What to know:

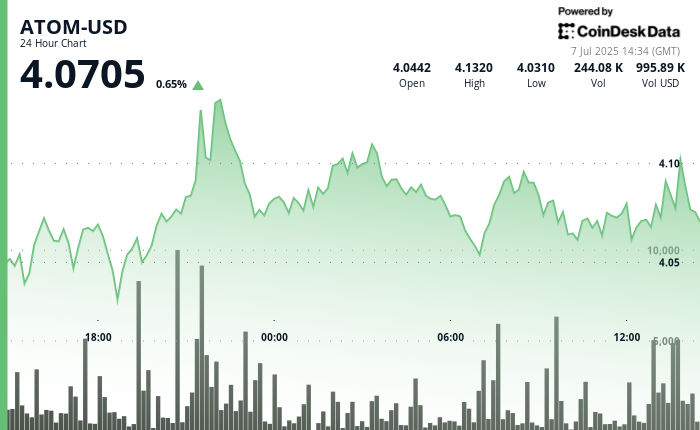

- Cosmos (ATOM) ascends 1.23% from $4.05 to $4.10 in 24 hours, fueled by a surge in volume and robust support at crucial levels, hinting at continued upward potential.

- A breakthrough above $4.10 with tripled trading volume and evident buyer interest around $4.03–$4.05 reinforces bullish sentiment.

- The CD20 index seesaws within a 1.18% range, reflecting broader market uncertainty amid profit-taking and renewed buying activity.

The Cosmos ecosystem token

showed significant bullish momentum during a recent 24-hour period from 6 July 15:00 to 7 July 14:00, climbing from $4.05 to $4.10 with strong buyer support at key levels.

ATOM is now well-positioned to continue its upward trajectory as trading volume tripled over the past 24 hours, indicating optimism from traders.

Technical Analysis

- ATOM-USD rose from $4.05 to $4.10, representing a 1.23% gain during the 24-hour period from 6 July 15:00 to 7 July 14:00.

- A significant breakout occurred at 21:00 on 6 July when volume surged to over 1 million units (3x the hourly average), pushing price through the $4.10 resistance level.

- Price established a trading range of $0.097 (2.4%) with a high of $4.13.

- Strong buyer interest confirmed at support zones between $4.03-$4.05, suggesting continued upward momentum.

- During the 60-minute period from 7 July 13:05 to 14:04, ATOM exhibited a bullish breakout at 13:57-13:59, with price surging from $4.09 to $4.10 on elevated volume exceeding 20,000 units per minute.

- Clear support zone established at $4.07-$4.08 during mid-period consolidation before the final rally.

- Price pushed up 0.5% from period low to high ($4.07 to $4.10).

- Closing hour showed profit-taking with price settling at $4.09, still maintaining most gains and forming a higher low compared to opening price.

CD20 Index Whipsaws as Market Indecision Intensifies

CD20 Volatility Signals Market Uncertainty The CD20 displayed notable volatility over the last 24 hours from 6 July 15:00 to 7 July 14:00, with a significant range of $21.06 (1.18%) between the low of $1772.50 and high of $1793.57.

After reaching a peak during the early hours of 7 July, the index experienced a sharp correction, dropping to $1772.50 at 13:00 before staging a recovery to close at $1780.94, suggesting market indecision as traders navigate between profit-taking and renewed buying interest.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Werewolf Movies (October 2025)

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Best Controller Settings for ARC Raiders

- Silent Hill 2 Leaks for Xbox Ahead of Official Reveal

- These Are the 10 Best Stephen King Movies of All Time

- 10 Movies That Were Secretly Sequels

- How to Build a Waterfall in Enshrouded

2025-07-07 19:13