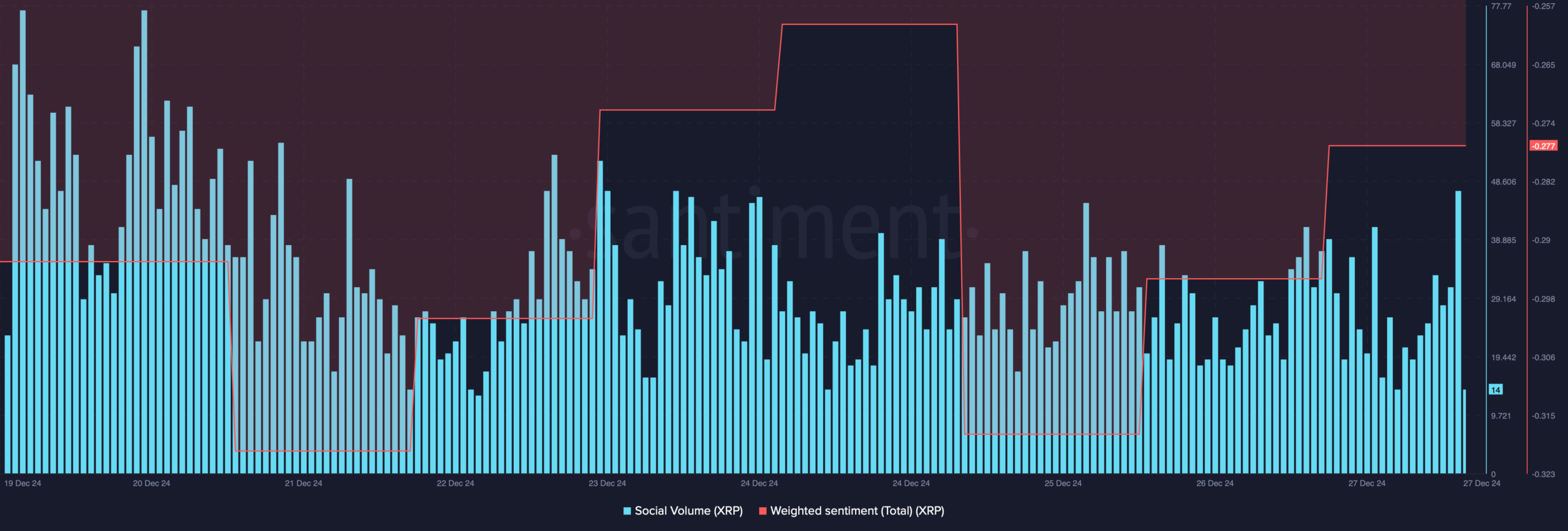

- Altcoin’s social volume dropped, which indicated a decline in its popularity

- Technical indicators revealed that selling pressure on XRP has been rising

As a seasoned analyst with a rich background in cryptocurrency analysis, I have seen my fair share of market fluctuations and trends. Looking at XRP’s recent performance, it appears to be a mixed bag. On one hand, its price has taken a hit, dropping by over 6% in the last seven days, as evidenced by CoinMarketCap data. On the other hand, there seems to be an improvement in market sentiment around XRP, which is quite intriguing.

Over the last seven days, XRP’s value has decreased – a development that may worry investors. Could this recent decrease in price hinder XRP from keeping pace with leading cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH)?

How is XRP affected?

According to CoinMarketCap’s recent findings, XRP experienced a drop of more than 6% in just seven days. Currently, its value is at approximately $2.15 per unit, and it has a market capitalization exceeding $123 billion, ranking it as the 4th largest cryptocurrency. It’s worth pointing out that despite this price decrease, there appears to be a positive shift in sentiment surrounding XRP.

Over the last several days, the positive feelings associated with XRP have increased, indicating a rise in optimistic views towards the token. Yet, there was a decrease in the amount of conversation about it on social media – suggesting that XRP’s influence within the cryptocurrency community may be waning.

Going forward with the token…

Despite a decline in XRP’s value, the well-known crypto handle EGRAG CRYPTO on Twitter has hinted at potential competition between XRP, Bitcoin, and Ethereum in the near future, based on a recent tweet they shared about blockchain developments.

