-

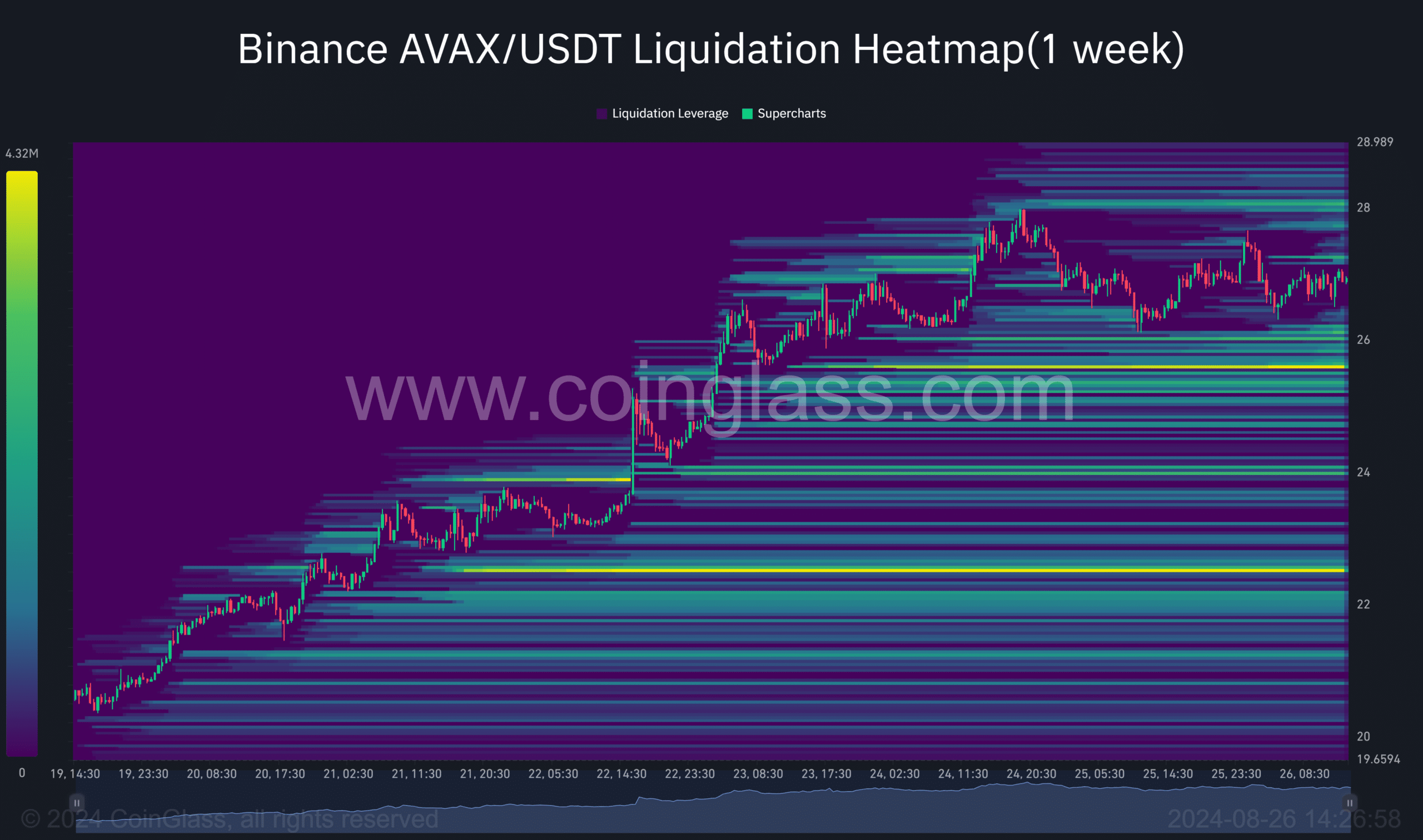

AVAX liquidation heatmap indicates a significant pool of $4 million at the $25 level.

