- Base marketcap just soared to a new all-time high underpinned by sustained volumes.

- TVL and transaction growth complete a picture of a healthy DeFi ecosystem.

As an analyst with over two decades of experience in the financial sector and a deep-rooted interest in blockchain technology, I find the recent growth of Base, particularly its stablecoin marketcap and TVL, nothing short of impressive. The sustained volumes and surging transaction numbers indicate a vibrant DeFi ecosystem thriving on this L2 network.

The Ethereum [ETH] layer 2 ecosystem has been expanding and Base has emerged as one of the L2 networks on the fast lane. Base recently achieved new milestones, including a new stablecoin marketcap all-time high.

The Base platform is advancing within the established Ethereum layer 2 networks, as demonstrated by its significant growth in the stablecoin market capitalization.

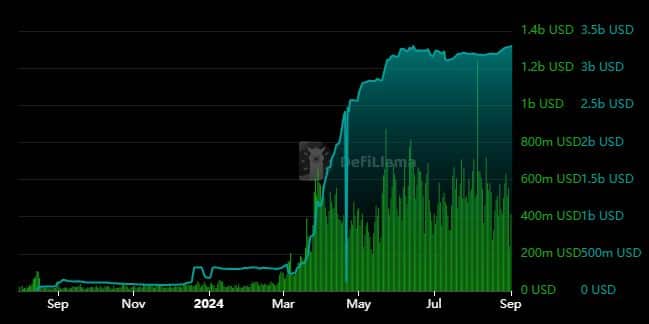

More recently, the market capitalization of Base’s stablecoin hit an unprecedented peak of 3.28 billion. Remarkably, the growth of this stablecoin’s market cap showed an exponential increase from March through June. Even amidst challenging market conditions in August, it continued to expand.

In the world of Decentralized Finance (DeFi), the expansion of stablecoins often coincides with increased functionality. For instance, when it comes to Base, the increase in the stablecoin’s market capitalization was followed by a significant spike in trading volume.

To give you some context, the daily transaction volume on the layer 2 network was typically less than $50 million prior to March. Yet, by the end of March, this figure surpassed $600 million.

Assessing the impact of Base stablecoin growth

Since that time, the base has consistently kept its daily on-chain transaction volume above $200 million, even during market lulls. The blend of high-stability coins and substantial trading activity suggests a strong demand and usefulness in the system.

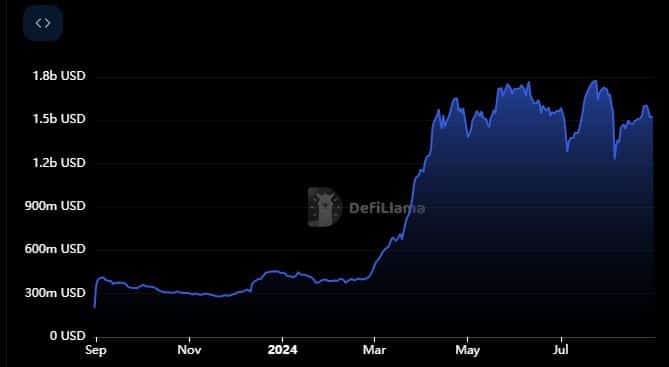

As a researcher, I’ve observed an upward trend in the Total Value Locked (TVL) within our network. At present, it stands second on the leaderboard of top Ethereum Layer 2 solutions, ranked by TVL.

During the March-June period, when the stablecoin marketcap reached an unprecedented peak, Base successfully hit a new record high for Total Value Locked (TVL) at around $1.77 billion. However, over the past few months, the TVL has seen a slight decrease and currently stands at approximately $1.51 billion as of press time.

It’s plausible that the Total Value Locked (TVL) experiences fluctuations due to market turbulence, and this could account for the drops in TVL observed since its highest point. Moreover, the consistent expansion of the TVL demonstrates the strong movement of value within the BASE network.

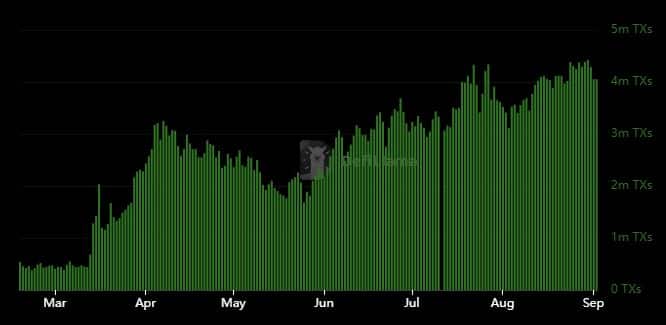

As a researcher delving into the world of blockchain, I can attest to the remarkable expansion of the Base Layer 2 protocol. This growth is underpinned by its strong utility, as demonstrated by user engagement. Notably, according to DeFiLlama, Base registered the highest number of daily transactions ever recorded in August, a testament to its robustness and popularity.

On August 30th, the number of daily transactions on the network reached an all-time high of 4.42 million. A closer look shows that this surge in transactions began approximately mid-March.

The number of transactions on the blockchain has consistently risen, indicating a continuous upward trend in its usage.

The base has not introduced its own indigenous token so far, but if it does, it’s likely to be eagerly awaited. In the meantime, the significant growth suggests a thriving Ethereum environment that remains bustling with activity.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-09-03 13:12