- BEAM crypto showed signs of a breakout as trading volume rose and the price nears resistance.

- Mixed on-chain signals revealed cautious sentiment, with limited big-holder activity despite rising interest.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by BEAM’s recent developments. The surge in trading volume and subsequent price rise have caught my attention, hinting at a potential breakout from its consolidation zone. However, I remain cautiously optimistic given the mixed signals that on-chain analysis provides.

In the last while, BEAM’s trading volume experienced a significant increase of 21%, which also led to a 3% rise in its price. This trend could indicate a possible change in market dynamics or momentum.

Currently, the altcoin is being exchanged for around $0.01878, displaying potential for growth.

On the other hand, it’s uncertain if this continued movement will cause a breakout from its holding pattern.

Is BEAM ready to break out of its range?

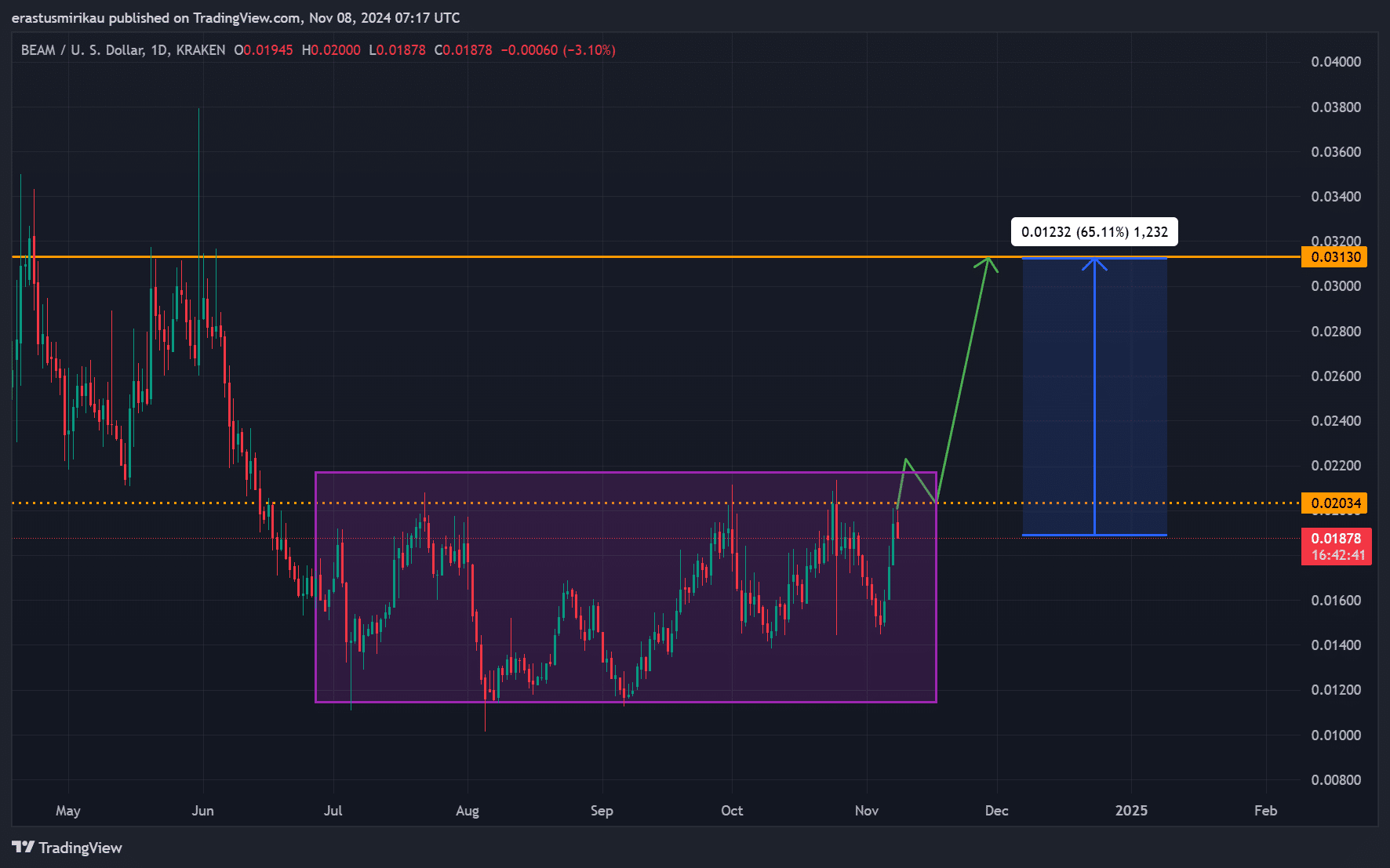

Over the past while, BEAM’s price movement has remained relatively stable, oscillating between approximately $0.015 and $0.022. This prolonged fluctuation indicates a phase of equilibrium, where both buyers and sellers seem to be evenly matched, neither holding a significant advantage over the other.

On the other hand, due to the recent surge in volume, there’s an indication that BEAM might soon move beyond its current range. Such a movement could suggest a shift towards a new trend.

