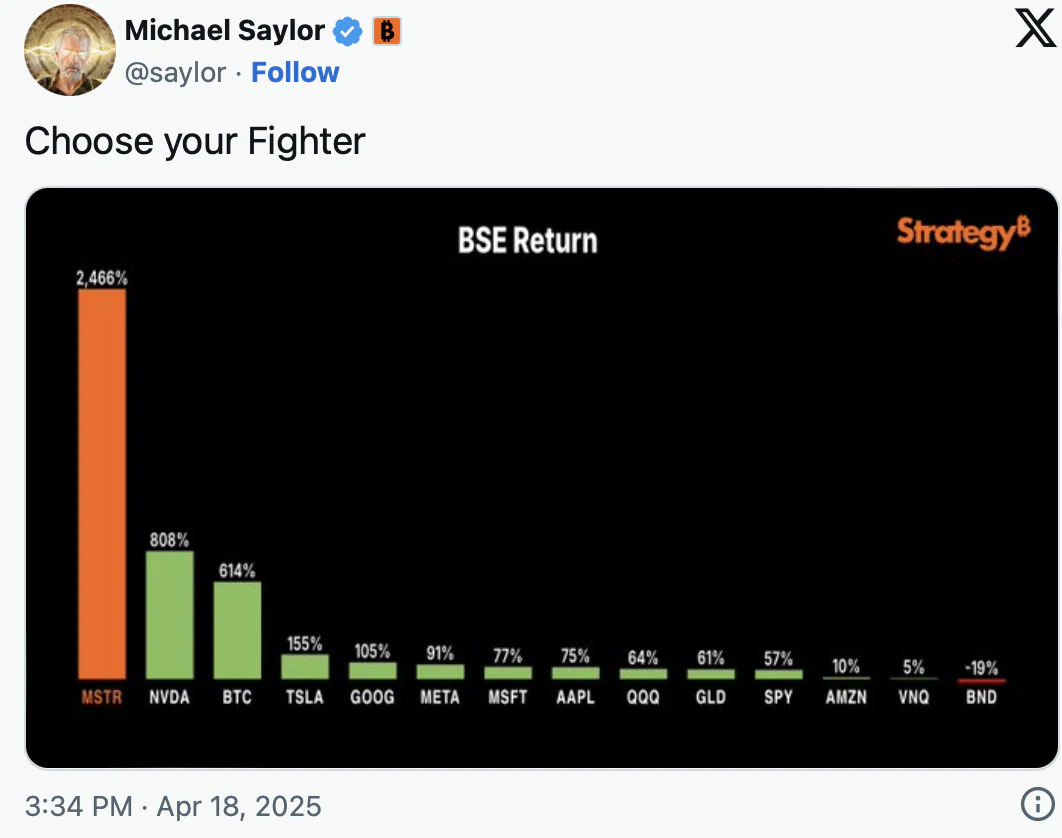

On the rather dreary date of April 18, 2025, the indomitable Michael Saylor, that dashing co-founder and Executive Chairman of MicroStrategy, tossed a gauntlet into the digital arena via Twitter, christened “Choose your Fighter.” Accompanying this masterpiece was a graphic so revealing, it might as well have been painted in gold leaf, showcasing the long-term returns of Bitcoin and its more flamboyant corporate companions.

The chart, a prodigious offering from the oracle known as Strategy B, dares to compare the financial feasts wrought by various assets and stocks under the pompous banner “BSE Return.” And who, dear reader, claims the crown? MicroStrategy (MSTR), with a return so dizzying—2,466%—that other contenders look like pebbles compared to a mountain.

Trailing graciously behind this colossus are these humble aspirants:

- NVIDIA (NVDA): A respectable 808%, or as close to a victory lap as one can manage without actually winning.

- Bitcoin (BTC): A charming 614%, proving that digital gold is no mere fad.

- Tesla (TSLA): 155%—enough to keep Elon Musk’s parties well-funded.

- Google (GOOG): 105%, because who doesn’t want their search engine to make them money?

- Meta (META): 91%, still fighting to Meta-morph into something profitable.

- Microsoft (MSFT): 77%, the corporate equivalent of a reliable but slightly dull butler.

- Apple (AAPL): 75%, fancy enough to wear a turtleneck and drink espresso.

- QQQ ETF: 64%, the investment world’s version of a decent cocktail party guest.

- Gold (GLD): 61%, shimmering but seemingly overshadowed by digital dazzlers.

- S&P 500 (SPY): 57%, steady and dependable, like a grandfather clock.

- Amazon (AMZN): 10%, perhaps too busy delivering packages to ponder profits.

- Real Estate (VNQ): 5%, the slow tortoise in this race of market hares.

- Bonds (BND): -19%, the party pooper, proving that sometimes safety nets have more holes than substance.

This visual symphony elegantly rehearses the narrative that Saylor has passionately performed for years: Bitcoin and its devoted ally, MicroStrategy, wield the kind of market magic that turns financial lead into gold. Quite literally.

Meanwhile, tech titans like NVIDIA and Tesla prance about with dazzling gains, yet traditional stalwarts—gold, property, and especially bonds—shamble laggards, the latter tipping the scales with a rather unbefitting negative return. A cautionary tale for those who find comfort in the familiar: the market is, as ever, the greatest theatre of absurdity. 🎭💸

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-18 20:54