- AVAX, in a fit of bullish enthusiasm, has drawn a symmetrical triangle, with $43.50 and $60 playing the role of the bouncers at a posh nightclub.

- Market indicators, like over-caffeinated traders, are showing strong momentum, with Open Interest and trader activity rising faster than a soufflé in a heatwave.

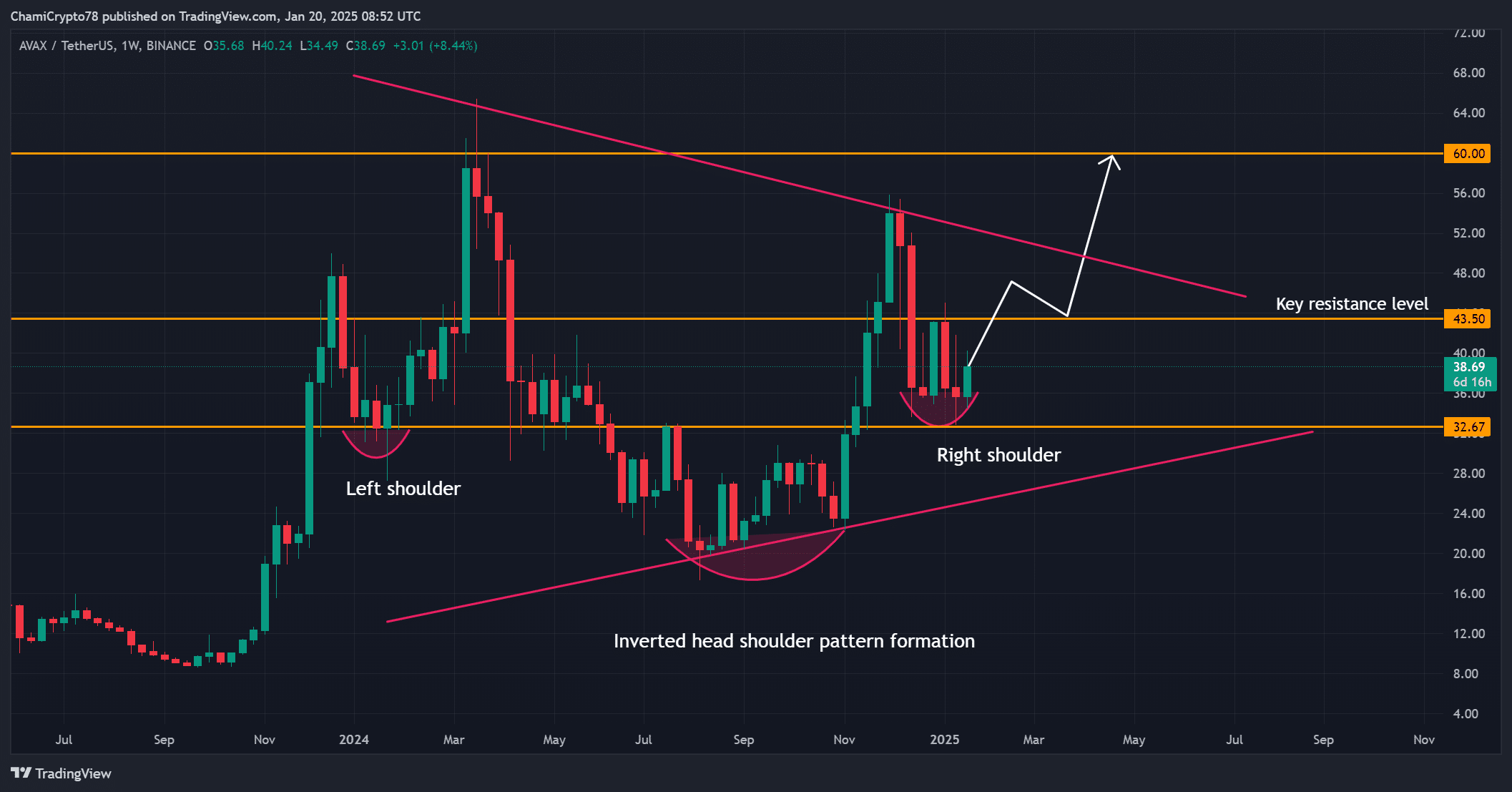

Avalanche [AVAX], that sprightly little crypto, is currently doing the cha-cha within a symmetrical triangle, a pattern so bullish it could make a matador blush. Trading at $38.98 (up a cheeky 2.98% at press time), AVAX is flirting with the idea of a rally like a debutante at her first ball. 🕺