As a researcher analyzing BEAM’s price action, I noticed a notable resistance level at approximately $0.02034. This level represents the upper boundary of its consolidation phase. Should BEAM manage to breach this resistance, it could potentially drive the price upward towards the next significant level at $0.03130, presenting an estimated potential upside of 65.11%.

Instead, it’s important to note that the $0.015 level acts as a strong barrier against any potential price drops, firmly establishing the lower limit of this price range.

As a crypto investor, I find these price points crucial for predicting BEAM’s future movement. A break above $0.02034 could potentially trigger a surge aiming at the target of $0.03130.

Additionally, the graph suggested a potential short-term dip to around $0.02034 might occur as a test of support. This dip offered a strategic buying opportunity for traders, reinforcing the support level.

Consequently, this pullback could confirm a sustained breakout, attracting more buyers.

BEAM technical indicators show…

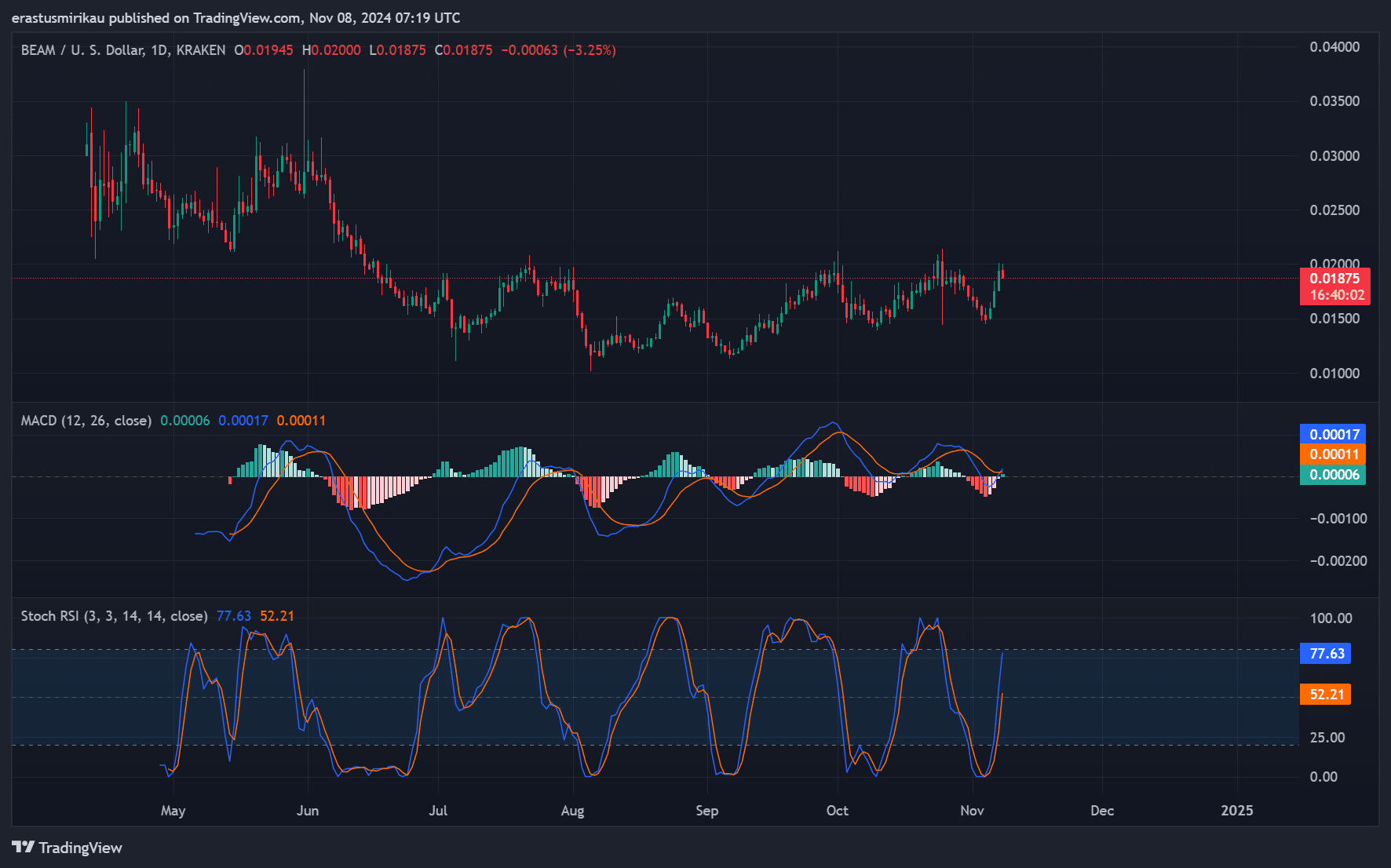

Technical indicators provide valuable information about BEAM’s trend, and the Moving Average Convergence Divergence (MACD) has recently displayed a positive crossover. This suggests that the momentum of BEAM is on the rise.

However, the histogram remains minimal, signaling that the bullish move is still cautious.