As a crypto investor, I’m intrigued by the rising dominance of Ethereum and the decreasing dominance of Bitcoin. However, I believe XRP has a remarkable potential to surpass both in terms of market share. At present, XRP holds 3.93% dominance, which is above the Fibonacci Retracement level of 0.382. If XRP manages to close above the next Fibonacci level of 0.5, or 5.57%, we might be looking at a significant increase in its market share, potentially even reaching double-digit dominance!

EGRAG CRYPTO’s tweet also highlighted that the VRVP indicated a gap above 4.30%, which means reduced resistance and a potentially easier path to an unprecedented peak (ATP) and beyond. The KABOOM Green Zone initiates at Fib 0.50, suggesting a significant surge is on the horizon!

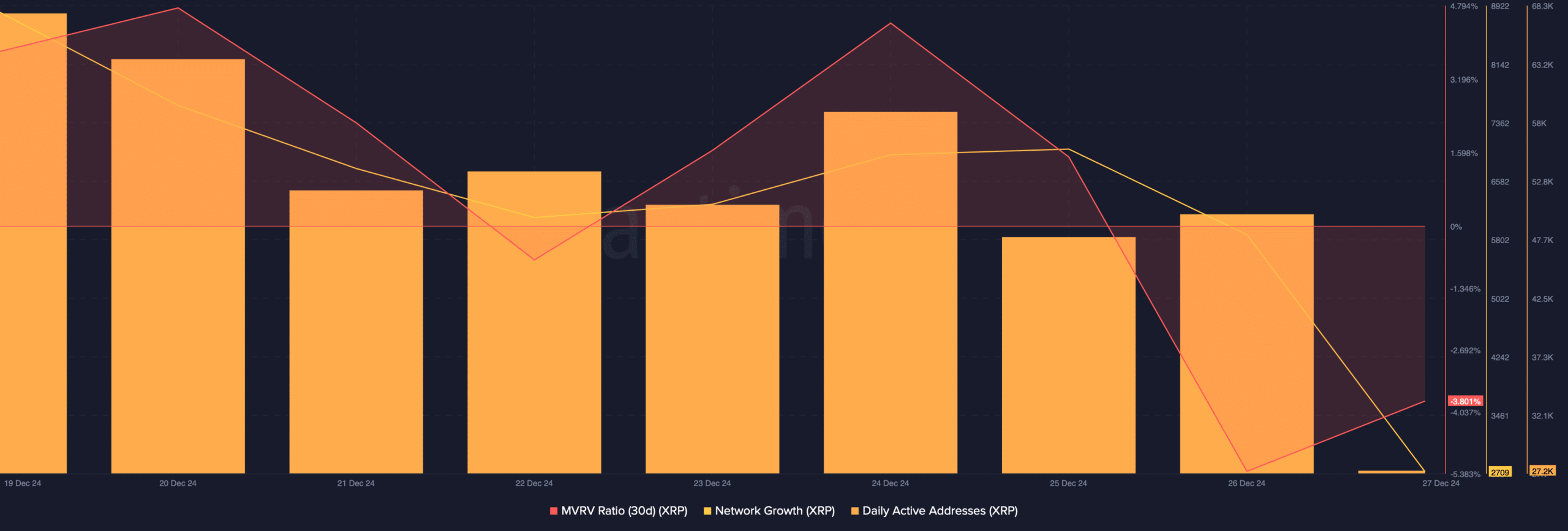

After examining the token’s blockchain information, we determined if this token could potentially overtake the leading cryptocurrencies in the near future. According to our study, following a significant drop, the token’s MVRV ratio showed a modest increase.

A rise in the metric shows that the market capitalization is expanding more quickly than the realized capitalization, suggesting a stronger motivation for individuals to offload their holdings in the market.

On the flip side, it seemed like some factors weren’t going the token’s way. For example, the number of daily active addresses for the token decreased last week, indicating less network activity. This trend was also reflected in XRP’s declining rate of network growth—which essentially means that fewer new addresses were being created to facilitate the transfer of the token over a specific period.

It appeared unlikely that XRP would overtake Bitcoin (BTC) or Ethereum (ETH), given that technical signs pointed towards a bearish trend as well.

Read XRP’s Price Prediction 2024–2025

Ultimately, the Moving Average Convergence Divergence (MACD) showed a bearish trend in the market. Additionally, the Chaikin Money Flow (CMF) decreased, suggesting an increase in selling pressure that may cause the token’s price to fall even more.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-28 11:03