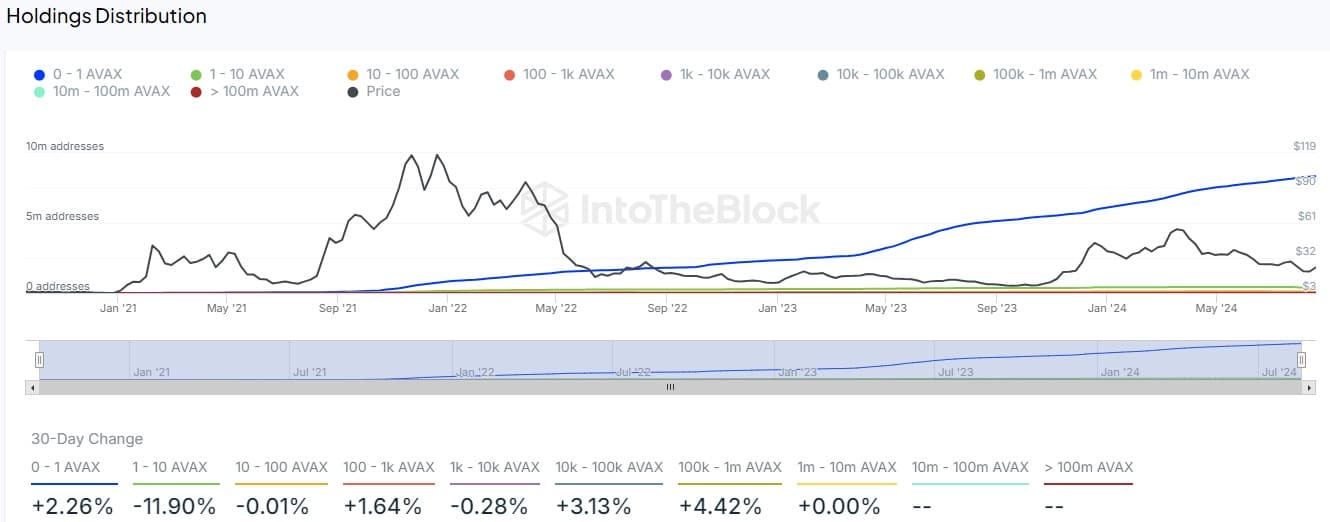

Whale activity and holding distribution could boost the price movement.

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself cautiously bearish about Avalanche [AVAX] at this juncture. The $4 million liquidation pool at the $25 level, as indicated by Coinglass’ liquidation heatmap, is a significant red flag that could potentially trigger an extensive sell-off if the market behaves as expected.

A look at AVAX‘s potential trend suggested a possible drop towards around $25. Data from Coinglass’ liquidation heatmap showed a liquidation pool worth approximately $4 million at that price level.

A large accumulation of liquid assets indicates that the current price point might be the market’s preferred direction, potentially leading to a widespread sell-off or liquidation event.

If the market follows the anticipated pattern, it should validate this trend over the coming days as traders concentrate on this particular point.

How holding distribution may speed up the drop

Based on distribution data from IntoTheBlock, it appears that AVAX‘s large investors (whales) could potentially make more moves to decrease the price.

These major cryptocurrency investors have been consistently purchasing additional AVAX stocks. If they were to sell these holdings at a price of $25, it could significantly intensify the existing negative mood among investors who are already bearish.

As an analyst, I’ve noticed a significant clustering of key transactions at these specific levels, which could potentially indicate instability. However, this concentration might also be perfectly harmonious with the gravitational pull exerted by the liquidation pool in this context.

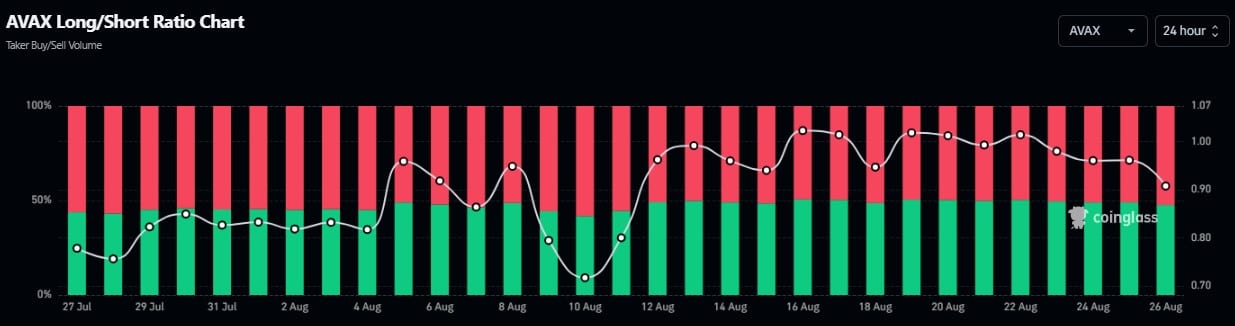

Approximately a 7% increase in investors holding over $100k in AVAX could significantly influence its price trend within the market. Meanwhile, the Coinglass 24-hour short ratio sits at 0.90, suggesting that the market is close to a balanced state.

In my perspective as a crypto investor, the gradually decreasing ratio seems to suggest a buildup of bearish sentiments in the near future. As prices continue to dip, it appears that we’re heading towards filling up the liquidation pools.

