AVAX‘s price has once again taken the spotlight, after spending August in a rather unexciting sideways waltz. One might think it was trying to sneak past the 200-day EMA like a mischievous kitten avoiding a laser pointer. 🐱

AVAX Price Analysis: Bullish Structure Regains Strength

AVAX’s price is now showing renewed vigor after a long August of consolidation, as if it’s finally shaken off the drowsy haze of summer. The 200-day EMA reclaim is a feat that even a seasoned poker player might admire for its strategic brilliance. 🃏 Trading Aloha notes this recovery is like a well-timed joke-unexpected but oddly satisfying.

What stands out is how this reclaim of the 200-day EMA aligns with the broader bullish shifts seen in recent weeks. Momentum indicators are beginning to tilt upward, hinting at improving conditions if AVAX can maintain its footing above the reclaimed EMAs. It’s like a slow-burning firecracker-quiet, but waiting to explode. 🔥

AVAX Leads Weekly Inflows Across Chains

Building on the renewed technical strength highlighted earlier, Avalanche is now showing dominance on the capital flows front as well. Nicolas Lemaitre points out that AVAX led all chains in weekly net inflows with over $111 million entering the ecosystem. This stands in sharp contrast to outflows seen on majors like Ethereum and Solana, signaling a rotation of liquidity toward Avalanche. One might say the market is finally giving AVAX a standing ovation. 🎤

Sustained inflows of this scale often reflect growing confidence among participants, particularly when paired with a stable chart structure. It’s like a crowd cheering for a underdog-except the underdog is a cryptocurrency. 🏆

What makes this more notable is how these inflows arrive just as AVAX has reclaimed its 200-day EMA and built a higher-low base on the chart. The convergence of strong technical recovery with fresh liquidity suggests that buyers are positioning with strength. It’s the financial equivalent of a well-armed squirrel hoarding acorns. 🐿️

AVAX Holds Key Support Levels with $30 in Sight

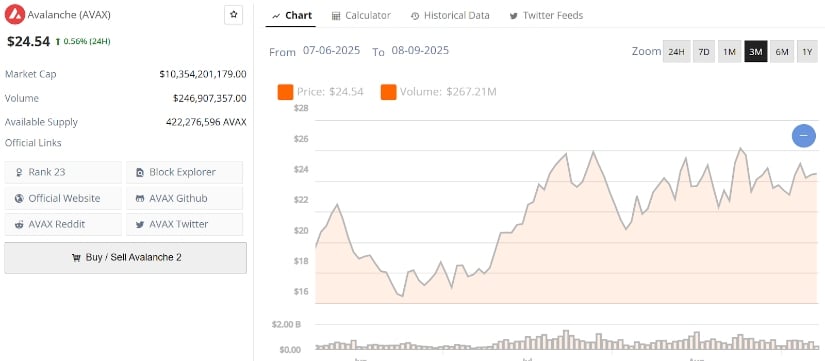

Avalanche is currently trading at $24.54, holding steady above its short-term support band that has been tested multiple times over the past month. The higher-low formation visible on the chart reinforces the idea that buyers are stepping in on each dip, keeping the structure constructive. It’s like a determined toddler refusing to let go of a toy-unyielding and slightly exasperating. 🍼

Technically, the next challenge sits at the $27 resistance zone, where previous attempts have stalled. A clean move through this level would clear the way towards the psychological $30 mark, aligning with the broader bullish narrative built in recent sessions. One can only hope the market isn’t as fickle as a toddler with a sugar rush. 🍬

AVAX Narrative Strengthens

The bullish backdrop for Avalanche is now being echoed beyond charts and inflows, with sentiment shifting toward a broader narrative of ecosystem expansion. Analyst Skrrt suggests that a “massive repricing” could be imminent, pointing to the steady growth in Avalanche’s ecosystem as a factor the market can’t continue to overlook. It’s like a magician pulling a rabbit out of a hat-except the rabbit is $50. 🎩🐇

With price holding firm above short-term supports around $24 and eyeing the $27 to $30 resistance band, the broader story of ecosystem adoption could act as the catalyst to carry AVAX into its next phase. If capital rotation continues and sentiment builds, the repricing angle highlighted by Skrrt may lead to a bullish AVAX Price Prediction. It’s the financial version of a slow-burn thriller-tense, suspenseful, and slightly terrifying. 🎬

Final Thoughts: Can AVAX Challenge the $50 Zone Again?

Avalanche’s steady climb back above its 200-day EMA, coupled with strong weekly inflows, paints a constructive backdrop heading into the next phase. Short-term traders will be watching closely to see if AVAX can hold its $23 to $24 support zone while making another attempt at the $27 resistance. A breakout through that level could quickly bring the $30 target into play, which would further validate the current bullish setup. It’s like a chess game where the pieces are slowly moving into position-except the stakes are higher than a game of checkers. 🏰

Looking ahead, the real question for investors is whether Avalanche has the momentum and capital rotation to retest its former $50 highs later this cycle. If ecosystem growth continues and inflows remain consistent, the probability of such a move rises sharply. For now, market watchers may find value in the mid-$20 zone, while long-term holders are likely eyeing the bigger picture. It’s like waiting for a sunrise-exciting, but you have to be patient. ☀️

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- Embracer Group is Divesting Ownership of Arc Games, Cryptic Studios to Project Golden Arc

- Bitcoin or Bust? 🚀

- IT: Welcome to Derry Review – Pennywise’s Return Is Big on Lore, But Light on Scares

- XRP’s Cosmic Dance: $2.46 and Counting 🌌📉

2025-09-07 19:27