-

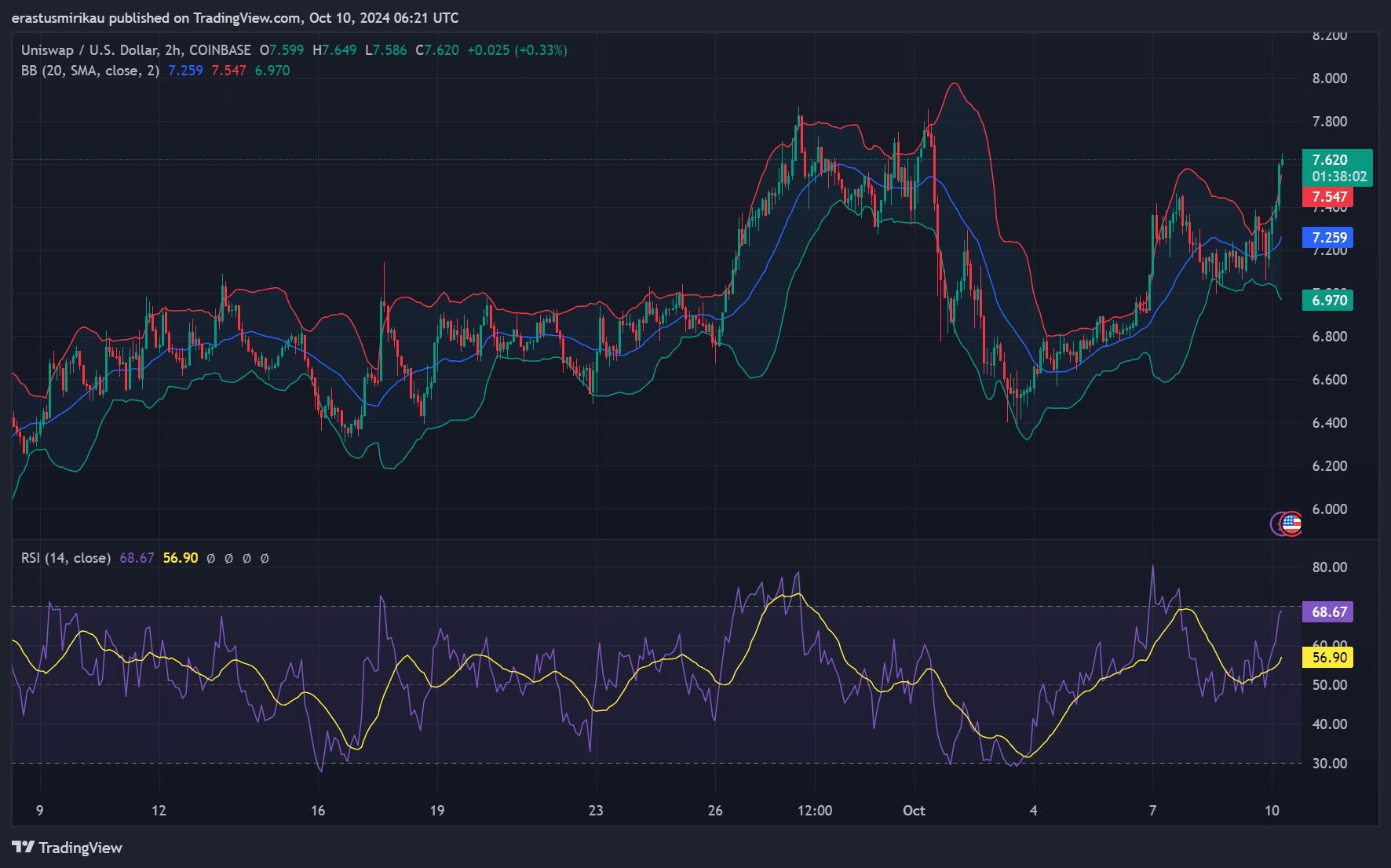

UNI’s bullish momentum is fueled by rising volume, with RSI nearing overbought levels at 68.67.

