-

The AVAX price jumped 25% in 48 hours after breaking out of a bullish flag pattern.

Metrics indicate reduced large transactions and a declining whale-to-retail ratio.

As an experienced analyst, I’ve seen my fair share of market fluctuations in the crypto space. The recent surge in AVAX price has certainly caught my attention, and it seems that this digital asset is making some significant moves.

As a crypto investor, I’ve noticed the exhilarating journey of Avalanche (AVAX) in recent times. The buzz surrounding this digital asset has left me intrigued, and I believe it’s essential to delve deeper into its current state and potential future developments.

Price action heats up

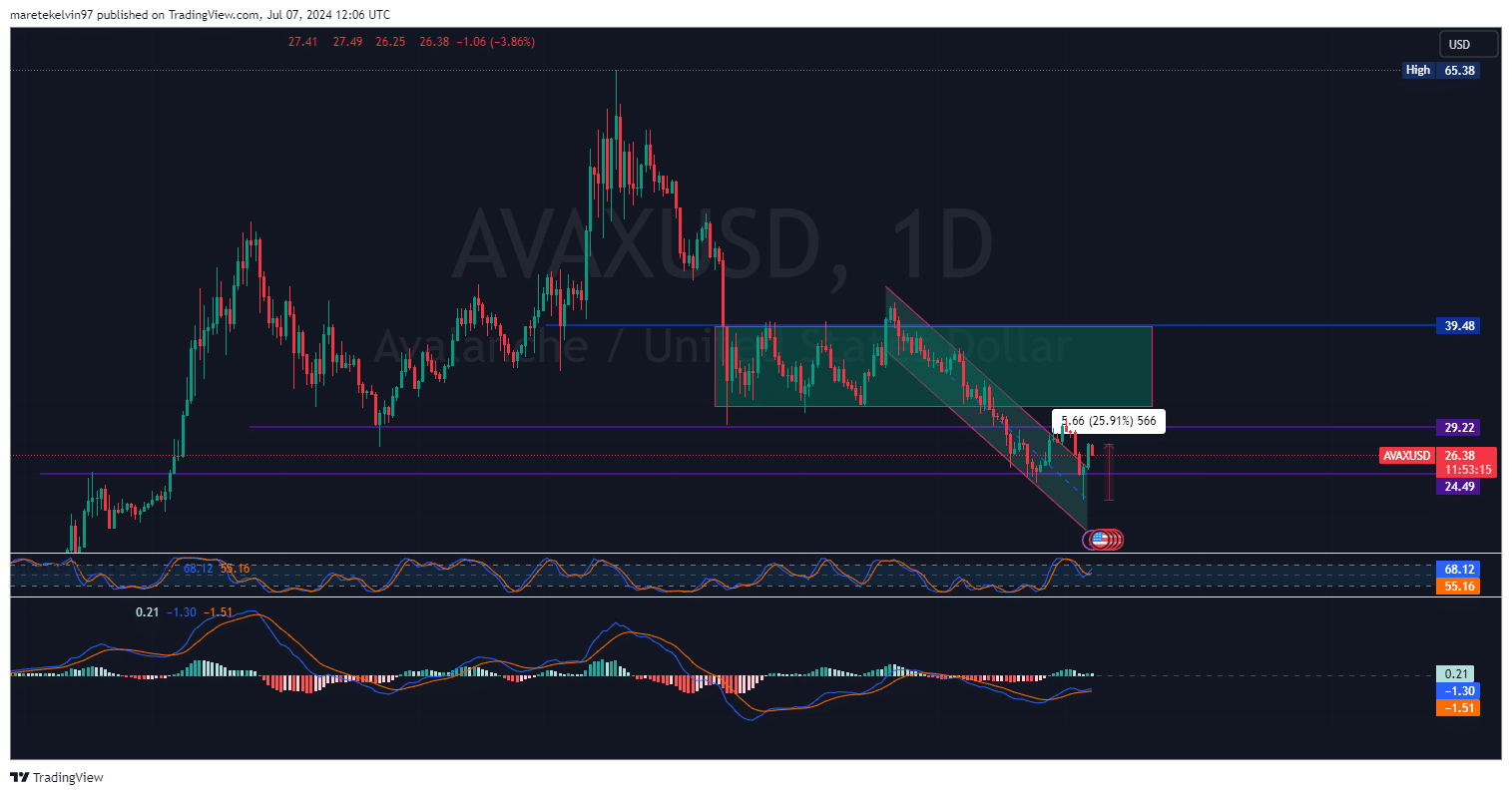

On June 29th, AVAX broke out of a bullish flag formation, marking the beginning of a robust uptrend. Consequently, the cryptocurrency soared by approximately 25% within a mere 48 hours, reaching $27.70. Long position investors found themselves playing catch-up in response to this abrupt price surge.

