-

A positive movement on some on-chain metric doesn’t necessarily suggest a bullish trend for AVAX.

Whales and retailers are rapidly selling off their AVAX holdings but a little hope remains.

As a seasoned crypto investor with battle-tested nerves and a portfolio that has weathered more market storms than a hurricane-prone island, I can confidently say that the current state of Avalanche [AVAX] is a tale as old as time – whales cashing out, retailers jumping ship, and the price taking a nosedive.

Over the last seven days, the trend for Avalanche’s [AVAX] price has significantly dropped by 17.13%, suggesting a downturn, and it appears that a quick rebound might be hard to come by.

Although there are positive indicators like a 53.73% surge in trading volume within the past day, an uptick in daily active users, and a rise in large transactions, AMBCrypto suggests that these improvements may not necessarily mark a shift in the ongoing trend.

Increased activity suggests exit by major holders

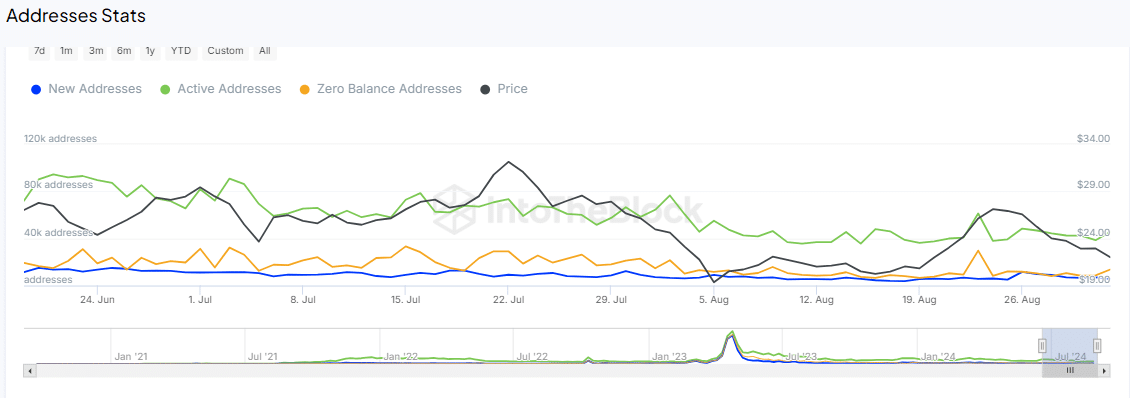

According to IntoTheBlock’s data, there has been a significant increase in activity on Avalanche, as the number of active addresses has jumped from approximately 38,580 to 45,690 within a single day.

Simultaneously, there was an increase in the quantity of significant transactions, going from 166 to 297 during that specific period.

Generally speaking, these spikes often point towards a bullish market, yet the fall in AVAX‘s value seems to contradict this, suggesting instead that it may not be a bullish trend after all.

The rise in user interaction alongside decreasing prices suggests that there may be actions related to profits being distributed or taken out of the market.

It seems like big investors holding AVAX (whales) might be selling their AVAX for money, which could suggest they’re cashing out on their gains. This action appears to be transferring more AVAX to numerous smaller investors. Such a shift usually hints at a possible continued decrease in the price.

According to additional examination conducted by AMBCrypto, it appears that both large investors (whales) and smaller individual investors (retail traders) are involved in this market downturn.

