- Avalanche has lackluster capital inflows and signaled bearish momentum in the one-day timeframe.

- The range formation’s mid-level support at $36 needs to be defended, but the bulls could fail at this task.

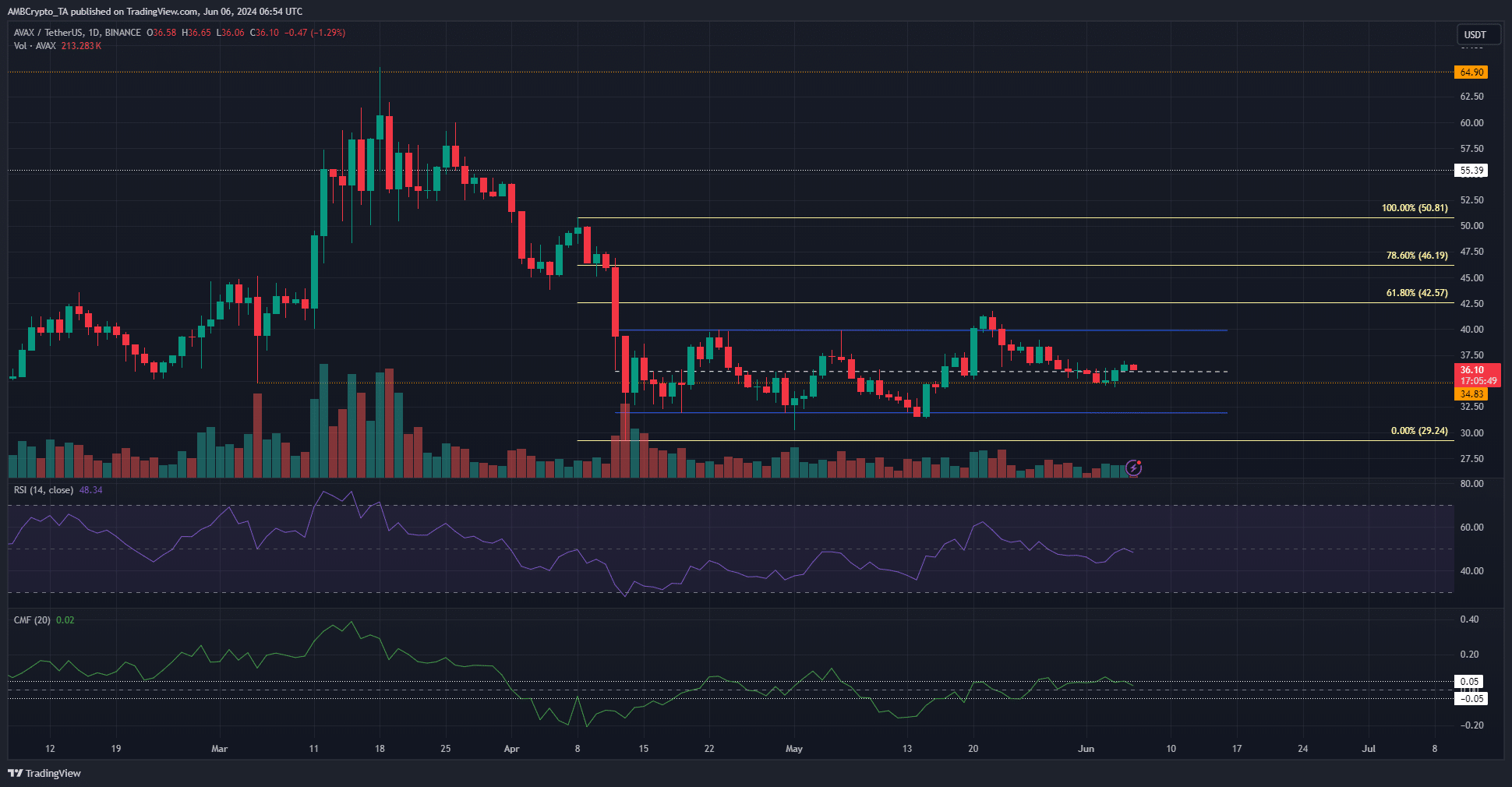

As a crypto investor with some experience under my belt, I’ve seen my fair share of market fluctuations. Avalanche [AVAX], currently trading within a range formation, has left me feeling cautious. The lackluster capital inflows and bearish momentum in the one-day timeframe are signals that should not be ignored.

In the previous analysis by AMBCrypto, it was noted that the price action of Avalanche’s cryptocurrency, represented by the ticker symbol AVAX, remained contained within a specific range. At the time, futures market participants demonstrated hesitance to enter long positions and trading activity was relatively low.

At the moment of writing this analysis, the situation was reminiscent of a previous one. Not much has shifted since Bitcoin [BTC] surpassed the $70k mark. Despite this upward movement, AVAX bears have continued to show determination. Here’s what traders may expect for the upcoming week.

Examining Monday’s range

On the price chart for June 20th, Monday, the day’s highest point reached $36.27, while the lowest point was at $34.56. Occasionally, the entire week’s trading remains within this range, creating a short-term price fluctuation.

Over the past two months, Avalanche’s price has remained relatively stable. However, recently, there have been signs of upward momentum. On Wednesday, for instance, the price broke above its previous high from Monday. At the current moment, the bulls are attempting to hold onto the $36 level as a support in the short term.

