- The large size of the Options expiry on 16 August was preceded by a volatility spike in prices

- Price trends could stabilize from here on, but the bears still have the upper hand

As a seasoned researcher with years of experience in navigating the volatile crypto markets, I find the recent Options expiry data for Bitcoin [BTC] and Ethereum [ETH] intriguing. The steep drop in prices on Wednesday, 14 August, was a stark reminder of the market’s unpredictability, but it also set the stage for an interesting expiry day.

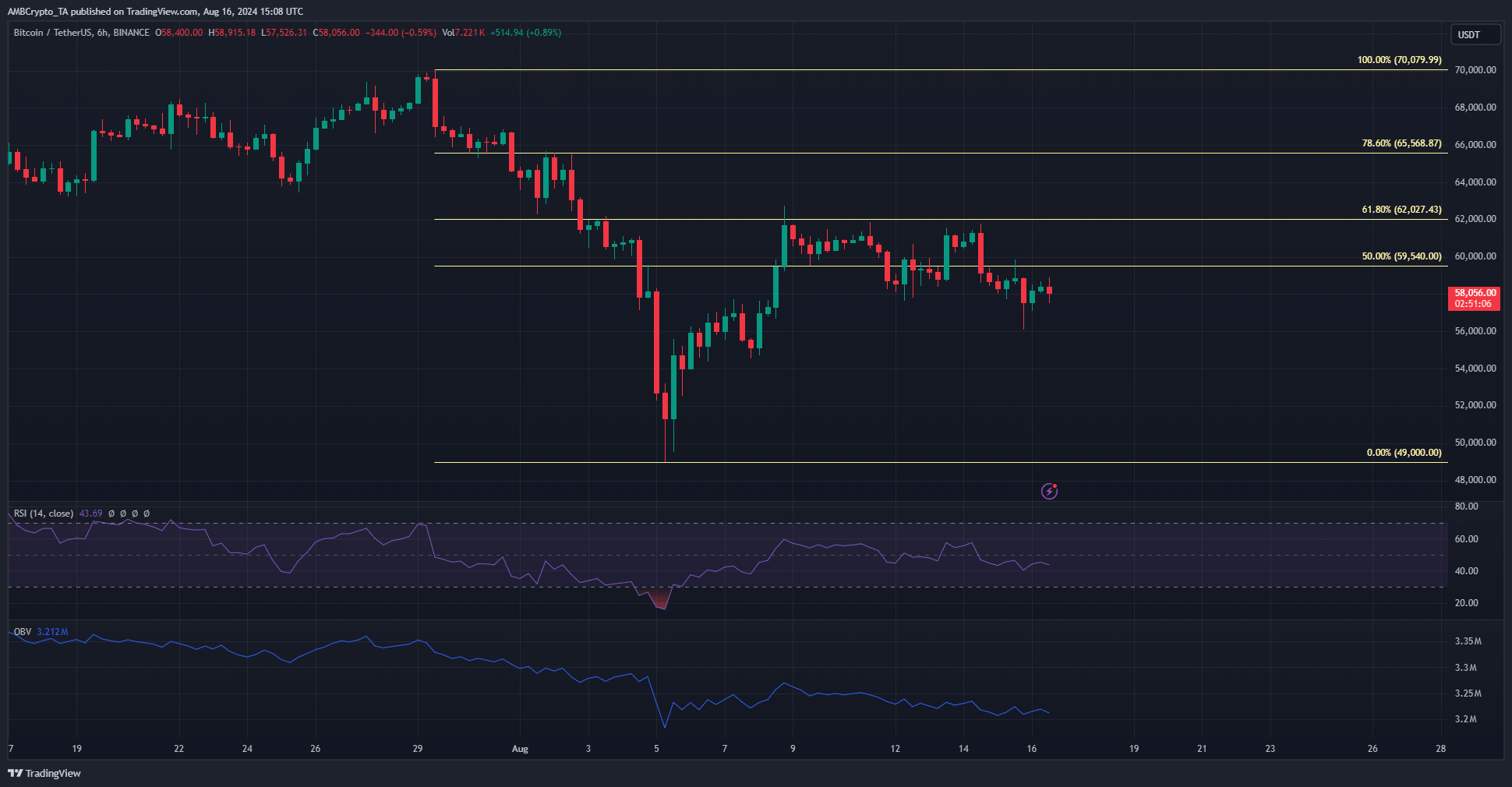

Insights into the Bitcoin (BTC) and Ethereum (ETH) Options expiry on Friday, 16th August, are intriguing. A significant drop in Bitcoin’s price occurred between Tuesday, 10th August, and Wednesday, 14th August, with the value dipping from approximately $61,800 to $57,900 within that timeframe.

