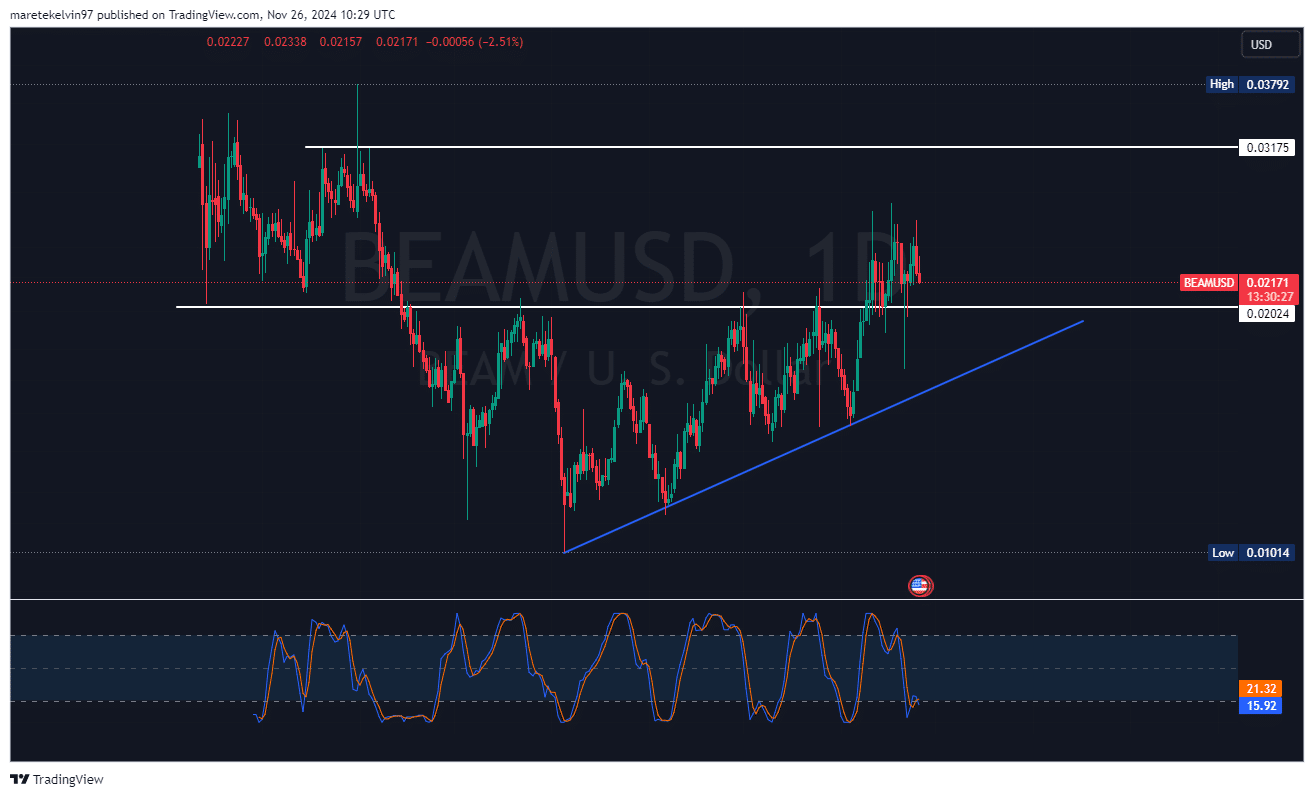

- Beam was approaching a crucial support level of $0.0202 at press time.

- On-chain metrics pointed to declining whale and trading activity.

As a seasoned crypto investor who has weathered many market storms, I find myself watching Beam [BEAM] with a mix of trepidation and cautious optimism. The cryptocurrency is approaching a critical support level at $0.0202, and its recent sharp dip of over 16% in just 48 hours has raised some eyebrows.

Undergoing a crucial examination, the privacy-centric cryptocurrency known as BEAM approached a significant support point at around $0.0202 on the daily chart.

In just under two days, the value of this asset dropped significantly by more than 16%, causing worry among investors about its immediate future direction.

At the current moment, I’ve noticed that the Stochastic RSI is trending towards an oversold region as the price of Beam keeps decreasing.

As someone who has been closely following the cryptocurrency market for several years now, I must admit that I was initially skeptical about Beam when it first entered the scene. However, after observing its steady growth and resilience in the face of market volatility, I have come to appreciate its potential as a valuable addition to my investment portfolio. This recent development could be a promising sign for those who believe in Beam’s long-term success. If history has taught me anything, it’s that even the most volatile markets can experience temporary corrections before making a strong comeback. As such, I see this potential price reversal and near-term bounce as a hopeful indicator for the Beam bulls like myself. Let’s keep our fingers crossed and continue to closely monitor its progress!

