- FLOKI has a short-term bullish outlook after climbing above June’s local resistance zone

- On-chain metrics showed the long-term outlook is bullish, with a chance of short-term holders realizing profits

As a seasoned researcher with extensive experience in the crypto market, I have closely monitored FLOKI’s price action and on-chain metrics. Based on my analysis, I am bullish on FLOKI’s short-term outlook.

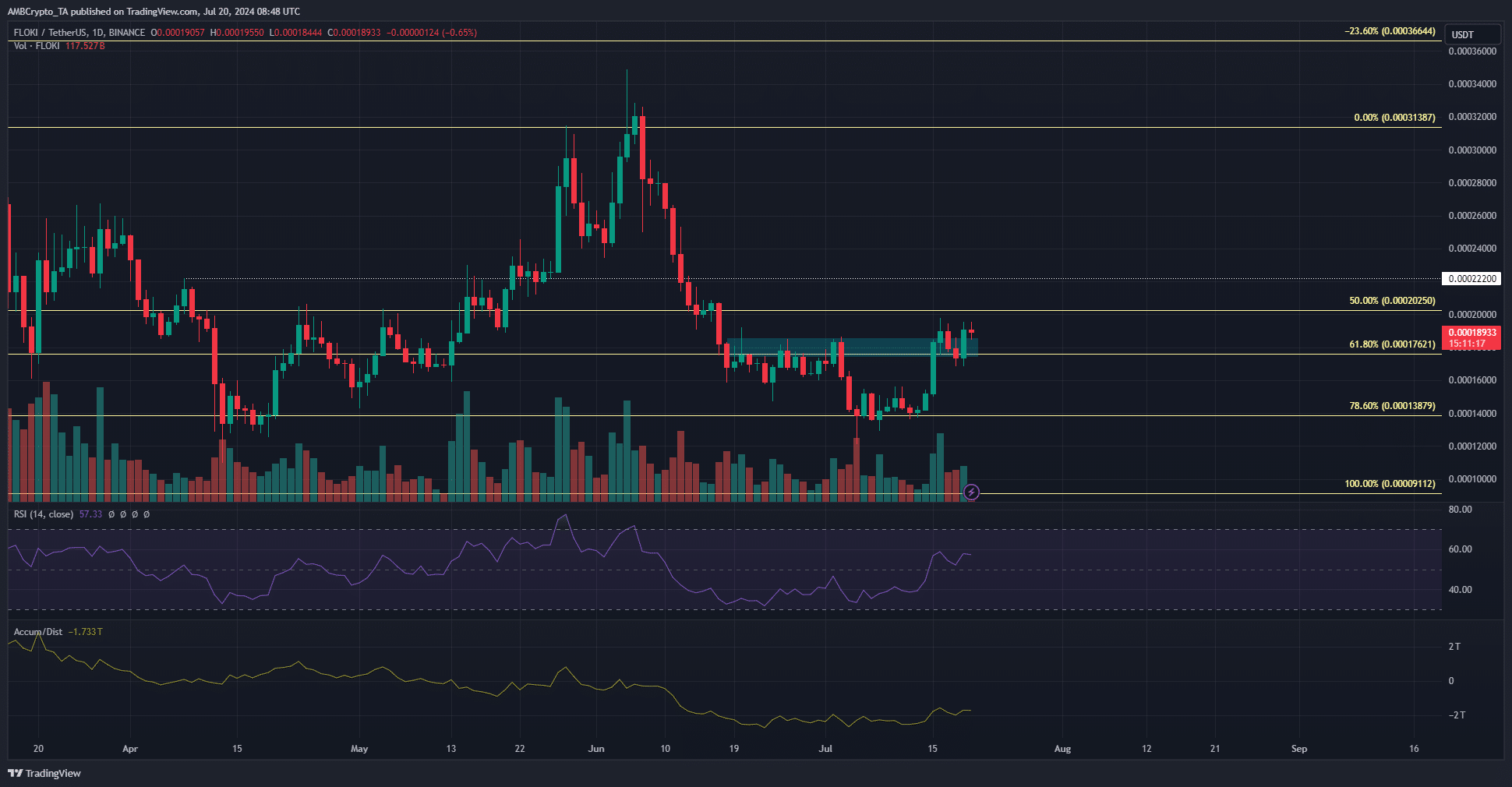

At present, FLOKI is transacting above the resistance level it came up against towards the end of June. Notably, it has shaped a bullish configuration and could potentially increase by approximately 60% in worth within the upcoming weeks.

