-

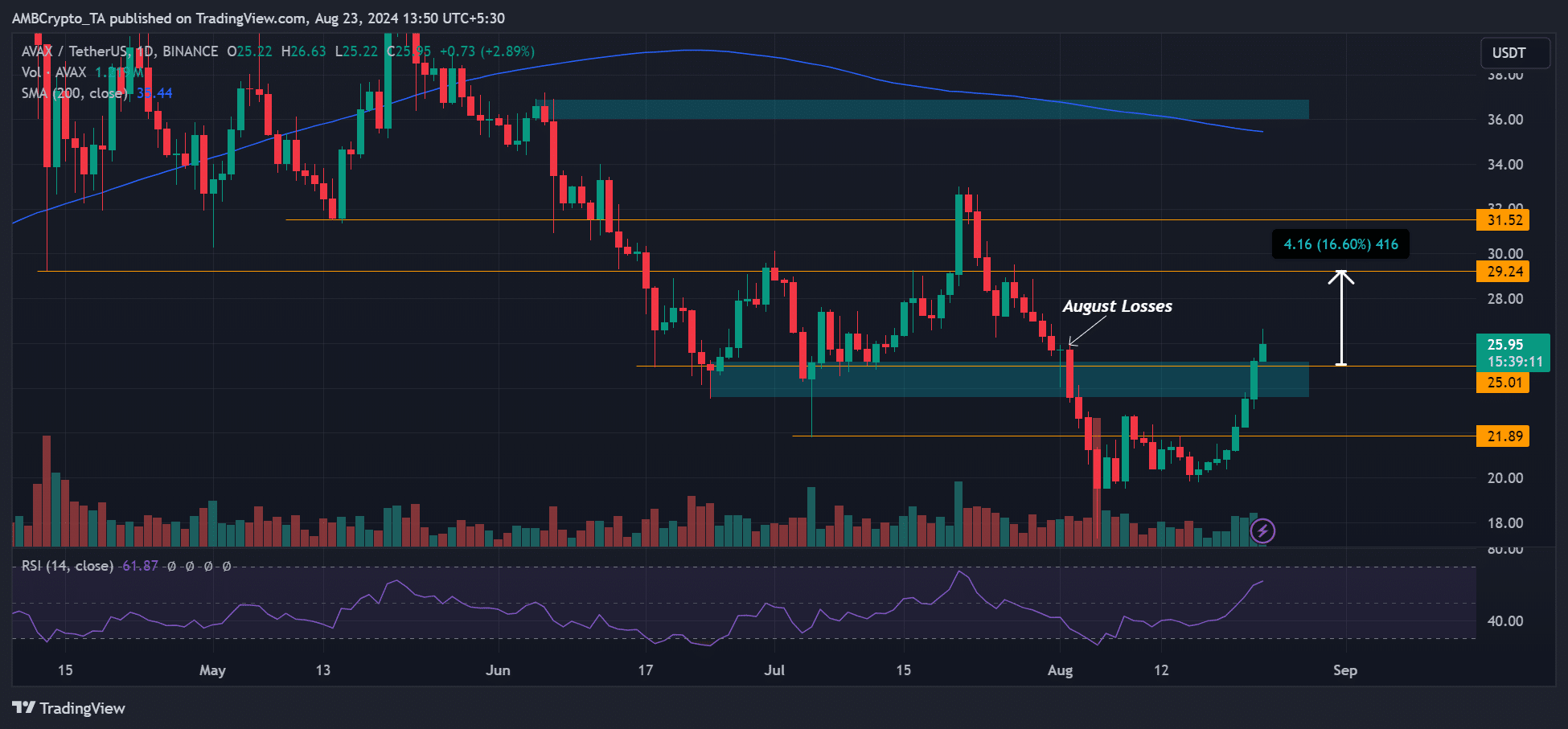

AVAX jumped +10% in 24 hours, effectively erasing early August losses.

Recent updates from Grayscale and Franklin Templeton could have boosted the rally.

As a seasoned researcher with years of experience in the cryptosphere, I must say that witnessing AVAX‘s 10% surge and subsequent recovery from early August losses is nothing short of exhilarating. It’s reminiscent of a phoenix rising from the ashes, a sight that always brings a sense of hope and anticipation for greater things to come.

On the 22nd of August, I observed a significant surge of approximately 10% in the value of Avalanche (AVAX), positioning it as the second-highest daily gainer among the top cryptocurrencies listed on CoinMarketCap.

In simpler terms, the recent increase in AVAX‘s value has boosted its recovery by approximately 30%. This growth has allowed AVAX to regain the $25 mark, effectively undoing all the declines that occurred in early August.

