- Activity in the spot market did not align with the bearish expectations in the derivatives market.

- Open Interest increased and might back a continuation of the the price increase.

As an experienced analyst, I’ve closely observed the recent trend in Avalanche (AVAX) and have noticed some intriguing discrepancies between the spot market and derivatives market. While the spot market has shown resilience in holding onto the upswing after a price crash, traders in the derivatives market held bearish expectations.

Despite the recent price surge of altcoins such as Avalanche (AVAX), which have managed to maintain their upward trend following a previous price drop, some traders in the cryptocurrency market have opted to take opposing positions. According to AMBCrypto’s analysis.

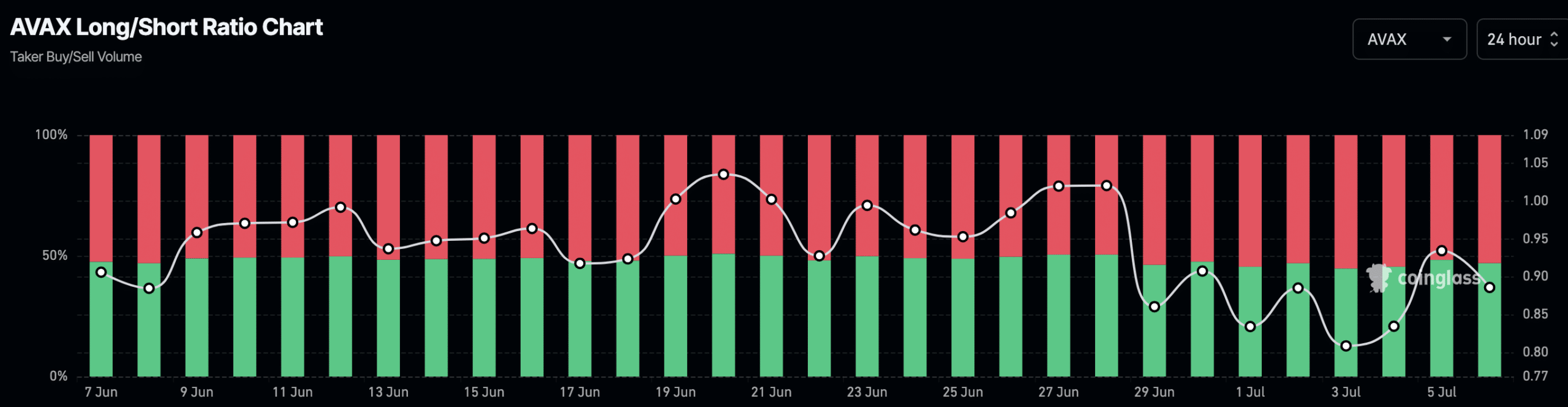

As a researcher examining the cryptocurrency market at this moment, I’ve discovered that AVAX‘s Long/Short Ratio stands at 0.88. This ratio functions as an essential indicator, reflecting the current sentiment among investors.

To arrive at the result, one has to divide the number of long positions by the number of shorts.

No trust in the uptrend

In the financial markets, long positions are held by traders who anticipate a rise in asset prices with the intention of realizing a profit. Conversely, short positions are taken by traders who believe that asset prices will decline, and they aim to make a profit by selling assets borrowed from others before buying them back at a lower price.

With a Long/Short Ratio exceeding 1, market participants on average anticipate prices to rise.

If the ratio falls short of the benchmark, this implies a predicted price decline based on wider expectations, as was the case with the token.

From my research perspective, at the current moment, I observe that the AVAX token is being traded at a price of $27.44. This represents a noteworthy growth of 9.09% within the past 24 hours. Previously, its value had dipped down to $22.25. The available data implies that traders might anticipate the AVAX value to revert back towards this lower price range.

