- AVAX’s price fell, with its market cap dropping below $19 billion

Signals from AMBCrypto’s analysis revealed that the price might recover soon

Despite putting in great effort to stay among the top 10 cryptocurrencies by market capitalization, Avalanche (AVAX) has unfortunately slipped out of this elite ranking. At present, its market cap stands at approximately $18.31 billion.

The difference between this value and Toncoin‘s [TON] market cap was approximately $5 billion. This disparity primarily caused the shift in ranking. Specifically, AVAX decreased by 3.93% over the past 24 hours. Conversely, TON experienced a rise of 15.45%, advancing to the ninth spot on the list.

Recently, AVAX‘s performance in the market has gone against its strong showing a few months ago. Previously, AVAX and Solana (SOL) were among the top performers. However, with new market conditions, there is a possibility that AVAX may keep sliding down the rankings. But will it actually do so?

Frail AVAX ready to bounce

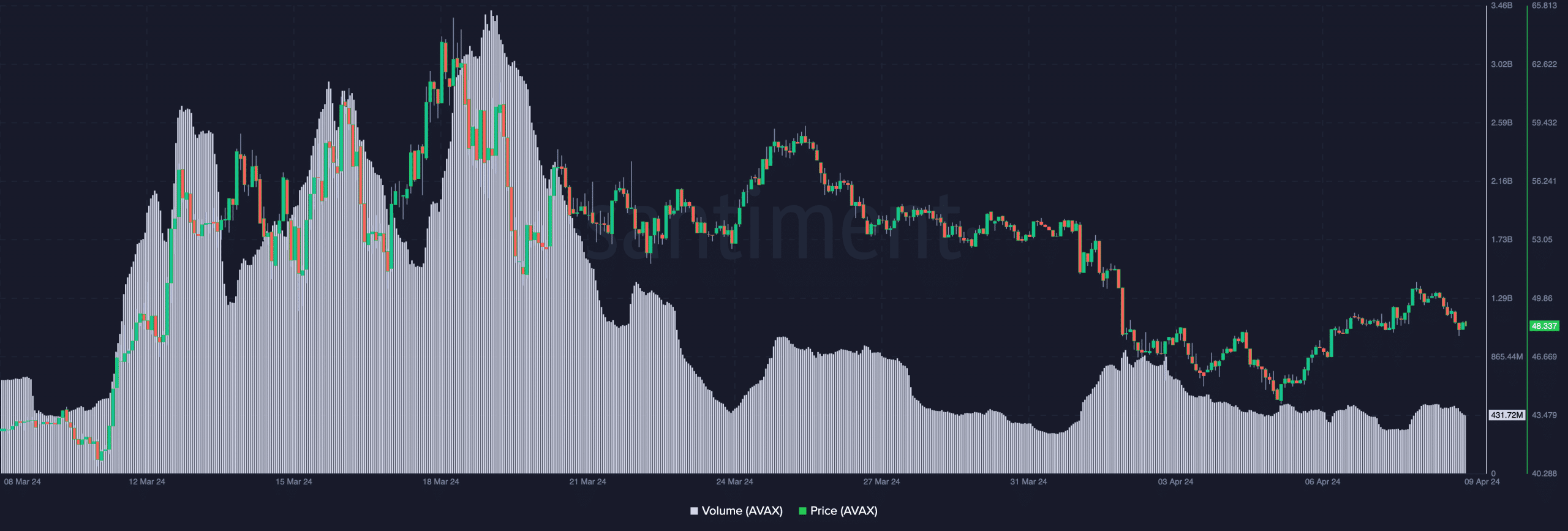

AMBCrypto examined the potential by focusing on the trading activity first. Trading volume represents buyers and sellers and signifies the level of engagement with a cryptocurrency token.

Based on Santiment’s data, the trading volume of AVAX on March 19th was significantly higher than it currently is. On that day, the volume reached approximately $3.42 billion. In contrast, at present, the trading volume stands at around $400 million.

