-

AVAX bulls demonstrate resilience despite the resurgence of bearish expectations.

Short sellers suffer as price pushes above short-term resistance.

As a seasoned researcher with years of experience in the crypto market, I find myself constantly intrigued by the dynamics of coins like AVAX. The recent surge above resistance at $27 and the subsequent liquidations have been a fascinating spectacle to observe. It seems that the bulls are determined to push prices as high as $32 if they can sustain their rally.

As a researcher, I’ve noticed an intriguing shift in Avalanche [AVAX]. After enduring several months of dips, it appears to have transitioned into a bullish phase. The impressive performance this month is evident, with its trajectory surpassing the immediate resistance at the $27 mark, suggesting a robust momentum.

If this momentum continues, there could be a potential rise up to $32 in the short term.

It’s possible that the Avalanche (AVAX) bulls got a helpful push due to forced liquidations. The market was anticipating a potential turnaround near the $27 price point.

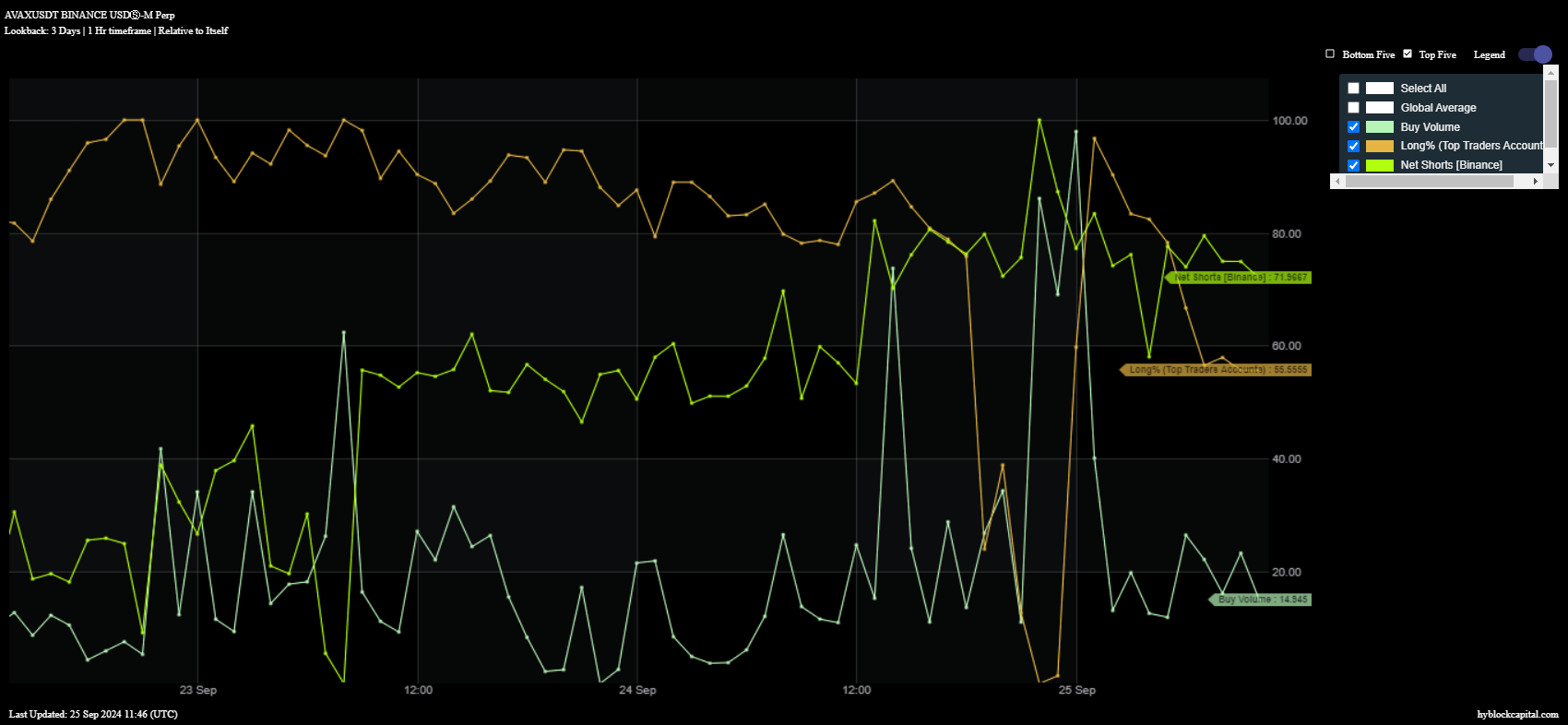

As a researcher examining data from Hyblock Capital, I’ve observed an upward trend in the number of net short positions (represented by green) on Binance over the span from the 23rd to the 24th of September.