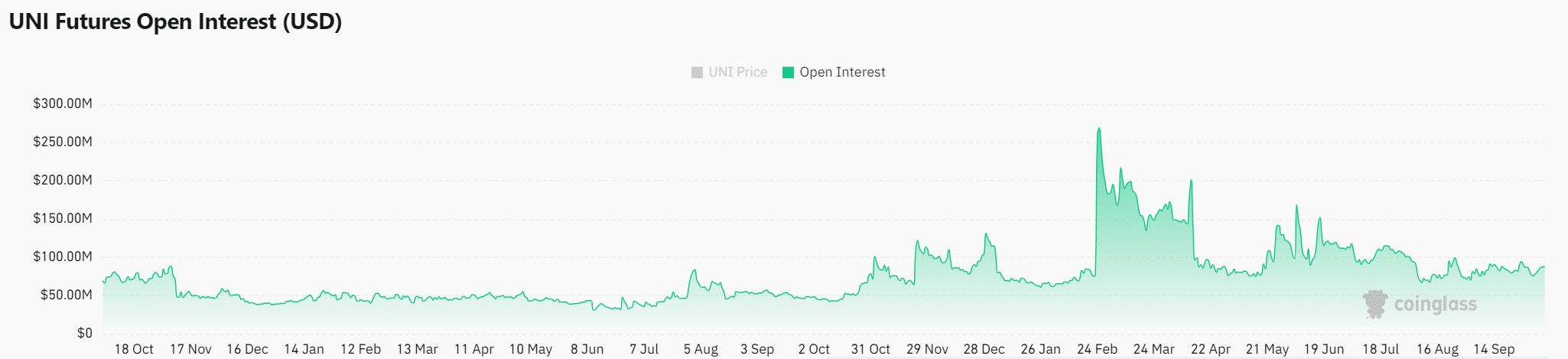

Open interest has surged, but lower exchange reserves signal potential liquidity concerns ahead.

As an analyst with years of experience navigating the cryptocurrency market, I find myself impressed by Uniswap’s [UNI] recent performance. The token’s bullish momentum is undeniable, driven by strong price action and increased trading activity that has caught my attention. At press time, UNI was trading at $7.62 with a 6.52% rise – not too shabby for a day in the life of a digital asset.

Uniswap’s UNI token is currently experiencing a surge in market confidence, driven by robust price trends and heightened trading volume. As I write this, the token is being exchanged at approximately $7.62, marking a 6.52% increase.

Has the University of Nanos (UNI) demonstrated strength at critical price points, yet is there a chance it will sustain this progression, or could external factors cause it to retreat instead?

Strong price action driving market optimism

At the moment of reporting, the University Network (UNI) has seen substantial growth, as its 24-hour trading volume has spiked by 58.59%, reaching a total of $168.51 million. This surge in trading activity suggests that more traders are becoming increasingly interested in UNI due to its rising trend, and they are keen on capitalizing on this upward movement.

The technical signs provide additional support for a positive outlook on UNI. At present, the Relative Strength Index (RSI) stands at 68.67, suggesting that UNI is nearing an overbought state, but it hasn’t quite reached the significant 70 threshold yet.

Furthermore, it appears that Uniswap’s Bollinger Bands are indicating a position close to the upper band at $7.62, typically signaling increased volatility. As such, traders should stay vigilant of these points since they could signal impending price consolidation or a breakout in the near future.

UNI on-chain indicators: Are they supporting the bullish case?

Beyond just looking at its price movement, data from CryptoQuant shows that on-chain metrics also support UNI‘s robust market performance. Specifically, there has been a 1.35% rise in active addresses over the past day, amounting to approximately 65,040.

As someone who has been actively involved in the decentralized finance (DeFi) space for quite some time now, I can confidently say that an increase in activity on Uniswap is a clear sign of network vitality. Having personally witnessed the growth and evolution of this platform, I’ve come to understand that higher engagement with the Uniswap protocol indicates a thriving ecosystem. This uptick in participants not only underscores the trust and confidence users have in the system but also serves as a testament to the potential of DeFi as a whole.

