-

AVAX plummeted by 10% due to massive shady whale transactions.

Despite the sharp decline, the derivatives market showed a bullish inclination among traders.

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility and whale transactions. The sudden 10% drop in AVAX‘s price due to massive shady whale transactions is concerning, but it’s important to look at other factors before making any hasty decisions.

In recent hours, there’s been a marked decrease of approximately 10% in the value of Avalanche’s cryptocurrency, primarily driven by substantial transactions made by large investors or “whales.”

As a crypto investor, I’ve noticed an interesting transaction where a significant player moved approximately 1.96 million AVAX, equivalent to around $54.2 million at current market prices, to various major exchanges including Coinbase, Binance, and Gate. Additionally, some portion of this transfer was facilitated through THORChain.

Are we headed for a massive crypto market sell-off?

Is AVAX in trouble?

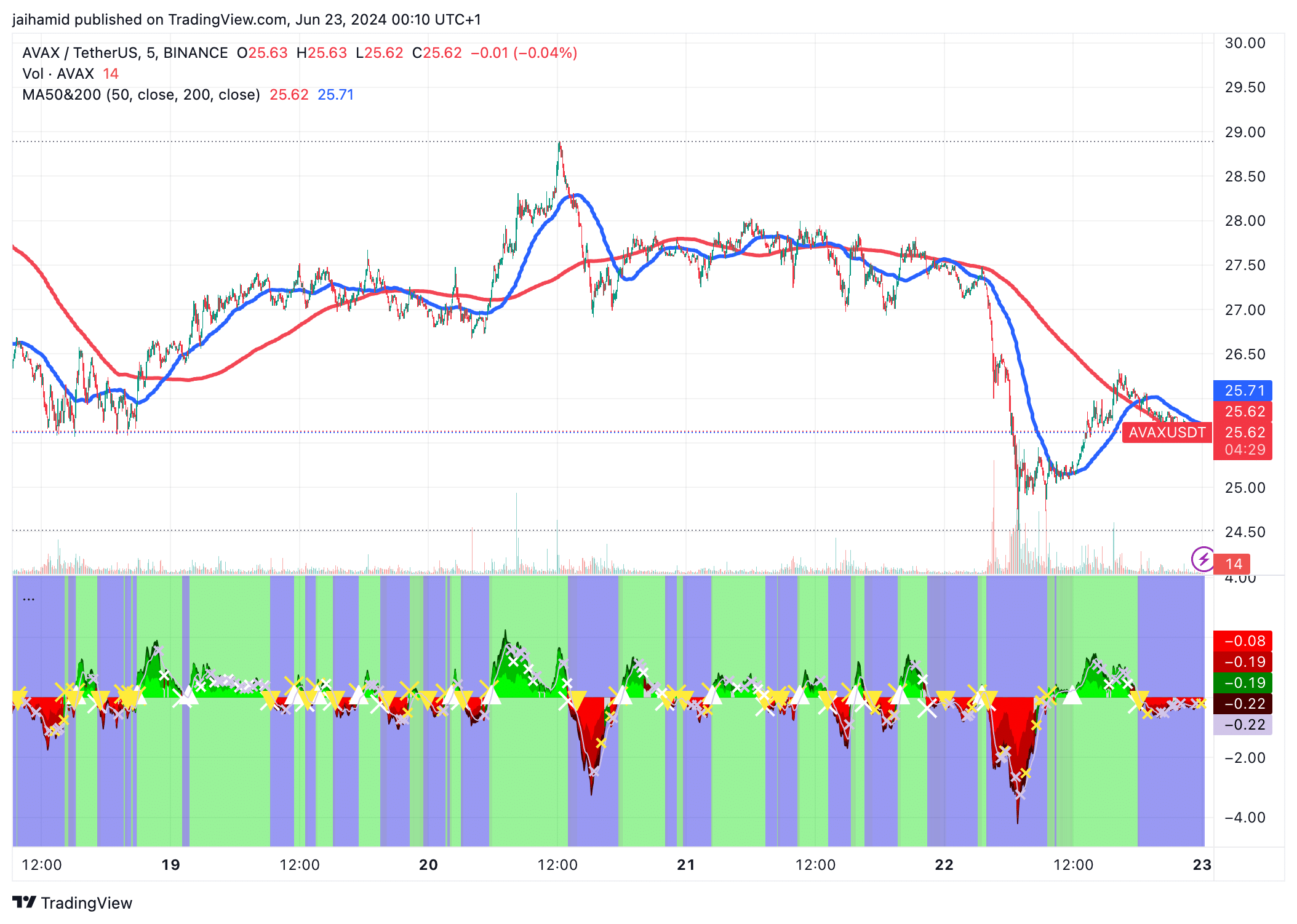

The moving average of Avax, calculated over the past 50 periods, has recently dropped below its longer-term moving average based on the previous 200 periods. This event is often interpreted as a bearish sign among traders, known as a “death cross.”

At the current moment, the price was fluctuating near the moving average of the last 200 periods, which was around $25.73, indicating a significant barrier for further increase.

