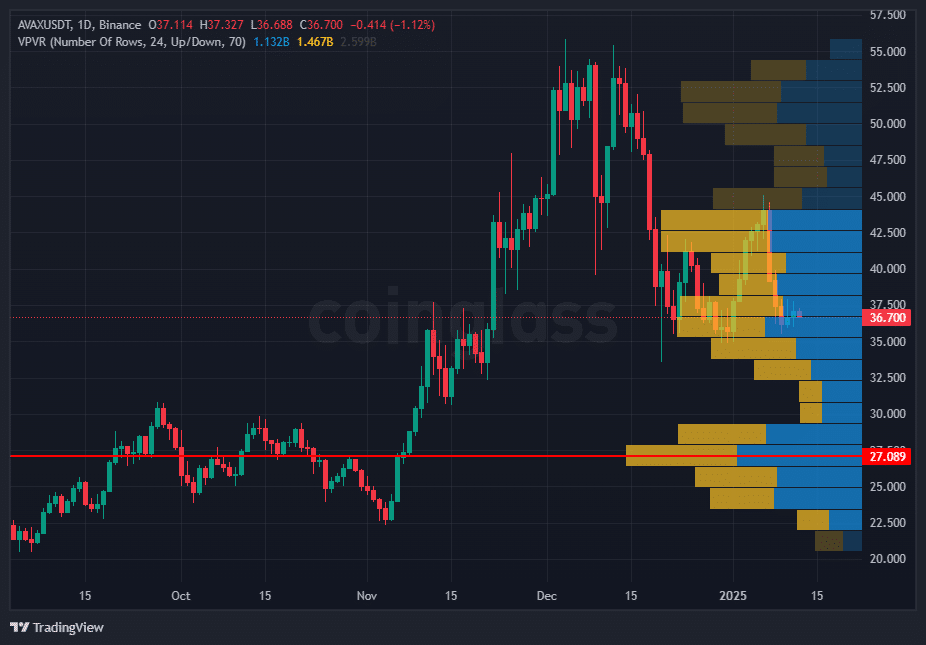

- Trading at approx. $36.72, AVAX/USDT showed signs of a prevailing bearish trend

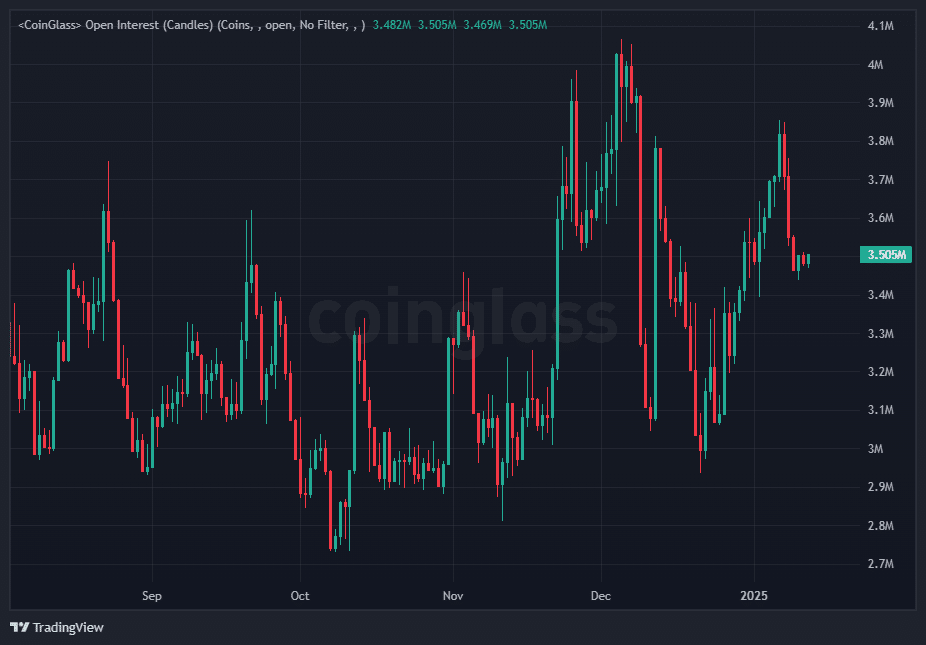

- Decline in OI seemed to be in line with AVAX’s inability to sustain its upward momentum above $55 in November

At the moment, the fast-transaction blockchain platform known as Avalanche (AVAX) is experiencing a significant price adjustment, according to the charts. As we speak, one AVAX is worth approximately $36.72, suggesting a possible downtrend in the market.