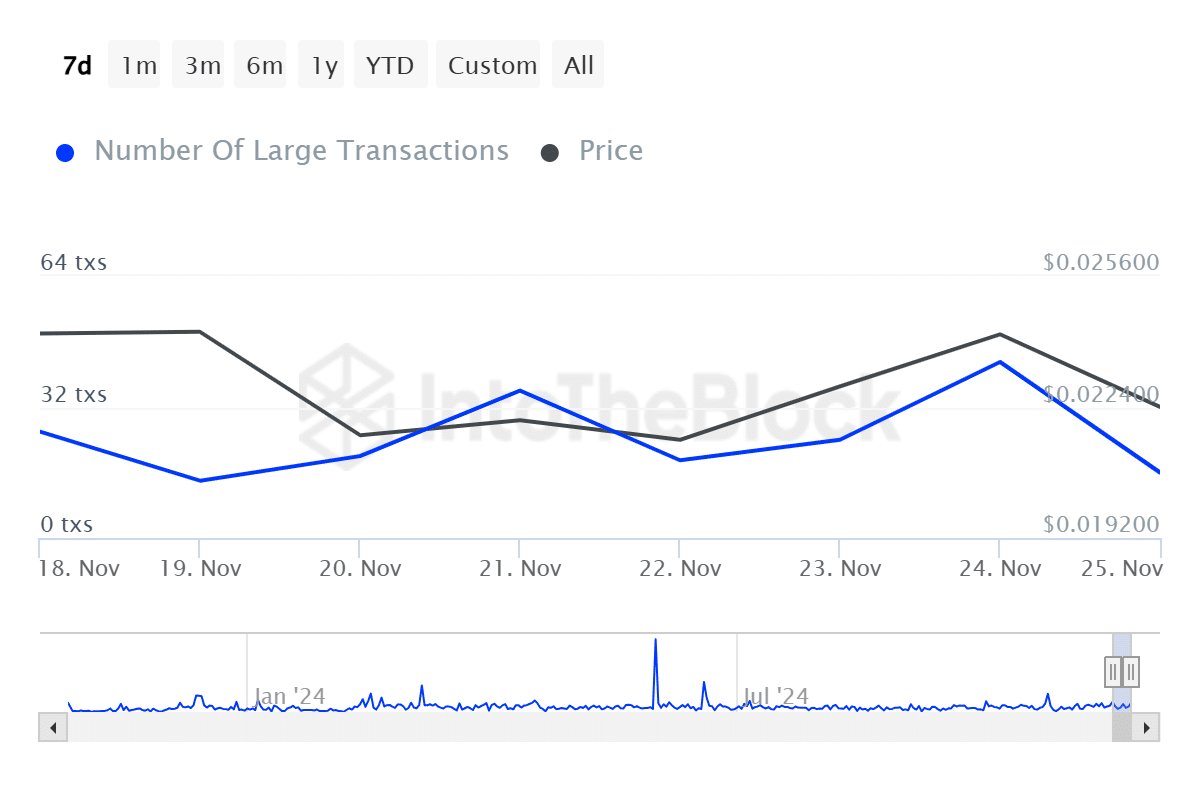

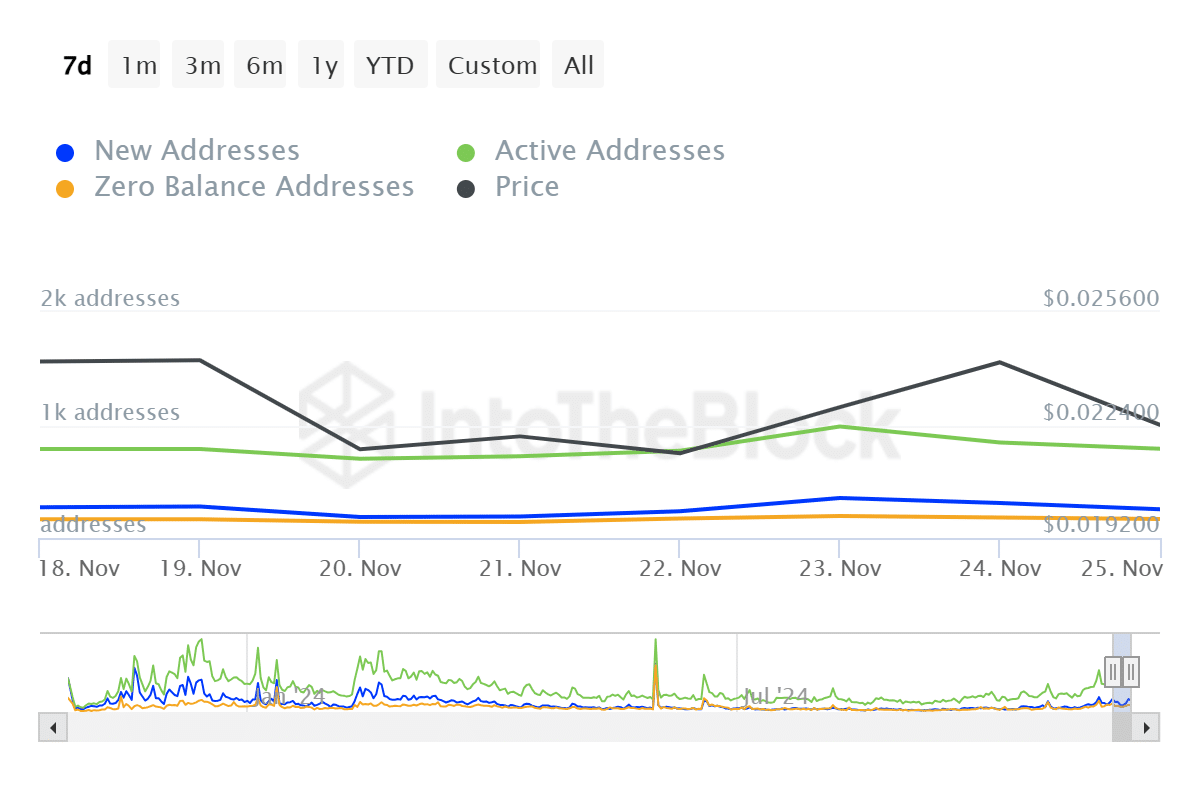

Declining whale and trading activity

According to AMBCrypto’s interpretation of IntoTheBlock’s findings, most indicators showed a bearish trend predominantly driven by a significant drop (69%) in large transactions within the last 24 hours.

This implies that large market participants are adopting a “watchful” stance as they monitor how Beam reacts to the $0.0202 price floor. In simpler terms, these big players are keeping a close eye on how Beam behaves around this specific support level.

1) The decrease in whale-related activities was more evident due to a 7% decline in active wallets. This substantial decrease in active wallets suggested a lessening of overall Beam transactions within the network, implying reduced trading activity among the users.

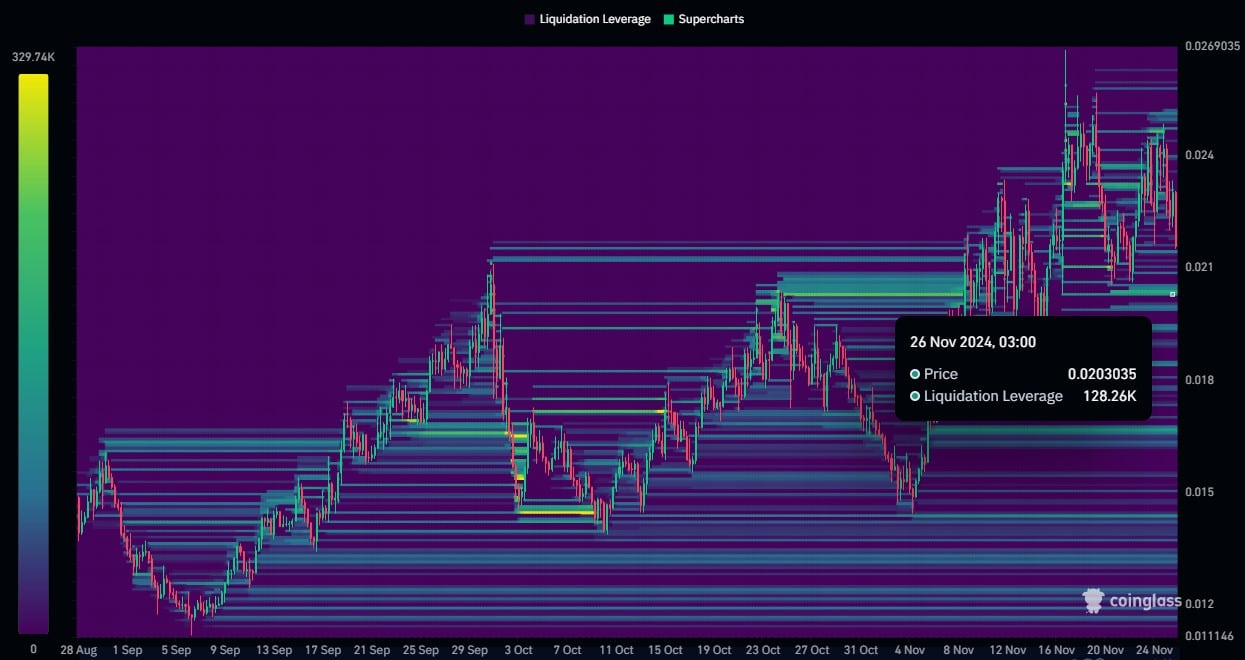

Liquidation pool to pull price further

Nevertheless, the presence of a significant liquidation pool valued at approximately 128,260 units at a price point of $0.0203 has contributed to a more pessimistic perspective on Beam’s market trend.

At $0.0202, this pool aligns with a crucial level of support for Beam. If it breaks, there might be more pressure pushing the price downwards.

What’s next for Beam?

Combining weak on-chain indicators with pessimistic price movements suggests a troubling short-term forecast for Beam.

Read BEAM Price Prediction 2024-25

In other words, the stochastic RSI indicates that the market might experience a price drop, but this could signal an opportunity for bulls (buyers) in the future.

Maintaining the current level at $0.0202 is vital for the upcoming market setup. If the price falls below this point, it might indicate a continued downtrend. However, if the price recovers, it could establish a foundation for an impending bullish surge.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-27 07:35