- Avalanche was in a long-term downtrend but appeared likely to reach the $30 level soon.

- Sustained gains beyond that region could be difficult and could see a retracement and consolidation phase.

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of bull and bear runs. The current trend of Avalanche [AVAX] has me intrigued but cautiously optimistic.

💥 Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastIn simpler terms, the price of Avalanche (AVAX) had been climbing on smaller time scales. After reaching $20, its price entered a period of relative stability, lasting around two weeks.

A recent report highlighted the bullish enthusiasm behind the token.

Starting from the 16th of August, the value of Avalanche crypto has climbed more than 30% higher. According to technical analysis, this upward trend may persist for several additional days.

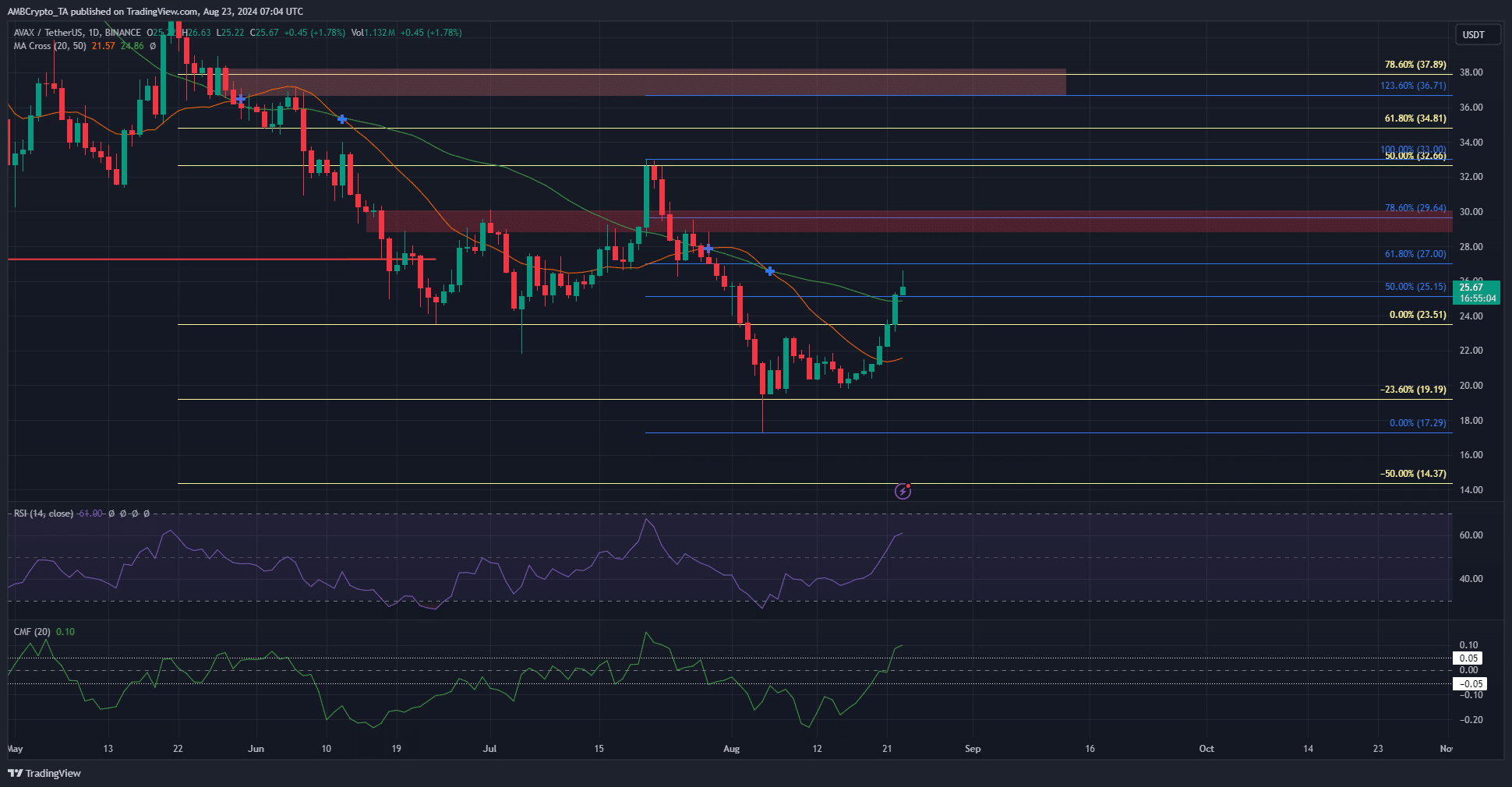

Two sets of Fibonacci levels to tell the AVAX price action tale

In May and June, the price decrease from $41.8 to $23.51, as well as the subsequent fall from $33 to $17.29, were applied to create a series of Fibonacci levels represented by yellow and blue lines respectively.

The more recent drop highlighted $29.64 as a key resistance level.

