- AVAX could soar by 23% to hit the $50.50-level if it holds the $40-level.

- Traders seemed to be over-leveraged at $39.24 on the lower side and $41.64 on the upper side

As I pen this down, I find myself intrigued by the positive vibes surrounding Avalanche’s native token AVAX. It seems to be gearing up for some substantial upward movement based on the charts, and its bullish price action pattern on the daily timeframe only reinforces this notion. I’m keeping a close eye on it!

Behind the robust performance of the broader cryptocurrency market, with prominent players such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) also demonstrating their own signs of strength.

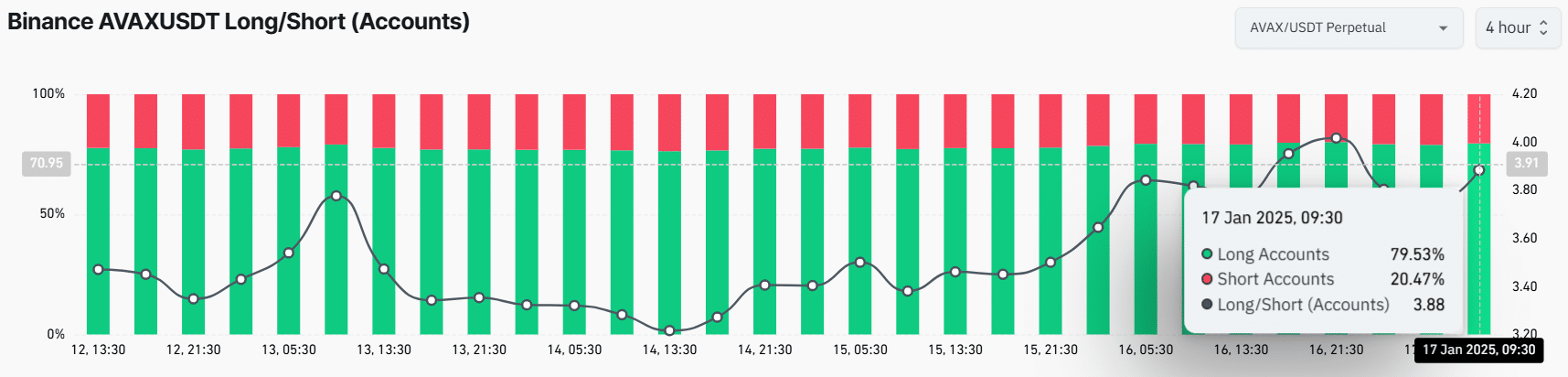

80% of top AVAX traders go long

From my perspective as an analyst, it’s clear that the positive market sentiment is palpable. Traders are actively increasing their long positions, a trend indicated by the data provided by CoinGlass, an on-chain analytics firm.

Currently, for every 3.88 long positions on Binance‘s AVAX/USDT pair, there is only one short position, suggesting a robust optimistic outlook among traders towards this altcoin, as indicated by the high long-to-short ratio of 3.88.

Approximately 79.53% of the prominent AVAX traders on Binance were found to have long positions, whereas around 20.47% of them had short positions.

$6.65 million of AVAX outflows from exchanges

Due to the optimistic perspective on AVAX, not only traders but also long-term investors have shown significant enthusiasm for it. As per data from CoinGlass’s spot inflow/outflow, exchanges experienced withdrawals of approximately $6.65 million within the past 24 hours.

In simple terms, when large amounts of tokens leave exchanges and go into individual wallets, it’s often a positive sign for token owners. This action typically indicates that long-term holders are accumulating more tokens, which can create buying pressure and potentially trigger a surge in the token’s price.

