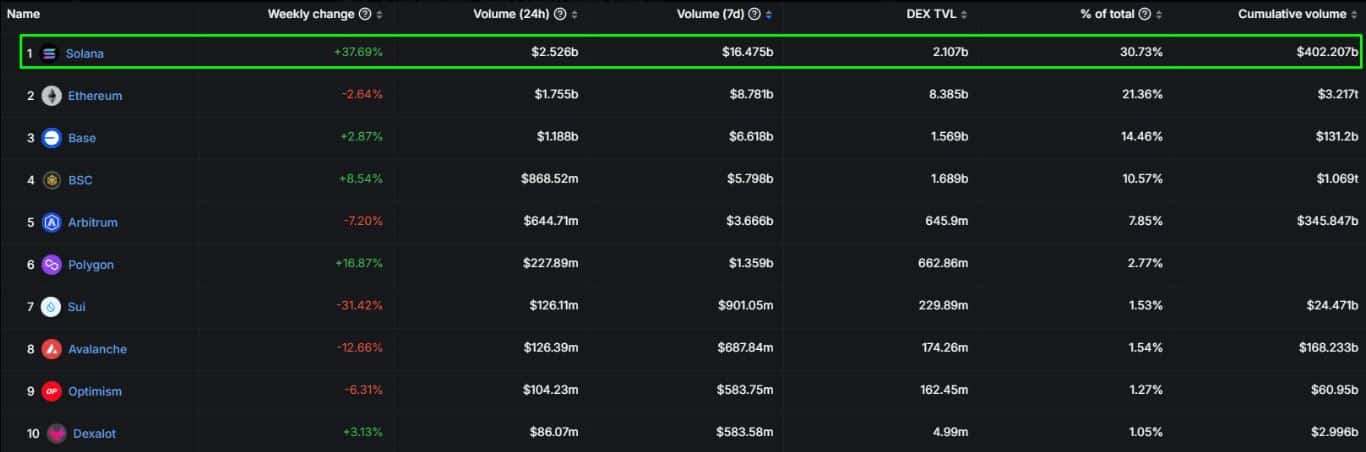

- Base ranks third after Solana and Ethereum in the list of blockchains with the highest volumes.

- Daily transactions soar to a new all-time high of $6.52 million, aided by strong address growth.

As a seasoned crypto investor who has witnessed the rise and fall of numerous blockchain projects since the early days of Bitcoin, I must say that Base’s recent performance has been nothing short of impressive. Ranking third behind Solana and Ethereum in terms of weekly volume is no small feat, especially considering the intense competition these two giants represent.

In the year 2024, the Base chain stands out as one of the most rapidly expanding networks. It’s evident that it’s gunning for the number one position. However, let’s consider how near it might be to realizing this ambition.

The most recent research suggests it has been interacting closely with leading blockchains, facing stiff competition.

According to a recent GeckoTerminal ranking, it was found that Base traded the third most volume during the past week. However, Solana [SOL] took the lead with the highest trading volume, while Ethereum [ETH] came in second.

As an analyst, I observed that our base managed a weekly trading volume of approximately $6.61 billion, whereas the leading contenders reported volumes of around $16.47 billion and $8.78 billion respectively in the same period.

It turns out that Base is among the top chosen blockchains during the recent uptick in DeFi actions, as shown by the ranking. With a DeFi TVL (Total Value Locked) of approximately $1.56 billion, it’s clear that its DeFi environment has been bustling with activity.

