-

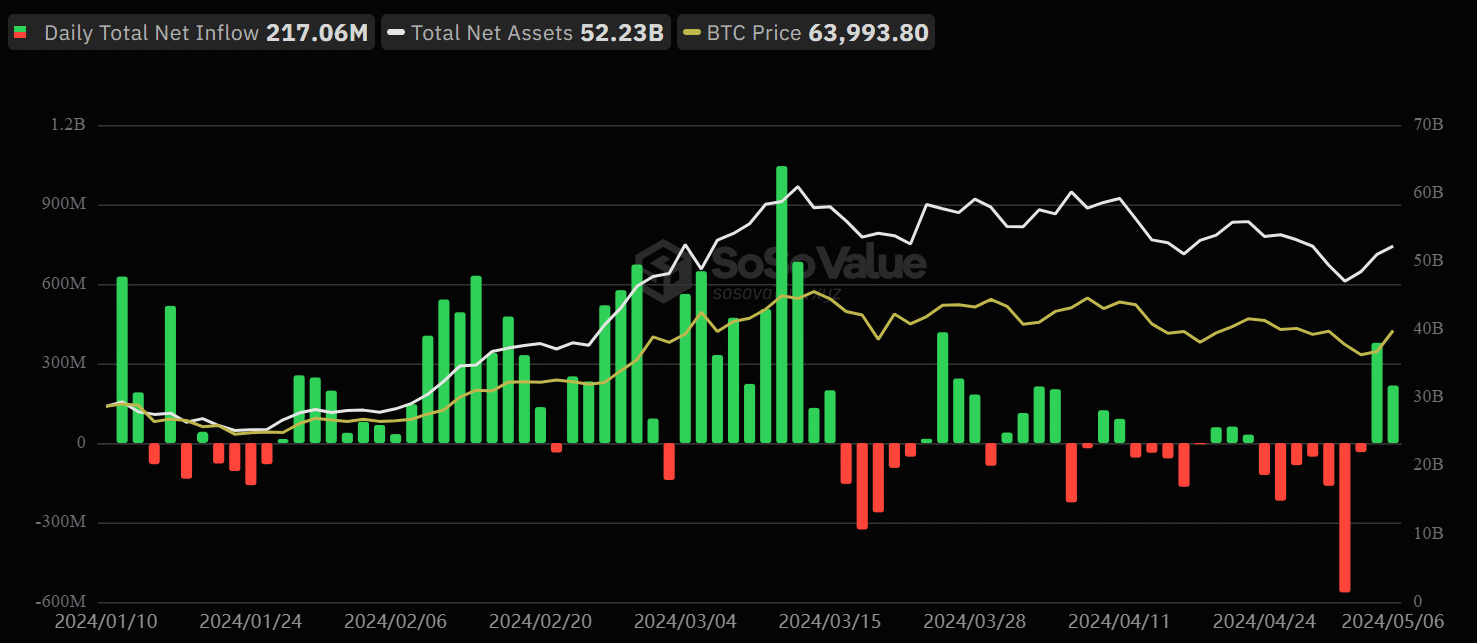

U.S. BTC ETFs saw $156 million in outflows last week amidst market drawdown.

GBTC saw inflows for two days straight as markets improved.

As a crypto investor with some experience in the market, I’ve seen my fair share of volatility and price swings. Last week’s $156 million in outflows from U.S. Bitcoin ETFs was concerning, but it seems that Grayscale’s GBTC is leading the recovery charge.

Last week, US Bitcoin (BTC) ETFs experienced a net withdrawal of approximately $156 million. However, this trend may shift as the bleeding in Grayscale’s GBTC seems to be coming to a close.

Based on data from a recent CoinShares report, there was notable withdrawal of funds from Bitcoin (BTC) investment products last week, as the value of BTC dipped below the typical purchase cost for exchange-traded fund (ETF) providers.

The report mentioned that automatic sell orders could have spiked last week’s BTC drawdown.

As a crypto investor, I’ve calculated the average cost basis for these Bitcoin ETFs since their inception to be around $62,200 per coin. When the price dipped approximately 10% below this figure, it could potentially have set off automated sell orders.

On May 1st, Bitcoin reached a bottom of $56,500, triggering a widespread sell-off and forced liquidations across the market. All U.S.-listed Bitcoin ETFs experienced significant redemptions on this day, marking BlackRock’s IShares Bitcoin Trust as the first to record outflows since January.

On May Day, a grand total of $563.7 million was withdrawn in aggregate, with Fidelity and Grayscale being the top contributors at $191.1 million and $167.4 million respectively.

The report states that the outflows became less severe towards the end of the week, resulting in a total outflow of $156 million for the previous week.

Will GBTC’s U-turn fuel the Bitcoin ETF recovery?

As a researcher studying the cryptocurrency market, I’ve observed an uplift in investor optimism as Bitcoin (BTC) rebounded from its dip at $56,500 to reach $65,000. Surprisingly, Grayscale’s GBTC fund took center stage during this recovery, making headlines with its unexpected moves.

Last Friday, it received the initial investment of $63.9 million, while an additional $3.9 million was invested on Monday.

As a researcher observing the financial market scene, I was taken aback, just like many other analysts at Bloomberg, by Grayscale’s unexpected reversal in strategy. Eric Balchunas, one of my colleagues at Bloomberg, pointed out in his analysis.

It seems that inflows are occurring once again today. With their sizable marketing budget and the current market recovery, as well as a decrease in departures, this situation might be the reason.

Last Friday, the market’s rebound sparked renewed interest among investors, leading to an inflow of $378.2 million. US Bitcoin exchange-traded funds continued their positive trend on Monday, attracting an additional $217 million in investments.

Currently, Bitcoin (BTC) had retreated to its prior price corridor of around $60,000 to $71,000 during my writing, but subsequently fell beneath the $64,000 mark after extracting liquidity at $65,500.

As a crypto investor, if Bitcoin’s (BTC) price recovers and reaches its upper range, US Bitcoin Exchange-Traded Funds (ETFs) might reverse the significant $156 million worth of outflows that occurred last week.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-05-08 09:11