Indeed, the overall drop in the market along with certain technical indicators made for a difficult forecast regarding the altcoin’s performance.

VPVR indicates strong resistance

The examination uncovered a substantial grouping of trading actions occurring around the $40 and $42 price ranges, which stood out prominently within the Volume Profile Visible Range (VPVR), in simpler terms.

In this area, there was robust pushback as many traders had historically placed buy or sell orders. However, despite efforts to surge past this level during the December rally, AVAX consistently encountered resistance, lending credence to a pessimistic outlook.

On the negative side, the VPVR pinpointed an important resistance area approximately at $27. This area coincided with a past accumulation zone, characterized by high historical activity, suggesting potential buying interest. If this resistance is broken, it might trigger more downward movement, potentially aiming for the $25 range.

Due to AVAX’s inability to maintain its surge around $55, it has exhibited a pattern of successively decreasing highs and lows. This common bearish structure indicates that the price might continue to drop unless an event or factor drives the token beyond its resistance level.

Gauging market participation

Lately, there’s been a decrease in Open Interest (OI) coinciding with a fall in prices, which suggests less speculative activity. It seems as though traders could be liquidating their positions, potentially because they’re losing faith in the immediate rebound of AVAX.

The decrease in OI mirrored AVAX’s failure to maintain its price surge over $55 during the month of November.

When an asset’s value drops during a market adjustment, it frequently signals that investors are closing their long positions, showing apprehension and a negative outlook. Furthermore, this situation might suggest that traders are hesitant to resume trading until they observe more definitive signals indicating the direction of the market trend.

For AVAX to flip this perspective, it requires a continuous increase in both its price and open interest (OI). An uptick in OI combined with breaking through the $40-$42 resistance area would indicate growing trust among traders.

If the On-Balance Volume (OI) persistently decreases as the price approaches its support levels, this might signal a stronger influence of bearish energy. The $27 area could then emerge as a significant area of interest for traders.

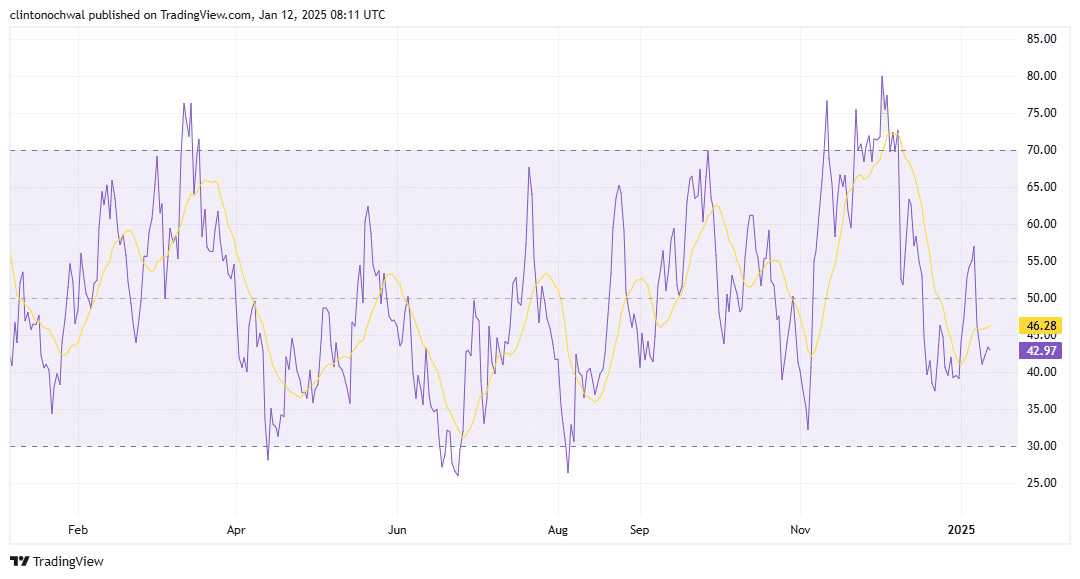

Oversold or room for further declines?