As I observed, the Avalanche crypto’s trajectory mirrored a significant point where it had previously found support in April. However, this area transformed into a level of resistance in June. Moving forward, the $37.5 region stands out as another crucial resistance zone.

As a researcher analyzing market trends, I found it encouraging that the price surpassed $24 following its test at the 23.6% extension level in the short term. This upward movement suggested a potential approach toward the $30 resistance. However, traders should exercise caution and temper any excessively optimistic bullish expectations.

1. In simpler terms, when the Capital Movement Factor (CMF) exceeded 0.05, it signaled robust buying activity. This vigorous purchasing trend could be seen in the Daily Relative Strength Index (RSI) readings and the price breaking through its moving averages.

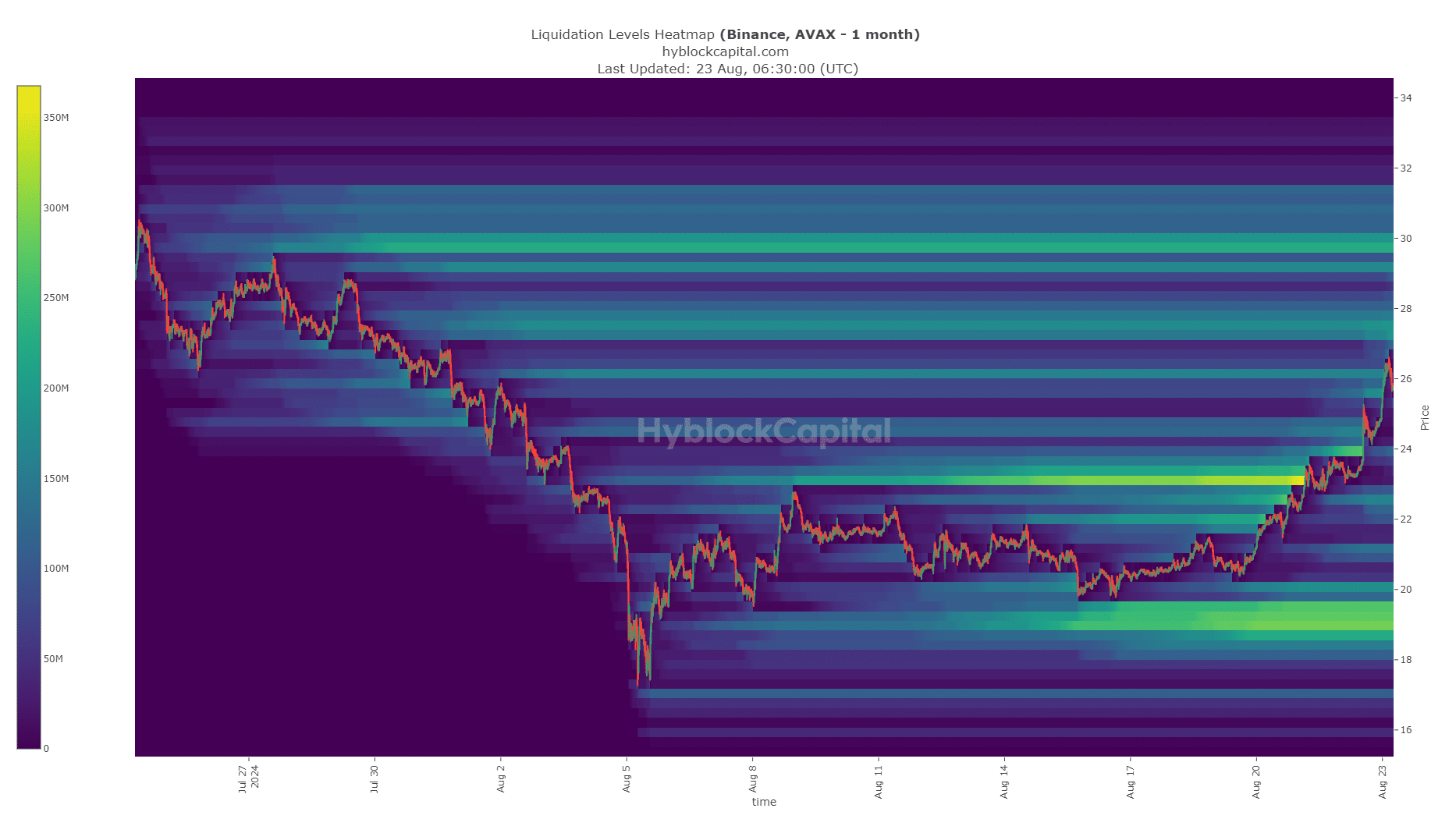

Evidence corroborates the $30 target for Avalanche crypto

The liquidation heatmap showed a concentration of liquidity just below $28 and around the $30 level. Combined with the momentum and demand for AVAX, it was likely that the price would move higher.

If Bitcoin surpasses the $66,000 mark, there’s a strong possibility that Avalanche could experience an extended surge as well, fueled by the overall optimistic market atmosphere.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-24 00:07