As a researcher observing the market, I’ve noticed that with the expiration of options, there seems to be a slight calming down of price trends. However, my analysis of technical indicators and liquidity charts suggests a potential downturn could be imminent.

Market outlook from the Options expiry data

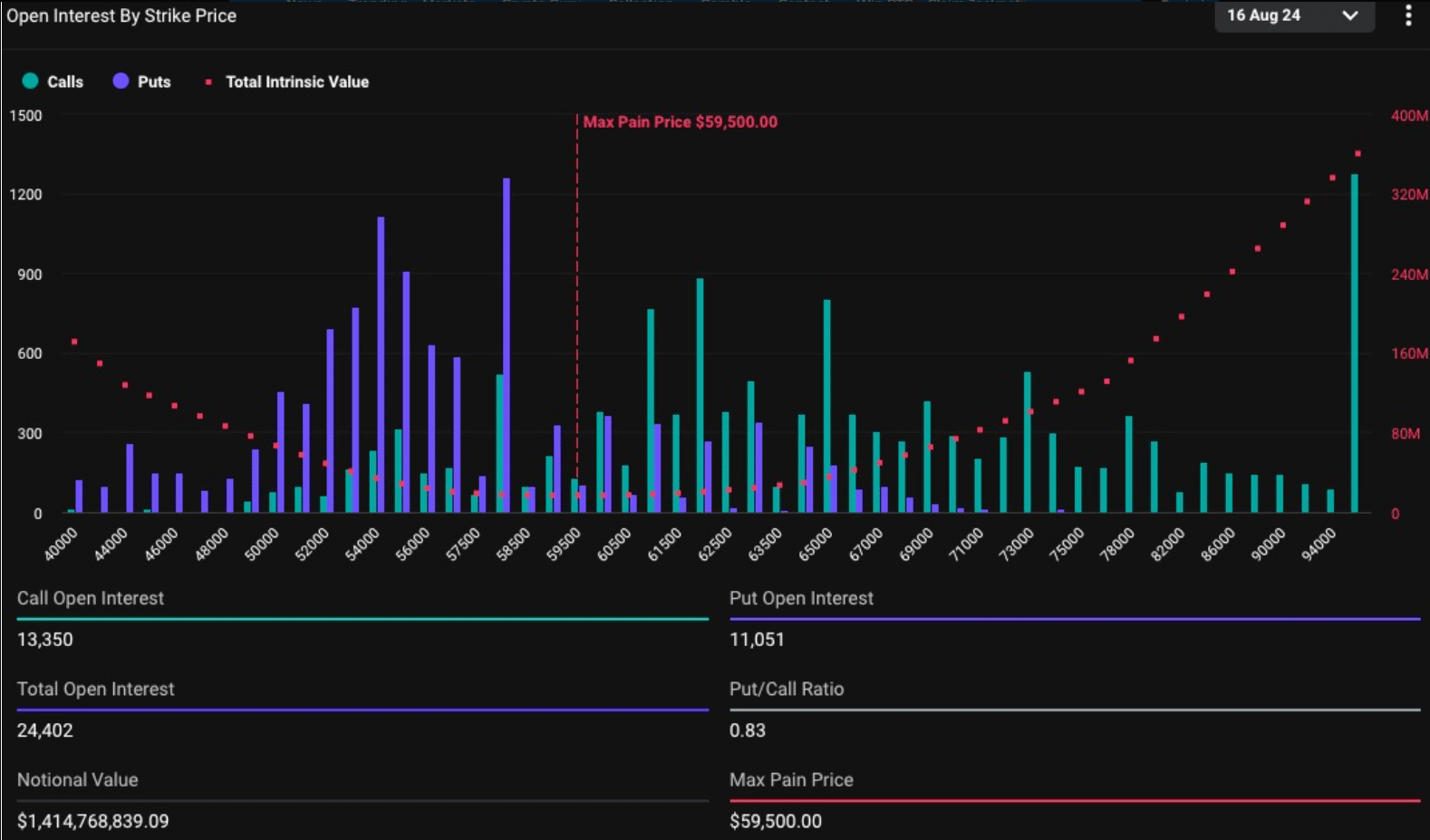

According to information from Deribit (as reported by Coingape), it appears that the upcoming weekends might lean towards a downward trend for both Bitcoin and Ethereum. As for Bitcoin, the total value of active contracts, or Open Interest, was approximately $1.414 billion before its expiration on Friday.

