- Aura Finance seemed to have a strongly bearish bias on the higher timeframes, despite recent gains

- Spike in dormant activity was concerning for long-term holders

As a long-term crypto investor with experience in analyzing market trends and on-chain metrics, I’m cautiously optimistic about the recent gains of Aura Finance (AURA). While the short-term technical analysis shows bullish momentum, the longer-term market structure and on-chain metrics are bearish.

As an analyst, I’ve noticed that Aura Finance (AURA) experienced significant growth of 26% over the past two days. The buying volume has surged in the short term, and the daily chart displays a bullish shift in momentum. Furthermore, Bitcoin [BTC] has shown a robust upward trend on its price charts.

As an analyst, I’ve examined the technical and on-chain data, and although the recent two-day trend appears promising for AURA bulls, my analysis raises some doubts. The longer-term technical indicators suggest a bearish market trend, which could potentially hinder the bulls’ progress. Additionally, the on-chain metrics have sparked concerns about the sustainability of this rally. Consequently, it remains to be seen whether AURA bulls can maintain their trajectory.

Market structure was unbeaten

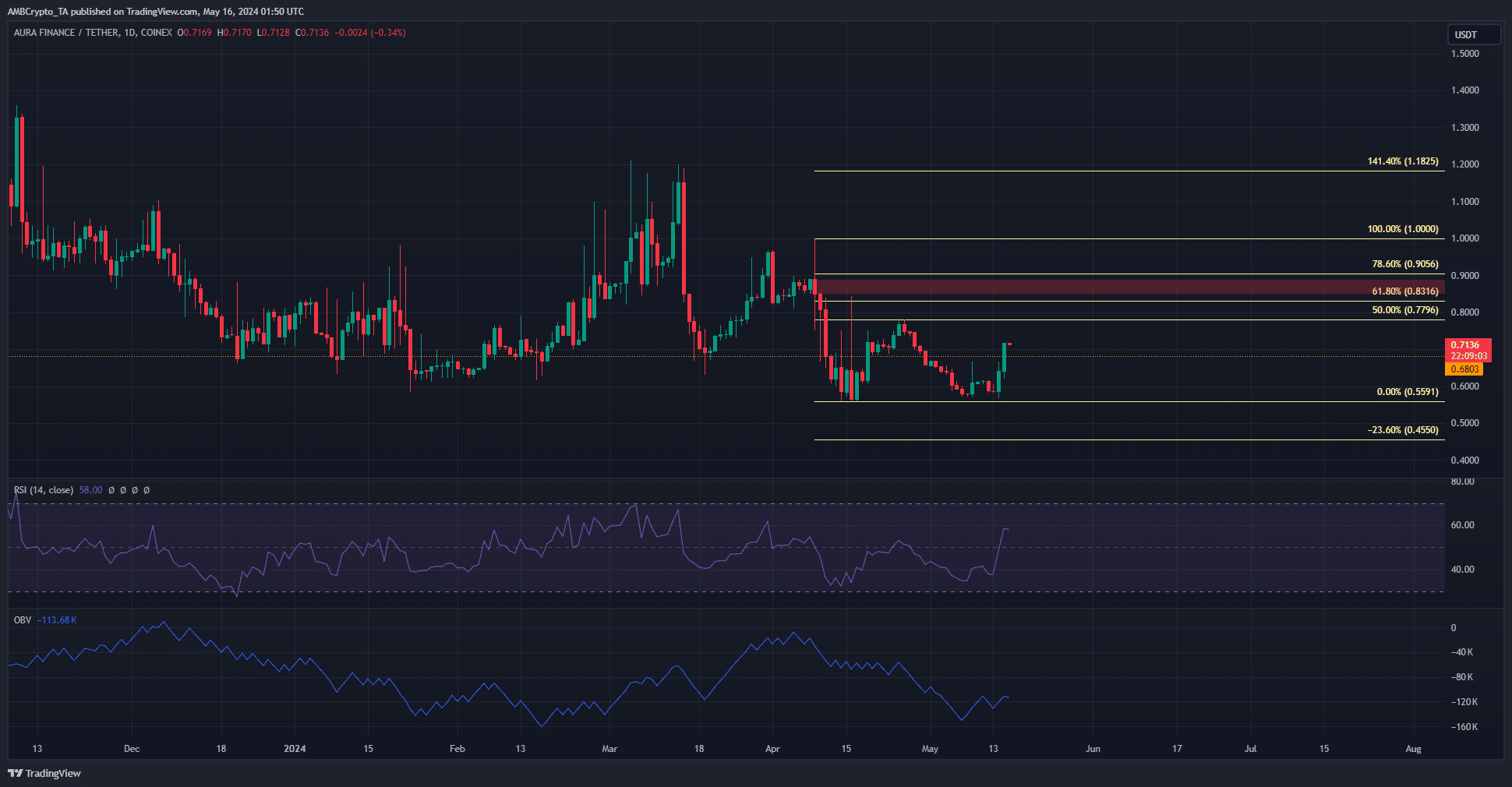

Daily chart analysis reveals that AURA has been forming successive lower peaks since mid-March. The price dip beneath $0.68 during the second week of March shifted its trend to a bearish one.

