AVAX crypto is back, baby! After weeks of steady selling, the market is now showing early signs of strength… or maybe it’s just the ghost of crypto past haunting the charts. 🕷️💸

AVAX Crypto: Reversal Potential? More Like a Reversal of Fortune! 🤯📉

Price action shows AVAX crypto stabilizing near a major weekly support zone, the same area that previously triggered multiple impulsive rallies. Structure suggests accumulation pressure is quietly returning… or maybe it’s just the market trying to trick us into thinking it’s bullish. 🤡💰

As noted by VexeCrypto, this “super discount zone” around $18 to $20 has historically acted as the ignition point for every strong leg higher. A clean defense here, followed by a reclaim above $24, could confirm a short-term reversal setup and mark the beginning of another expansion phase. Or it could be a trap. Who knows? 🕵️♂️💣

AVAX’s Market Comeback? More Like a Comeback Kid with a Grudge! 🎤🥊

The conversation surrounding Avalanche is beginning to heat up again. Social momentum is rising, and sentiment is turning constructive as the AVAX community anticipates its return among the top 10 market-cap assets. Or maybe they’re just desperate for a miracle. 🙏💸

ExcelBaller captured this renewed optimism, pointing to how institutional liquidity may start rotating back into high-efficiency Layer-1 networks like Avalanche as broader market appetite recovers. The network’s scaling fundamentals, coupled with aggressive development activity, suggest the foundation for that comeback is already in motion… or it’s just a well-funded PR campaign. 📈💸

AVAX Price Prediction: Monthly Structure Hints at Breakout Setup? Maybe! 🧐

Monthly technicals reveal a maturing symmetrical triangle, where AVAX crypto has compressed between declining trendline resistance and horizontal support. This setup, visible on Pure8’s chart, typically precedes major breakouts once the upper structure gives way. Or it could just be a fancy way of saying “wait and see.” 🤷♂️📉

A decisive move above $40 to $45 could open the path towards $70 to $90, matching the measured move target of the formation. Support remains well-defined around $18, keeping downside risk controlled as the broader consolidation nears resolution. Or maybe it’s just a temporary reprieve before the next crash. 🚨💸

Momentum Indicators: Strong? Or Just a Desperate Prayer? 🙏📉

Price resilience is being reinforced by on-chain and indicator-based metrics. Recent data from Honeybear’s technical breakdown shows RSI flattening near its lower band and MACD losing negative momentum, reflecting cooling sell-side pressure. Or it’s just the market taking a nap. 🛌💤

The same $19 to $20 area that acted as support in August 2024 has once again held firm, creating a possible cyclical bottom. Historically, this combination of oversold RSI and waning bearish MACD has marked the early stages of reversal across previous AVAX cycles. Or it’s just a coincidence. 🤷♂️🤷♀️

On-Chain Burn Activity: Supply Contraction or a Joke? 🧨💸

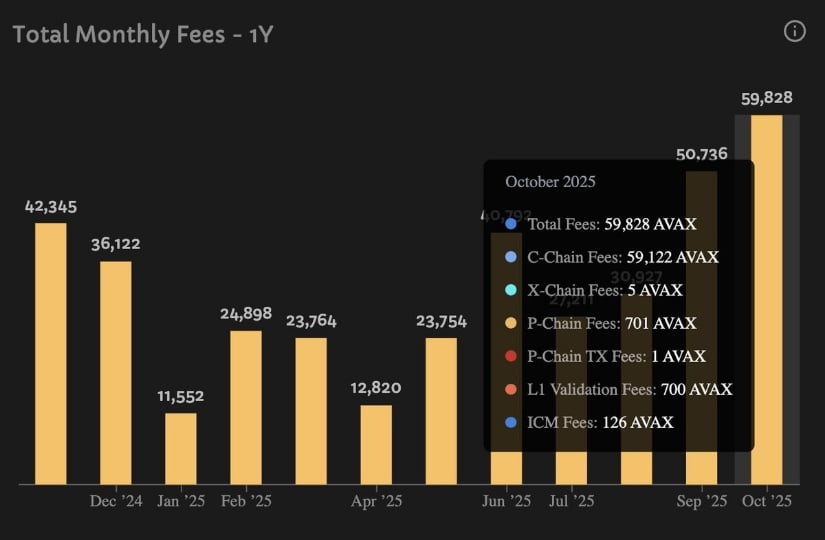

Tokenomics are also aligning with the technical picture. Analyst joeycannoli9 highlighted that October marked Avalanche’s highest monthly burn in over a year, with 59,000 AVAX (over $1.1M) permanently removed from circulation. This supply contraction mechanism strengthens long-term value dynamics as network usage continues to expand. Or it’s just a fancy way of saying “we’re burning money.” 💸🔥

Burn acceleration has consistently preceded price recoveries, underscoring how transactional growth directly feeds back into token scarcity. As ecosystem adoption pushes fees higher, the deflationary impact could strengthen any forthcoming technical breakout, providing tailwinds for sustainable upside momentum. Or it’s just a bubble waiting to pop. 🧨💥

Final Thoughts: AVAX Technical Analysis? More Like a Technical Nightmare! 🤯💸

AVAX is beginning to show signs of strength after holding the $19 support level, which continues to act as a solid base for buyers. Price reactions in this zone have repeatedly marked local bottoms, signaling that demand is quietly stepping back in as selling pressure fades. Or it’s just a mirage. 🌅🌀

The immediate resistance lies at $20.80, a level that has capped several recent recovery attempts. A clean breakout above this threshold could open the door for a rally towards $23.50, where the main hurdle awaits. This region remains a key battleground; short-term bulls have struggled to maintain momentum beyond it, making the next retest a decisive moment for confirming trend continuation. Or it’s just a cliffhanger. 🎬💣

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Werewolf Movies (October 2025)

- Goat 2 Release Date Estimate, News & Updates

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- KAMITSUBAKI ACADEMY NEWSPAPER CLUB adds Switch version, launches October 30

2025-10-24 12:39