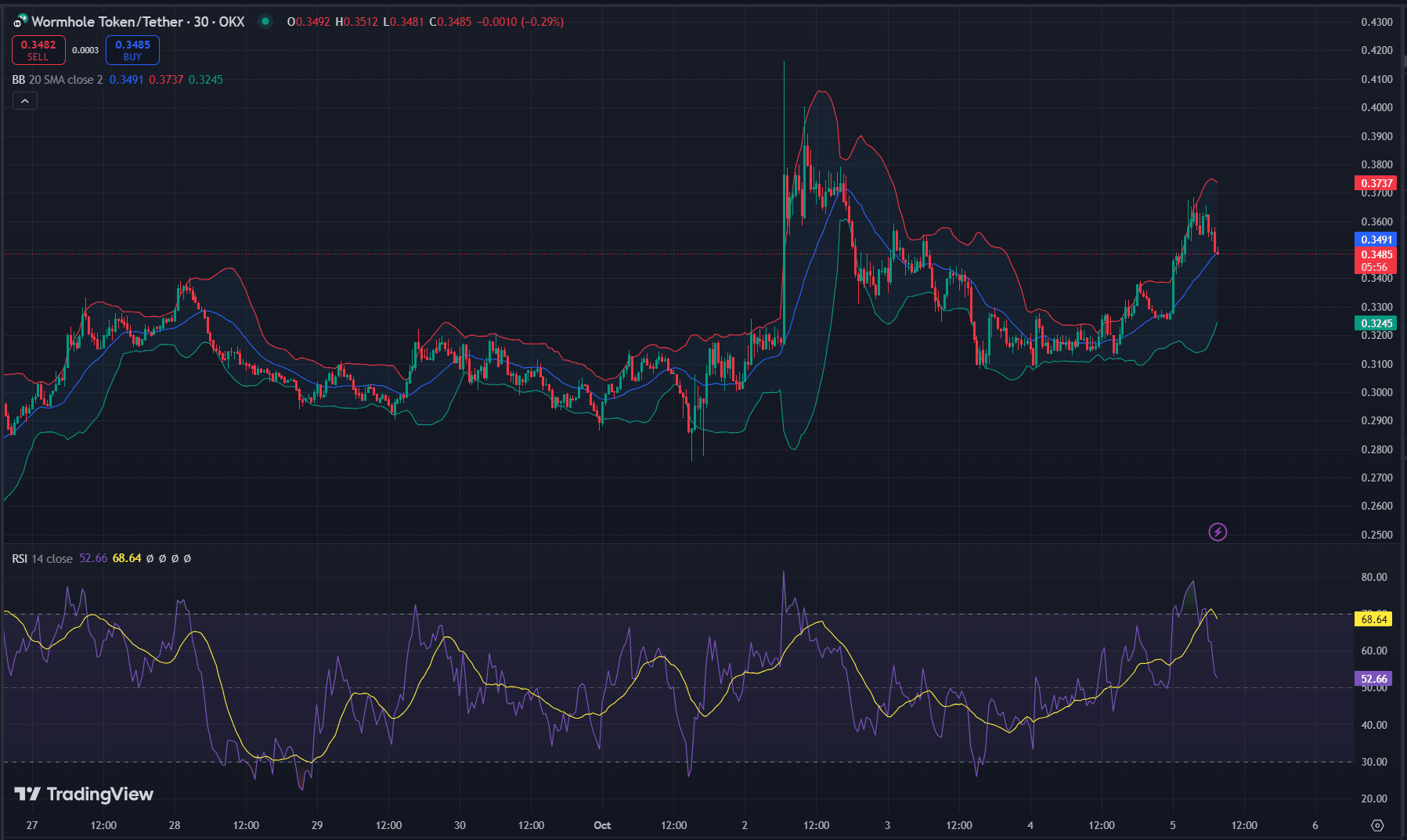

Wormhole, at press time, faced key resistance at $0.3737, with strong support at $0.3245

Open Interest climbed by 10.57%, suggesting strong trader interest despite mixed on-chain data

As a seasoned researcher with years of experience under my belt, I’ve seen my fair share of market fluctuations and surprises. Wormhole [W] has certainly piqued my interest with its impressive 13.93% surge over the past day, pushing it to $0.3626 at press time. The token seems to be on the brink of a potential breakout, but as we all know, the crypto market can be as unpredictable as a rollercoaster ride in a theme park.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastWormhole [W] recorded a significant surge of 13.93% over the past 24 hours, propelling its price to $0.3626 at press time. This sharp hike, along with a 37% jump in trading volume, has raised questions about whether the token is nearing a breakout or not.

Investors are keeping a close eye on significant technical thresholds, trying to determine whether the current trend will persist or if a potential reversal may be imminent.

Key support and resistance levels to watch

Currently, as I’m typing this, the token is nearing a potential resistance point of $0.3737, as suggested by Bollinger Bands analysis. If it doesn’t manage to break through this level, there could be a pullback. But if the strong support at $0.3245 holds firm, the bullish momentum might continue.

Furthermore, the Relative Strength Index (RSI) was at 68.64, suggesting a state of overbought market conditions. This might indicate the need for caution since the asset is approaching these levels.

