- The Avalanche price prediction supported a short-term bullish outlook.

- AVAX’s retracement could offer a great buying opportunity at $50.

As an analyst with over a decade of experience in the crypto markets, I find myself particularly intrigued by the current state of Avalanche (AVAX). While it may have trailed behind some of its peers in terms of YTD returns, its position within the top 100 tokens by market cap makes it an interesting prospect.

As an analyst, I find the current retreat of Avalanche’s [AVAX] presents a potential opportunity for a strategic long position, potentially yielding a 12% return. It’s crucial to note that AVAX might also provide attractive prospects for both long-term and short-term plays in the altcoin market.

Looking at the bigger picture, AVAX ranked among the top 100 cryptocurrencies by market capitalization. However, it has trailed behind many leading tokens that have shown impressive year-to-date (YTD) gains in triple digits.

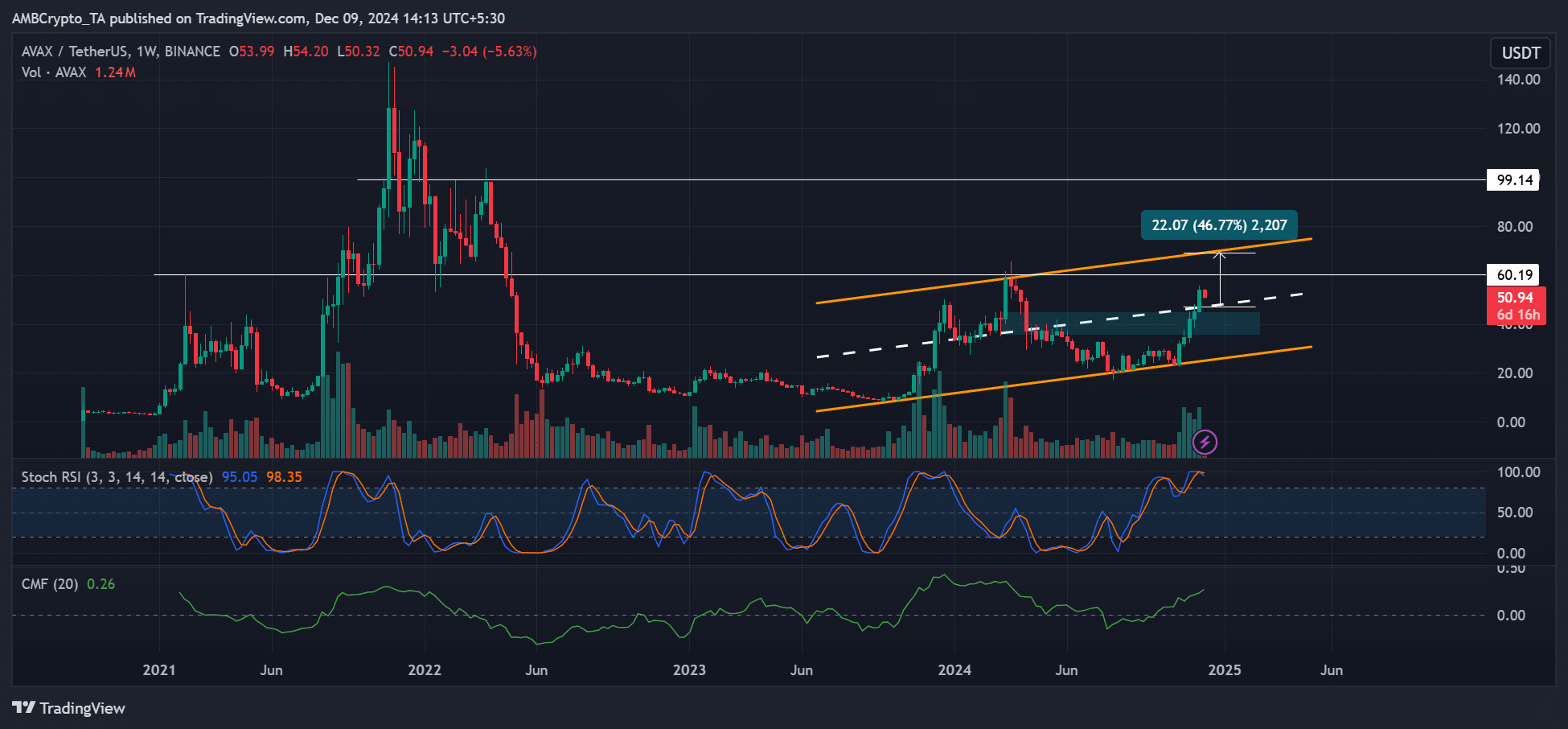

This could make it a better opportunity should it soar to its 2024 ($65) or 2021 highs ($147).

Given past patterns, surpassing the $60 mark might pave the way for hitting the 2021 high of $100.