Moreover, the Stochastic RSI suggests that BEAM might be nearing overbought territory, hinting at a possible temporary dip before more growth. Consequently, although momentum seems strong, it’s crucial to keep an eye out for a re-test before making any investment decisions.

Can BEAM’s price rally without more address activity?

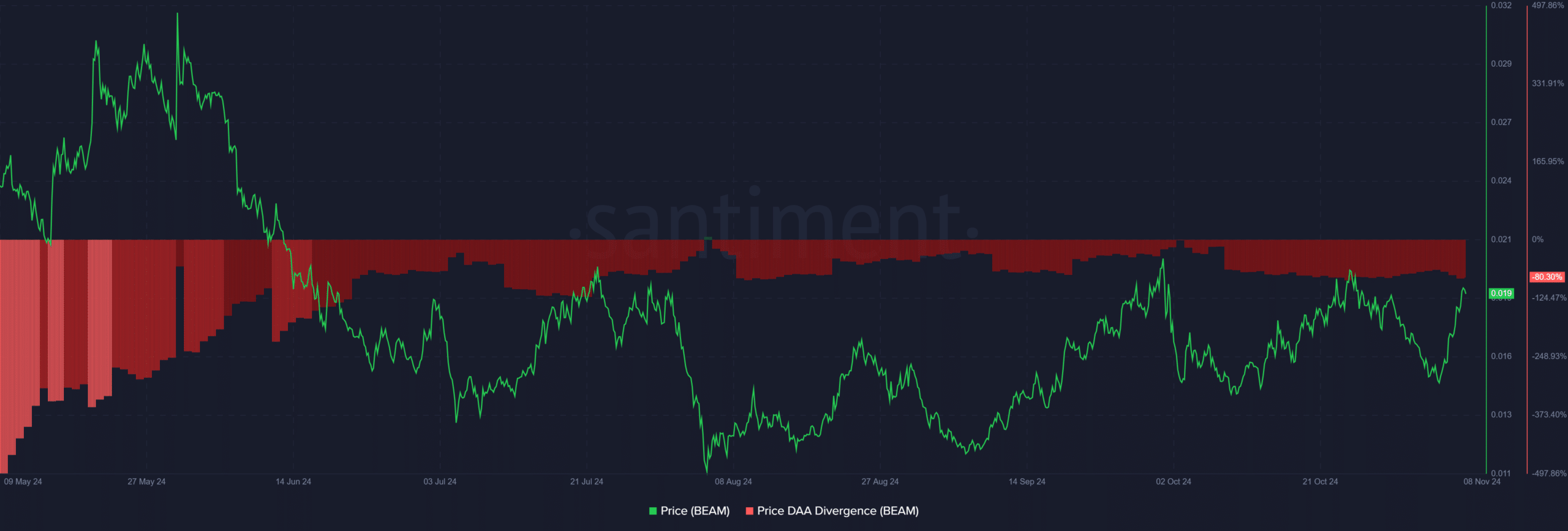

According to the Daily Active Addresses (DAA), there was a 80.3% decline in activity, which suggests a substantial gap between price movements and user engagement. This on-chain indicator frequently indicates a bearish trend.

As a result, even though BEAM’s price has increased, the minimal number of transactions at its addresses could cast doubt on the longevity of this upward trend.

Mixed on-chain signals: Are big holders cautious?

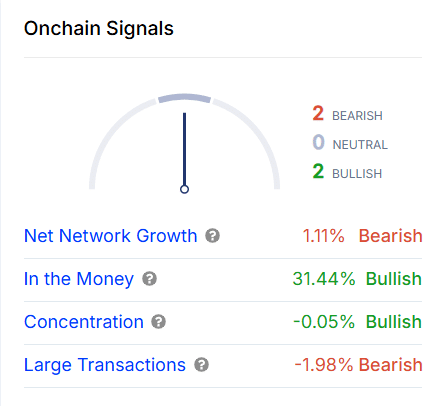

The information directly linked to the blockchain shows a somewhat intricate scenario. While the overall network expansion increased by 1.11%, this specific increase is classified as bearish.

Currently, the “In the Money” figure is at 31.44%, which means a significant number of holders are now making a profit.

Furthermore, the focus indicator of BEAM shows a slight optimism, whereas large-scale transactions declined by 1.98%, implying reduced participation from significant actors.

Therefore, while retail activity appears strong, large holders seem cautious.

Realistic or not, here’s BEAM’s market cap in BTC’s terms

As a researcher, I’m observing an upward trend in both the volume and price of BEAM, suggesting increasing investor attention. This could potentially lead to a significant breakout. Yet, it’s crucial to approach this situation with measured optimism, as the technical and on-chain signals are somewhat conflicting.

As I analyze the current market trends of BEAM, a potential move surpassing $0.02034, accompanied by substantial trading volume, could pave the way for the price to reach approximately $0.03130. However, to reduce potential risks, it would be wise to wait for confirmation at crucial levels before engaging in trades.

Read More

2024-11-09 03:04