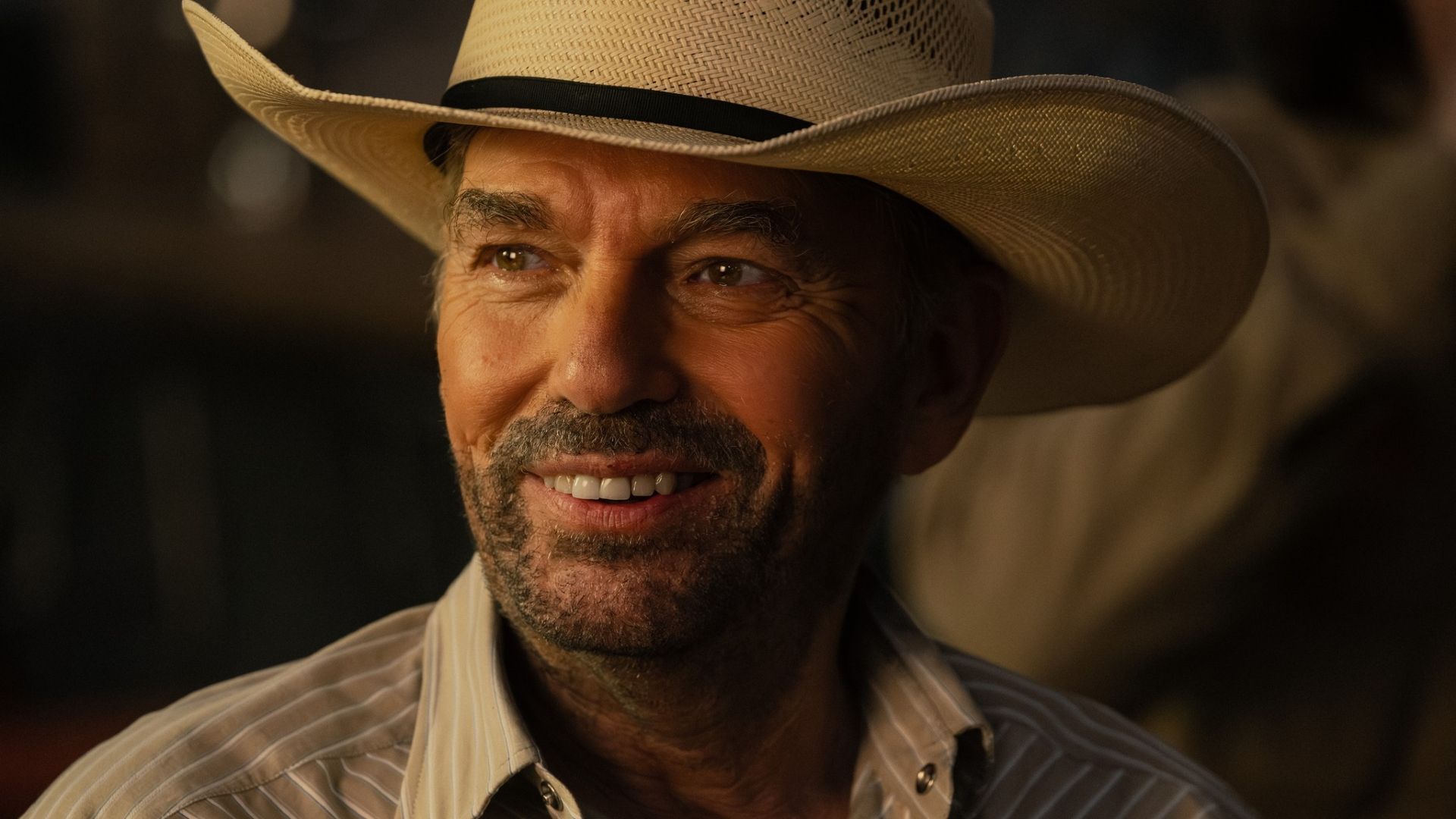

Return to Silent Hill Star Jeremy Irvine Talks Iconic Monsters, Trauma & His DC Casting [Exclusive]

In a recent interview with ComicBook, Irvine discussed his passion for the Silent Hill game, as well as his work on the character development, creatures, the ultimate destiny of James, and the cancellation of his Green Lantern comic series.