During significant price declines, such as when the price dropped from around $28 to below $26, an noticeable surge in trading volume occurs, indicating intense selling activity.

All hope is not lost

There is still hope for a swift recovery for AVAX.

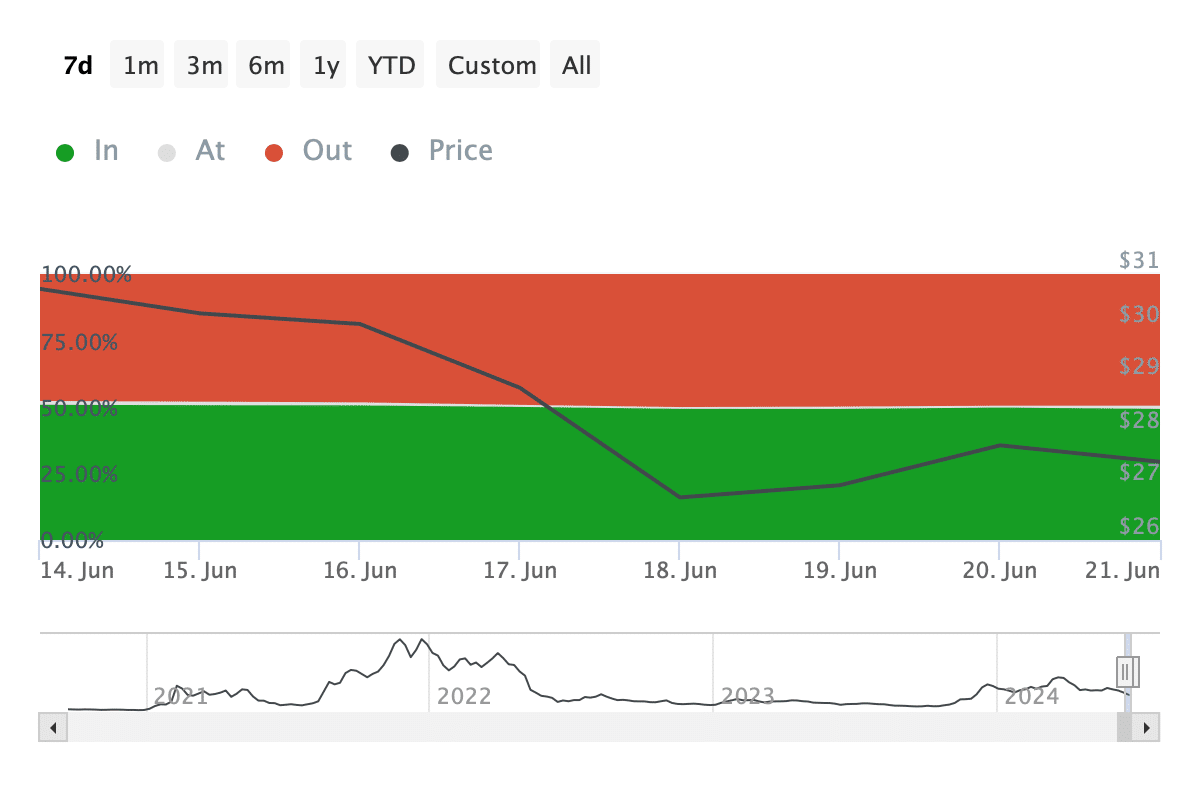

As an analyst, I’ve observed a significant drop in the value of investments labeled “In the Money.” This decline suggests that those holding these assets have likely disposed of their positions, potentially at a loss.

If the number of “Out of the Money” holders keeps decreasing or staying the same, while the number of “In the Money” holders grows, it’s likely that Avalanche (AVAX) will experience a prolonged phase of improvement.

However, external market factors or another wave of large-scale sell-offs may disrupt this.

