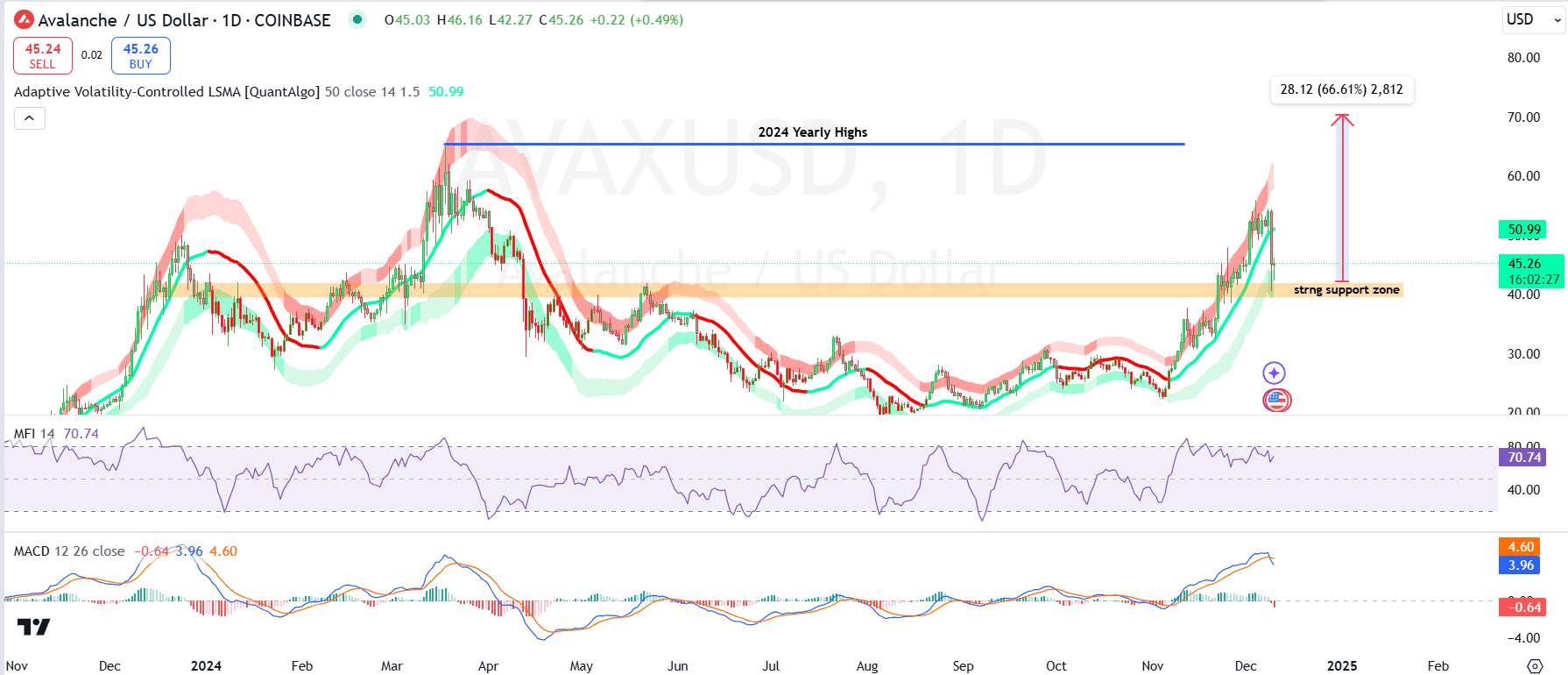

- After a 23% drop, AVAX’s new support was near $40.