The drop in trading activity signaled waning enthusiasm for the token. But the token’s price could still experience a surge based on current market trends. If volume keeps decreasing at the same rate as the price, however, this downtrend may lose momentum, potentially leading to a rebound for AVAX on the charts.

Not everyone is confident

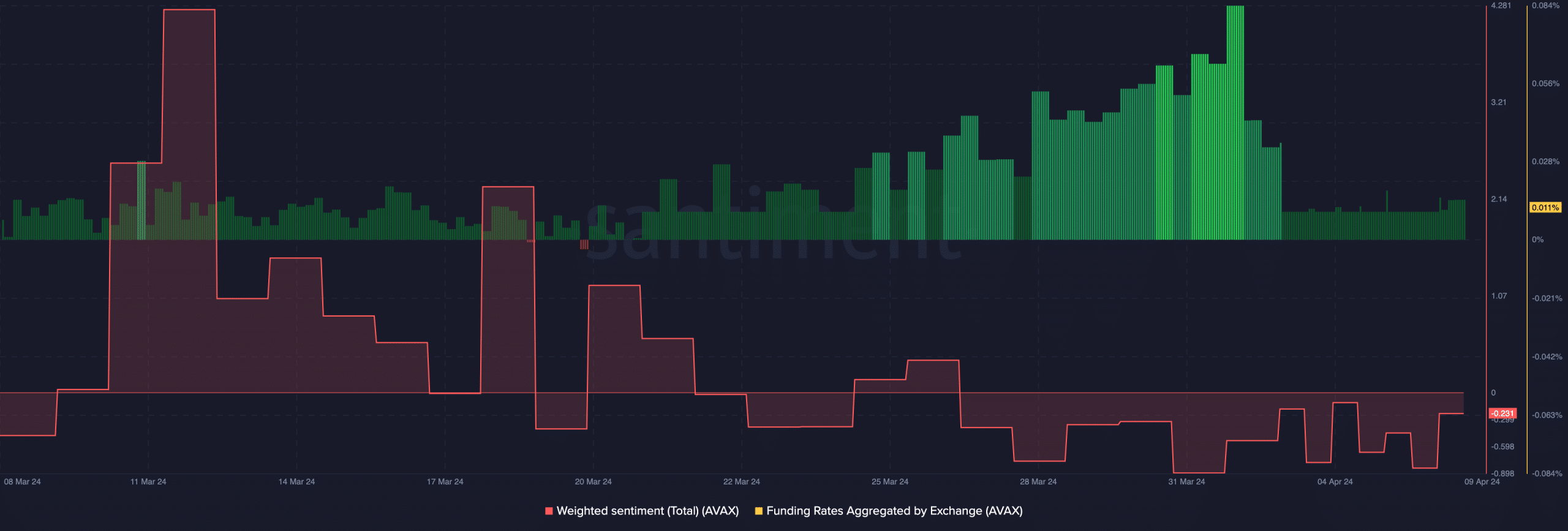

Evidence of this perception was highlighted by the Weighted Sentiment. At the time of writing, the Weighted Sentiment was -0.231, indicating that most comments about AVAX were pessimistic. Despite this, the price of the cryptocurrency could bounce if the sentiment reading drops lower than the one mentioned above.

AMBCrypto examined another indicator, referred to as the Funding Rate. This figure represents the expense incurred for maintaining an active position in the derivatives market.

When we checked the news at that moment, the financing for holding long positions was favorable, causing the perpetual contract price to be noticeably higher than the current market price. Consequently, it grew costlier for traders holding long positions to maintain them.

they weren’t receiving any rewards for their aggressive long positions.

Is your portfolio green? Check the AVAX Profit Calculator

At current costs, this trend could indicate a possible decrease in AVAX‘s value. If the situation continues over the next few days, it’s likely that AVAX‘s price may drop further, causing its market capitalization to shrink even more.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-10 15:51