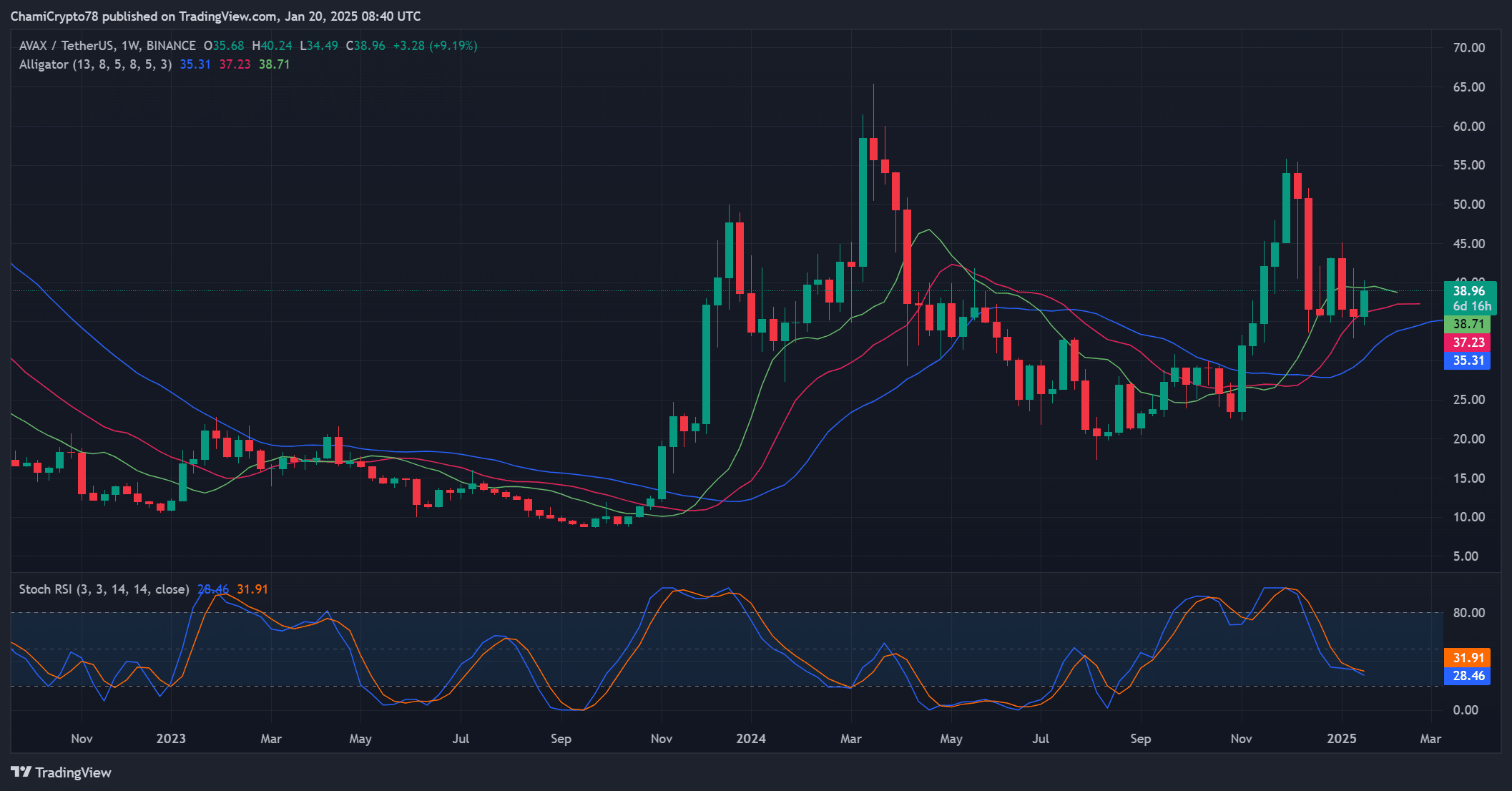

With the 50-week moving average playing the role of a sturdy butler, and bullish sentiment wafting through the air like the scent of freshly baked scones, traders are perched on the edge of their seats, wondering: will AVAX break through the resistance and waltz its way to glory?

Is AVAX About to Pull a Houdini?

AVAX’s price action is currently performing an inverted head-and-shoulders routine, with the head at $32.67 and shoulders on either side, like a crypto contortionist. This formation, as any self-respecting trader will tell you, is the equivalent of a flashing neon sign saying, “Bullish Potential Ahead!”