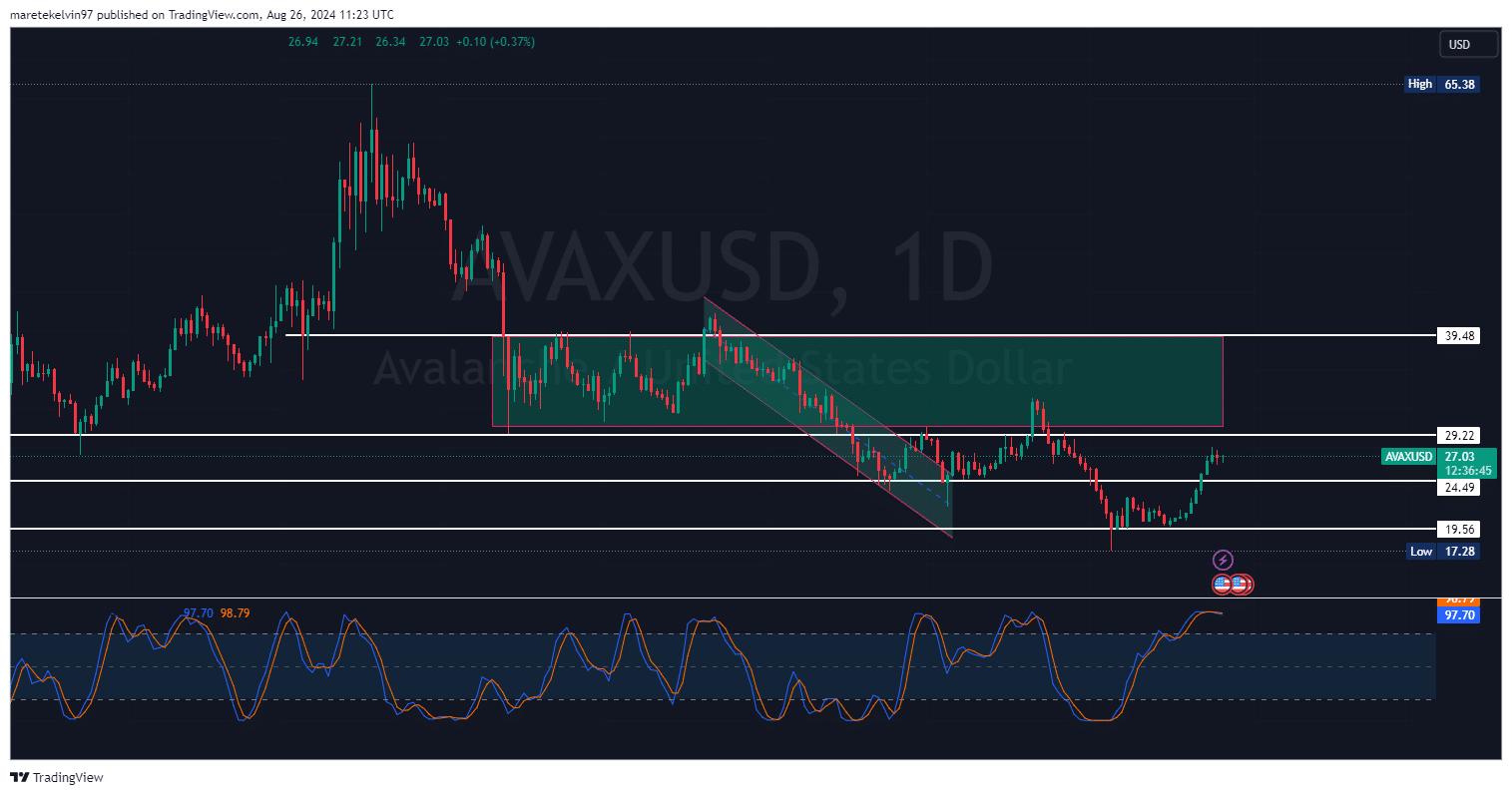

AVAX bearish signals

Enhancing the possibility of a pullback, the random RSI (Relative Strength Index) has just entered a bearish phase. This additional concern is significant because it frequently predicts downward trends, especially when combined with liquidation maps and whale activity at this time.

Is your portfolio green? Check the Avalanche Profit Calculator

In simpler terms, the mix of data from the liquidation map, whale behavior, and specialized tools like Stochastic RSI suggests a potentially negative short-term trend for AVAX.

Given these bearish influences, it’s more likely that the market may experience a pullback towards the $25 mark before it becomes clear where the overall trend is heading.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-27 12:07