As a researcher studying the cryptocurrency market, I’ve noticed that after a significant price increase, Avalanche (AVAX) has momentarily paused its upward trend. The value has retreated to approximately $25, a level that previously served as a formidable resistance for bullish flag patterns.

As a researcher studying the cryptocurrency market at present, I’ve observed that the levels we see now have been functioning as support. However, it’s important to note that circumstances can shift rapidly in crypto markets.

Over the past day, AVAX experienced a minor decrease of 2.24%, bringing its current value down to $26.24. A potential drop to $24.49 could be on the horizon if this trend continues. The price action around $24.49 will provide valuable insights into AVAX’s future direction.

What is happening behind the scenes for AVAX?

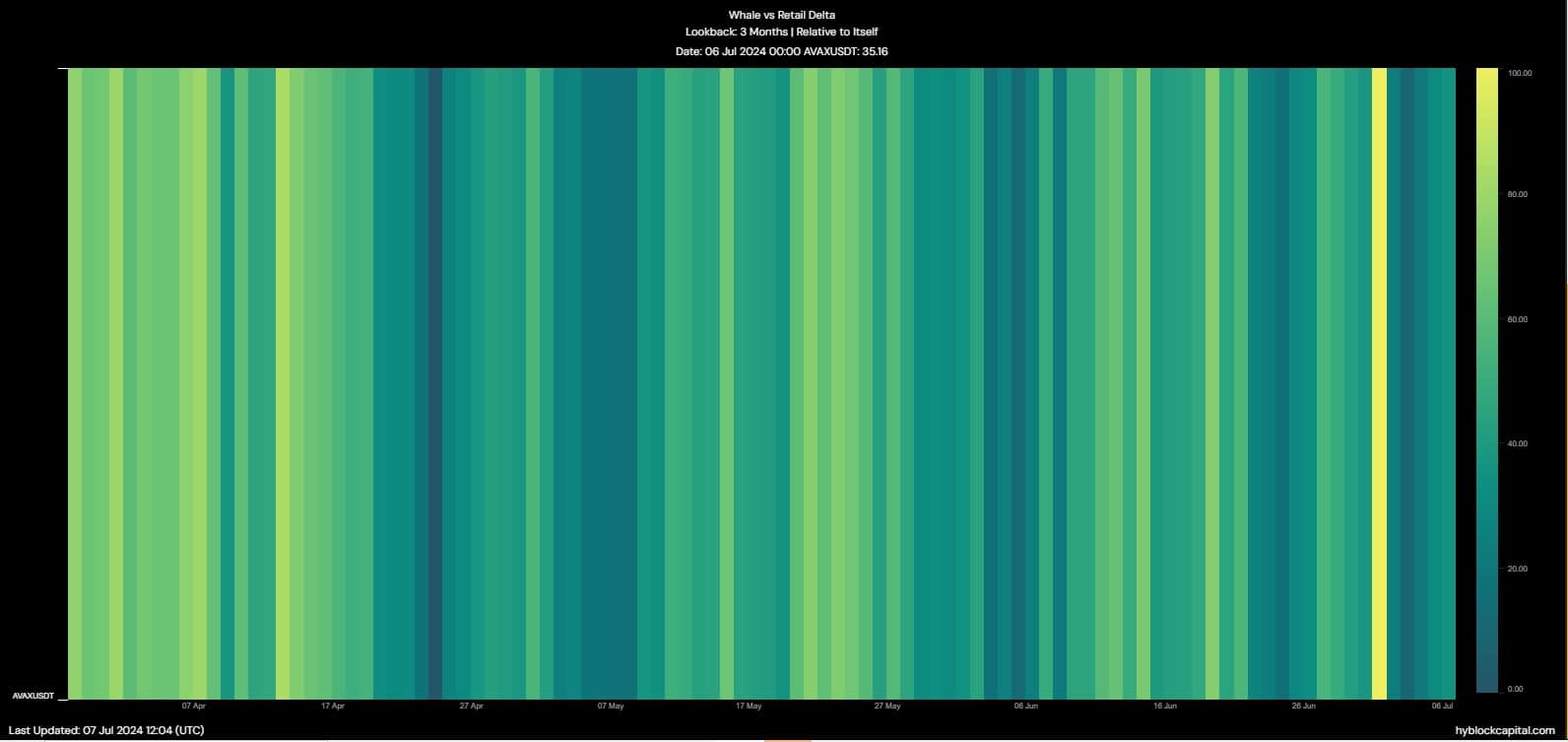

Although the price trend appears optimistic based on the chart, the intricate details from on-chain data paint a more complex picture. According to AMBCrypto’s interpretation of IntoTheBlock’s statistics, there has been a significant decrease of approximately 45% in large transactions involving AVAX. This observation might suggest that whales are currently less engaged in the market.

As an analyst, I would interpret the Hyblock Capital data indicating a whale-to-retail ratio of 35.16 as meaning that retail traders are increasingly participating in the market relative to large institutional investors or “whales.”