An altcoin has a bearish outlook within a one-day timeframe, despite the RSI surging above the neutral 50 mark, suggesting bullish momentum. However, it’s likely that the RSI will keep declining. The Fibonacci retracement levels, denoted by pale yellow, at $0.83 and $0.9, are anticipated to act as obstacles and thwart any potential advances from the bulls.

As a crypto investor, I’ve noticed that the $0.85-$0.88 price range (indicated in red) has historically served as a formidable technical resistance level. The On-Balance Volume (OBV) has been on an uptrend over the past week, but it hasn’t quite managed to reach its April highs yet. This could be interpreted as a sign that there is buying pressure at play, but it might not be sufficient to push the price above the resistance level just yet.

A wave of selling around the corner?

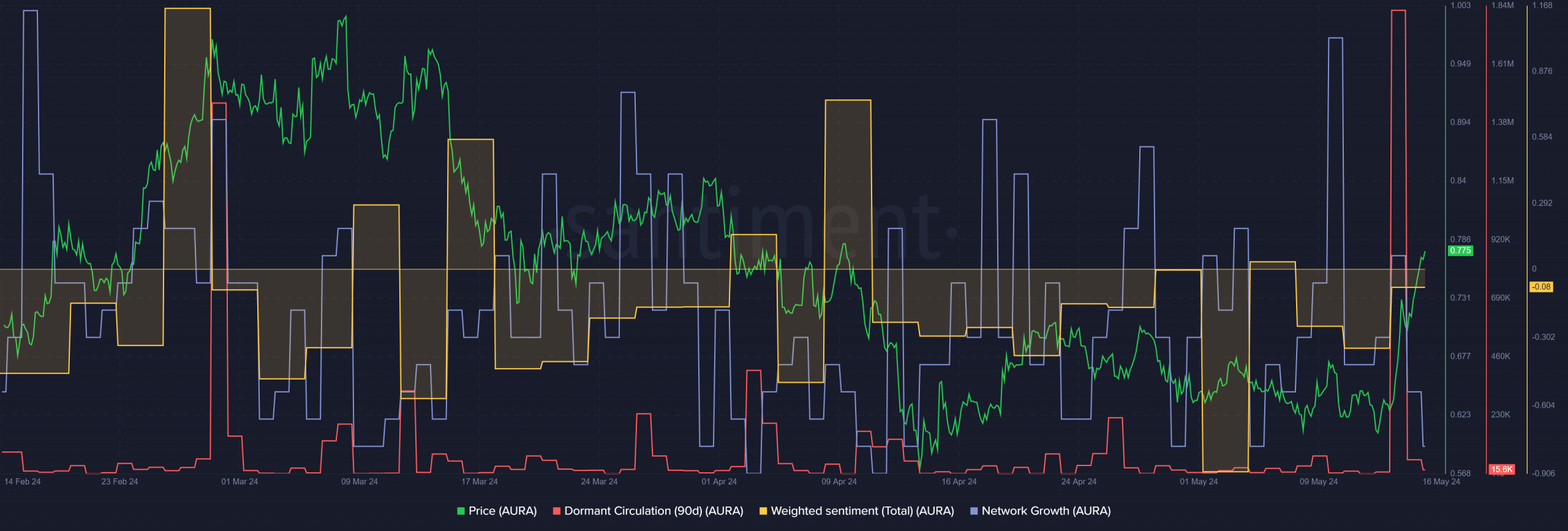

As a crypto investor, I’ve closely monitored the on-chain metrics of Aura Finance, and unfortunately, they haven’t displayed any bullish signs for this project as of late. Although network growth has remained steady over the past two months, the value indicators have stayed below the 20 mark since February.

Fewer than twenty distinct addresses have been generated daily on the network since late February, which might be disheartening news for long-term investors.

Realistic or not, here’s AURA’s market cap in BTC’s terms

Over the last two days, there’s been a significant surge in the market, resulting in approximately a 30% increase. This revival brought about a considerable jump in dormant circulation – the most substantial rise over the past three months. Consequently, an influx of token transactions was observed – a potential indicator of selling activity during this short-term price rebound.

The past month has seen a persistent negativity in the weighted sentiment, indicating that the bears may be in control.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-05-16 15:03