- Currently trading within a bullish ascending triangle, AXS is nearing a support zone that could spark a major price rally.

- Short-term downward pressure is anticipated as indicators suggest temporary weakness.

As a seasoned researcher who has navigated through countless market cycles, I have grown accustomed to the ebb and flow of cryptocurrency trends. The recent performance of Axie Infinity [AXS] has been intriguing, with its dips and rallies offering valuable insights into the ever-evolving crypto landscape.

In the last few weeks, the performance of Axie Infinity’s token AXS has been subpar, dropping around 5.42% during the past month following its response at a significant resistance point.

Given the ongoing pessimistic atmosphere in the market, there’s a strong likelihood that the downtrend for AXS may persist, since multiple indicators suggest this possibility.

A necessary dip for an upswing in AXS

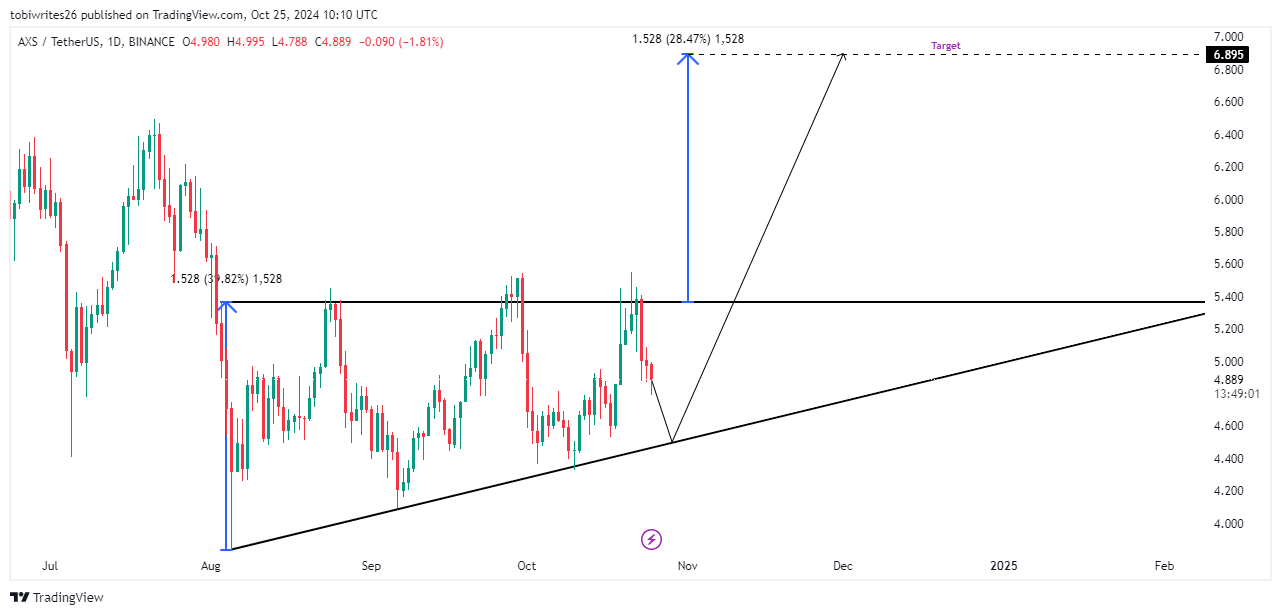

Following a rebound from the resistance level around $5.366 within its ascending triangle structure, AXS has seen a drop in price. This downward movement could potentially extend further, reaching the diagonal support line of the pattern.

Should AXS touch this potential support point, it may regain its bullish trend, initially aiming for the resistance area as the destination.

If AXS manages to break through its current resistance level, it could potentially see a rise of approximately 28.47%, taking the price up to around $6.895. This prediction is derived from the distance between the resistance and support levels within the pattern depicted in the chart below.

Traders shift to sell as AXS faces downward pressure

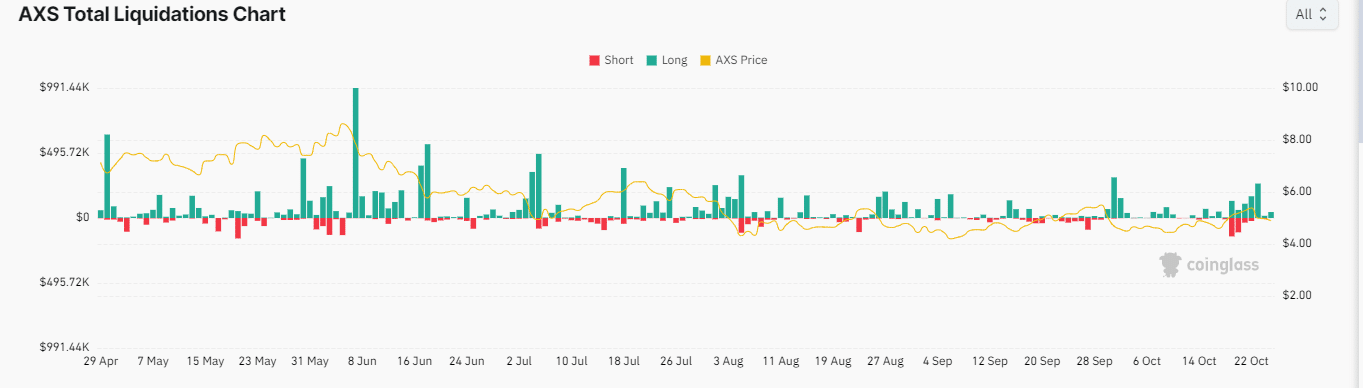

Data from Coinglass, as analyzed by AMBCrypto, suggests an upward trend in traders offloading their holdings. This could indicate a possible continuation of downward price movements.

Over the last day, I’ve observed a substantial setback for long traders who were wagering on the increase of AXS prices. In fact, a staggering $50.56K out of the total $51.82K liquidated during this period can be traced back to these traders. This data underscores the challenges they faced in their positions.

This demonstrates that short sellers are currently dominating the market, having wisely predicted a decline in the price of AXS instead of a rise, potentially causing prices to drop further.

Furthermore, currently, the funding rate is below zero, indicating a greater preference among traders for short positions. This means that short traders are prepared to compensate long traders for maintaining their short positions, thereby intensifying the price decline of AXS.

Should these trends hold steady, it’s probable that AXS will keep falling unless there’s a change in market dynamics, which could occur around the resistance level of its historical trend pattern.

Gradual supply squeeze builds up

As a crypto investor, I’ve noticed an intriguing contrast in the market. While derivative traders seem to be mostly bearish, anticipating a price decrease for AXS, the activity in the spot market suggests a more optimistic outlook. Traders appear to be gearing up for an uptrend, indicating a potential rally could be on the horizon.

Is your portfolio green? Check the Axie Infinity Profit Calculator

Based on data from Coinglass, approximately $417,880 in AXS tokens were removed from exchanges within the last 24 hours. This decrease in available supply could potentially lead to a situation where demand exceeds supply, known as a “supply squeeze”.

This change indicates that negative feelings about AXS might be nearing an end, suggesting a potential turning point could be imminent, as positive momentum seems to be growing.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-10-26 09:11