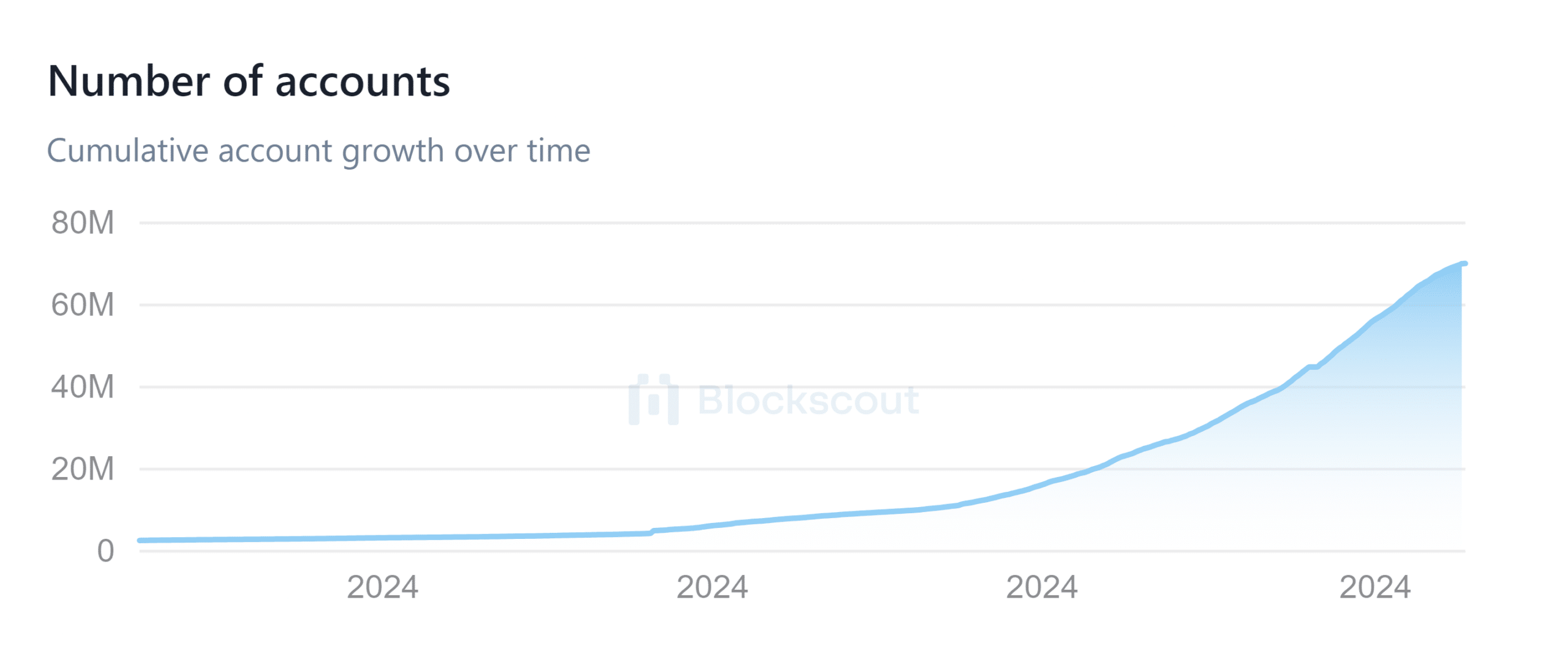

In their analysis, AMBCrypto looked at the count of active addresses to gauge the network’s activity level. Over the past year, the number of active addresses, or user accounts, on the Base platform has grown rapidly and significantly.

To provide some context, the number of accounts on the network was under 2 million at the beginning of January this year. As of October 25th, it has grown significantly to more than 69.7 million unique addresses.

Source; BlockScout

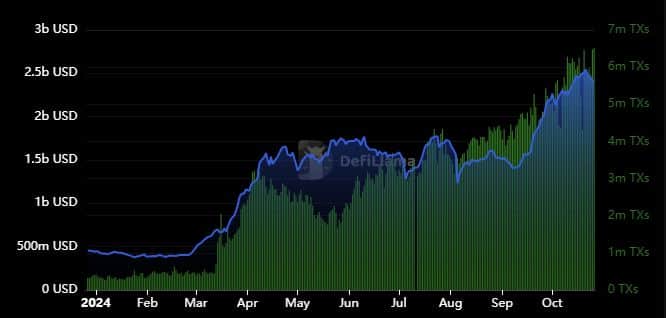

The rapid expansion was certain to trigger a spike in on-chain actions. This is most evident through the high volume of transactions within the network.

Base daily transactions hit new historic high

As reported by DeFiLlama, daily transactions reached an unprecedented peak of 6.52 million within the past 24 hours when this article was written.

Note that this is the same network which averaged less than 500, 000 daily transactions in Q1 2024.

At the moment of writing, the Total Value Locked (TVL) had slightly dipped from its record-breaking peak of $2.54 billion earlier this week, to $2.41 billion. This slight decrease might be linked to the recent decrease in bullish momentum.

On October 25th, the network amassed approximately $141,000 in fees. This daily fee collection has generally been below $150,000 since the network’s recent performance, which aligns with our previous observation.

In March, the base fees peaked at an astonishing $3.78 million per day. This spike can primarily be attributed to the significantly increased value of Ethereum during that period, which in turn led to elevated gas fees.

Both ETH’s price and gas fees have been declining for the last few months.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-26 22:15