Whales, retailers losing confidence in AVAX

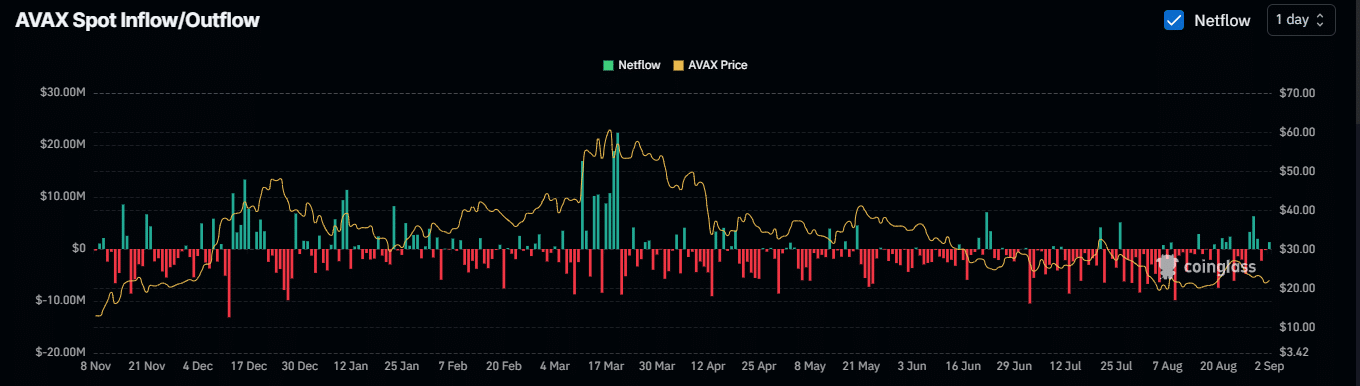

As reported by Coinglass, the flow of AVAX on significant centralized trading platforms has primarily been moving upwards, usually indicating a potentially bearish trend for the cryptocurrency.

A Netflow that is positive implies more AVAX is being put into these exchanges for deposit than taken out for withdrawal, indicating a higher inclination among traders to offload their AVAX rather than keep it.

In this scenario, a rise in incoming funds can lead to an expansion of the available supply on trading platforms, potentially intensifying the downward trend in the asset’s price due to the excess supply.

As an analyst, I observe a bearish inclination among retail traders, subtly hinted by a downward trend in the Open Interest (OI) Weighted Funds rate.

In simpler terms, this warning sign suggests that traders are adopting a cautious stance in the futures and derivatives markets, either by selling off their holdings in expectation of continued price drops or by reducing their positions to limit potential losses.

According to AMBCrypto’s examination of various technical indicators, there seem to be consistently bearish trends, yet a potential recovery could be on the horizon.