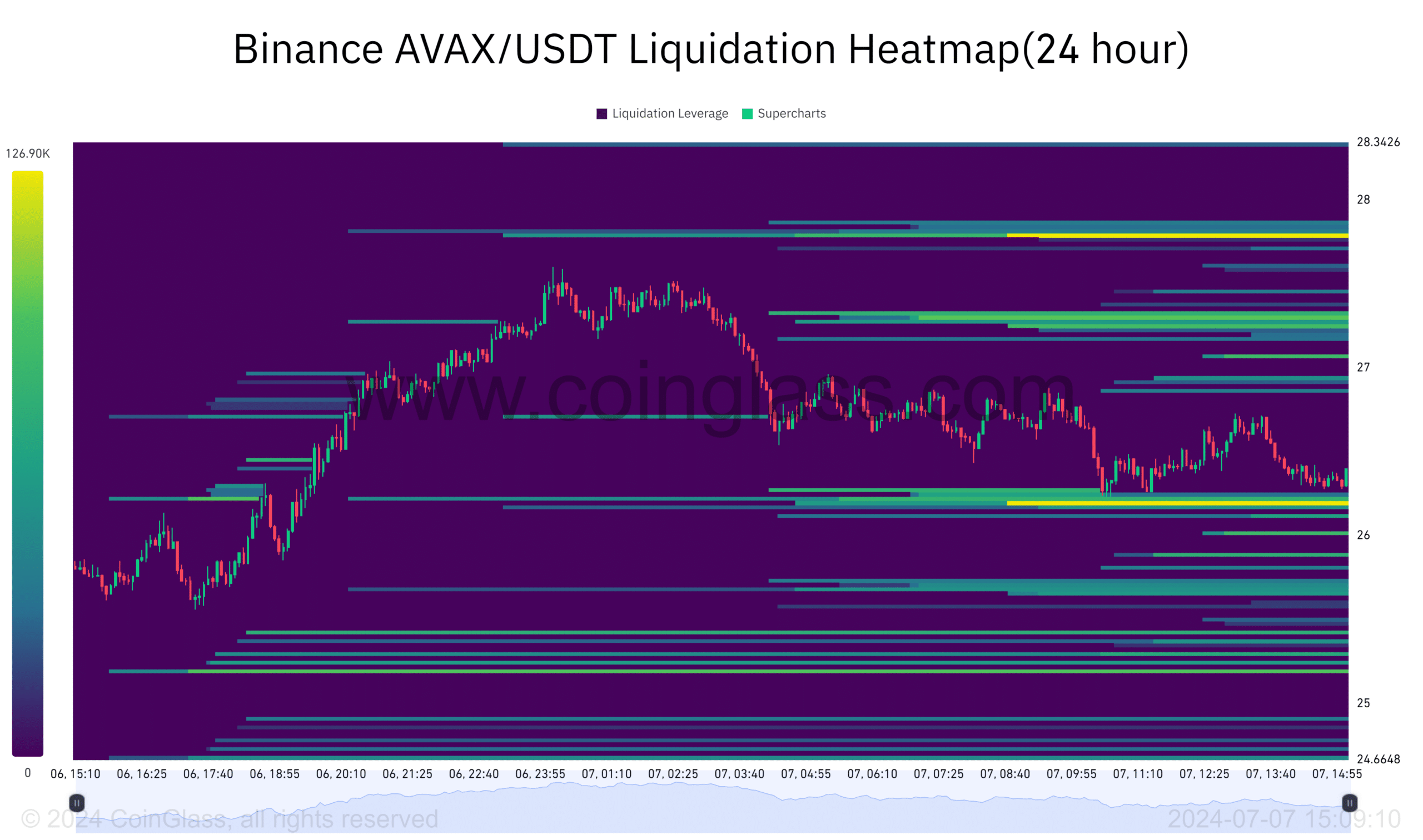

Based on the liquidity analysis provided by Coinglass, there are numerous sell orders accumulated at higher price points. Consequently, Avax may face challenges in advancing significantly unless substantial buying demand materializes.

What’s next for AVAX?

As a crypto investor, I’m observing that AVAX has gained significant momentum lately, propelling it to new heights. However, I can’t ignore the formidable resistance levels it’s currently encountering. It’s a critical juncture for AVAX, and how it navigates these challenges could significantly impact its future price action.

Is your portfolio green? Check the Avalanche Profit Calculator

At the current price of $24.49, this level serves as a significant anchor for AVAX. Should it give way, we may witness a continuation of the downward trend with potential for lower prices. Conversely, if AVAX manages to maintain its position above $25 and draws in additional buyers, it could potentially surge towards the upcoming resistance at around $29.22.

The decrease in whale involvement in the market raises some worries, yet the influx of additional retail traders might bolster the price.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-07-08 11:03