AVAX price action and key levels

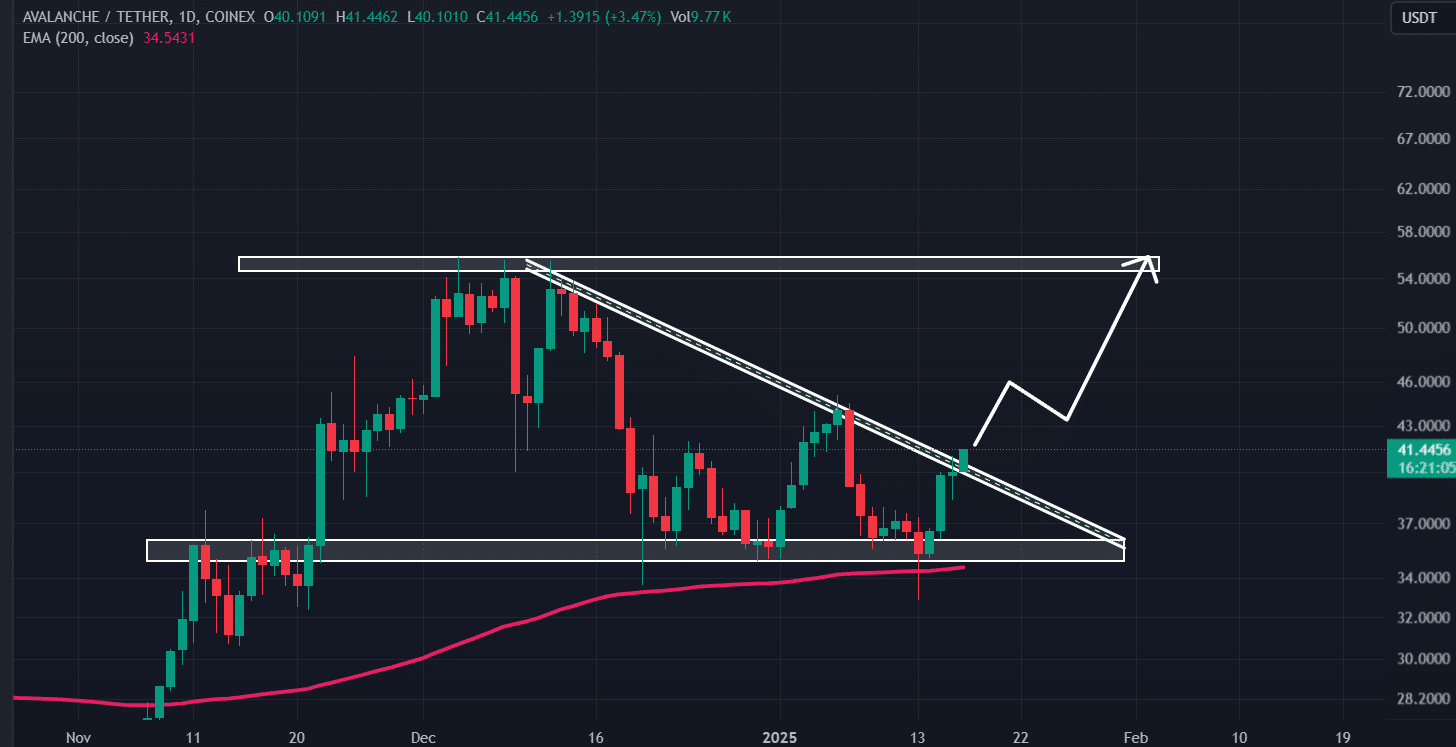

Based on the technical assessment by AMBCrypto, Avalanche (AVAX) exhibited a bullish trend following its breakout from a line it had been adhering to since late 2024.

Over these past few days, I’ve noticed that my altcoin has encountered resistance on three separate occasions, resulting in a drop in price after each instance. However, as the overall market mood shifted, AVAX surprisingly broke through this persistent trendline resistance. Now, it seems ready to embark on a significant upward momentum surge.

Given its current trend and past performance, there’s a high likelihood that Avalanche (AVAX) might surge by approximately 23%, potentially reaching around $50.50, if it maintains its position above the $40 mark in the near future.

Major liquidation levels

Reflecting on the market data provided by CoinGlass’s exchange liquidation map, it appears that traders were heavily leveraged at approximately $39.24 on the downside and $41.64 on the upside, indicating potential volatility in these price regions.

At these current positions, traders have established a total of $7.90 million in long trades and $5.70 million in short trades. Should the market price shift, these positions could be automatically closed out.

Read More

2025-01-17 20:07