AVAX Mania: On-Chain Buzz vs. Price Bleakness — What’s Really Going On?

Avalanche (AVAX), that sprightly darling of the layer-1 cryptos, is somehow managing to tempt the masses with its soaring wallet counts—like a teenager showing off at the mall.

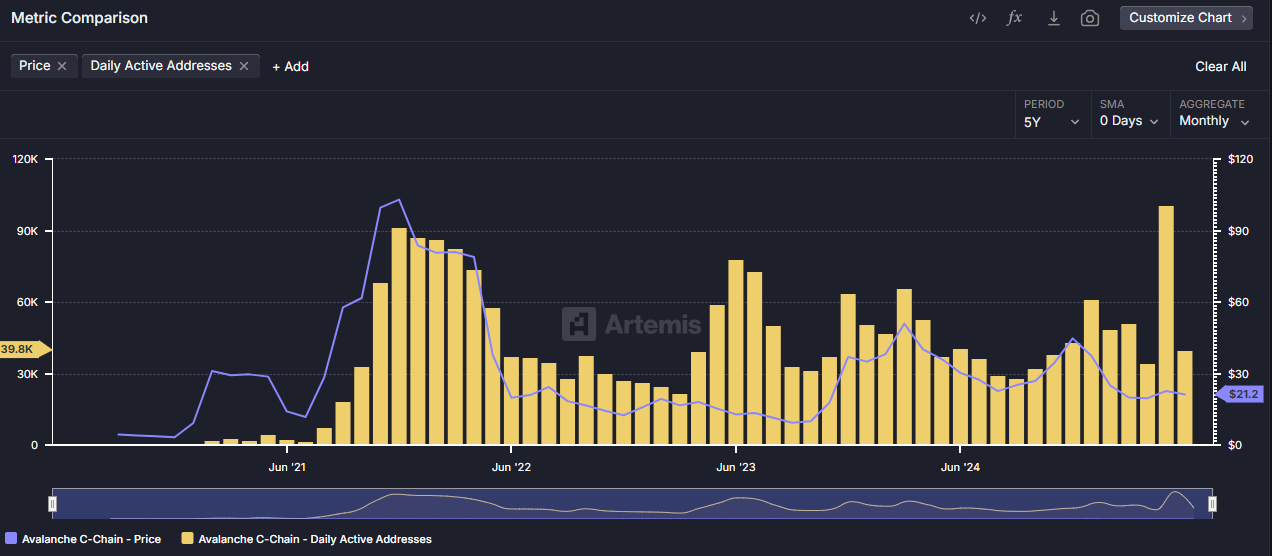

Alas, the irony is thick enough to cut with a knife. While wallets multiply faster than rabbits in spring, the price of AVAX stubbornly trundles along at a humiliating 2021-level—down more than 60% since the end of 2024—prompting a flurry of head-scratching. Could it be undervalued, or are we witnessing the market’s version of a tragicomedy?

Why is Avalanche’s On-chain Activity Soaring?

According to Artemis’ keen-eyed data, daily active wallets on the Avalanche C-Chain have shamelessly surpassed 100,000—more than when AVAX last saw $147 at its all-time high at the end of 2021. Looks like someone’s been busy—probably dreaming of riches.

Meanwhile, Token Terminal reports that monthly active wallets have gone from below 500,000 to an astonishing 2.2 million in just a single month. A veritable rave of activity, one might say, despite current price doldrums. Market genius Wu Blockchain hints that it’s all about institutional fingers poking around in the ecosystem—probably for the thrill of it.

“This surge is likely driven by the launch of the blockchain game MapleStory Universe. Meanwhile, BlackRock’s tokenized short-term US Treasury product, sBUIDL, has been adopted as collateral on the Avalanche-based Euler protocol,” Wu Blockchain explained.

Yet, here’s the rub: on-chain activity is merrily marching along while AVAX’s market price is stuck in a somnolent stupor at around $21—over 60% down from its late-2024 peak. It’s the financial equivalent of a splendid dinner with no wine in sight.

This oddity has some analysts pondering whether now is a fine time to fill one’s bags with AVAX—an opportunity cloaked in mystery and meme-hope.

Crypto Pirates—or so they call themselves—predict AVAX has slipped into a demand zone, ready for a June rebound. With a wink and a nod, they suggest, “AVAX tapped into my daily demand level. From here, we can plan longs all the way to the weak high,”—a forecast as precise as a weather vane.

“AVAX tapped into my daily demand level. From here, we can plan longs all the way to the weak high,” Crypto Pirates said.

Looking at the long arc of history, investor Hasan opines that AVAX currently occupies a “historical demand zone.” That’s finance-speak for a spot where the savvy might stash their crypto and wait—probably in a thistle-tangled garden of volatility and hope.

“Performance hasn’t been great yet. It rose from $14 to $27 recently. Right now, it seems to be attracting demand around the $16 range. If BTC corrects in June, AVAX could revisit this area. Those thinking of investing might want to wait and reassess if the price returns to that level,” Hasan advised.

Despite last month’s glimpses of hope and promising developments, the investor sentiment remains akin to a damp sponge thanks to the SEC’s interminable delay on the AVAX ETF application. Meanwhile, Bitcoin’s dominance continues to hover at over 63%, making altcoins shy and self-conscious.

So, brave soul, perhaps patience is the order of the day. Expect the stars to align—fundamentals, market mood, and regulators all in a dramatic dance—before you can expect a proper fireworks display of returns. Until then, we wait, with or without a chuckle.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-06-04 14:36