-

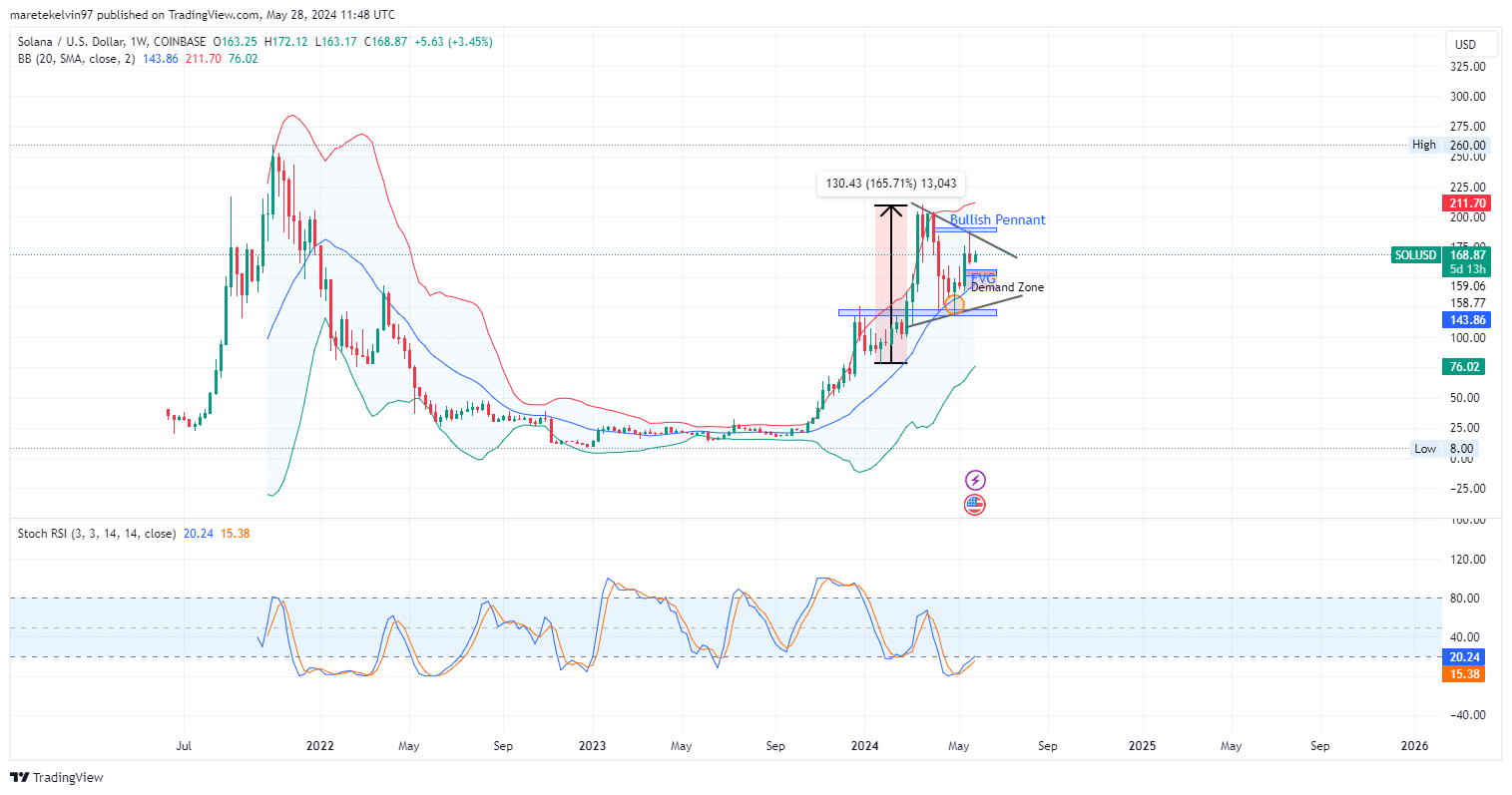

SOL recorded a 165% surge from late January to late March.

Solana has been consolidating inside a bullish pennant since early March 2024.

As a seasoned crypto investor with a keen interest in Solana (SOL), I’ve been closely monitoring its price action and market trends. The 165% surge that SOL recorded from late January to late March was an impressive feat, but it wasn’t surprising given the growing hype around this promising Layer-1 blockchain.

As a Solana (SOL) analyst, I’ve observed an impressive 165% price increase from late January to late March. Following this growth spurt, the token entered a consolidation phase, forming a bullish pennant pattern.

As of the latest news update, the value of Solana hovered near $167.30. The cryptocurrency remained in a tight formation, known as a bullish pennant, indicating potential for further gains.

As a researcher, I’ve identified two significant areas in the market that could potentially influence the price action. The first one is the fair value gap around $153, which seems to be attracting prices due to its importance. The second one is a demand zone situated just beneath the fair value gap at approximately $145. These zones may cause a correction before the price eventually retraces back up towards the Pennant resistance level.

If the price falls below the demand zone, it may continue to decrease and reach the pennant’s support level.

If the price pulls back to the demand level after touching the fair value mark, regaining strength to surmount the pennant’s resistance line, a potential rally toward $200 ensues.

At present, based on information from CoinMarketCap, Solana’s price stands at $167.83, representing a 1.34% increase over the past day, but a 7.93% decrease during the last week.

The market value of Solana stood at a staggering $75.5 billion, while its trading volume amounted to an impressive $2.99 billion in the last 24 hours, representing a noteworthy surge of 21.8%.

What does Solana’s future look like?

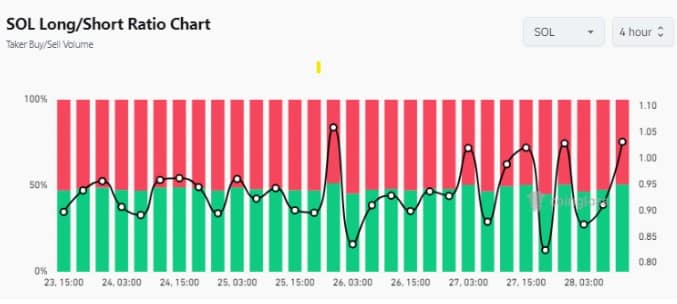

According to AMBCrypto’s analysis of Coinglass data, the long-to-short ratio for Solana has been quite elevated over the past few days. This finding suggests that the price of Solana has been experiencing significant buying pressure, potentially signaling a bullish trend.

As a researcher, I’ve observed that a large difference between buying and selling pressure, indicated by a high long-to-short ratio, suggests strong bullish sentiment in the market. Traders are actively seeking opportunities to purchase and hold assets, driving up their prices.

The Bollinger bands on the daily chart have expanded, indicating a volatile market where the bullish trend may encounter resistance or potentially revisit support areas.

As a market analyst, I’ve noticed that the Stochastic RSI, with a value of 20.24, signaled an oversold condition recently. This observation implies a potential reversal from the current downtrend and a possible shift back into a bullish phase.

As a researcher examining the social volume chart from Santiment, I discovered a noteworthy connection between Solana’s price trend and social volume. My observation revealed that heightened social media activity tends to fuel public interest, subsequently triggering price increases for Solana.

Read More

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- OM PREDICTION. OM cryptocurrency

- 1923 Sets Up MASSIVE Yellowstone Crossover

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Paige DeSorbo’s Sassy Message: A Clear Shade at Craig Conover?

- Discover How Brittany Mahomes Fuels Patrick’s Super Bowl Spirit!

2024-05-29 12:07