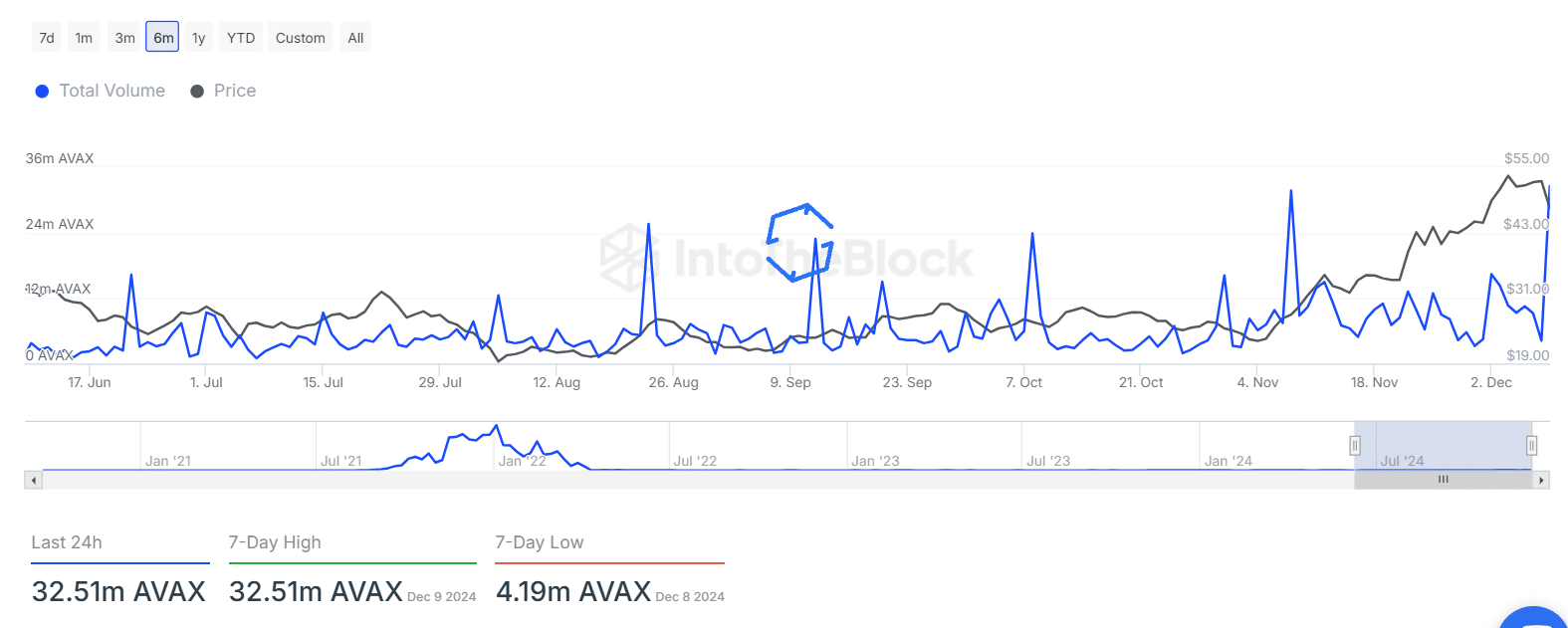

- A 602.61% spike in transaction volume signaled rising institutional interest.

As a seasoned researcher with years of experience navigating the dynamic cryptocurrency landscape, I find myself intrigued by Avalanche’s [AVAX] recent performance and market activity. The 23% drop following the surge on the 8th of December may have spooked some traders, but the subsequent rise in transaction volume suggests growing institutional interest.

As an analyst, I’ve noticed that the price action of Avalanche (AVAX) over the past few weeks has been quite dynamic, offering substantial trading opportunities for those keeping a keen eye on the market.

Following unification by the 7th of December, the price spiked during the opening of the NYSE on the 8th, but soon dropped by 23% and closed at $40 on the 9th of December.

Currently, Avalanche (AVAX) is being exchanged for approximately $45.50, and if it manages to reach significant resistance points, there’s the possibility of a 66% price increase.

The decrease in price followed by a retreat implies a period of stabilization, potentially paving the way for additional growth.

As the trading volume grows and solid backing is evident, it’s likely that Avalanche (AVAX) may climb upwards over the next few weeks.

AVAX looks overbought but stable

AVAX’s recent price action highlighted its strong upward trend but also signals caution.

In simpler terms, the Adaptive Volatility-Controlled Linear Smoothing Moving Average (LSMA) for AVAX suggests that its price is currently dipping below a significant 50-day moving average line. This moving average could potentially serve as a barrier and make it harder for AVAX to rise in the immediate future.

Regardless, the token was holding steady around $45.26, and potential backing could be found within the $40-$42 area. If positive momentum continues, the price goal of $70 might still be achievable, representing a potential 66.61% increase.

Based on a Money Flow Index of 70.74, it appears that Avalanche (AVAX) is nearing an overbought state. Yet, there seems to be potential for additional price increases in the asset.

According to the MACD (Moving Average Convergence Divergence), there’s a sign of increasing bullish strength since the MACD line is positioned above the signal line. However, the histogram indicates a slight lessening of this momentum.

Although there’s a noticeable decrease in momentum, the current signs don’t suggest an immediate reversal, indicating that it might continue if the support remains strong. In the short term, the significant resistance level is at $50. Moving forward, the high of $65 in 2024 could be a crucial target to reach.

AVAX transactions on the rise

As a crypto investor, I’ve observed some significant spikes in Avalanche’s market activity recently, with a particular focus on transaction volume. In fact, over the past 24 hours, a staggering 32.51 million AVAX tokens have been traded – which happens to be a 7-day peak for this cryptocurrency.

The cost adjusted down to $45.23, representing a decrease of 5.76%. Although this drop could appear troubling, the rise in trading activity implies increasing involvement from institutional investors and “whales”.

