- Baby Doge’s impressive recovery has positioned the meme coin above key moving averages.

- The memecoin was now in a relatively high liquidity zone, signaling chances of near-term consolidation in its newly found oscillation range.

As an analyst with years of experience in the volatile world of cryptocurrencies, I have seen my fair share of price action that would make even the most seasoned traders question their sanity. However, Baby Doge Coin’s (BABYDOGE) recent breakout and subsequent consolidation has caught my attention.

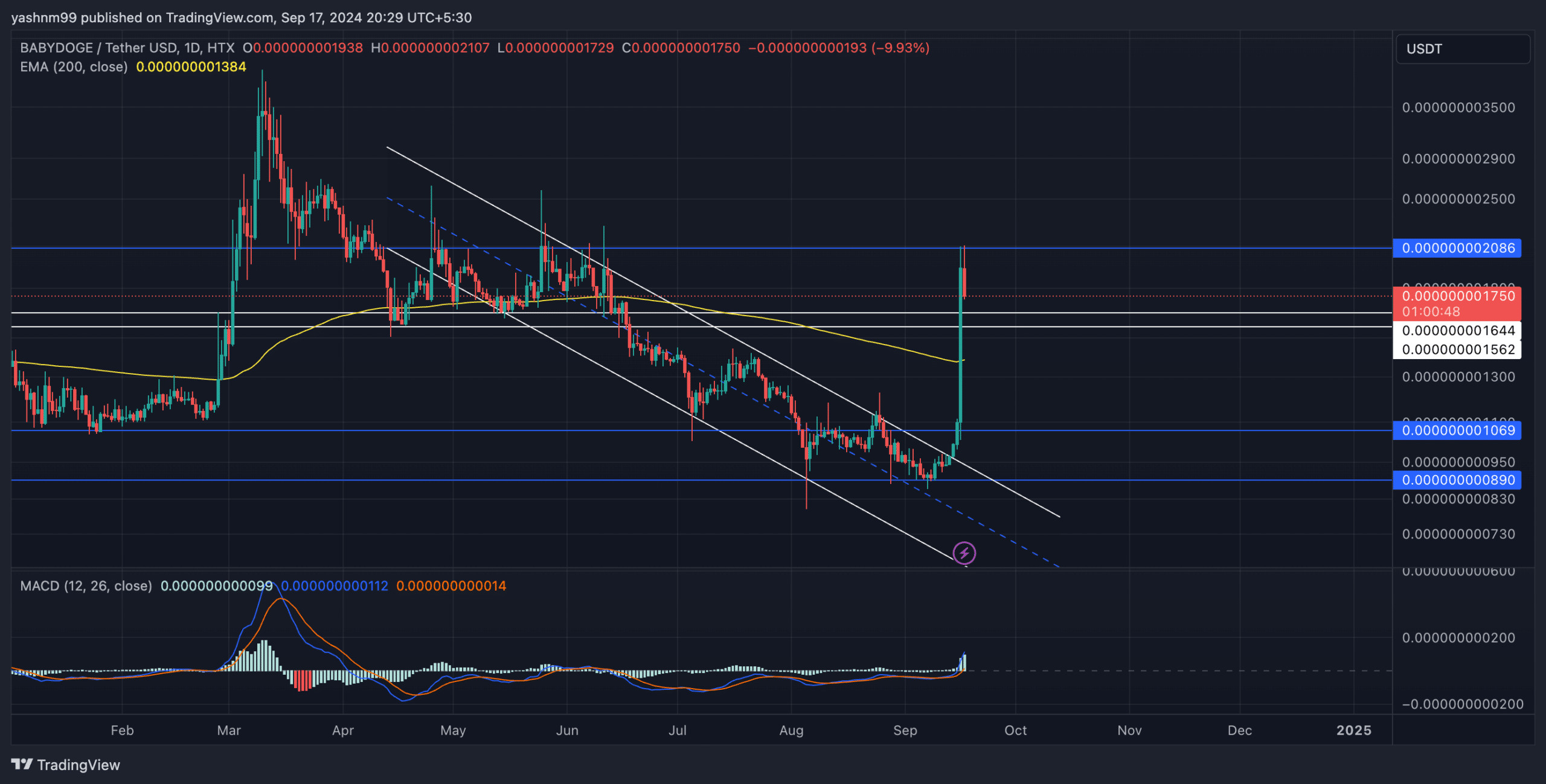

baby-Doge token (BABYDOGE) has seen a strong recovery following its breakout from a downward trending channel on its daily chart. After enduring several months of continuous bearish momentum, this meme-based cryptocurrency surged by more than 115% in less than three days, after finding support at $0.00000000089.

Currently, BABYDOGE is being traded around 0.0000000018 dollars, having difficulty in sustaining the pace it gained during its latest increase in value.

In simple terms, the value of the meme coin has surged beyond its average moving price over the past 200 days, suggesting that buyers are now in charge.

Baby doge coin price prediction: Will consolidation follow the breakout?

As an analyst, I’ve observed a significant surge in Baby Doge, which has now positioned it in a high-liquidity area. It’s plausible that some consolidation might occur within the range of $0.0000000015 and $0.000000002. A potential dip back towards the baseline of $0.0000000015 could be imminent, particularly if profit-taking becomes prevalent.

If Baby Doge maintains a value over 0.0000000015, it might revisit the 0.000000002 resistance level shortly after. If it can hold above this resistance, the bulls may then aim for approximately 0.0000000024 in the next price increase.

If sellers regain dominance, there’s a possibility that the price could return to the $0.0000000013 support level close to the 200 Exponential Moving Average (EMA), and then try to head upward again.

In simpler terms, the MACD (Moving Average Convergence Divergence) graph indicates that the MACD line has moved above the signal line following a positive crossover – this is often a sign of a bullish trend. However, this upward momentum might be starting to slow down, as the recent surge in prices appears to be weakening slightly, which could potentially lead to a temporary cooling-off period in the short term.

Additionally, it’s important to mention that when the price was being written, it was situated within a zone known for its high liquidity. This could potentially lead to consolidation or a small pullback.

Derivates data shows…

Over the past 24 hours, the number of short positions compared to long ones was higher, with a ratio of approximately 0.6166. This suggests that traders have favored taking short positions on platforms such as Binance and OKX more than long positions during this period.

This implies that traders may have been exercising caution, perhaps due to expectations of an imminent dip. Yet, recent data shows that some long positions were liquidated within the last 12 hours, whereas there were no notable short liquidations.

If buyers are able to protect the $0.0000000015 level, it’s possible that Baby Doge could aim for $0.000000002 and even surge towards $0.0000000024. Conversely, if there’s a clear drop below the $0.0000000015 level, it might halt the positive trend and lead to another period of consolidation.

Keep a close eye on the Moving Average Convergence Divergence (MACD) and related derivative information, as this data can help determine if bullish market trends are likely to persist or if a bearish reversal might occur.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-18 10:15