Last week, the on-chain data indicated positive signs for buyers, leading to a notable surge of around 41% in price from the Fibonacci retracement level. Moreover, based on technical analysis, it seemed plausible that the upward trend would persist, at least temporarily.

Another northbound move anticipated

In simpler terms, the memecoin hit a significant mark for the second time within a four-month span, as it approached the 78.6% pullback level according to Fibonacci retracement analysis. These levels were derived from the price surge of FLOKI in March and remain relevant.

As a researcher studying the cryptocurrency market, I’ve noticed that the support level at $0.000176 has been flipped, indicating potential buying pressure from the bulls. Their next target would be $0.000222 as the next resistance level. The daily Relative Strength Index (RSI) has turned bullish after moving above the neutral 50 threshold, suggesting that momentum is shifting in favor of the buyers. However, I’ve also observed that the Accumulation/Distribution (A/D) indicator did not rebound as swiftly as I would have expected from a confirmed bullish signal. This discrepancy between the RSI and A/D indicators may warrant further investigation to fully understand the current market dynamics.

The downtrend was interrupted by an upward trend, albeit a slow and hesitant one. This may indicate insufficient buying power in the market. Although it doesn’t necessarily signal a divergence, it serves as a potential caution sign for investors.

Network-wide accumulation has resumed

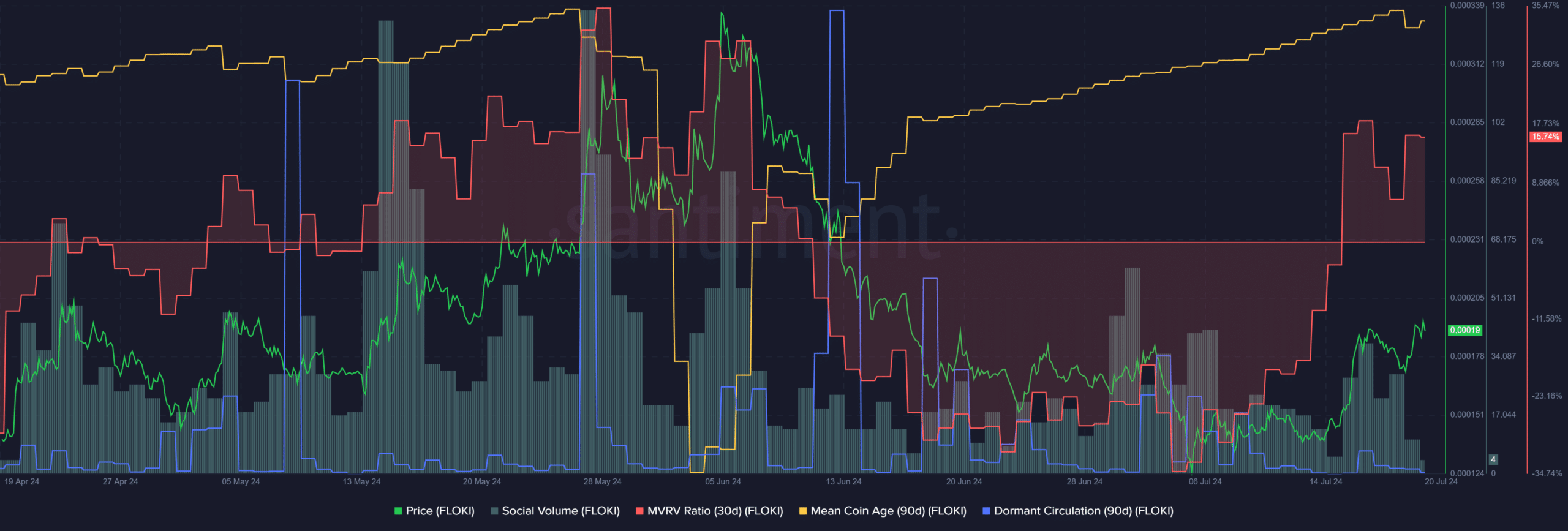

The average age of coins in circulation has been increasing noticeably since a significant decline around early June. This uptrend might be indicative of investors hoarding or accumulating more coins. Additionally, the 30-day MVRV (Moving Average Realized Value) has now moved into positive territory, potentially triggering sell-offs from short-term traders looking to lock in profits.

Is your portfolio green? Check the Floki Profit Calculator

As a researcher, I’ve observed that social volume has decreased significantly since late May. However, if the bullish trend continues, we might witness increased engagement and heightened demand in the following weeks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-21 00:07