Despite the current positive trend, it’s possible that this momentum may not last long. The Relative Strength Index (RSI) on the daily chart remains below the neutral level of 50, and the Chaikin Money Flow (CMF) indicates only a weak inflow of capital into the Avalanche (AVAX) market. Short sellers might look for opportunities at lower timeframes that align with their trading strategies, given the bearish outlook on higher timeframes.

What clues do the liquidation levels yield?

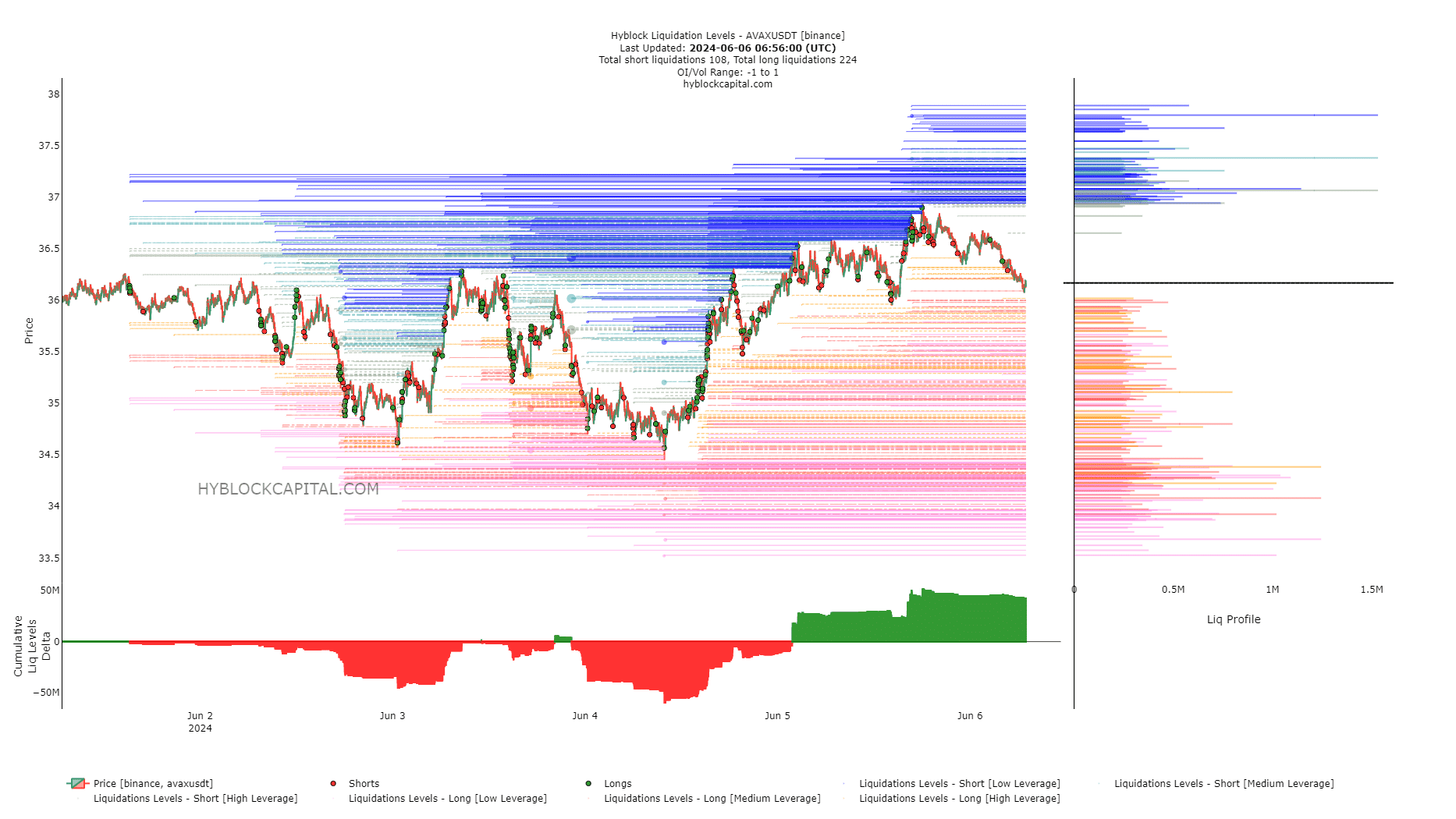

As an analyst, I’ve noticed that the cumulative change in liquidity levels has been positive and quite substantial. This significant increase could potentially trigger a search for liquidity in northern markets. Furthermore, the fact that long liquidations exceed short ones indicates that there is a larger number of traders looking to exit their long positions than those seeking to close their short positions. Consequently, a price reversal to facilitate the liquidation of these traders might transpire.

Read Avalanche’s [AVAX] Price Prediction 2024-25

As an analyst, I’d recommend considering $37.06 as a potential short-term target for liquidity in the market. For those traders looking to make quick profits through scalping, entering short positions around $37 could be an effective strategy. The ultimate goal would be a move toward $34.5 or even lower prices.

For swing traders and investors, there’s an option to hold off and observe as the market revisits the $30-$32 area for potential re-entry. Another possibility is to watch for a surge past the current range high of $40, but this would require a powerful breakout that may not guarantee an immediate or relaxed pullback afterwards.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-07 01:11