- AVAX seemed to be consolidating around $38, despite mixed market signals

Bullish sentiment on Binance and resistances at $50 and $55 could drive the price to $100

As a researcher with experience in analyzing cryptocurrency markets, I believe AVAX‘s current consolidation around $38 is a sign of market uncertainty and reduced trading activity. However, there are bullish indicators that could drive the price to potentially reach $100 in the third quarter of this year.

As a crypto investor, I’ve noticed that Avalanche (AVAX) has been generating a lot of buzz in the market lately due to recent developments. Throughout its history, this cryptocurrency has proven its mettle by holding strong even during the most challenging bear markets.

At the moment of publication, AVAX was priced at $38.49, representing a 2.5% increase within the past 24 hours. Although this growth isn’t substantial compared to other cryptocurrencies, AVAX exhibited better performance than several altcoins in the market. This improvement raises speculation about AVAX’s potential price trend for the remainder of the year.

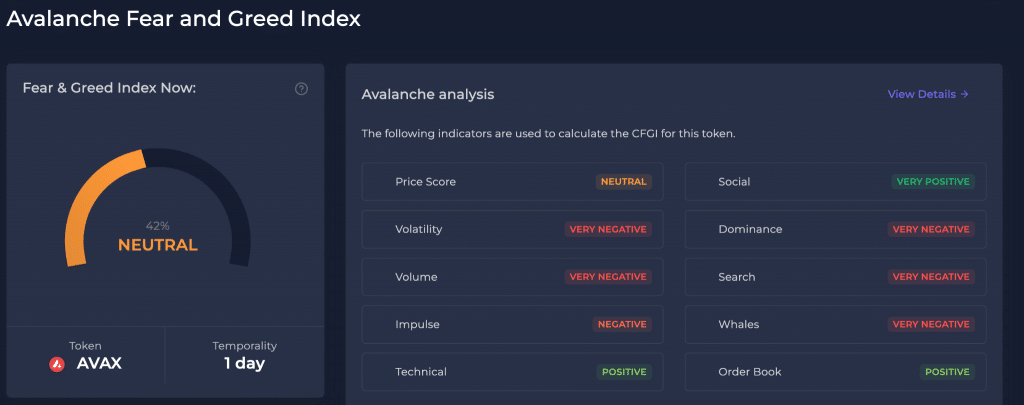

Initially, the Avax market exhibits a neutral attitude based on the Fear and Greed Index, which rates it at 42%. This indicates that investors hold relatively equal parts of fear and greed towards the asset.

At the moment when this report was compiled, public opinion towards the social media buzz was quite favorable. However, other significant factors such as volatility levels, trading volume, and whale activity were displaying unfavorable signs, indicating market instability and decreased engagement from major traders. Furthermore, the influence and curiosity surrounding AVAX have been relatively low, suggesting a weak hold on the market and reduced overall enthusiasm.

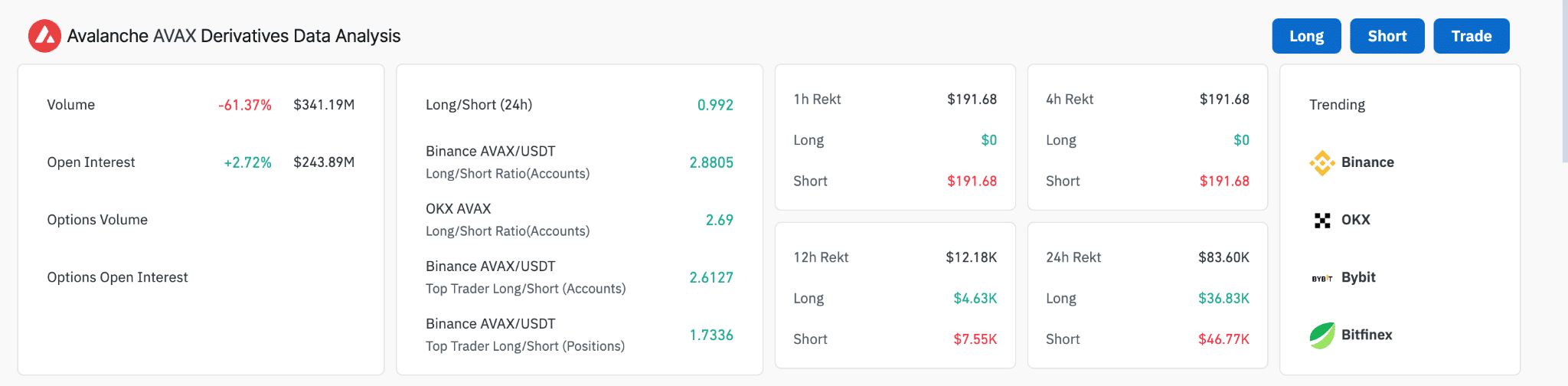

The data from Coinglass revealed a significant decrease in trading volume by approximately 61%, amounting to $341.19 million at present. On the trading platform front, the long/short ratio appeared evenly distributed, signaling that traders are currently indecisive about AVAX.