The 0.83 put-to-call ratio suggested a market sentiment that was somewhat optimistic, yet tending towards neutral territory. The critical point for maximum loss, or the likely expiration point of most options, was at $59.5k.

The Thursday price dip below $58.5k was not reversed.

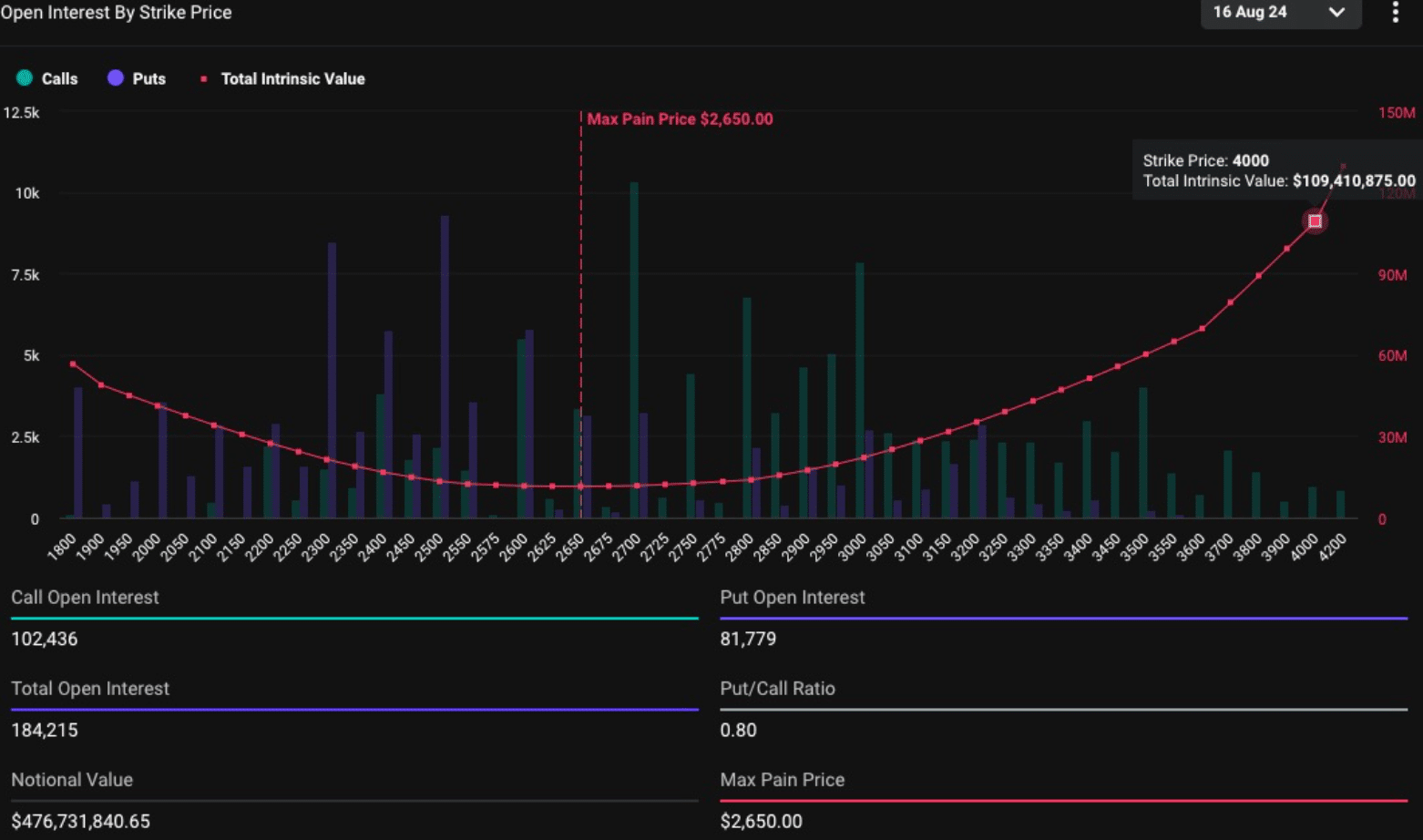

The Ethereum Options expiry amounted to $476.7 million, and the similar put/call ratio to BTC’s meant the market was only slightly bullish. ETH remained below $2610, with the max pain point at $2650.

On Friday, Bitcoin (BTC) and Ethereum (ETH) experienced growth by 0.8% and 0.4%, respectively, as reported at the time of publishing. This increase occurred following the significant Options expiration event, which injected volatility and led to a minor price drop in the latter part of Thursday evening.