Short-term AVAX prospect

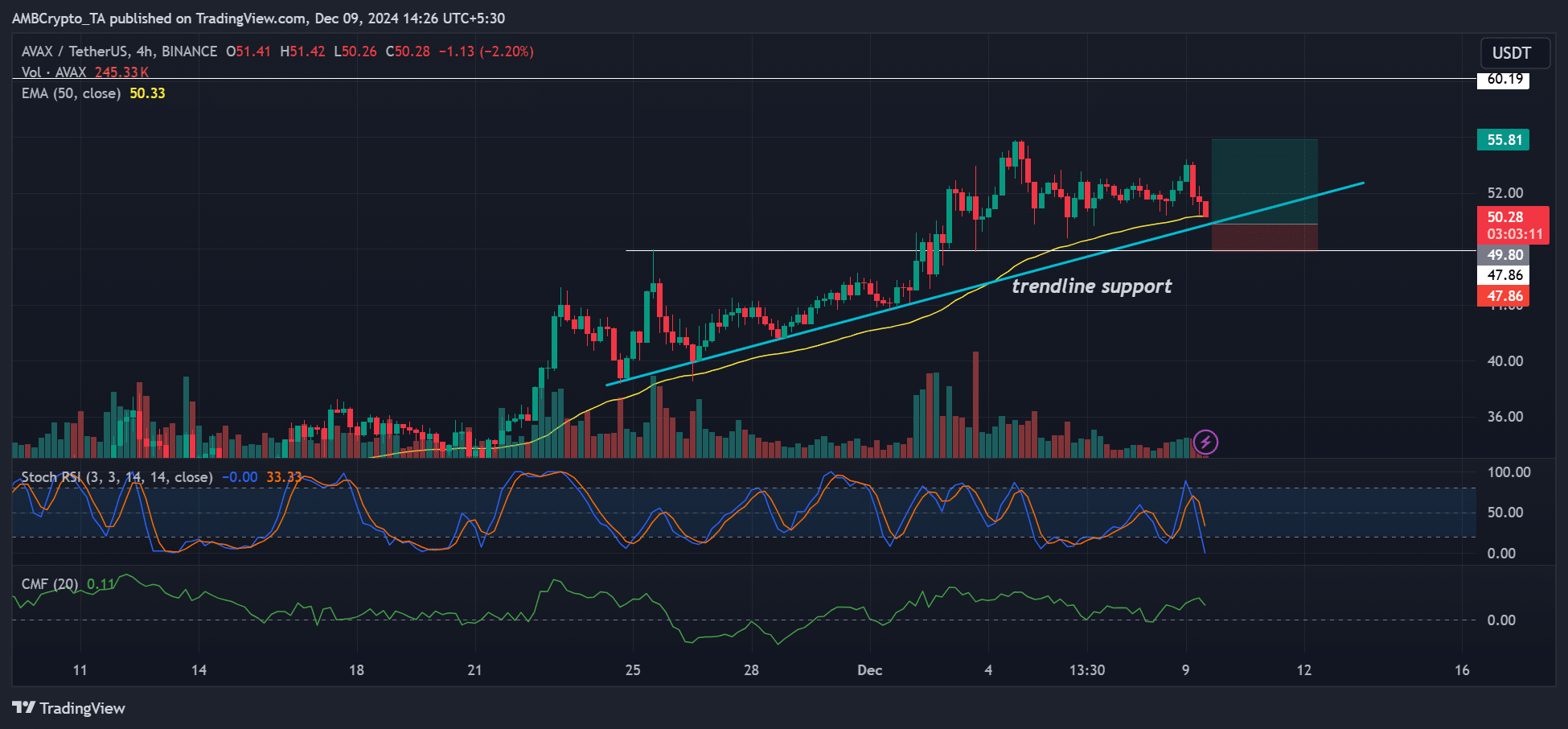

When zoomed in on the 4-hour chart, AVAX retracement was headed to key short-term support levels.

Starting from late November, both the trendline support and the moving average line (specifically the 50-day Exponential Moving Average) have been preventing a significant drop in AVAX’s value.

Looking at the current trend, if history repeats itself, I’d anticipate a potential rebound around these price points, offering a promising opportunity to establish a long position at approximately $49.7.

In simpler terms, if you’re holding a long position (buying), setting the stop loss around $48.8 (below the high of $49.8) could help protect your investment. This means that if the price drops to $48 or lower, your trade would be closed automatically, preventing further potential losses.

The temporary strength in prices might decrease, potentially leading to a price change in the opposite direction, as indicated by an oversold signal on the Stochastic Relative Strength Index (RSI).

Additionally, the higher than normal incoming funds, as indicated by the CMF, bolstered the prediction that a price increase was imminent.