On a day-to-day scale, the Relative Strength Index (RSI) for AVAX has been moving below the nonpartisan 50-mark, indicating persistent bearish energy. As we speak, the RSI is hovering close to 35, gradually approaching the oversold limit of 30.

This text emphasizes that the reading shows a decrease in demand for purchasing, coinciding with the token’s decreasing peak values and troughs (higher lows and lower highs). Although an excessively sold condition in the RSI might occasionally lead to a brief rebound, the absence of significant bullish factors suggests minimal growth potential in the near future.

If the Relative Strength Index (RSI) drops below 30, it might signal an oversold situation, which can entice value seekers and possibly initiate a brief rebound. But if it fails to recover and remain above 45, this could intensify the downward trend, suggesting further decreases may follow.

To fully reclaim dominance, the Relative Strength Index (RSI) should rise significantly beyond 50, ideally together with a surge past critical resistance levels such as the $42 mark.

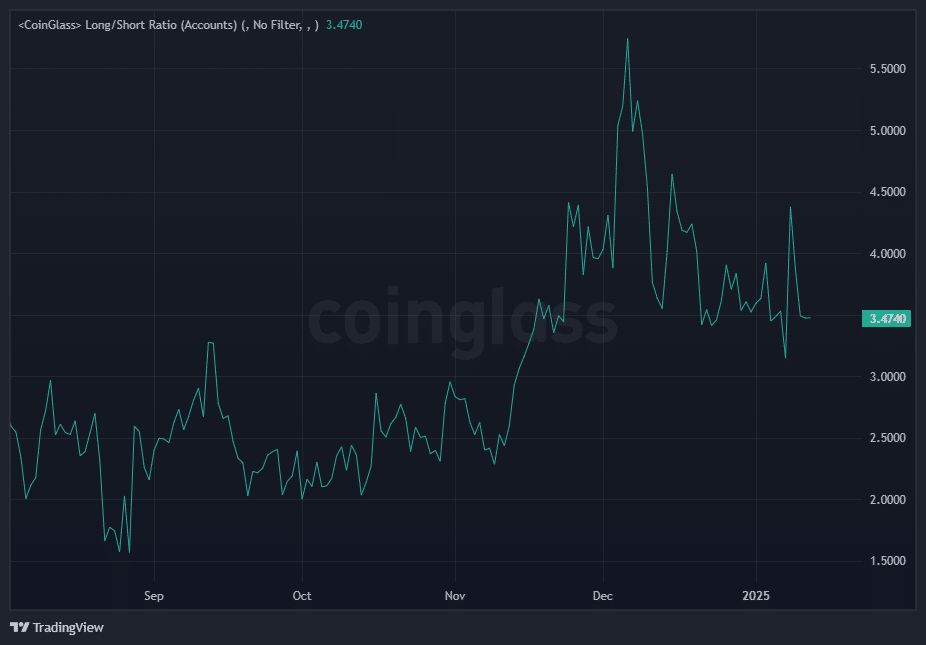

Sentiment and market bias

Lastly, the latest figures show an increasing trend of short positions over long ones in the AVAX/USDT market – A hint that traders are becoming more pessimistic about the market.

Currently, the chosen hike aligns with the overall descending pattern and also reflects a rejection at the price range of $40 to $42, which functions as a resistance zone.

An increasing short position among traders indicates they’re preparing for a possible price drop, as they expect a potential fall below the $27 support level.

Conversely, when there’s a significant imbalance between long and short positions, it could serve as a sign against the prevailing trend. In situations where shorts significantly outnumber longs, short squeezes might take place. This is when the price rapidly increases to cover excessive short positions, resulting in temporary price surges.

To foster a bullish trend, it’s essential for the Long/Short Ratio to either stabilize or lean towards more long positions, suggesting increased optimism among traders. As long as there’s an increasing number of short positions, the pessimistic market sentiment will continue, putting pressure on the prices to keep falling.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 08:08