On September 24th, AMBCrypto saw an increase in buying activity (as indicated by the blue line), which could potentially account for why AVAX managed to break through its resistance level.

During the same session, there was a revival of long positions (brown) following their earlier drop.

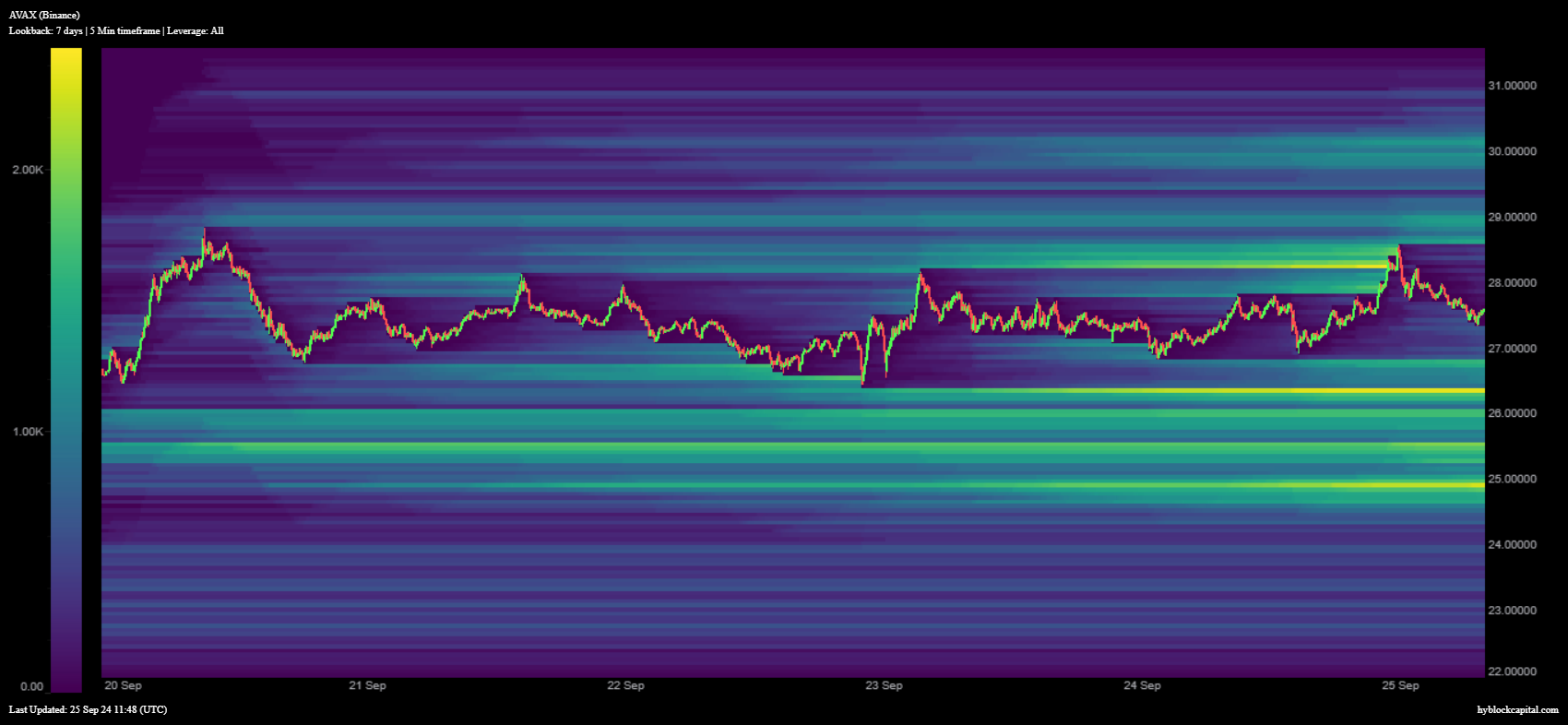

The process of liquidation could potentially trigger a stronger upward trend, particularly when accompanied by a rise in demand. As seen on AVAX‘s heat maps within the past day, there has been a significant increase in liquidations at approximately $28.20.

