- Base continues to hit new all-time highs in multiple areas, underscoring its dominance.

- Base Network Utility Drives Transactions to historic highs

As a researcher who has been closely observing the crypto space for quite some time now, I must say that Base’s performance this year has been nothing short of impressive. It’s like watching a rocket take off and soar to new heights. The TVL and transaction activity numbers are simply astounding, and it’s clear that the network is solidifying its leading position in the Ethereum layer 2 space.

Base has been gunning to for the top spot as the leading Ethereum [ETH] layer 2 network.

So far this year, it’s been on a remarkable trajectory of growth, and moreover, recent findings suggest that it’s strengthening its dominant stance.

The current Total Value Locked (TVL) figure serves as a testament to the significant growth the network has experienced thus far. Over the past year, there’s been a consistent upward trajectory, with no signs of slowing down as the graph continues its ascent.

This week, the total value locked on Base reached an all-time high of $2.30 billion, marking the greatest amount ever secured by the platform since its debut.

The robust TVL performance was also accompanied by healthy stablecoin market cap growth. The latter also soared to a new ATH of $3.72 billion.

A significant increase in TVL (Total Value Locked) suggests that a substantial amount of liquidity is being directed towards the ecosystem of layer 2 platforms.

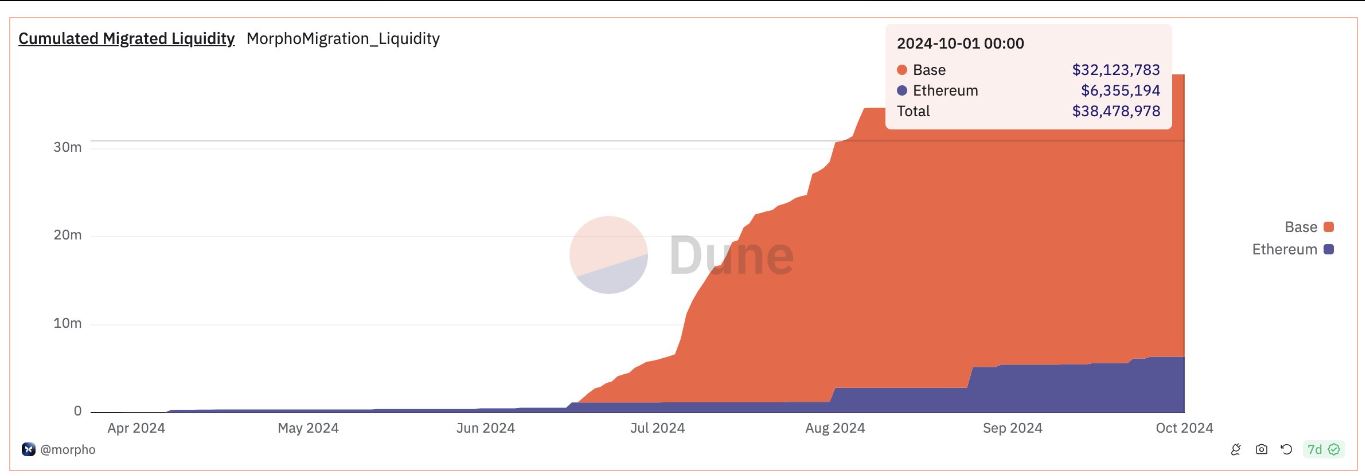

According to the latest findings from Dune, the liquidity entering Base has been surpassing that on the Ethereum mainnet as of late.

During the span of June through October, it’s been estimated that approximately $32.1 million in liquidity flowed into Base’s ecosystem. In contrast, just around $6.35 million moved into Ethereum over the same time frame.

During the mentioned timeframe, it seems that much of the liquidity moving into Base originated from CompundV2. On the other hand, the majority of the liquidity entering Ethereum appears to be sourced from Aave.

Robust transaction activity is fuel

These observations indicate that the layer 2 network has been enjoying robust usage.

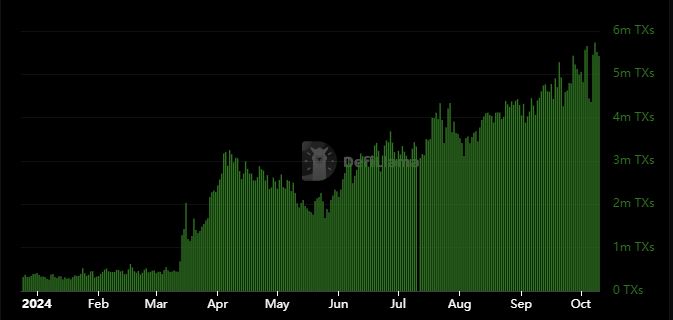

Based on DeFiLlama’s report, there has been a consistent rise in daily transactions on the Base network this year. This week, these transactions even hit a new all-time high.

On October 8th, the number of transactions reached an all-time high of 5.73 million, marking the most activity in a single day that this system has experienced thus far.

From a broader viewpoint, the Base network’s daily transactions averaged less than one million from January through mid-March.

These findings underscore Base’s impressive rise to become one of the top Ethereum networks. It ranked second in the list of top Ethereum layer 2 networks in terms of TVL, only outperformed by Arbitrum [ARB].

At the moment of this writing, its market capitalization stood at approximately $2.32 billion. If it continues to increase TVL (Total Value Locked), it has the potential to claim the number one position.

To sum up, it’s worth noting that Base has been among the top-performing cryptocurrency networks this year due to several favorable conditions. These include strong expansion in user addresses, indicating increased network utility, a thriving stablecoin ecosystem, and an alluring liquidity landscape.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-10-10 21:43