According to IntoTheBlock’s data, significant increases in transaction activity, notably surges in September and November, tended to coincide with times of market price fluctuations.

These spikes underscored significant market involvement, often leading to price swings.

As a dedicated AVAX investor, I can confidently say that my active involvement underscores my faith in this cryptocurrency. My continued engagement signals that even amid temporary market dips, the long-term perspective maintains an optimistic stance.

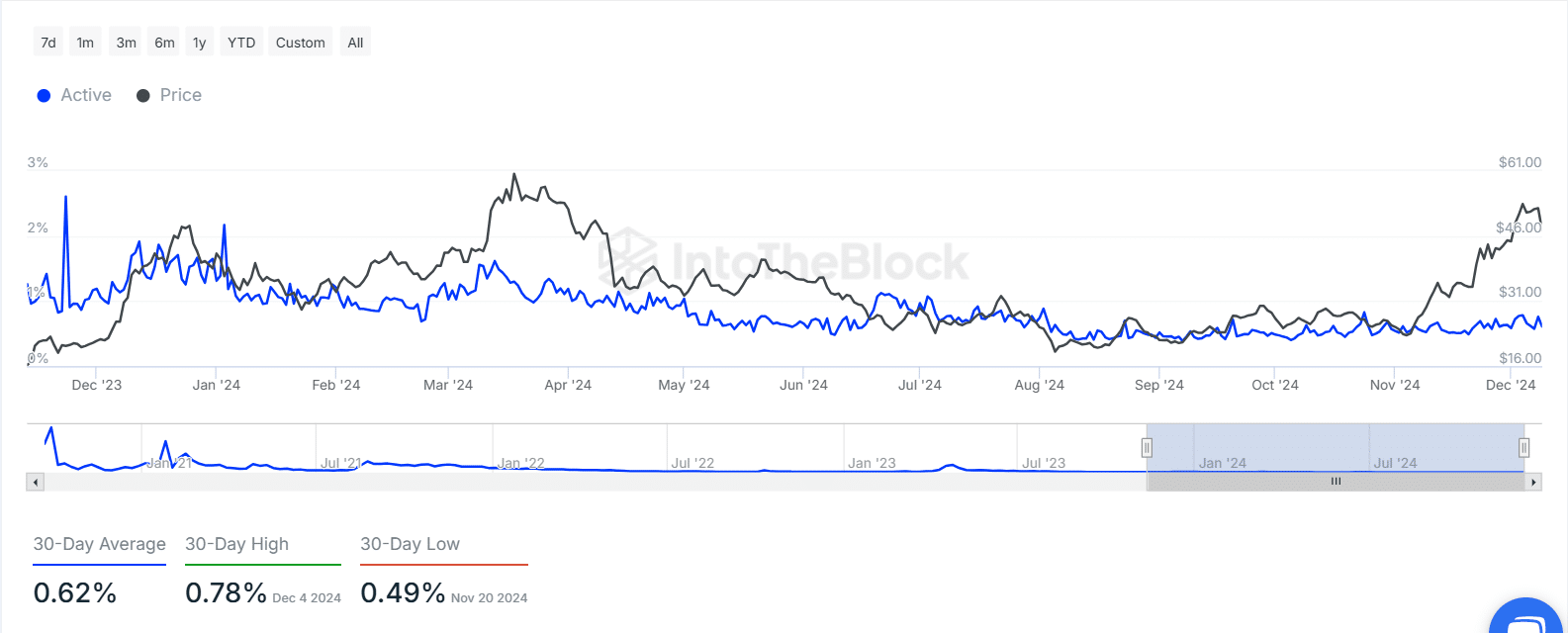

More growth to come for AVAX?

Avalanche’s Active Address Ratio offered insight into sustained network engagement over the past year. The average ratio has remained stable at 0.62% over 30 days, with recent peaks at 0.78% in December.

As a dedicated AVAX holder, I’ve noticed my regular involvement in transactions. This consistency suggests that many fellow AVAX investors are actively using the network, which I view as a promising sign of long-term network adoption and sustainability.

As I observed, a higher active address ratio seemed to align with price surges, such as the one AVAX experienced on its journey to $61. This consistent user engagement suggested that the network maintained its strength and resilience, even in the face of fluctuating prices.

With ongoing growth in engagement, there’s a potential for price hikes in the future, bolstered by vigorous participation from the community and investors.

In summary, the consistent involvement indicated by the Active Address Ratio underscored the robustness of the Avalanche network’s infrastructure.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

Despite market fluctuations, AVAX’s expanding user activity indicates a robust and thriving network.

Regular involvement suggests that Avalanche (AVAX) may hold significant long-term promise, even amid temporary adjustments in the short term market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-10 17:44