Liquidity sweep at $50

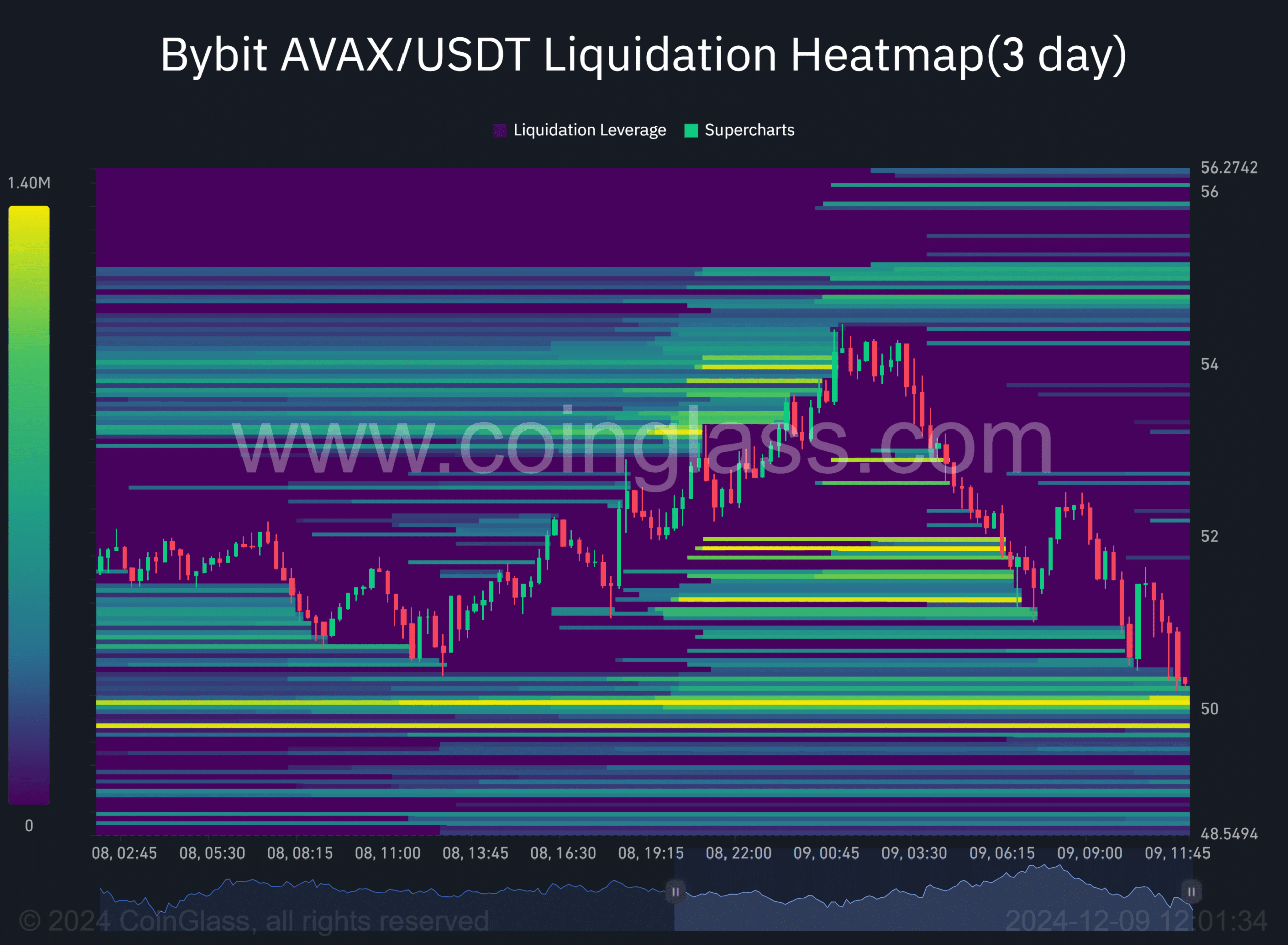

To put it simply, the initial fluctuations during the start of the week were primarily caused by a search for liquidity. As reported by Coinglass, AVAX had drained its liquidity at around $52 and was hovering near the support level of less than $50 (distinctively yellow areas) as we speak.

Without much available liquid funds besides the leveraged long positions at $49.8, a sell-off at these prices might prompt Avalanche (AVAX) to move back upward.

Read Avalanche [AVAX] Price Prediction 2024-2025

The accumulation of favorable conditions was growing around the $54-$55 range. This was due to a large number of highly leveraged sell positions being stacked up, potentially making the $54-$55 area the next goal for this trend’s upward momentum.

As a crypto investor, I see a projected rally, fueled by liquidity demand, moving from around $49.8 up to approximately $54-$55. This trend aligns with my long-term strategy and offers a potential 12% return. However, if we experience an extended dip below $48, it could challenge the near-term bullish perspective I currently hold.

Read More

2024-12-09 20:07