Resistance at $43.50 is the next hurdle, followed by the grand prize of $60, a target so tantalizing it could make a bull weak at the knees. The symmetrical triangle, meanwhile, is cheering from the sidelines like an overenthusiastic aunt at a cricket match.

However, should AVAX fail to hold above $43.50, the momentum could fizzle out faster than a soda left in the sun, making these levels as crucial as a butler’s discretion.

What Do the Tea Leaves Say?

Technical indicators, those mystical oracles of the trading world, are whispering sweet nothings about AVAX’s future. The Stochastic RSI, currently at 31.91, is hinting at oversold conditions, suggesting a rebound could be as inevitable as a British summer rain. 🌧️

Meanwhile, the Williams Alligator lines (35.31, 37.23, 38.71) are narrowing like a pair of trousers after Christmas dinner, signaling consolidation. As these lines begin to diverge, a breakout could gather steam faster than a steam engine in a hurry.

These indicators, like a chorus of well-trained butlers, are underscoring the importance of upcoming price movements, with resistance and support levels playing the lead roles in this financial drama.

Market Interest: The Plot Thickens

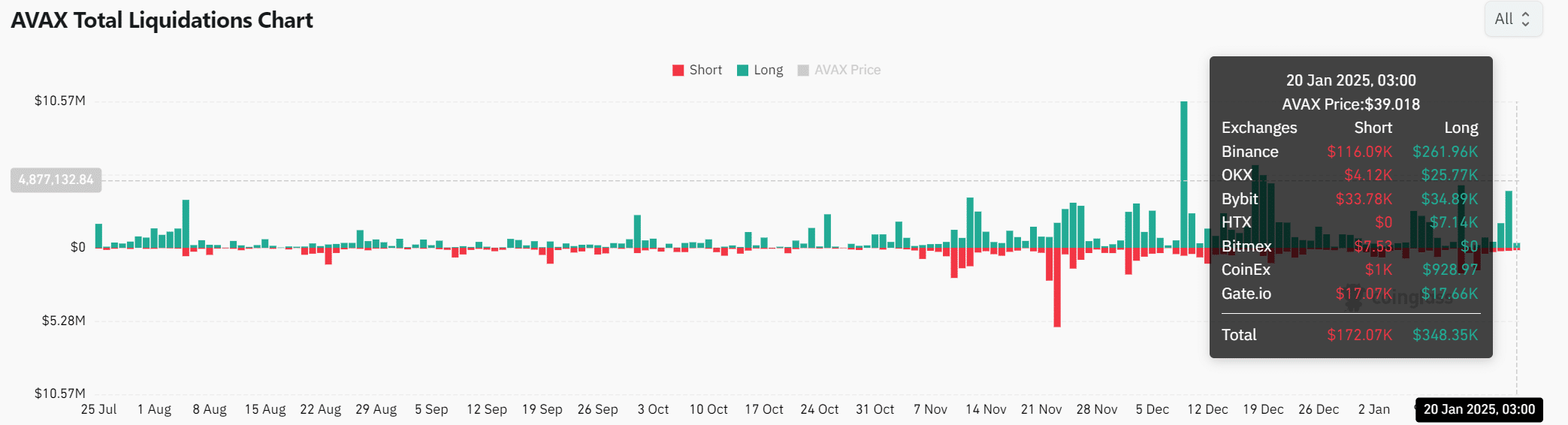

Market data, that ever-reliable gossip, is highlighting the growing interest in AVAX. Open Interest has risen by 1.61% to $706.52 million, reflecting increased trader activity. Total liquidations, meanwhile, stand at $348.35K in long positions and $172.07K in shorts, suggesting volatility is as high as a cat on a hot tin roof. 🐱

This increased trading volume, coupled with rising open interest, suggests traders are positioning themselves for significant price action, like actors preparing for the final act of a Shakespearean tragedy. However, sustained momentum will depend on whether buyers can maintain control at key levels, much like a butler maintaining order in a chaotic household.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

Conclusion: AVAX, the Crypto That Could

AVAX appears to be on the cusp of a breakout, consolidating within a symmetrical triangle like a coiled spring ready to pounce. Supported by bullish price action and technical indicators that are as reliable as a butler’s morning tea service, AVAX could be gearing up for its next major rally. 🚀

If the price can break and hold above $43.50, the path to $60 becomes as clear as a summer’s day. With rising market interest and technical alignment, AVAX might just be the crypto to watch, like a starlet on the red carpet.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2025-01-21 06:16