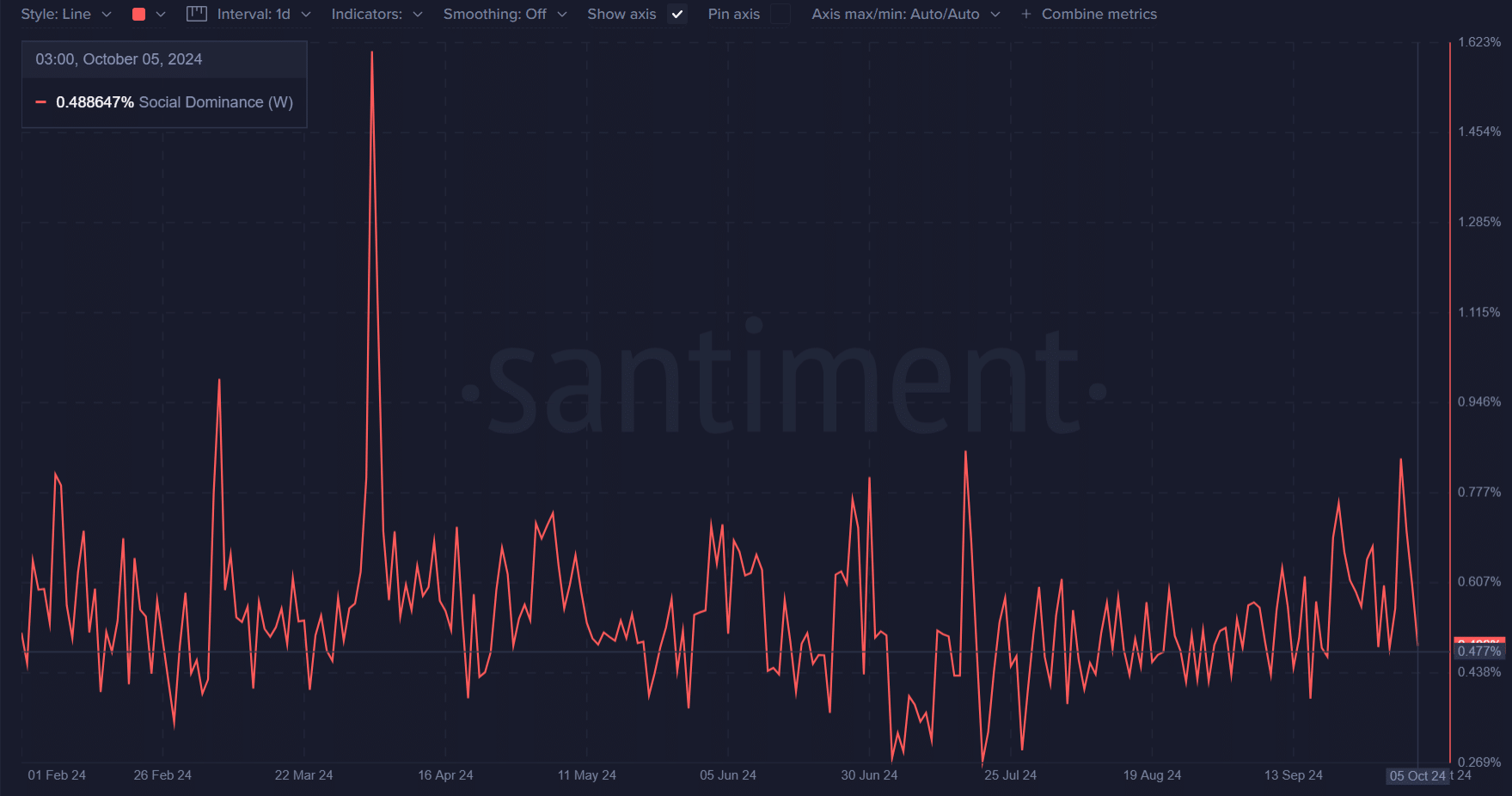

Wormhole social dominance – Still modest

A social dominance level of 0.488% suggests it hasn’t gained significant traction yet, implying it hasn’t sparked a major surge in popularity.

On the other hand, an increase in social dominance might serve as a spark for additional price increases. Investors are keeping a keen eye on online conversations to predict any changes in market opinion.

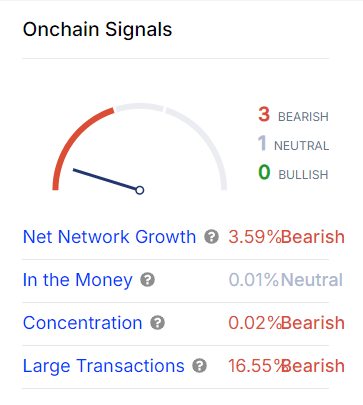

On-chain data provides mixed signals

On-chain indicators paint a somewhat intricate image, but here’s what they suggest: A decrease of 3.59% in network growth signals a slowdown in user adoption. Additionally, a decline of 16.55% in large transactions may imply reduced activity from the ‘whales’.

Conversely, the “In the Money” signal showed as neutral, implying many owners might be at breakeven points. This could indicate a period of market turbulence ahead.

Wormhole’s Open Interest on the rise

A rise of 10.57% in Open Interest, currently standing at $52.46 million, indicates a positive outlook for bulls as it suggests that an increased number of traders are wagering on continued market movement.

A rise in Open Interest might boost the token over its temporary resistance barriers in the near future.

Is your portfolio green? Check the Wormhole Profit Calculator

Breakout likely, but caution is warranted

With its ongoing bullish trend, increasing trading volume, and robust underlying support, it seems Wormhole might be gearing up for a possible surge. Yet, conflicting signs from social influence and blockchain activity indicate that investors should exercise caution.

To continue the upward trend convincingly, it’s essential to overcome the significant hurdle at approximately $0.3737. Although a surge appears imminent, closely observing this and other relevant indicators will be vital in making informed decisions about the market’s future direction.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-06 02:15