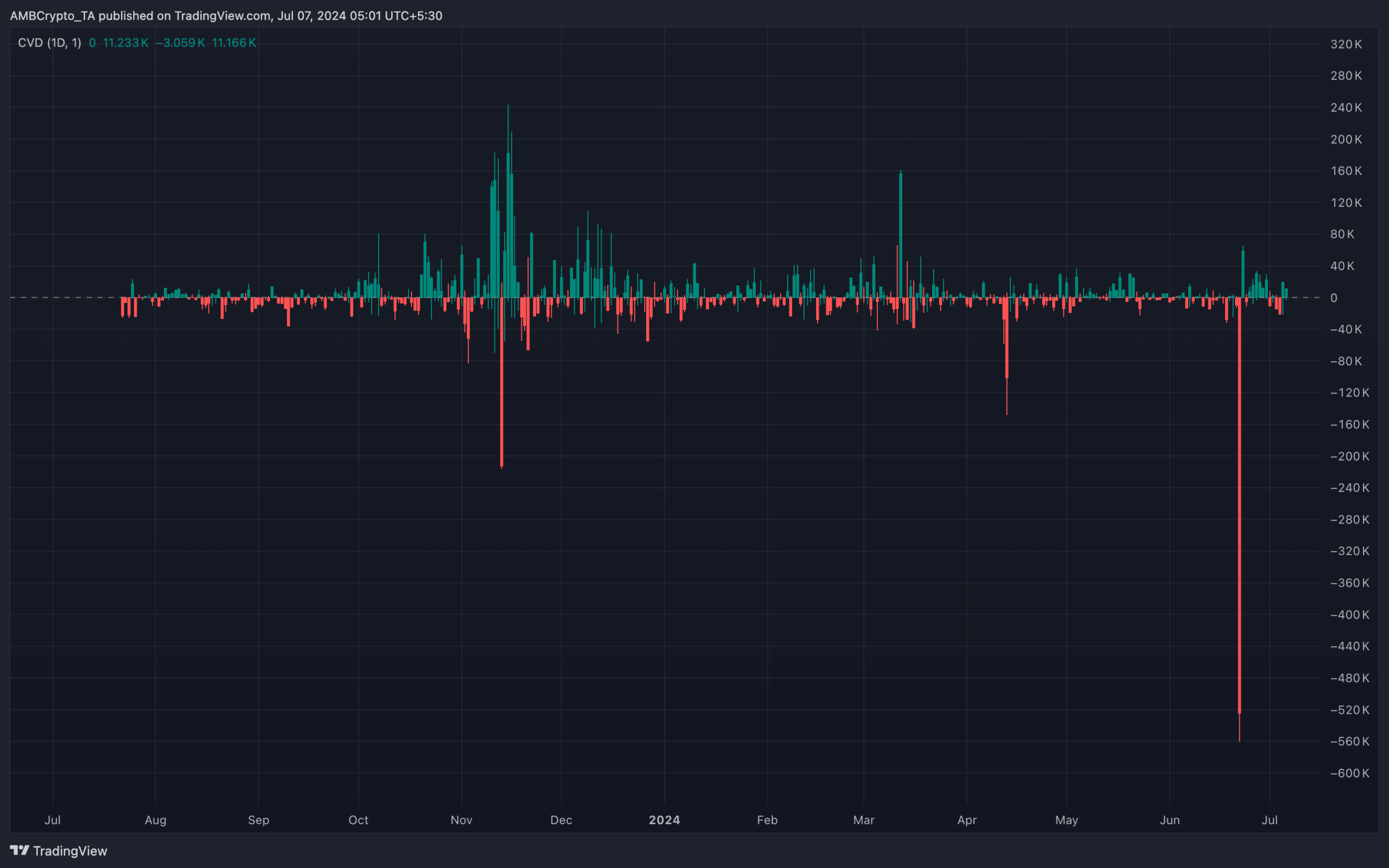

Based on the information from the Cumulative Volume Delta (CVD), an indicator that shows the net volume of a cryptocurrency based on buy and sell orders, this event may not transpire.

AVAX wants $30 back

As a market analyst, I would interpret a positive CVD (Cumulative Volume Delta) as indicative of stronger buying activity than selling in the spot market. Conversely, a negative CVD implies significant sell-side pressure, with more volume being traded on the sell side compared to the buy side.