A glimmer of hope for AVAX remains

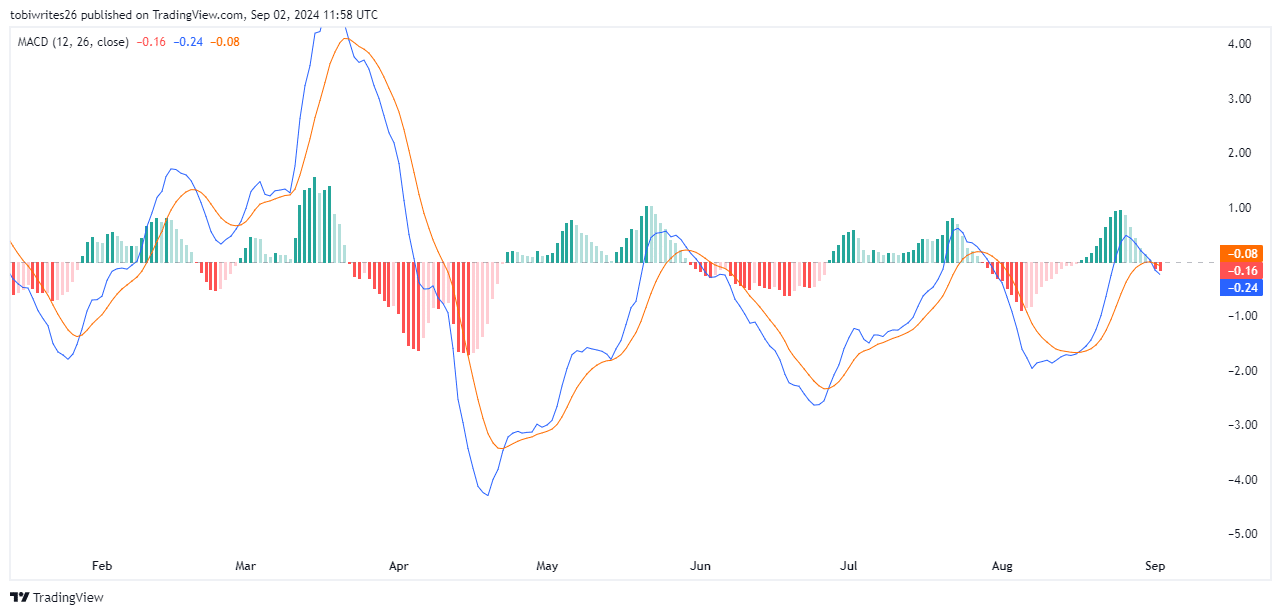

The Moving Average Convergence Divergence (MACD) signal indicates a stronger bearish perspective for AVAX. When the MACD line crosses under the signal line, it signals an impending decrease in both momentum and price movement.

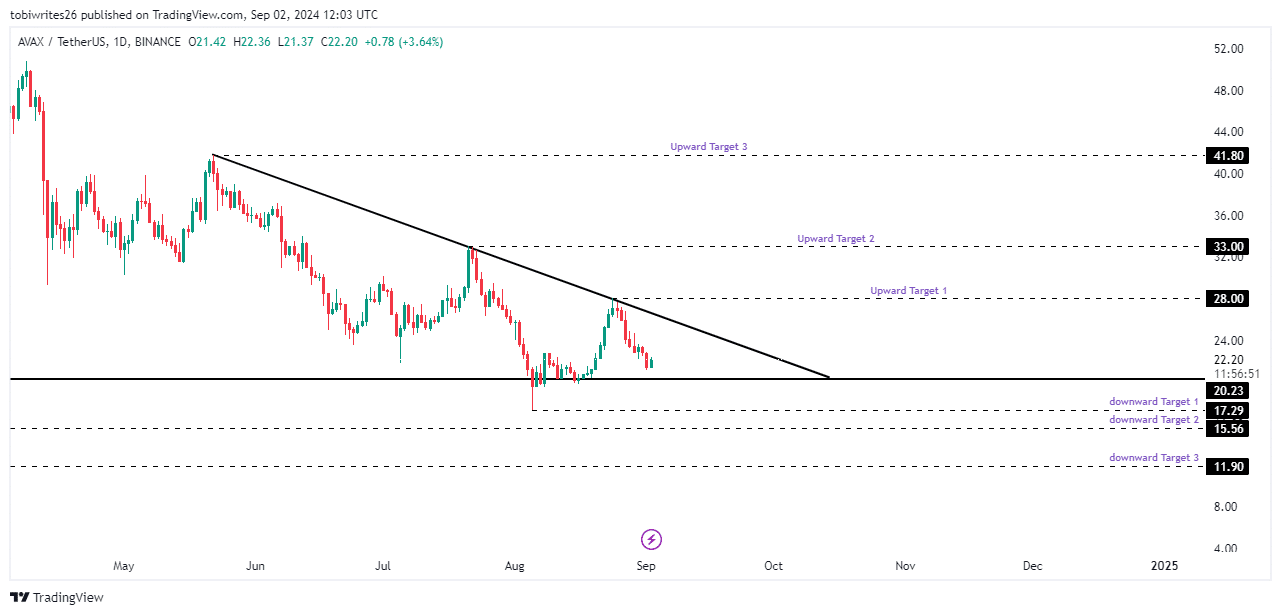

In simpler terms, this trend indicates that the price of AVAX might decrease in the short run. But, some crucial technical indicators like local reinforcements and a downward trend line on the daily graph hint at a potential upturn or bullish recovery soon.

Due to the current market trend, AVAX could be trying to find its footing by testing the nearby support area around $20.23. This region has shown robust demand in the past, suggesting that buyers have traditionally stepped in at this price point.

Is your portfolio green? Check the Avalanche Profit Calculator

If this backing continues, it might spark a surge, propelling the price above the falling trendline, aiming for a final goal of $28.

Conversely, if bearish influences become dominant, Avalanche (AVAX) could potentially drop to its initial lower support level at $17.29. Subsequent strong selling pressure might cause the price to fall even further to around $11.90.

Read More

2024-09-03 09:12