- Notcoin is in the spotlight today courtesy of its healthy ranking in the play-to-earn segment.

- NOT flashed a major trend pivot as whales re-accumulated after previously pushing down the price

As a seasoned analyst with over two decades of experience in the crypto market, I’ve witnessed numerous trends come and go, but the rise of Notcoin is one that has certainly piqued my interest. The altcoin’s impressive performance in the play-to-earn segment, coupled with its high trading volume, suggests a promising future for this cryptocurrency.

Over the past period, Notcoin has been steadily increasing in recognition and climbing the charts. As a matter of fact, it stood as the 79th largest cryptocurrency by market capitalization at the point of publication. In the play-to-earn sector, one of the most rapidly expanding segments of 2024 crypto market, Notcoin even outperformed its peers.

In third place among Ben GCrypto’s top 10 play-to-earn coins was Notcoin, boasting a market cap of $897 million. What stood out, though, was its impressive trading volume, which surpassed all other coins on the list. This strong showing suggests that Notcoin is making its mark and could be a force to reckon with in the segment, hinting at its growing influence.

Given the current trends, we’re questioning if this performance could potentially help Notcoin’s native cryptocurrency bounce back. Notably, since June, Notcoin has predominantly moved downwards, with a brief but significant uptick in July. The primary cause behind this trend can be attributed to continuous selling from the large-scale investors, often referred to as ‘whales’.