What next for the crypto markets?

The anticipation is that the volatility will decrease, yet both trends continue to lean negative. Bitcoin exhibits a bearish market pattern and the On-Balance Volume indicates consistent selling pressure over a 6-hour timeframe.

The lack of upward momentum agreed with the structure and did not promise a reversal. Ethereum seemed to have a similar bearish outlook too.

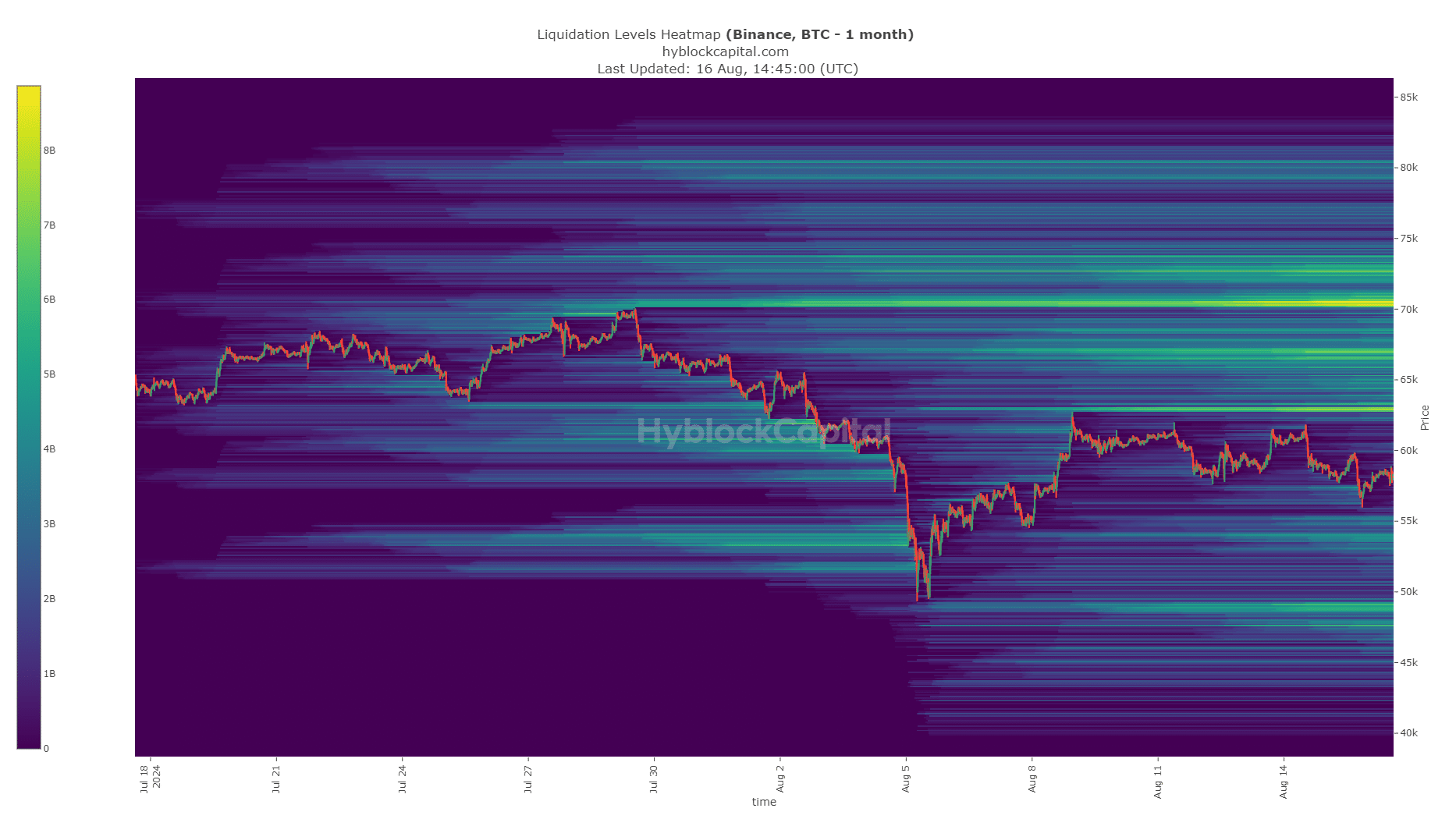

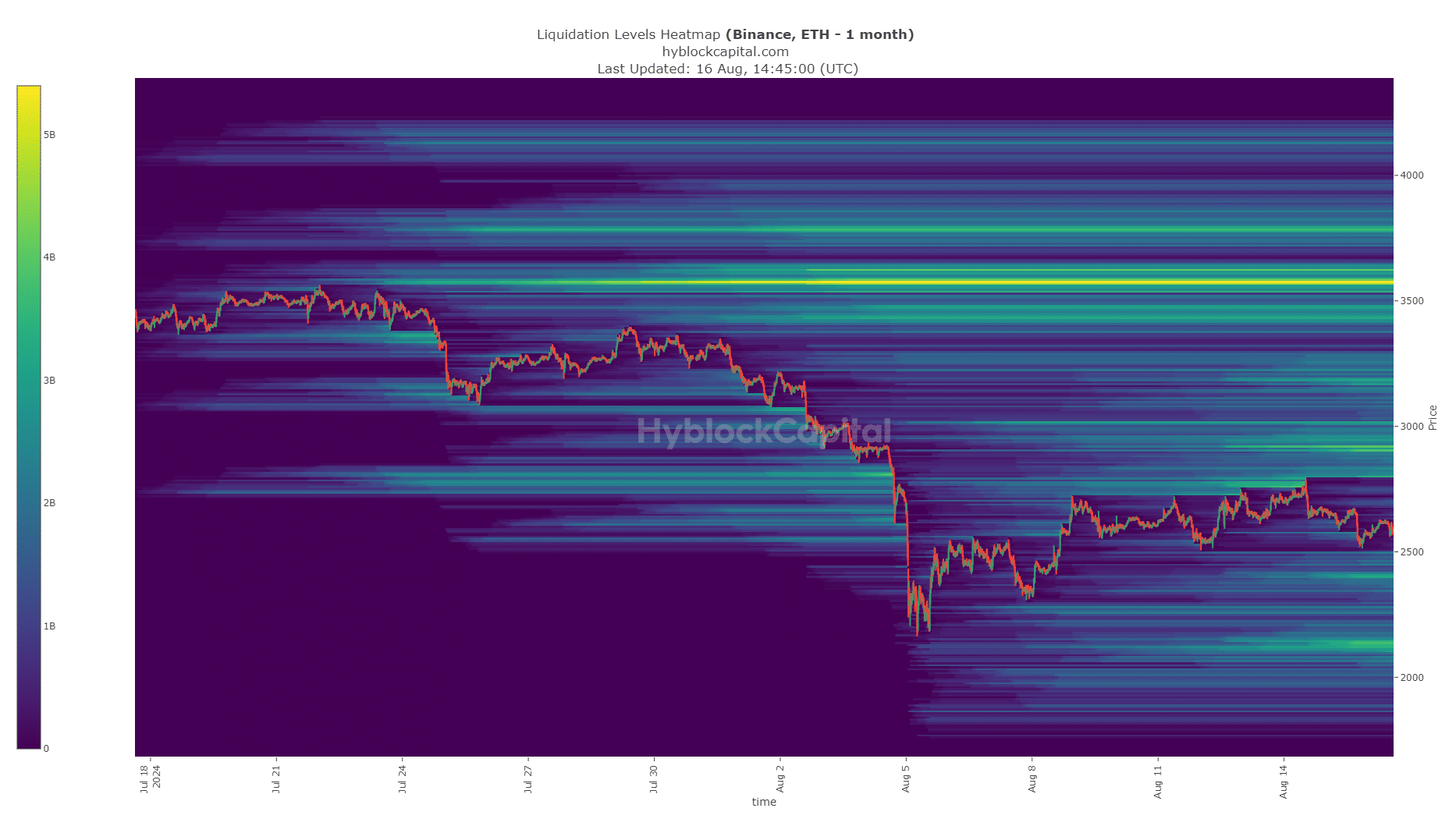

In reality, the heatmaps indicated that the lower price points were nearer, making it simpler for prices to move towards them.

As an analyst, I’ve noticed that the most substantial liquidity pools for Bitcoin are currently located at approximately $55.1k and another significant one at around $53.9k. Moving forward, the $70k zone, filled with potential liquidation levels, might not be breached in the near future.

At the moment of reporting, Ethereum’s nearest peak stood at around $2,400. While it’s less probable, potential future highs could reach between $2,800 and $2,900. The latest Consumer Price Index (CPI) data indicated a 0.2% rise from June to July, which was in line with market forecasts.

Is your portfolio green? Check the Bitcoin [BTC] Price Prediction 2024-25

Given that the likelihood of a significant Federal Reserve interest rate reduction has decreased, it seems that the technical, liquidity, and broader economic factors are currently leaning towards the advantage of the bearish market over the following month.

Read More

2024-08-17 10:15