Based on AMBCrypto’s assessment, the daily Comoving Average Divergence (CVD) for AVAX indicated a buy signal, hinting at growing demand for this cryptocurrency.

Should the current situation persist, there’s a strong possibility that Avalanche’s price may surge towards $30. Those who have betted on a price decline by shorting AVAX might find themselves missing out on potential gains.

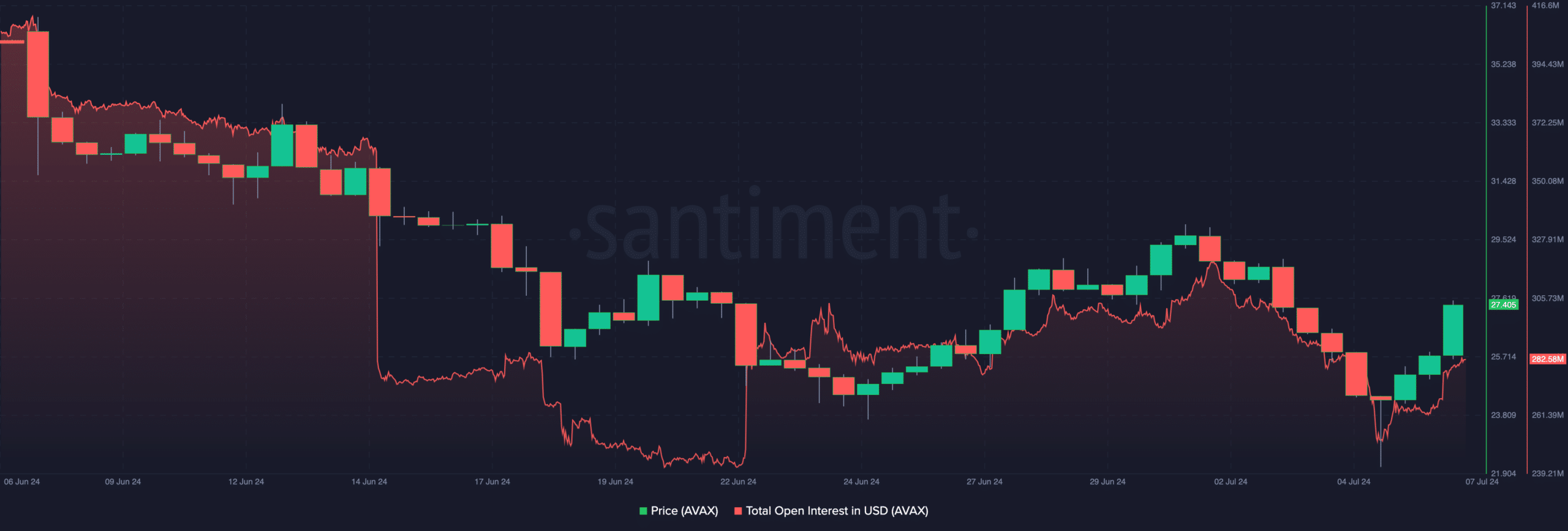

Along with the given signal, AMBCrypto examined the Open Interest (OI) as an additional metric. This assessment aims to determine whether the price trend of AVAX could potentially contradict the positions held by traders in the derivatives market.

As of the current moment, the Open Interest value has risen by $267.12 million, nearing the $300 million threshold in the market. Open Interest signifies the total number of outstanding contracts in the market at any given time.

When it goes up, this signifies an influx of funds into the market and a rise in investors’ overall holdings. Conversely, a decrease indicates that money is being withdrawn from the market and investors are reducing their positions.

The upward trend in AVAX‘s price could be a sign of further price growth, but this can only be confirmed if the price rise endures.

Is your portfolio green? Check the Avalanche Profit Calculator

As a crypto investor observing the market trends, I see an increasing flow of funds into the derivatives sector and strong demand for spot purchases. This could potentially lead to further price surges in the cryptocurrency.

If this is the case, the token might hit $30 in a few days. meaning bears would not get any reward.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-07 13:12