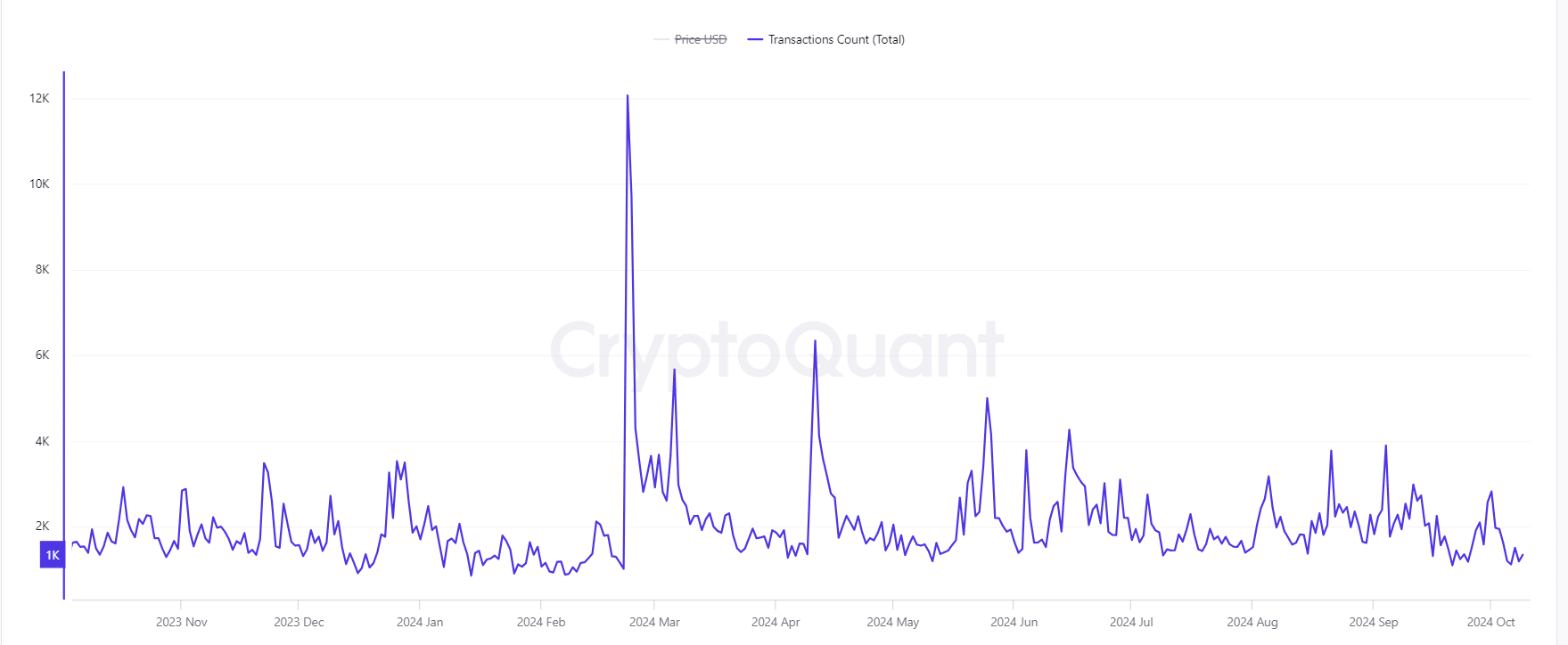

As a crypto investor, I’ve noticed an uptick in our transaction count, specifically a 1.6% increase, which translates to approximately 1,691 transactions processed within the given period. This surge in transactions, coupled with the rise in active addresses, suggests a thriving and engaged user base that could potentially fuel further growth.

UNI exchange reserves: A warning sign?

