Bitcoin’s September Swoon: Will Q4 Be a Bull Run or Just Another Crypto Soap Opera? 🎭💸

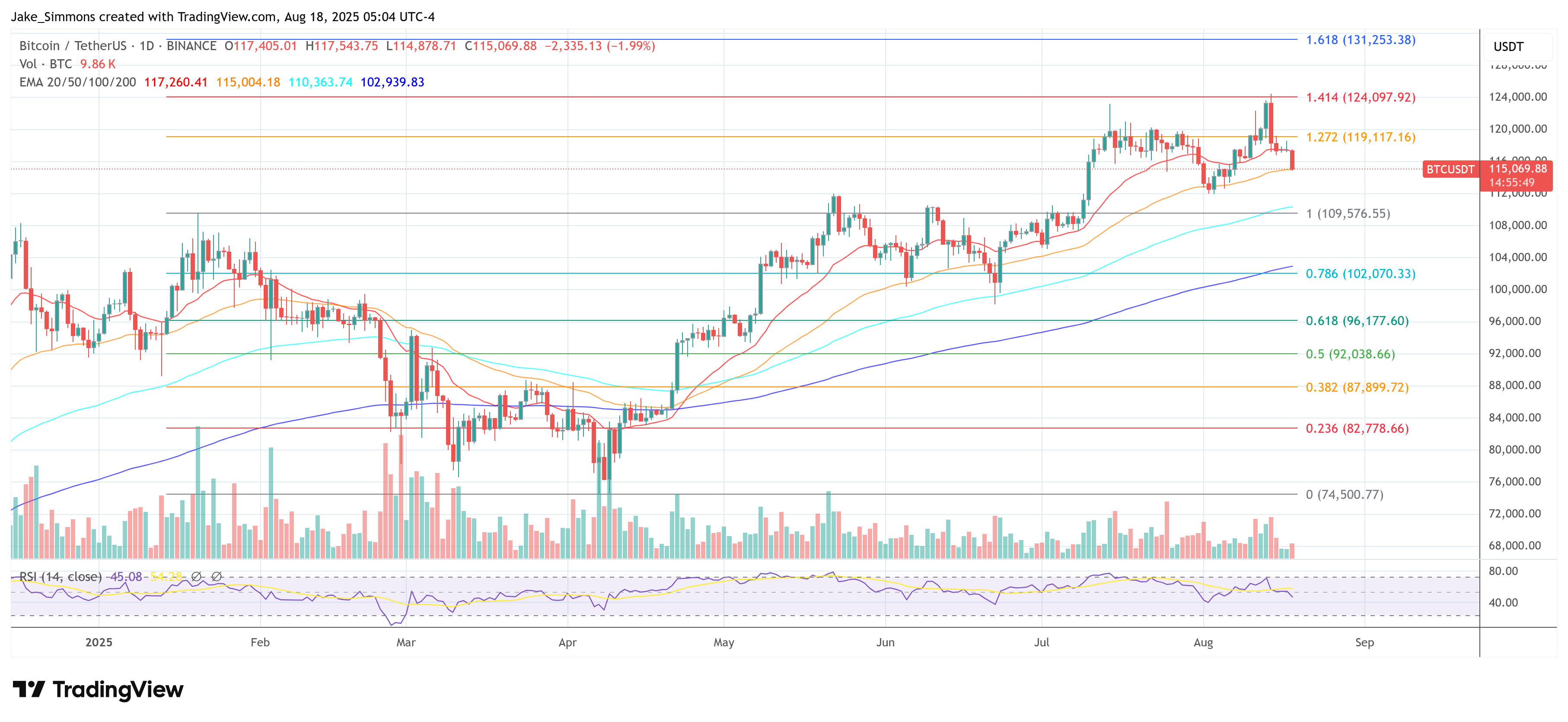

On Bitcoin’s chart, Olszewicz draws his line in the sand at $121,000-$122,000. A daily close above that level? Green light for higher prices. But until then, expect choppy seas. He warns of trouble signs like closing below the 20-week moving average ($104,000) or slipping into the Ichimoku cloud-a phrase that sounds like a mythical forest but is actually just technical jargon. Timing matters here: a September dip isn’t catastrophic, but an October breakdown could signal the end of the cycle. Cue dramatic music. 🎵💀