According to the heat map, it seemed like a liquidity sweep should occur at the mentioned level. Yet, the results didn’t seem to show a persistent strong momentum continuing.

In simpler terms, the price of AVAX has experienced a decrease of around 2.71% over the past 24 hours as of now. The upward momentum seems to have softened.

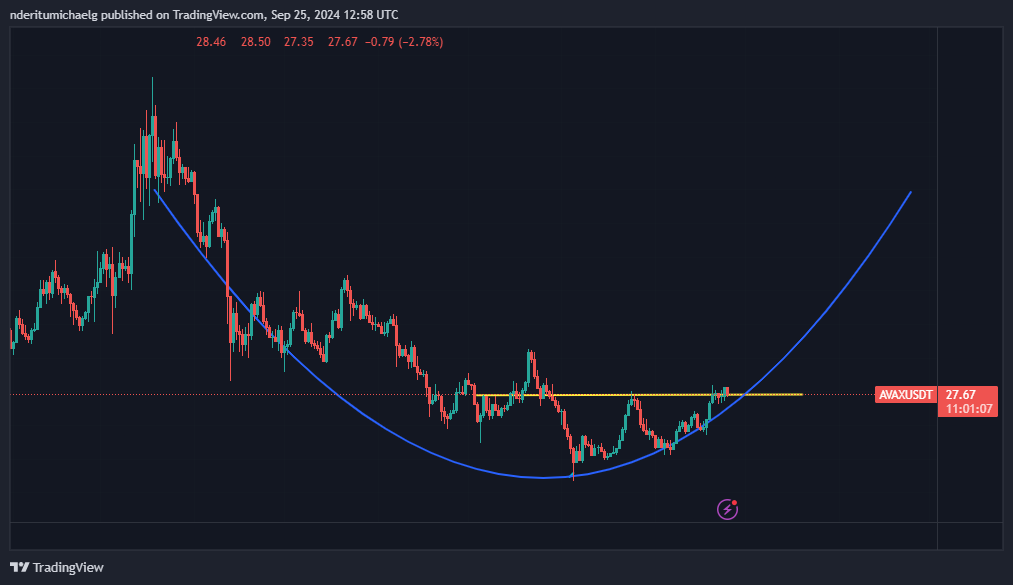

At the moment of writing, the value of AVAX stood at approximately $27.67. This implies that the present price point might be causing a degree of doubt about its capacity to generate robust demand at its current stage.

However, zooming out on its chart revealed that it has been trading in a cup and handle pattern.

The trend suggests AVAX is starting an upward recovery phase. If this prediction proves accurate, it would lean towards the bulls for several weeks or months ahead.

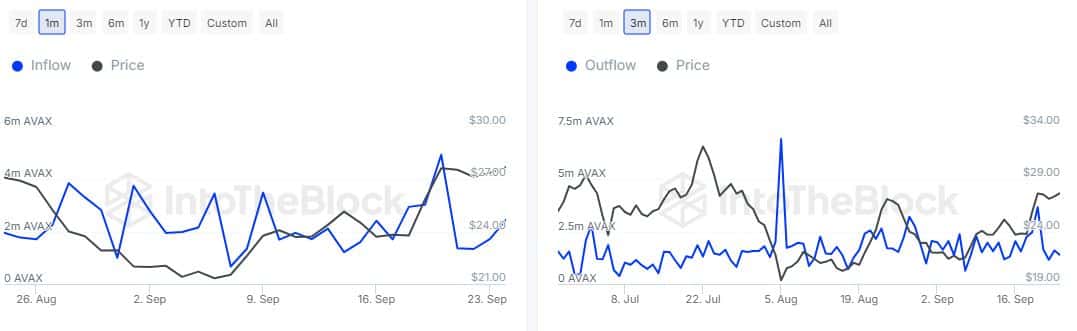

As far as demand was concerned, on-chain data showed that the bulls were still dominant.

This week, the highest inflow of AVAX tokens into large wallets (significant inflows) reached approximately 4.97 million coins, whereas the peak outflow from these same large wallets (significant outflows) amounted to about 3.67 million coins.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

On the 24th of September, incoming AVAX transactions had decreased to approximately 2.45 million. Nevertheless, this figure remained greater than the outflows from large holders, which amounted to 1.34 million AVAX on the same day.

It appears that the demand decreased noticeably yet remained stronger than the supply pressure, approximately on the same day when short positions were closed.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-26 02:47