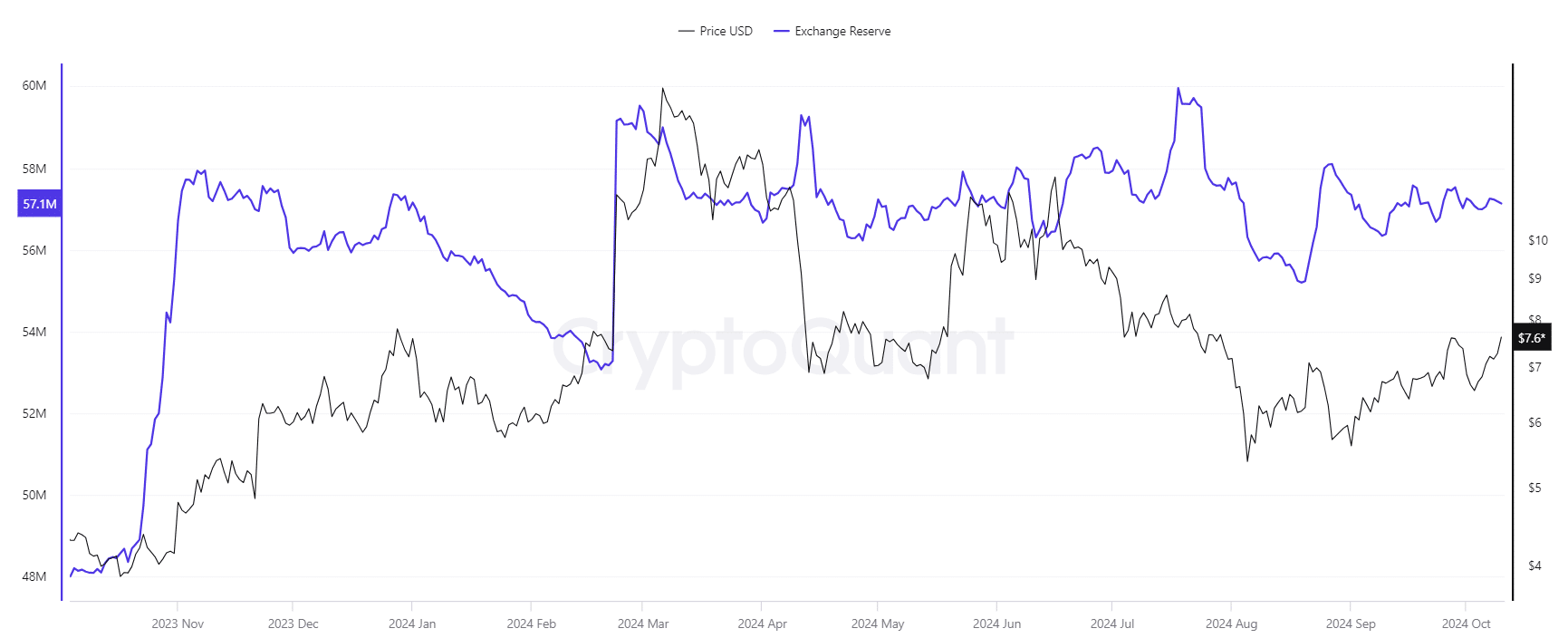

As a crypto investor, I’ve noticed that the reserves have decreased by 0.17% over the past day, now sitting at approximately 57.136 million. This reduction in reserves might suggest a diminished selling pressure, potentially hinting at an unexpected supply shortage.

Although a decrease in reserves tends to reflect positive market feelings among traders (bullish sentiment), they should be mindful and cautious. A lower reserve may restrict the available liquidity, making it challenging for Uniswap to maintain its ongoing rally should there be an unexpected surge in demand.

Open interest: Growing trader confidence

Additionally, UNI’s open interest has surged by 7.11%, reaching $91.96 million.

The rise in open interest indicates that an increasing number of traders are joining the market, anticipating additional price increases. Consequently, it strengthens the overall positive outlook (bullish trend).

The upward trend at the University of Namibia (UNI), fueled by increased trading activity and robust on-chain indicators, indicates it might surpass the resistance level. Yet, potential issues with liquidity could dampen this positive perspective.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-11 01:11