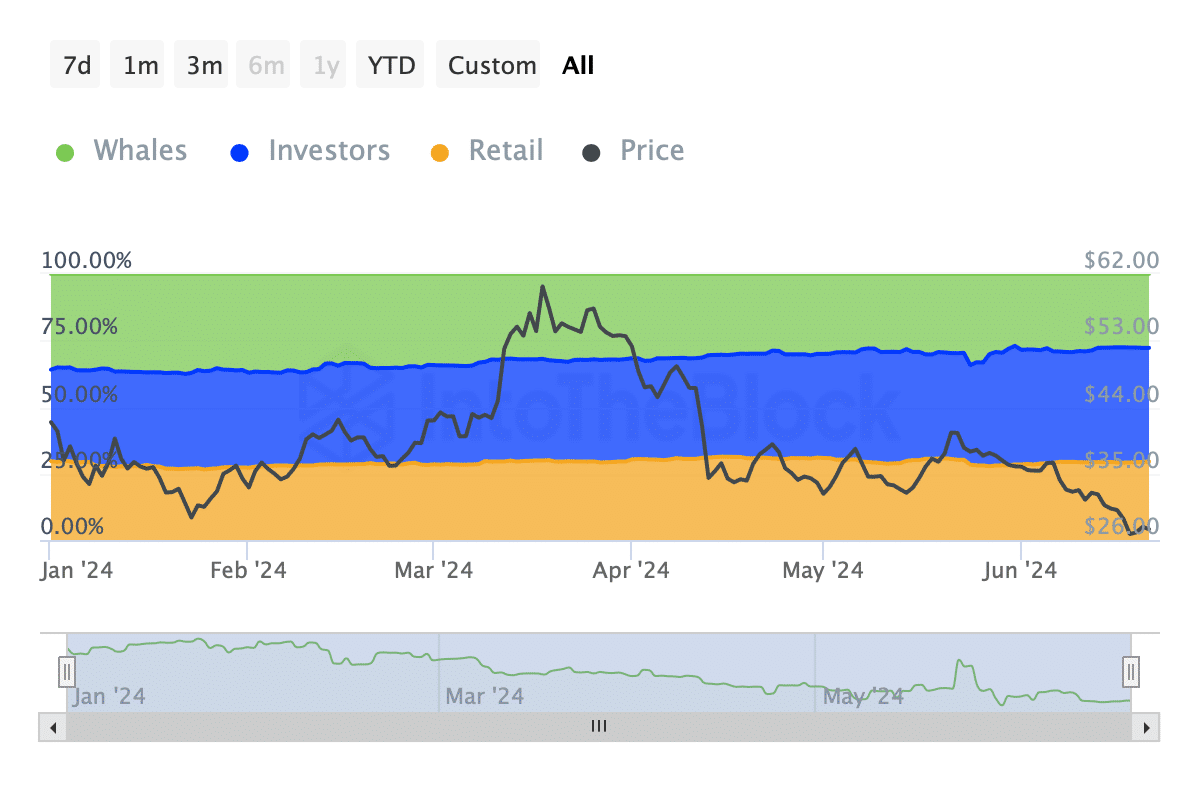

The data indicates a complex emotion landscape, where whale investments may bring about stabilization and heightened investor involvement could offset the detrimental effects of retail selling.

With a fairly consistent netflow ratio and a decreasing price trend, it appears that major investors have not been prompted to sell off their holdings in response, contrary to usual assumptions.

As a crypto investor closely monitoring the AVAX market, I’ve noticed an intriguing trend: the whales have been relatively quiet recently. They haven’t shown any signs of depositing massive amounts of AVAX into exchanges with the intention of selling, nor have they withdrawn significant quantities for safekeeping. This pattern is typically indicative of a stable market situation, where neither a potential price surge nor a sell-off seems imminent.

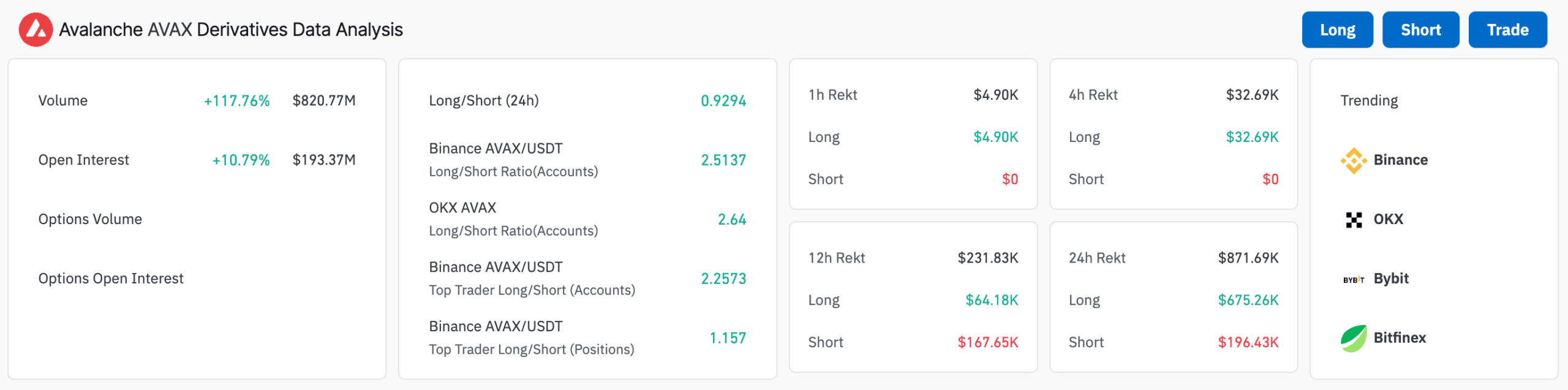

Avalanche’s derivatives market is currently buzzing with increased action, reflecting optimistic sentiment among traders.

Realistic or not, here’s AVAX market cap in BTC’s terms

Among both individual investors and professional traders on significant trading platforms, there’s a robust optimistic outlook. However, it’s important to note that recent market declines have primarily affected long positions, resulting in a loss of $675,260 during the last 24 hours. In contrast, short positions experienced a comparatively smaller loss of $196,430.

The market’s latest developments have surprised us by going against the prevailing bullish trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-23 14:15