As an analyst, I found it intriguing that the long/short ratio on Binance stood at a notable figure of 2.8805. This signifies a higher number of long positions compared to short positions, possibly reflecting a more bullish stance among individual traders using this particular exchange.

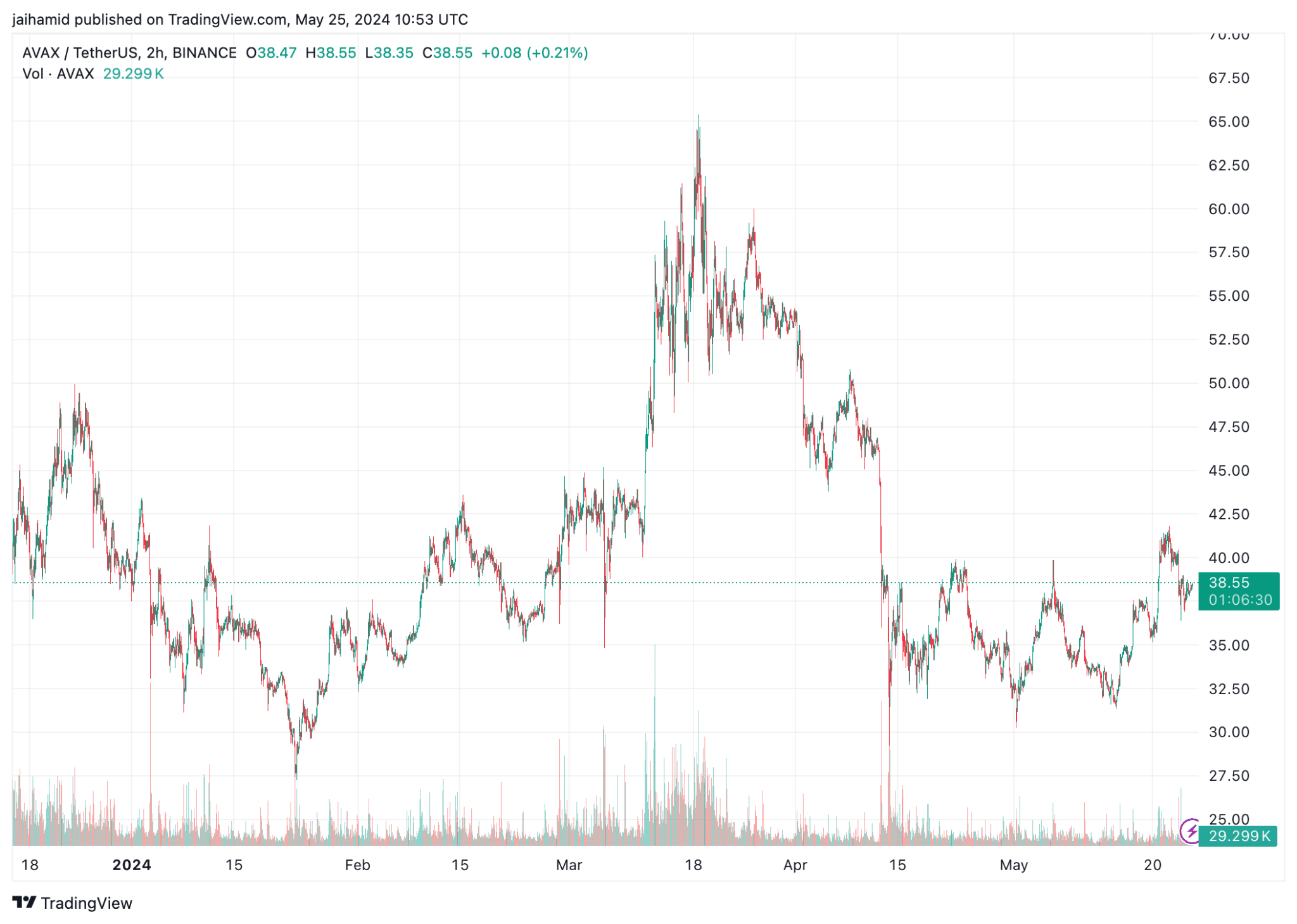

“The six-month Avalanche price chart demonstrates significant volatility, marked by numerous ups and downs. In other words, it’s a market that reacts to both overarching market movements and distinct developments within its ecosystem.”

In the previous period, AVAX experienced numerous price surges that were subsequently followed by significant declines as depicted on the graph. Currently, the cryptocurrency appears to be stabilizing near the $38 mark following a recent drop from more elevated prices reached in April.

Should AVAX hold its ground near the $35 mark, it may indicate an upward trend, particularly during market upturns. Important resistance points to keep an eye on are around $50 and $55 – levels that AVAX has previously encountered frequently in recent months.

Maintaining a prolonged rise above these figures might indicate robust bullish energy, potentially pushing the price up to the $80 region or even reaching $100 by the end of the third quarter.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-05-26 01:11