It’s possible that Avalanche (AVAX) might continue to increase, as the Relative Strength Index (RSI) wasn’t showing signs of being overly high (it wasn’t in an overbought state), indicating there may be additional potential for growth.

What caused such a significant surge in Avalanche (AVAX) prices on Thursday, while Bitcoin (BTC) has been holding steady within its current range?

Did Grayscale and Franklin Templeton boost AVAX?

As a crypto investor, I’ve been thrilled to see AVAX‘s surge in value recently, and it seems this rally aligns perfectly with two significant updates on the Avalanche network. Firstly, my attention was caught by Grayscale’s decision to include AVAX within their crypto offerings through a single trust—Grayscale Avalanche Trust ($AVAX). This move not only validates AVAX’s potential but also brings increased institutional interest towards the Avalanche ecosystem.

Based on the statements from Rayhaneh Sharif-Askary, Grayscale’s Head of Product and Research, the integration of AVAX into their offerings can be attributed to the influence of the chain on Real-World Asset tokenization.

“Avalanche is significantly contributing to the progress of RWA tokenization through its crucial strategic alliances and distinctive multi-chain setup.”

Indeed, Avalanche’s RWA segment has begun to spike, with the latest player being Franklin Templeton’s tokenized US Treasury expanding to the chain.

The recent good news may have significantly accelerated the ongoing comeback in the wild market, enabling it to overturn all the declines experienced in August.

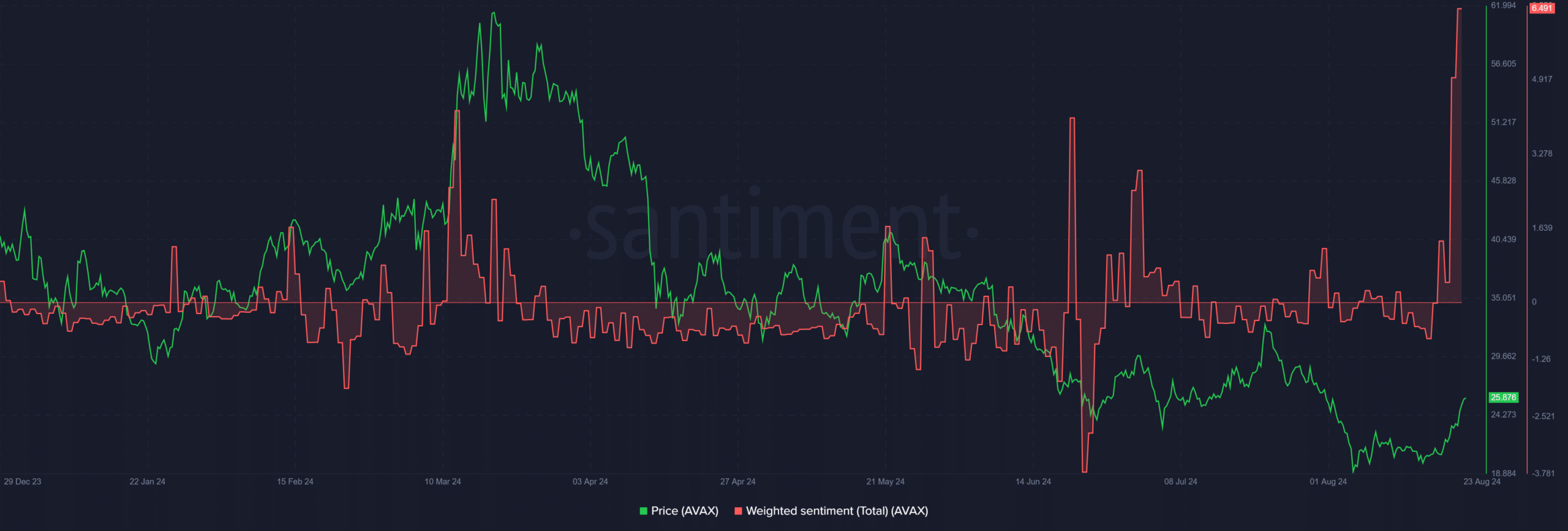

The altcoin also massive spike in positive sentiment, hitting a yearly high as the price trended higher.

These updates seem to have improved the speculators’ perspective on the altcoin. If the bullish trend persists, the price might aim for $30 as its next goal.

The optimistic viewpoint gained strength as AVAX successfully regained the $25 mark, a significant support point back in June and July. If this defense holds firm, AVAX might aim for $30 next.

In response to Grayscale’s recent action regarding AVAX, I, as an analyst, find it noteworthy that Ava Labs President, John Wu, characterized the update as a ‘significant achievement.’ This move underscores the growing importance and potential of the AVAX ecosystem.

“Grayscale launching an Avalanche trust is a huge milestone for the ecosystem.”

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-08-23 22:15