How Notcoin whales affected NOT’s price action

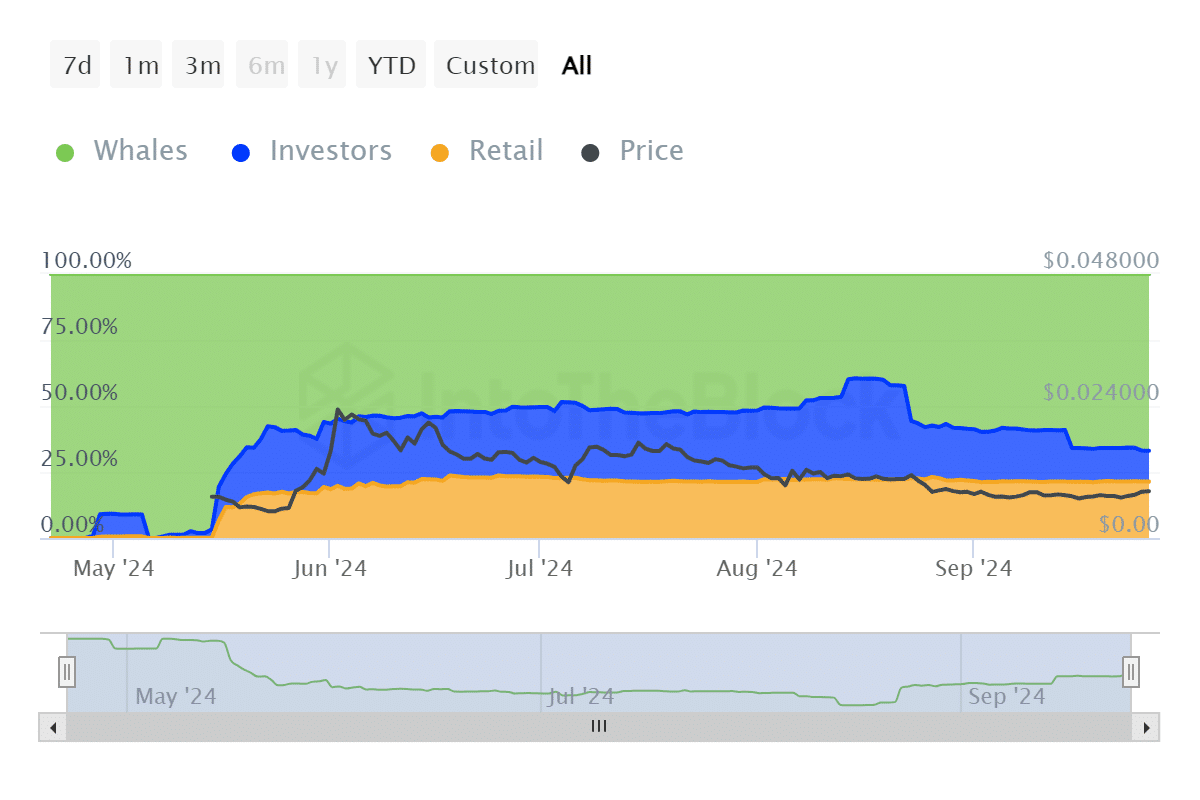

The data from history shows that the whales’ possession reached a minimum of approximately 54.17 billion coins, which accounted for about 52.17% of the total supply, on June 14. However, their holdings dropped again to around 40.54 billion coins (39.6% of the supply) by August 17. To put it simply, the whales have been significantly increasing the selling pressure.

The data shows that whales haven’t been reaccumulating their coins since mid-August. As of September 26th, they were holding approximately 68.58 billion coins, which equates to 66.91%. This accumulation seems to have mitigated the decrease in their holdings.

Over a two-week span, starting from mid-June, investors withdrew approximately 22 billion coins, leaving about 12 billion at present. During the same period, retail investors reduced their holdings by around 2 billion coins. Essentially, the movements of large-scale investors (whales) had the most significant effect on the altcoin’s price.

The resistance from selling pressure appears to have stabilized around the $0.0071 mark this month. However, it has shown some positive signs of growth this week, with prices surging approximately 40% in the last five days. Interestingly, the cryptocurrency currently stands at a value of $0.0090 as we speak.

In contrast to its recent price increase, it appears that whale activity is the driving force, aligning well with their accumulation phase. The influx of liquidity could potentially lead to further recovery for Notcoin within the upcoming weeks or months.

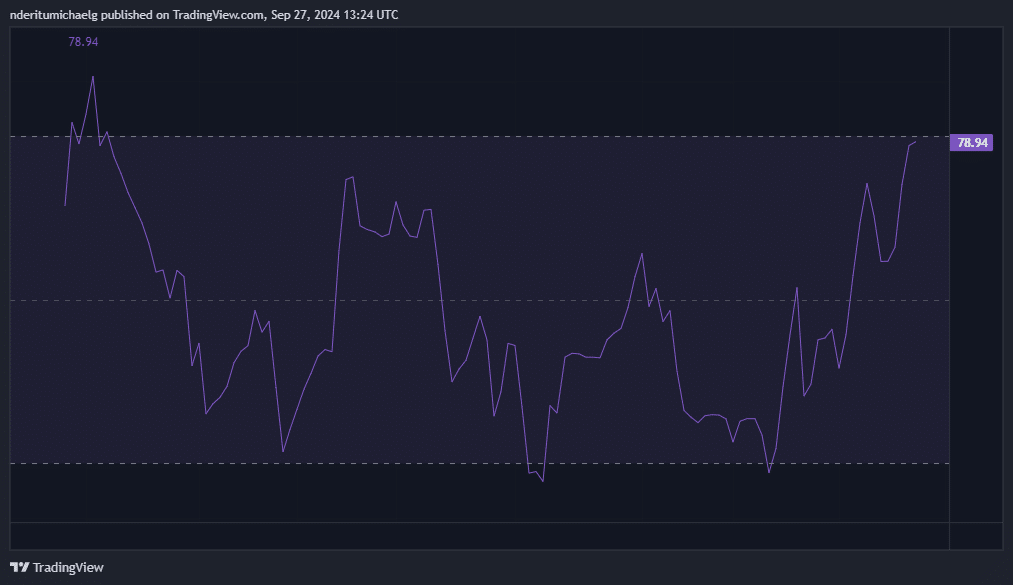

Finally, its money flow indicator revealed a strong liquidity resurgence so far this month.

Currently, at the point of composition, NOT was found trading at a 76% reduction from its peak record high. This could be perceived as enticing. A surge in liquidity, notably from significant investors known as whales, might rekindle interest among retail buyers and other investors. In the near term, projected price targets for NOT are $0.012 and $0.017.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-28 09:11